[ad_1]

My different publish listed 2023 2024 401k and IRA contribution and revenue limits. I additionally calculated the inflation-adjusted tax brackets and a few of the mostly used numbers in tax planning for 2024 utilizing the revealed inflation numbers and the identical system prescribed within the tax legislation.

The official announcement by the IRS in Rev. Proc. 2023-34 confirmed all these numbers.

2023 2024 Commonplace Deduction

You don’t pay federal revenue tax on each greenback of your revenue. You deduct an quantity out of your revenue earlier than you calculate taxes. About 90% of all taxpayers take the usual deduction. The opposite ~10% itemize deductions when their whole deductions exceed the usual deduction. In different phrases, you’re deducting a bigger quantity than your allowed deductions once you take the usual deduction. Don’t really feel unhealthy about taking the usual deduction!

The essential normal deduction in 2023 and 2024 are:

| 2023 | 2024 | |

|---|---|---|

| Single or Married Submitting Individually | $13,850 | $14,600 |

| Head of Family | $20,800 | $21,900 |

| Married Submitting Collectively | $27,700 | $29,200 |

Supply: IRS Rev. Proc. 2022-38, Rev. Proc. 2023-34.

People who find themselves age 65 and over have the next normal deduction than the fundamental normal deduction.

| 2023 | 2024 | |

|---|---|---|

| Single, age 65 and over | $15,700 | $16,550 |

| Head of Family, age 65 and over | $22,650 | $23,850 |

| Married Submitting Collectively, one individual age 65 and over | $29,200 | $30,750 |

| Married Submitting Collectively, each age 65 and over | $30,700 | $32,300 |

Supply: IRS Rev. Proc. 2022-38, Rev. Proc. 2023-34.

People who find themselves blind have a further normal deduction.

| 2023 | 2024 | |

|---|---|---|

| Single or Head of Family, blind | +$1,850 | +$1,950 |

| Married Submitting Collectively, one individual is blind | +$1,500 | +$1,550 |

| Married Submitting Collectively, each are blind | +$3,000 | +$3,100 |

Supply: IRS Rev. Proc. 2022-38, Rev. Proc. 2023-34.

2023 2024 Tax Brackets

The tax brackets are based mostly on taxable revenue, which is AGI minus varied deductions. The tax brackets in 2023 are:

| Single | Head of Family | Married Submitting Collectively | |

|---|---|---|---|

| 10% | $0 – $11,000 | $0 – $15,700 | $0 – $22,000 |

| 12% | $11,000 – $44,725 | $15,700 – $59,850 | $22,000 – $89,450 |

| 22% | $44,725 – $95,375 | $59,850 – $95,350 | $89,450 – $190,750 |

| 24% | $95,375 – $182,100 | $95,350 – $182,100 | $190,750 – $364,200 |

| 32% | $182,100 – $231,250 | $182,100 – $231,250 | $364,200 – $462,500 |

| 35% | $231,250 – $578,125 | $231,250 – $578,100 | $462,500 – $693,750 |

| 37% | Over $578,125 | Over $578,100 | Over $693,750 |

Supply: IRS Rev. Proc. 2022-38.

The 2024 tax brackets are:

| Single | Head of Family | Married Submitting Collectively | |

|---|---|---|---|

| 10% | $0 – $11,600 | $0 – $16,550 | $0 – $23,200 |

| 12% | $11,600 – $47,150 | $16,550 – $63,100 | $23,200 – $94,300 |

| 22% | $47,150 – $100,525 | $63,100 – $100,500 | $94,300 – $201,050 |

| 24% | $100,525 – $191,950 | $100,500 – $191,950 | $201,050 – $383,900 |

| 32% | $191,950 – $243,725 | $191,950 – $243,700 | $383,900 – $487,450 |

| 35% | $243,725 – $609,350 | $243,700 – $609,350 | $487,450 – $731,200 |

| 37% | Over $609,350 | Over $609,350 | Over $731,200 |

Supply: IRS Rev. Proc. 2023-34.

