[ad_1]

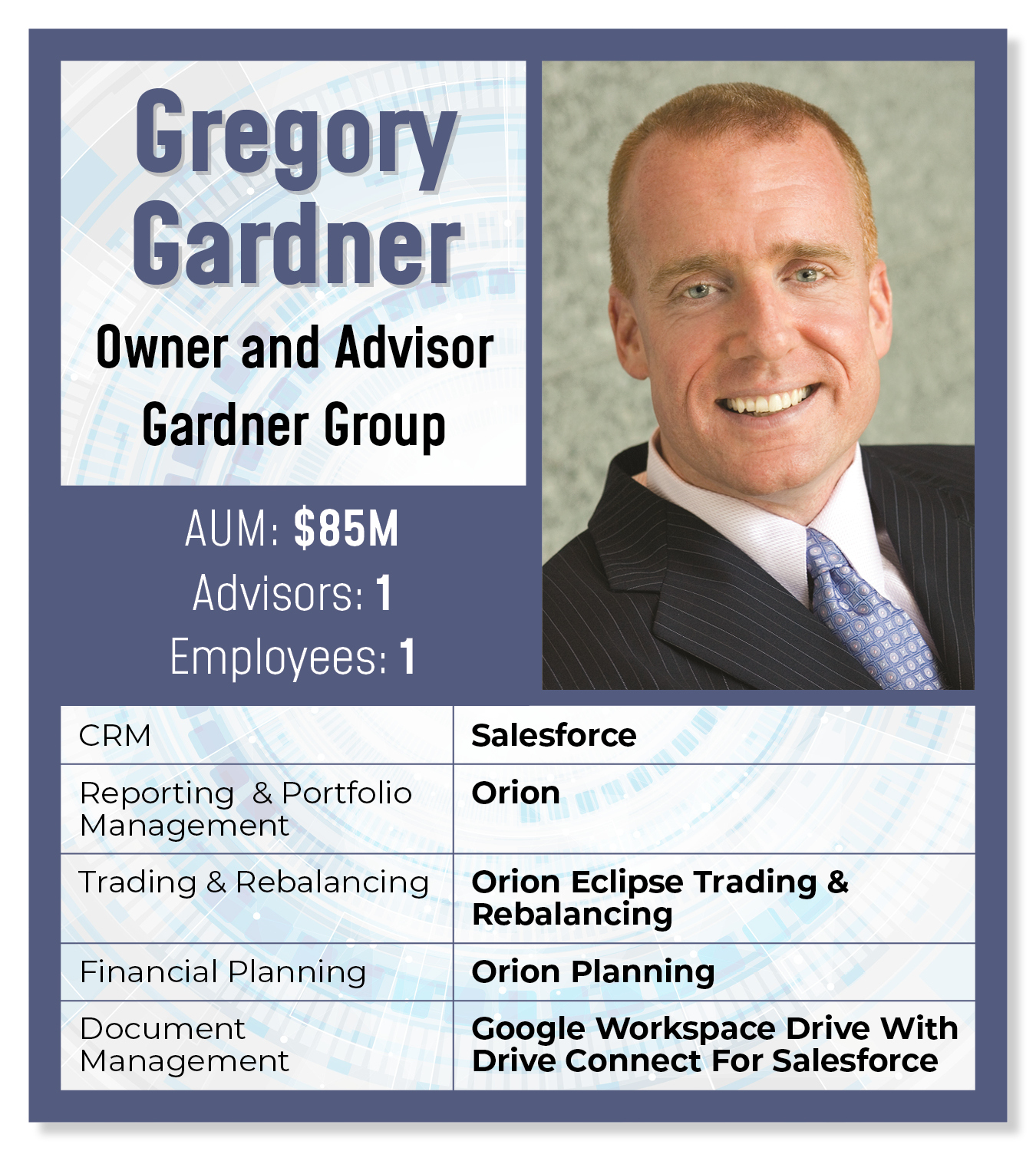

CRM: Salesforce

It’s been a 10- and 15-year journey [in terms of CRM use]. We had Junxure, which was a beautiful product. However they had been struggling on get to the cloud [about 11 years ago, prior to the acquisition of Junxure by AdvisorEngine].

So, I made the transition to Salesforce, which was nice. As a enterprise proprietor, each determination going ahead was going to be whether or not to combine it with Salesforce or not. That meant making a aware determination to fireside a few distributors whose merchandise we appreciated, however who weren’t built-in [with Salesforce and that had no plans to do so]. That’s been our mantra as we have a look at the competitors, as we have a look at higher run a enterprise: If it doesn’t work with Salesforce, we don’t have a look at integrating it.

It’s not my purpose to run my workplace from my cellphone. However I would like to have the ability to reply a query from my cellphone. And I can just about try this now with the best way we’ve obtained all the things built-in, automated and cloud-based. The considered me being within the server enterprise once more is about as unattractive because it will get [Junxure, which originally launched in 1995 went through several iterations where it often was run on an advisory firm’s own local servers]. I can’t fathom any monetary, automation or effectivity profit I’d ever see by going into that enterprise once more.

