[ad_1]

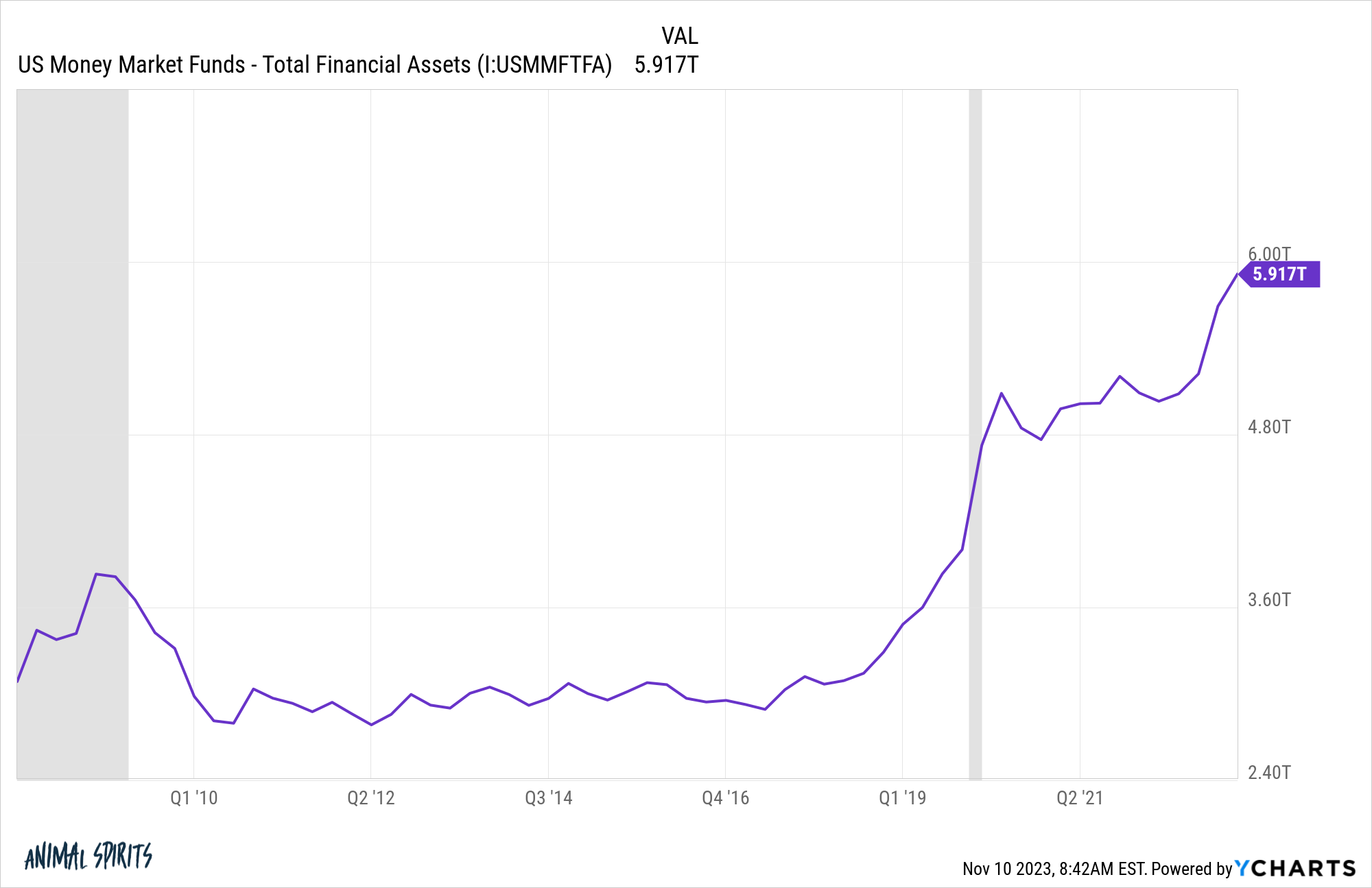

Boring outdated cash market funds are the most well liked factor in fund flows this 12 months. Simply have a look at the large sum of money that has poured into this stuff:

There’s a great cause these funds noticed stagnating asset development within the 2010s — there was no yield. Now there’s.

