[ad_1]

Technique generates wealth for purchasers, says monetary adviser

A monetary adviser has argued that paying lenders mortgage insurance coverage (LMI) could be a strategic transfer for producing wealth by way of property funding, however solely in particular conditions.

Billy Norman (pictured above) from monetary advisory agency Hyperlink Wealth Group mentioned he had used this technique a few instances just lately for his property investor purchasers, nonetheless, he admitted it was “solely applicable in sure conditions”.

“Paying LMI can generally be a smart selection, but many individuals battle to see why,” Norman mentioned.

The LMI situation

Norman explored this situation through the use of the instance of Luke, a 43-year-old investor incomes $220,000 with $200,000 in financial savings.

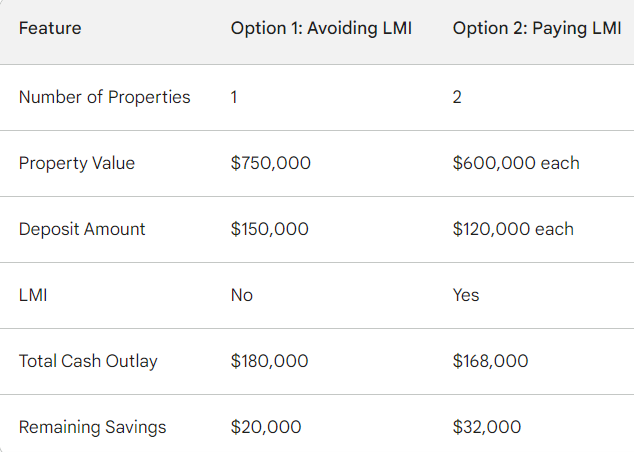

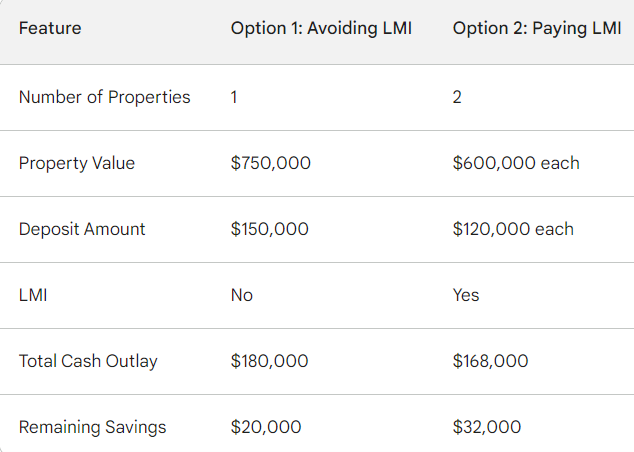

Choice 1: Avoiding LMI

- Luke places down a 20% deposit of $150,000 on a single $750,000 property.

- He spends one other $30,000 on stamp obligation and switch charges, leaving him with $20,000 in financial savings.

- Whereas LMI is averted, Luke’s capital is concentrated in a single property.

Choice 2: Paying LMI to buy two properties

- Luke utilises LMI to safe a decrease deposit, enabling him to purchase two $600,000 properties.

- He places down two 10% deposits totalling $120,000 and incurs $48,000 in stamp obligation and switch charges leaving him with $32,000 in financial savings.

- Though he pays LMI, he diversifies his portfolio with two properties, probably growing progress potential.

Right here’s a clearer breakdown of the important thing variations:

No LMI: breakdown of the professionals and cons

In fact, this strategy has its drawbacks. The LMI, which might complete $26,000 for every property, could be added to the mortgage steadiness.

Norman mentioned that this strategy would additionally solely typically work for purchasers that had important financial savings capability every month, and who had money within the financial institution to fund deposits.

“That is to allow them to deal with debt on a number of properties and have the flexibility to rebuild their money buffer comparatively quick,” Norman mentioned.

Nevertheless, provided that homes (5.1%) and items (2.7%) have elevated year-on-year over the September quarter, in line with Area, the chance to have two automobiles for progress moderately than one would speed up portfolio progress if this had been to proceed.

Are property buyers nonetheless shopping for in Australia?

Whereas 2023 will likely be remembered for the RBA’s speedy rise in rates of interest, there may be nonetheless eager curiosity on the property investor entrance.

The worth of latest mortgage commitments for investor housing rose 5.0% to $ 9.5bn and was 12.1% greater in comparison with a yr in the past, in line with the newest ABS information.

Norman mentioned most purchasers had been nonetheless eager to spend money on property, “if they’ll afford it”.

“I’ve seen a rising pattern in direction of utilizing a purchaser’s agent to purchase interstate. It is because the outlook for buyers in Victoria is not as beneficial as elsewhere in Australia,” Norman mentioned. “Additionally, the common worth in Melbourne is simply too excessive for many buyers who’re looking for current home and land.”

Nevertheless, Norman mentioned there have been some purchasers who mentioned they had been nervous about the price of being a landlord, and about property costs, so definitely some folks had been delay investing in property altogether in the mean time.

“More and more I am coming throughout individuals who beforehand invested in property and had been delay resulting from having a nasty expertise,” he mentioned.

“This is actually because they purchased residences off-the-plan and haven’t seen any progress.”

The connection between advisers and brokers

Monetary advisers and mortgage brokers play distinct however complementary roles within the monetary journey of property buyers.

Collectively, Norman mentioned, brokers and advisers might work collectively to information purchasers in direction of attaining their monetary objectives by way of completely different areas of experience.

“I’ll all the time work with mortgage brokers for purchasers,” Norman mentioned. “I discourage them from going on to the financial institution, as they’ll get a significantly better consequence or deal, from a dealer who can evaluate a wide array of lenders and choose the best choice for that individual shopper.”

“A great dealer can even run eventualities and assess borrowing capability, to offer us confidence across the technique.”

Norman mentioned whereas monetary advisers guided purchasers’ general funding technique, brokers navigated the mortgage utility course of with banks, making certain optimum outcomes.

“That is the place the dealer is vital,” Norman mentioned. “We’ve got an ideal dealer right here at Hyperlink Wealth Group, his identify is Eddie Malaeb. For each new shopper, I ask in the event that they already take care of a very good dealer, if they are saying no, I’ll all the time introduce them to Eddie.”

What do you consider Norman’s funding technique? Remark under

Associated Tales

Sustain with the most recent information and occasions

Be part of our mailing checklist, it’s free!

[ad_2]