[ad_1]

Studying Time: 8 minutes

Up to date 4th April 2024

Making an attempt to get on high of your general bills means it’s straightforward to neglect the little prices alongside the best way. This budgeting guidelines will provide help to break down your bills into chunks, with the intention to make a sensible family finances – and see the place it can save you.

- Why Finances?

- Family Payments

- Subscriptions and Memberships

- Meals, Magnificence, and Clothes

- Dental and Glasses

- Automotive, Journey, Parking Prices

- Vacation Prices

- Leisure and Leisure

- What to Do With Your New Finances

- Extra Cash Saving Ideas

Why Finances?

Making a finances is an effective way to get began along with your financial savings security web. Whenever you perceive your spending habits, it’s a lot simpler to see the place you may in the reduction of or change your strategy to save cash. It doesn’t imply you’ll must dwell a frugal life, both! This budgeting guidelines is designed that will help you see the place you may change issues, like your family payments, with out feeling such as you’re chopping something out of your life.

Use this budgeting guidelines to recollect the entire little belongings you spend on annually. It’s straightforward to neglect the prices that come round yearly or quarterly, they usually can shock you – leaving you with no financial savings security web. Arrange a financial savings account and begin sweeping these further bits of money away, too!

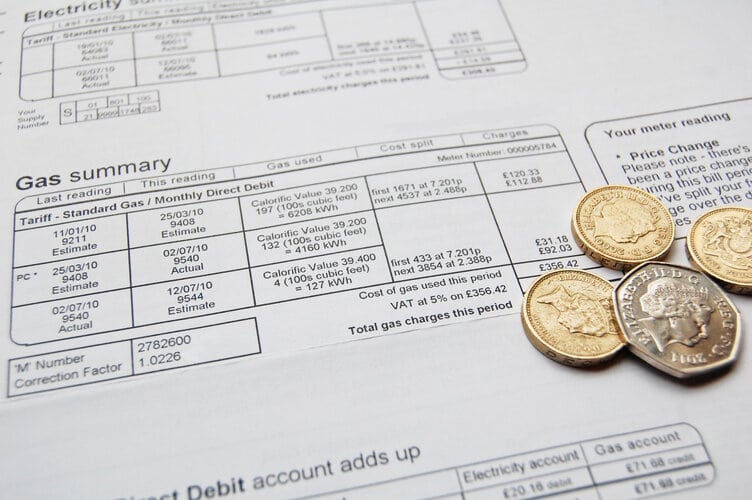

Family Payments

Essentially the most boring, however important, bills you’ll must cowl. Make a remark in case you pay yearly or month-to-month for every – some could possibly be less expensive in case you can afford to pay in a single annual lump sum (comparable to insurance coverage).

Checklist your bills for:

- Residence and contents insurance coverage

- Automotive insurance coverage

- TV license payment and broadband

- Council Tax

- Hire or mortgage funds

- Leasehold and administration charges (if in case you have them)

- Electrical energy, fuel, and water payments

Make a remark of the annual renewal date on your payments, too. This may provide help to store round and evaluate costs in time to nab a greater deal to save cash sooner or later.

It’s a tedious course of we all know, however purchasing round annually might prevent 1000’s of kilos over a lifetime – which implies further money in your pocket for investing!

Subscriptions and Memberships

We’re dwelling in an more and more subscription-based world, so now’s an excellent time to overview the whole lot you’re spending on digital and bodily memberships.

Checklist your month-to-month prices for:

- TV and streaming providers (Netflix, Amazon Prime, Disney Plus, Now TV, Hulu and so forth)

- Music and podcast streaming (Spotify, Amazon Music, Patreon, Audible and so forth)

- Fitness center memberships (Together with on-line courses!)

- Meals subscription bins (HelloFresh, Graze, and so forth)

- Cloud file storage

- Gaming subscriptions

- Social teams (WI, native courses, on-line courses)

Check out the place you might be able to save. Might you, for instance, ask your accomplice or housemate to enroll to one of many providers you’ve got (however they don’t) to share, benefiting from any new buyer free trial offers? Maybe you’re inadvertently paying for a subscription you not use (gyms, we’re you). Or, it’s possible you’ll discover somebody in your family additionally has the identical subscription that may be shared, comparable to Amazon Prime or Spotify Household.