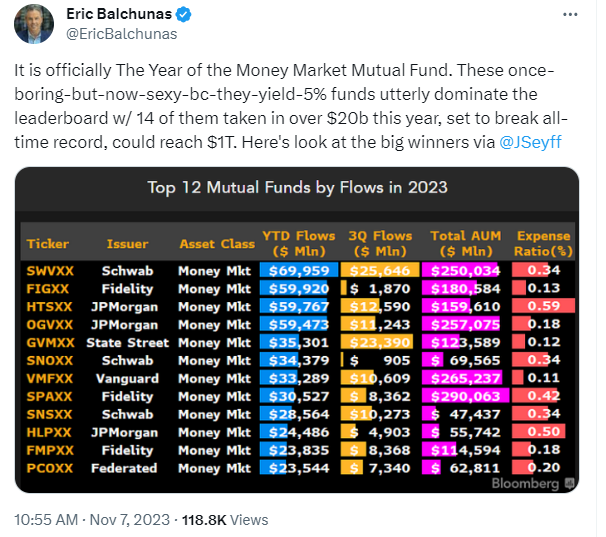

Bloomberg’s Eric Balchunas and Jeff Seyffart present how banks and fund firms throughout the board are vacuuming up cash now that cash market funds are yielding north of 5%:

Buyers have a historical past of chasing the best-performing funds however in addition they have a historical past of chasing yield in cash market funds.

Cash market funds are nonetheless a comparatively new growth within the fund world.

Again within the Nice Melancholy the federal government imposed a restrict on the quantity of curiosity a financial institution might pay to depositors as a result of so many banks failed within the Nineteen Thirties. The ceiling was a bit of greater than 5% which didn’t matter for a lot of many years as a result of charges by no means acquired that top.

Then the Seventies occurred. Inflation prompted greater rates of interest and banking clients couldn’t earn the a lot greater yields now accessible in short-term credit score devices.

A man by the identify of Bruce Bent acknowledged what was happening right here and didn’t prefer it. So within the early-Seventies Bent created the primary cash market fund, which wasn’t technically a financial savings account so it might supply market rates of interest and cost charges to get across the rules.

Bent had a powerfully easy concept that made sense and had fantastic timing — the proper mixture for fund flows.

The Seventies had been an terrible decade for shares and bonds alike. Money-like investments outperformed each of the 2 major asset courses as a result of rates of interest moved up so shortly.

Joe Nocera wrote an article in Esquire describing the ocean change that took place from cash market funds titled The Ga-Ga Years:

On January 7, 1973–greater than a 12 months after the SEC gave its approval–Bent acquired an enormous break. A New York Instances reporter, after months of badgering, wrote a brief article in regards to the fund. “The following day we acquired 100 telephone calls,” says Bent. “By the tip of the 12 months we had $100 million in belongings. Individuals I knew on Wall Avenue would ship their moms to me. Little outdated women would say to me, ‘My son informed me you’ve got a great factor.’ Then they’d say, ‘I’m nervous and I don’t wish to lose my cash.’”

Then Constancy’s Ned Johnson found out the way to add check-writing capabilities, giving much more ammo to the bankers, brokers and salespeople. It was a fund with each investing and saving attributes in a decade when folks had been looking for security.

Nocera referred to as cash market funds the seminal invention within the cash revolution, a minimum of on the funding facet:

It was the primary actually totally different wrinkle in private finance because the bank card. It was the primary product to cross beforehand iron-clad boundaries between banks and different monetary establishments, to not point out the psychological (however no much less ironclad) boundaries separating “financial savings” cash and “funding” cash within the minds of most People. When the monetary habits of the center class started to alter, of necessity, towards the tip of the last decade, the cash market fund was the product that made such adjustments possible, and even thinkable. Its creation signaled the start of the tip for the outdated world of non-public finance.

By 1981, T-bills had been yielding round 16% with the lengthy bond within the 14-15% vary. However bonds had been getting dinged yearly from rising charges. Cash market funds had been yielding nearer to 17-18% and also you didn’t have to fret about rate of interest threat.

In an age of inflation, Wall Avenue shortly discovered that yield sells.

The cash market fund fairly modified the course of the fund business eternally.

John Bogle described how this new fund saved Vanguard afloat throughout the late-Seventies and early-Nineteen Eighties in his ebook Keep the Course:

