[ad_1]

By Whitney Mapes, Elwyn Panggabean

For low-income girls worldwide, digital monetary providers can act as a stepping stone to larger monetary inclusion, but obstacles to activating utilization have prevented girls from realizing their full advantages. Among the many many obstacles girls face to utilizing digital monetary providers are a scarcity of economic and digital literacy, a lack of information of the fundamentals and advantages of digital accounts, and restricted capability to conduct transactions on their very own. Consequently, girls could solely minimally have interaction with their digital accounts or stay solely inactive, failing to make the most of all that digital monetary providers have to supply.

To handle this utilization hole, Ladies’s World Banking beforehand labored with Dutch Bangla Financial institution (DBBL) in Bangladesh to develop a digital account activation resolution. Previous to the venture, girls manufacturing facility employees, who obtained wages in a digital account, had been cashing out their wage at ATMs with out taking full benefit of different account providers. Our resolution helped these girls discover ways to make peer-to-peer transfers on their very own. From September to December 2019, we performed a pilot program of our resolution with almost 60,000 girls. Consequently, we discovered girls had been extra prone to switch cash or conduct different transactions – 19 proportion factors extra prone to make transfers as soon as they realized full a switch on their very own. These girls additionally made extra frequent transfers 2+ instances monthly, in addition to bigger switch quantities (126% improve) in comparison with a management group of shoppers who didn’t obtain the answer.

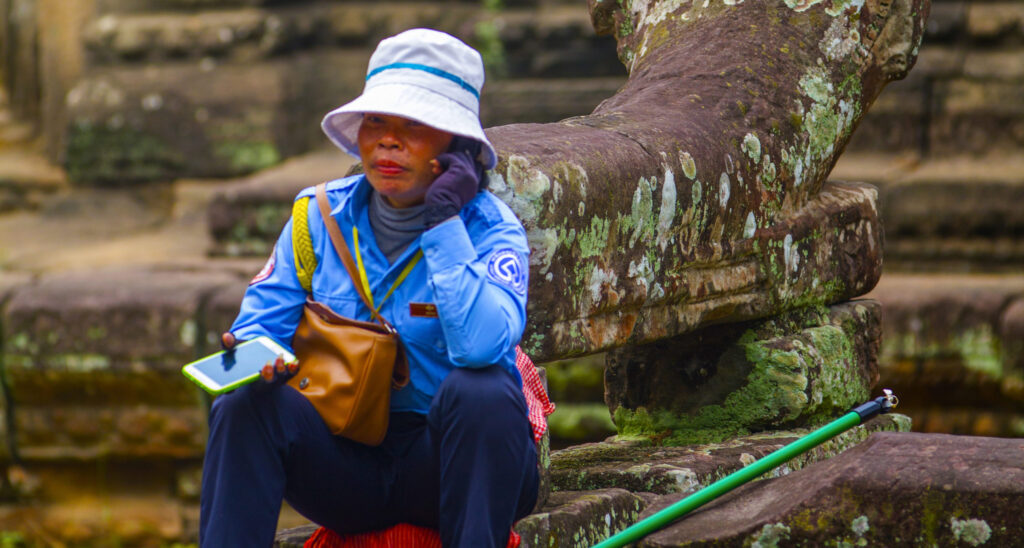

Earlier this yr, we have now continued this work by replicating the account activation resolution with Wing Financial institution, certainly one of Cambodian main cellular cash suppliers with over 12 million clients. They’ve confronted an identical problem to DBBL, through which Wing’s payroll clients obtain manufacturing facility wage funds instantly into cellular wallets, however select to cash-out their full funds over-the-counter with Wing’s agent community slightly than use their account or Wing Cash app to make monetary transactions.