With comparable providers, comparable to TV streaming, take into consideration which of them you utilize probably the most. Are there any you could possibly drop for some time? Rotating throughout providers helps you lower your expenses and in addition means whenever you’ve ‘accomplished Netflix’ there’s an entire new array of decisions on a distinct service to select from!

Meals, Magnificence, and Clothes

Return by way of your financial institution assertion from the final six months (ideally a 12 months). It’s tedious, however belief us – you’ll be amazed how a lot it provides up right here! Tot up the whole lot you’ve spent in a grocery retailer, on takeaways, and dinners out. Subsequent, take a look at what you’ve spent in shops like Boots and Superdrug, or what you’d usually spend on issues like toothpaste, hair merchandise, grooming merchandise, and make-up and equipment.

Lastly, contemplate what you’ve been spending on garments. Faculty uniforms add up rapidly – in case your faculty presents a uniform swap annually, this might save a variety of money. We’ve all spent much more time in leisurewear the previous 12 months, too – however because the world reopens, our wardrobe wants trying out. Empty your wardrobe and drawers of all gadgets of clothes and sneakers, together with these winter jackets you retailer within the attic.

Resolve which of them you may donate to charity, that are unworn and straightforward to promote, and which of them want repairing. Doing this can provide help to see what’s already there – and probably make you some further money when you’re at it! Make a listing of things of clothes you assume you’ll purchase within the subsequent six months, and the way a lot you’ll must spend on them. This gives you a greater concept of your clothes finances.

Dental and Glasses

Even whenever you’re an NHS affected person, you’ll often must pay for the dentist and optician. You’re presupposed to have a checkup on the dentist annually – when did you final go? Look on-line at your native follow to see how a lot a checkup will value – it’s often round £27 until you want further remedy. NHS prices are listed right here. There’s a disaster with NHS dentists proper now, so that you may must scout round to seek out your nearest follow taking over sufferers.

If you have to put on glasses to make use of a pc display screen for work, your employer might be able to cowl the price of an annual eye check. Anybody on a low revenue in receipt of advantages like Common Credit score may also entry low-cost or free optical care (not together with contact lenses). This consists of vouchers to cowl some or the entire value of a brand new pair of glasses. You’ll be able to usually buy glasses with these vouchers in two-for-one offers, too. Discover out in case you’re eligible for a free eye check on the NHS – it might prevent a ton of money.

Don’t qualify free of charge eyecare? Think about how a lot a watch examination, contact lens checkup, and new pair of glasses will set you again annually. Attempt to get your eyes checked yearly – opticians can spot some well being points lengthy earlier than they turn into an apparent drawback! Maintain a watch out for issues like eye check vouchers or reductions – you could possibly bag a cut price in case you discover a free eye check voucher and take the prescription to buy on-line for affordable glasses, too.

Automotive, Journey, and Parking Prices

The price of gasoline has remained pretty regular lately – steadily excessive! The free RAC app has a gasoline finder in it – serving to you discover the most affordable petrol or diesel wherever you might be within the UK.

Take into consideration and record your prices for:

- Automotive and/or bike insurance coverage

- Common gasoline prices (take a look at your 2019 utilization for a extra correct quantity!)

- Practice tickets (for normal leisure in addition to season tickets for commuting)

- Parking prices (at your native purchasing centre, city centre, and even office)

- MOT

- Automotive and different automobile tax

- Repairs and upkeep prices (don’t neglect screenwash, oil, and so forth!)

- Bus fares

- Taxi journeys (comparable to residence from an evening out, or after a late shift at work)

There are some methods to save lots of on these prices. For instance, it’s possible you’ll not want a full season ticket on your prepare fare in case you make money working from home a few of the week. Might you cycle to work as an alternative of drive? Maybe you may experience share with a neighborhood colleague, or discover others who dwell and work in the identical locations as you on rideshare apps like BlaBlaCar. When you park your automotive on the road at residence, search for resident parking schemes for reductions.