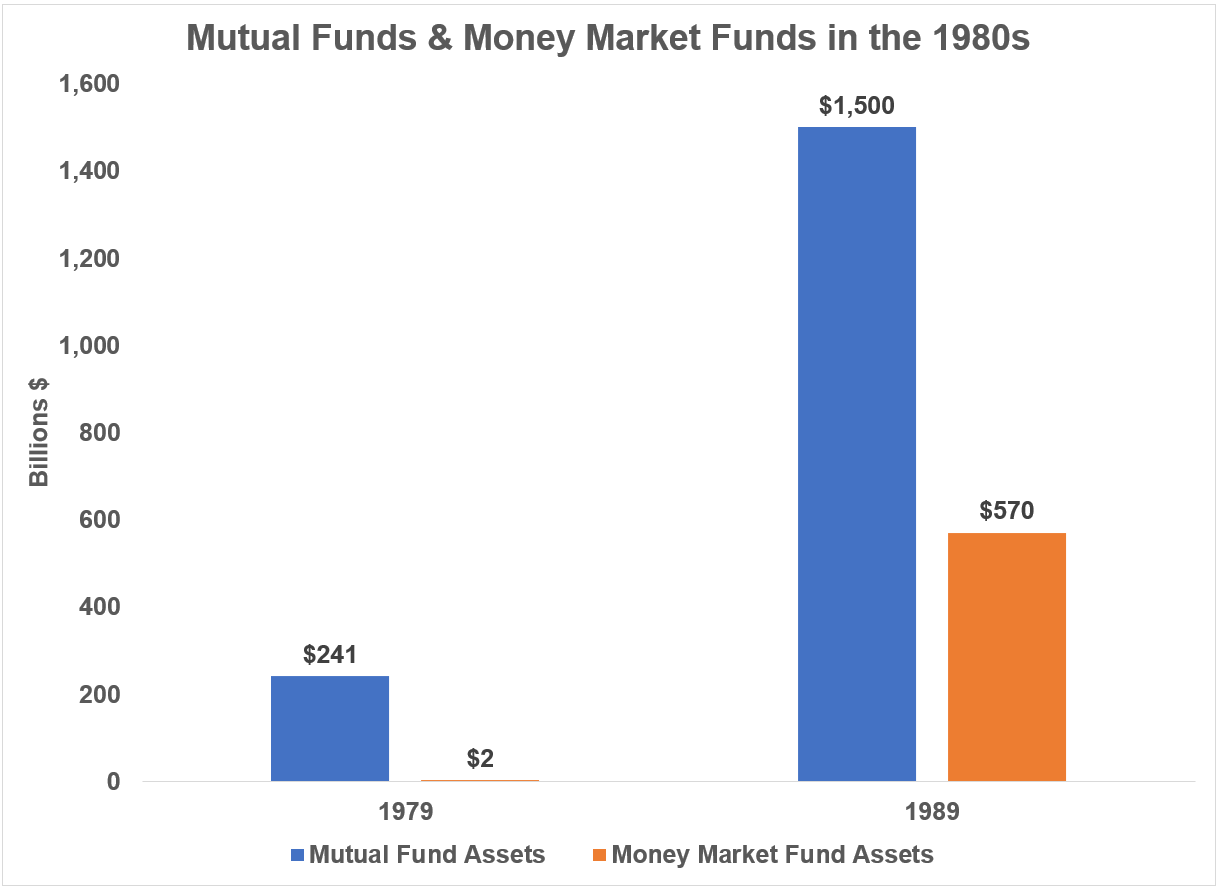

All through the last decade of the Nineteen Eighties, I typically bragged to our crew about Vanguard’s spectacular asset development, partially to take care of and construct on the strong morale we had established. However in actuality, our development largely mirrored the expansion of the burgeoning fund business. Throughout that decade, mutual fund belongings leaped from $241 billion to $1.45 trillion. The cost was led by cash market funds, which soared from $2 billion to $570 billion, accounting for nearly half of the rise.

Right here’s what Bogle wrote in chart kind:

From 1974-1981, the share of belongings in shares and balanced funds at Vanguard fell from 98% to 57%. The share of belongings in cash market funds went from 0% to 35% (bonds made up the distinction).

Cash market fund belongings leapt from $4 billion in 1977 to $185 billion in 1981. Bogle admitted, “With their excessive rates of interest and comparatively low threat, cash market funds created a brand new and fast-growing asset base which will have, in reality, saved the mutual fund business.”

When the financial and market malaise of the Seventies had lastly handed, these belongings had been already within the system to behave as a purchaser of shares within the ensuing bull market that started within the Nineteen Eighties. Ten million households owned cash market funds by the early-Nineteen Eighties. When the tax-deferred particular person retirement account hit the scene, lots of these cash market traders opened accounts and purchased shares.

Which brings us again to the current.

Monetary pundits wish to say, “I’ve seen this film earlier than and I understand how it ends.”

We’ve got seen this film earlier than however I don’t know the way it ends.

My largest query from the firehose of cash flowing into cash market funds is that this: How a lot of that cash will act as money on the sidelines if and when cash market yields fall?

There’s a case to be made that this cash will chase threat belongings greater throughout the subsequent bull market. Or this cash might keep in comparatively protected belongings if it got here from child boomers de-risking their portfolios as they enter or strategy retirement.

It might rely upon the trail of rates of interest from right here which is the last word unknown on this equation. If the previous cycle has taught us something, predicting rates of interest is kind of unimaginable.

If yields keep excessive, the cash will probably preserve flowing into fastened revenue funds like cash markets.

If yields return down, will probably be attention-grabbing to see how traders will react now that now we have so many retired child boomers and extra on the best way within the coming years.

If historical past has taught us something, one thing else will come alongside to seize investor consideration and fund flows.

Michael and I talked about cash markets, inflation and far more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional studying:

How Particular person Retirement Accounts Modified the Inventory Market Eternally

Now right here’s what I’ve been studying these days:

Books:

[ad_2]