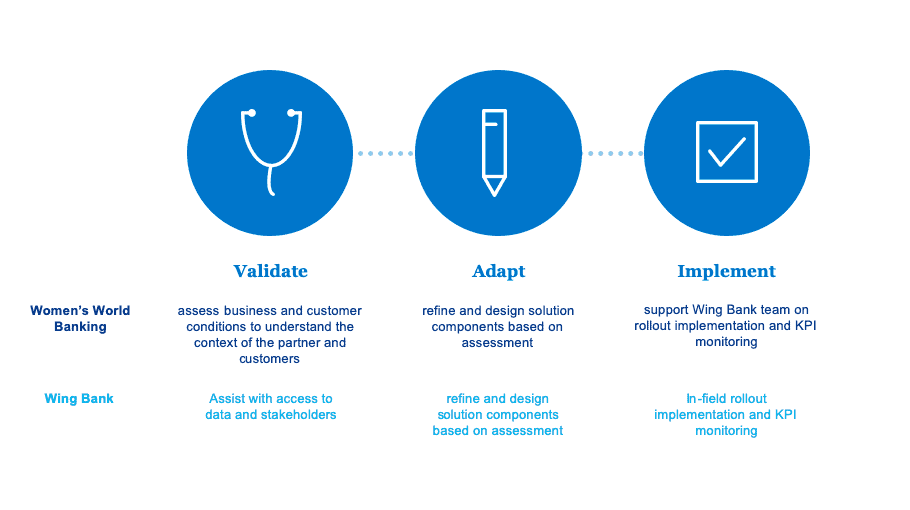

Ladies’s World Banking’s strategy to replication

Ladies’s World Banking makes use of a three-phase strategy to copy options which have been developed in different markets and/or with different monetary providers companions. Replication permits us to scale options in a shorter venture timeline. Within the first section, we led an evaluation of the Wing enterprise operational and buyer situations related to the digital account activation resolution. Then, we labored collaboratively with Wing Financial institution to adapt the answer parts primarily based on our assessments, and developed and executed an in depth implementation plan to launch the answer for Wing Financial institution clients. Within the remaining roll out section that’s presently in progress, Wing Financial institution is taking possession of the answer supply and monitoring, with continued help from Ladies’s World Banking to guage effectiveness and suggest further actions to regulate, develop, or scale the answer.

The options and advantages

Emphasizing a learning-by-doing course of, the answer parts intention to develop girls’s digital monetary functionality by enhancing their information in regards to the account, enabling them to make use of their account and conduct transactions confidently by their very own. Three key resolution parts are essential to attaining this behaviour change, which we tailored from the unique resolution to fulfill Wings particular wants. These embody:

- Be taught-by-doing training module:

To handle the information hole about their Wing Financial institution’s account and its advantages, we provide a studying alternative on the basics of their account and the complete vary of obtainable providers. We design the training course of with sensible learn-by-doing tutorials which embody cash transfers, cellphone top-ups, and invoice cost. These are essentially the most related and vital transactions for the ladies, particularly throughout Covid-19.

- Leveraging acquainted and trusted buyer touchpoint:

Wing Financial institution has a big and accessible agent community, with round 10,000 Wing Money Xpress brokers throughout Cambodia the place girls are presently cashing out funds. Nevertheless, we realized that brokers have restricted time and motivation to assist educate clients– particularly throughout excessive quantity intervals of wage disbursement when lots of of payroll clients come to cash-out their funds on the similar time.

As a substitute, we centered on current, day-to-day manufacturing facility relationships—and leveraged the important thing roles performed by manufacturing facility directors and crew leaders—to develop the best buyer touchpoint. Seen as an authority on Wing and the payroll course of, the manufacturing facility administrator is tasked with coaching crew leaders on the Wing account. In flip, the crew leaders go on this info to girls employees in casual, interactive, and extra time-efficient, teaching periods. As a result of crew leaders instantly supervise girls employees and have extra established, private, trusted relationships with them, girls really feel extra snug in these smaller periods.

- Focused and multi-channel communication technique:

By way of a signage marketing campaign, we inform girls employees in regards to the factory-wide academic initiative, through which girls be taught in regards to the Wing account from their crew leaders. We guarantee these posters are displayed in excessive visitors, excessive visibility areas all through the manufacturing facility, reminiscent of canteens, bogs, and bulletin boards. To bolster and encourage utilization of the Wing account, girls may even obtain digital follow-up messages that coincide with their wage funds.

| DBBL | Wing Financial institution | |

| Be taught-by-doing module |

|

|

| Communication technique |

|

|

| Buyer touchpoint |

|

|

Influence of elevated digital account activation and implications for future replication efforts

Wing Financial institution’s rollout of the account activation resolution instantly helps clients to find out about their Wing Checking account and conduct transactions that tackle their particular person wants. In studying be an unbiased account person, girls acquire larger confidence and consciousness of rapid account advantages, just like the comfort of conducting transactions anyplace, anytime through their digital units. This strategy of enhanced learning-by-doing and confidence constructing will encourage girls to start out, proceed, and improve their utilization of the Wing account.

Constructing digital monetary capabilities may even empower girls to more and more take possession of their funds. In the long run, the account activation resolution allows girls to realize larger monetary autonomy and improve their decision-making energy vis-à-vis their Wing Checking account and total funds. Whereas this explicit resolution focuses on primary use instances to start out, it goals to ascertain a basis for deeper private account engagement and adoption of different monetary providers over time that can enhance the monetary resilience of low-income girls in Cambodia. To observe this affect, we may even be conducting final result analysis with an end-line evaluation in 2022.

Our collaboration with Wing Financial institution represents the profitable replication of an answer in our goal market, Cambodia. By way of replication, the rollout stage is shortened considerably, leading to an answer for Wing delivered at a fraction of the time and value of the unique resolution developed for DBBL in Bangladesh. Additional, this newest success demonstrates vital potential to scale the identical replicated resolution with different monetary providers suppliers elsewhere as employers and labor organizations are displaying larger curiosity in digital wage funds as a extra handy cost-effective, and contactless transition from money. As such, this account activation resolution can present a useful blueprint for optimizing the client expertise within the wage digitization course of and enabling girls to benefit from the full advantages of digital monetary providers.

Ladies’s World Banking’s work with Wing Financial institution is supported by the Australian Authorities via the Division of International Affairs and Commerce.

[ad_2]