When you hardly use your automotive in any respect as of late, contemplate if it’s price holding in any respect. You possibly can be paying out for an costly driveway decoration! Take into consideration your typical journeys and the way a lot alternate options might value. For instance, in case you solely drive to the grocery store, take a look at the equal of fortnightly deliveries as an alternative (with a stroll to the native nook store for fundamentals like milk). It could possibly be far more cost effective so that you can be a part of a automotive membership or lease a automotive for particular journeys as an alternative of paying the common tax, gasoline, insurance coverage, and upkeep each month.

Vacation Prices

We’re all dreaming of getting away after greater than a 12 months of lockdown!

When including up your vacation prices, take into consideration:

- How lengthy you wish to go away for

- Who’s going with you

- The kind of lodging you need

- The way you’ll get there (and get round as soon as at your vacation spot)

- What your choices are for consuming in/consuming out

- Every day excursions you wish to take

- Spending cash

- Journey insurance coverage

- A vacation wardrobe

It’s straightforward to see how a vacation rapidly provides up! There are alternate options to costly worldwide holidays in case you’re stretched for money in the meanwhile. If you have already got (or can borrow) the tools, tenting is all the time an effective way to vacation on a finances.

Choosing the proper time of 12 months can prevent a whole bunch and even 1000’s of kilos, too! It’s harder for households with kids, because the off-peak seasons are usually outdoors of faculty vacation occasions. Nonetheless, even the day of the week that you just fly or take a ferry can impression the price of your tickets, so it’s price versatile dates earlier than you guide something to see how a lot you could possibly save.

Self-catered lodging is cheaper than a lodge or a bundle deal, however be sure you’re capable of make your personal meals with ease (i.e., that it has a completely outfitted kitchen!). Verify the typical worth of groceries, too – some locations may be VERY costly in relation to shopping for meals, which implies self-catered may not be the most affordable choice.

Leisure and Leisure

From out of doors sports activities to going to live shows, or meals out with the household and a recreation of ten pin bowling to complete, there are various methods we spend on leisure.

Take into consideration your leisure prices, comparable to:

- Swimming or sport prices (not included in a gymnasium memberships, which we accounted for above)

- Extra sportswear and tools rent or buy prices

- Going out for dinner or drinks

- Attending live shows or gigs

- Going to the theatre and cinema

- Day journeys with the household or your folks

- Area of interest pastime prices (comparable to shopping for wool in case you’re a knitter, or fishing deal with and permits in case you like fishing)

There are methods to save lots of on many leisure bills. Two-for-one offers on cinema tickets, for instance, will provide help to hold prices down. You may also be capable to purchase a ten-swim go or comparable at your native leisure centre, to cut back the price of common sports activities actions.

Attempt to break up day journey prices with family and friends, too. When you’re all going by automotive, attempt to share lifts wherever you may – and take a picnic as an alternative of shopping for meals at a restaurant. When you repeatedly journey as a pair or household by prepare, look into railcards to save lots of as much as 30% on rail fares.

Control native on-line noticeboards and newsletters for offers, too. You possibly can nab free or low-cost theatre tickets, or attend a free artwork gallery exhibition with a free glass of champagne, you by no means know!

What to Do With Your New Finances Guidelines

Now you’ve listed out your annual prices with our finances guidelines, take an extended, onerous take a look at it. What might you do with out? What might you minimise to save cash on? Is there something – like power payments – that you could possibly cut back with simply a day of analysis?

This helps you slash your outgoing bills. It additionally helps you see your spending habits – you may, for instance, be stunned to learn how a lot you spend on streaming providers that you just hardly use.

Work out what you could possibly save with a couple of easy adjustments, and voila! You’ve acquired the beginning of a financial savings security web. To seek out out what to do with it, obtain our FREE e-book right here.

[ad_2]