A typical false impression is that once you get into the next tax bracket, all of your revenue is taxed on the greater price and also you’re higher off not having the additional revenue. That’s not true. Tax brackets work incrementally. In case you’re $1,000 into the subsequent tax bracket, solely $1,000 is taxed on the greater price. It doesn’t have an effect on the revenue within the earlier brackets.

For instance, somebody single with a $60,000 AGI in 2023 can pay:

| First 13,850 (the usual deduction) | 0% | ||

| Subsequent $11,000 | 10% | ||

| Subsequent $33,725 ($44,725 – $11,000) | 12% | ||

| Closing $1,425 | 22% |

This individual is within the 22% tax bracket however solely a tiny fraction of the $60,000 AGI is absolutely taxed at 22%. The majority of the revenue is taxed at 0%, 10%, and 12%. The blended tax price is barely 9.1%. If this individual doesn’t earn the ultimate $1,425, she or he is within the 12% bracket as an alternative of the 22% bracket however the blended tax price solely goes down barely from 9.1% to eight.8%. Making the additional revenue doesn’t price this individual extra in taxes than the additional revenue.

Don’t be afraid of going into the subsequent tax bracket.

2023 2024 Capital Positive factors Tax

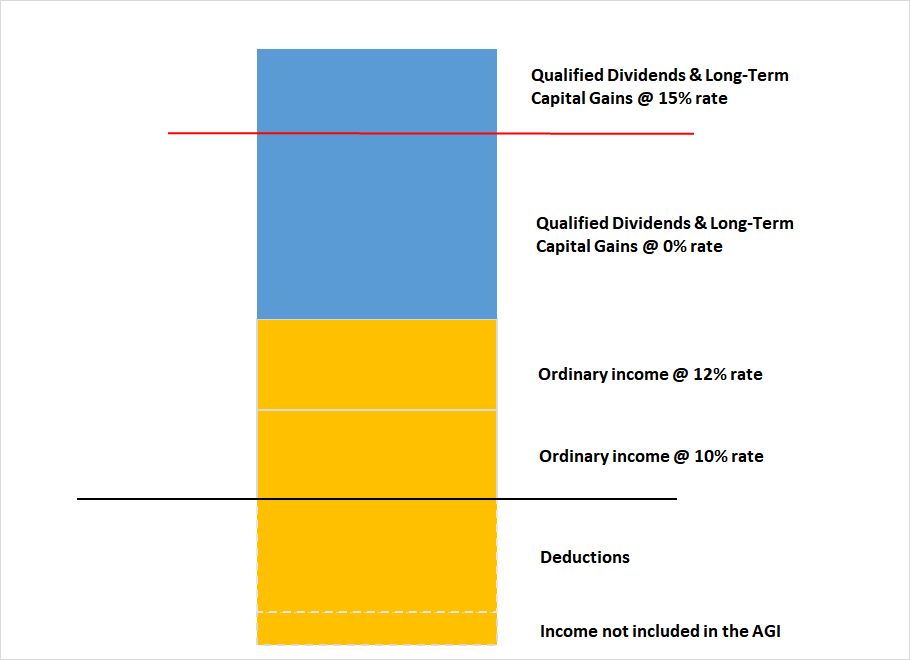

When your different taxable revenue (after deductions) plus your certified dividends and long-term capital beneficial properties are beneath a cutoff, you’ll pay 0% federal revenue tax in your certified dividends and long-term capital beneficial properties beneath this cutoff.

That is illustrated by the chart beneath. Taxable revenue is the half above the black line, after subtracting deductions. A portion of the certified dividends and long-term capital beneficial properties is taxed at 0% when the opposite taxable revenue plus these certified dividends and long-term capital beneficial properties are beneath the purple line.

The purple line is near the highest of the 12% tax bracket however they don’t line up precisely.

| 2023 | 2024 | |

|---|---|---|

| Single or Married Submitting Individually | $44,625 | $47,025 |

| Head of Family | $59,750 | $63,000 |

| Married Submitting Collectively | $89,250 | $94,050 |

Supply: IRS Rev. Proc. 2022-38, Rev. Proc. 2023-34.