We now have Salesforce operating the present. It’s our supply of reality. Every little thing begins with Salesforce. For each potential integration we are able to, we would like it to have the ability to speak to Salesforce in a single kind or one other. And that enables us to make use of Salesforce’s platform to automate issues.

We now have Salesforce operating the present. It’s our supply of reality. Every little thing begins with Salesforce. For each potential integration we are able to, we would like it to have the ability to speak to Salesforce in a single kind or one other. And that enables us to make use of Salesforce’s platform to automate issues.

My expertise invoice might be greater than some corporations. If you happen to have a look at my subscriptions and a few programming charges, I feel final 12 months it was about $75,000 in complete expertise bills. You possibly can’t discover a good worker for $75,000.

We attempt to automate step-by-step. I feel our most advanced [work]stream might be 10 to 12 steps in possibly six months. That’s for a brand new shopper. We need to onboard them as effectively, however on the highest stage of service potential. And expertise is permitting us to do this.

From a pure expertise standpoint, there are some issues I’d change. However I don’t know clarify to Salesforce or within the context of economic planning. From an automation standpoint, it’s, “Why can’t I do that? You’ve obtained to do an additional step.” Know-how is sort of like a overseas language to me. I can learn it and perceive what’s occurring. However I can’t write it. If you happen to took me right down to Cancun and advised me to order off a menu, I do know what I’m getting. However I can’t converse Spanish, I can’t write it.

Portfolio Administration/Reporting/Buying and selling & Rebalancing/Monetary Planning/Buying and selling: Orion

We’re capable of choose up much more automation with Orion Planning. It places it within the CRM. It hundreds the info shortly, with good aggregation.

With Orion Eclipse [Trading & Rebalancing] their buying and selling platform that has saved us a whole lot of hours a 12 months of labor. We’ve been happy with that. In addition they feed into Salesforce.

We have now considered Orion’s Redtail CRM as an excellent product, however we would like our CRM to run a enterprise, not our CRM to run a monetary planning observe. The benefit we’re seeing is we’re getting extra integration, extra automation with our cellphone system, with our accounting programs, with operating a enterprise than if we had been utilizing Redtail. I’ve by no means heard something unhealthy about Redtail. It’s very, excellent for monetary planning. I wished to view it as we’re operating a enterprise. Perhaps it may very well be argued we’re operating a expertise firm and the byproduct is monetary planning.

Doc Administration: Google Workspace Drive and Drive Join

After attempting three to 4 completely different cumbersome, and dear, programs, we now use Google Workspace Drive and combine into Salesforce with Drive Join [a Salesforce AppExchange application developed by Appiphony for integrating and building out workflows between the two]. It does a very good job of automation, and so on. inside Salesforce. It creates our folder template hierarchy and creates and merges some paperwork like our shopper agreements, for instance.

After attempting three to 4 completely different cumbersome, and dear, programs, we now use Google Workspace Drive and combine into Salesforce with Drive Join [a Salesforce AppExchange application developed by Appiphony for integrating and building out workflows between the two]. It does a very good job of automation, and so on. inside Salesforce. It creates our folder template hierarchy and creates and merges some paperwork like our shopper agreements, for instance.

[Editor’s note: It should be noted that this is not an off-the-shelf product created for financial advisors. While the most tech-savvy advisors could set up an SEC-compliant, comparably low-cost document management and archival system combining the two, most advisors will require the services of a consultant for setup and ongoing maintenance of this solution.]

Communications: Twilio

I’ve third-party consultants who do all our upgrades for me, and the final venture was redoing our Twilio cellphone system. The purpose is to have an individual speak to the shopper. If I’m not out there, we’re including in some extra automation, so the shopper is aware of I’m in a gathering. Then voicemail will get despatched straight to me in an e mail but additionally creates the duty in Salesforce. All our cellphone calls are actually getting captured by Salesforce. There’s a little bit little bit of compliance. There’s a little bit little bit of CYA. However largely it’s automation and delivering a greater, greater expertise for the shopper.

[Editor’s note: For advisors unfamiliar with Twilio, it is an API-based digital communications service, often associated with the management, integration and automation of phone and texting services. While it has hundreds of thousands of users from startups to large enterprise companies, and with the vast majority using it for legitimate purposes, the company has also taken some flak for conveying large volumes of spam on behalf of its customers/clients (the FCC sent the company a robocall cease and desist letter in January). Twilio also suffered a significant breach in 2022, whereby attackers instigated a series of phishing campaigns through the service].

As advised to reporter Rob Burgess and edited for size and readability. The views and opinions will not be consultant of the views of WealthManagement.com.

Wish to inform us what’s in your wealthstack? Contact Rob Burgess at [email protected].

[ad_2]