For instance, suppose a married couple submitting collectively has $70,000 in different taxable revenue (after deductions) and $20,000 in certified dividends and long-term capital beneficial properties in 2023. The utmost zero price quantity cutoff is $89,250. $19,250 of the certified dividends and long-term capital beneficial properties ($89,250 – $70,000) is taxed at 0%. The remaining $20,000 – $19,250 = $750 is taxed at 15%.

An analogous threshold exists on the higher finish for certified dividends and long-term capital beneficial properties. When your different taxable revenue (after deductions) plus your certified dividends and long-term capital beneficial properties are above a cutoff, you’ll pay 20% federal revenue tax as an alternative of 15% in your certified dividends and long-term capital beneficial properties above this cutoff.

| 2023 | 2024 | |

|---|---|---|

| Single | $492,300 | $518,900 |

| Head of Family | $523,050 | $551,350 |

| Married Submitting Collectively | $553,850 | $583,750 |

| Married Submitting Individually | $276,900 | $291,850 |

Supply: IRS Rev. Proc. 2022-38, Rev. Proc. 2023-34.

2023 2024 Property and Belief Tax Brackets

Estates and trusts have completely different tax brackets than people. These apply to non-grantor trusts and estates that retain revenue versus distributing the revenue to beneficiaries. Grantor trusts (together with the most typical revocable residing trusts) don’t pay taxes individually. The revenue of a grantor belief is taxed to the grantor on the grantor’s tax brackets.

Listed below are the tax brackets for estates and trusts in 2023 and 2024:

| 2023 | 2024 | |

|---|---|---|

| 10% | $0 – $2,900 | $0 – $3,100 |

| 24% | $2,900 – $10,550 | $3,100 – $11,150 |

| 35% | $10,550 – $14,450 | $11,150 – $15,200 |

| 37% | over $14,450 | over $15,200 |

Supply: IRS Rev. Proc. 2022-38, Rev. Proc. 2023-34.

2023 2024 Reward Tax Exclusion

Every individual may give one other individual as much as a set quantity in a calendar 12 months with out having to file a present tax type. Not that submitting a present tax type is onerous, however many individuals keep away from it if they’ll. This present tax exclusion quantity will improve from $17,000 in 2023 to $18,000 in 2024.

| 2023 | 2024 | |

|---|---|---|

| Reward Tax Exclusion | $17,000 | $18,000 |

Supply: IRS Rev. Proc. 2022-38, Rev. Proc. 2023-34.

The present tax exclusion is counted by every giver to every recipient. As a giver, you may give as much as $17,000 every in 2023 to a vast variety of individuals with out having to file a present tax type. In case you give $17,000 to every of your 10 grandkids in 2023 for a complete of $170,000, you continue to gained’t be required to file a present tax type. Any recipient also can obtain a present from a vast variety of individuals. If a grandchild receives $17,000 from every of his or her 4 grandparents in 2023, no taxes or tax varieties will likely be required.

2023 2024 Financial savings Bonds Tax-Free Redemption for School Bills

In case you money out U.S. Financial savings Bonds (Sequence I or Sequence EE) for faculty bills or switch to a 529 plan, your modified adjusted gross revenue should be beneath sure limits to get a tax exemption on the curiosity. See Money Out I Bonds Tax Free For School Bills Or 529 Plan.

Listed below are the revenue limits in 2023 and 2024. The boundaries are in a phaseout vary. You get a full exemption in case your revenue is beneath the decrease quantity within the vary. You get no exemption in case your revenue is above the upper quantity within the vary. You get a partial exemption in case your revenue falls throughout the vary.

| 2023 | 2024 | |

|---|---|---|

| Single, Head of Family | $91,850 – $106,850 | $96,800 – $111,800 |

| Married Submitting Collectively | $137,800 – $167,800 | $145,200 – $175,200 |

Supply: IRS Rev. Proc. 2022-38, Rev. Proc. 2023-34.

Say No To Administration Charges

In case you are paying an advisor a share of your property, you’re paying 5-10x an excessive amount of. Discover ways to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]