[ad_1]

A reader asks:

Josh is true that I’m inclined to belief my cash with somebody that I like, which I’m certain was the thought behind all of the content material you set out. My query is – when do I do know it’s time to make that decision? I’ve a objective quantity in thoughts which I’m monitoring in direction of properly. However I’d hate to be beneath/over-aggressive as I attain the purpose of approaching retirement. I’m at present possible 14-16 years away from retirement. However when do I make the decision for assist? 5 years away from retirement? One 12 months? Six months?

It is a query tens of millions of individuals will likely be asking themselves within the coming years.

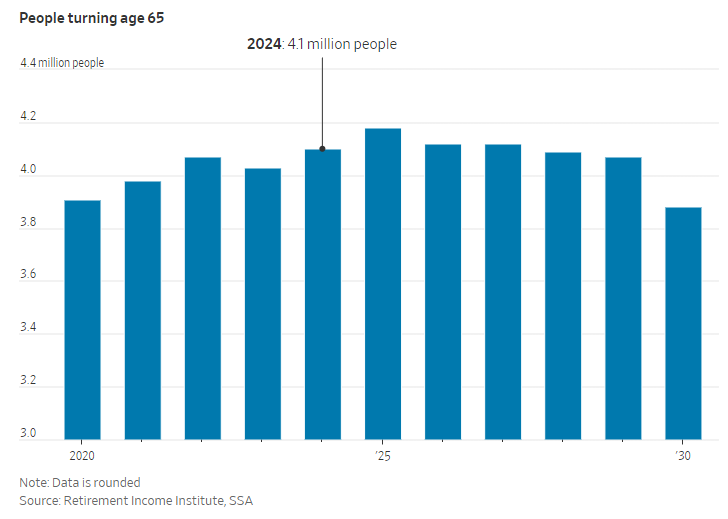

The Wall Road Journal notes there are extra Individuals turning 65 this 12 months than at any level in historical past:

There are going to be 4+ million folks reaching conventional retirement age yearly for the remainder of this decade.

The child boomer technology controls greater than $70 trillion of wealth. They’re retiring in droves. We’ve by no means seen a wave of older folks management this a lot cash earlier than.

This is without doubt one of the causes I’m so bullish on the wealth administration trade. Many of those new retirees will likely be searching for out monetary recommendation within the years forward.

In fact, not everybody wants an advisor.

I’ve spoken to a whole bunch (possibly 1000’s?) of DIY buyers through the years who research these items themselves, have a plan, and comply with that plan. Many of those folks can deal with it on their very own.

That’s wonderful.

However there are many individuals who can not or don’t need to.

Listed below are the most important causes it’s best to rent a monetary advisor:

You’ve got an enormous life occasion. For many individuals it’s retirement but it surely might be a loss of life within the household, marriage, children, inheritance, the sale of a enterprise, inventory choices, and many others.

Typically life forces your hand and it is advisable to search outdoors counsel.

Your monetary state of affairs is getting extra complicated. As you develop your wealth the stakes are inclined to get larger as a result of you’ve got extra to lose.

Folks hunt down monetary specialists when their monetary circumstances turn out to be extra complicated to take care of.

You don’t have the time or inclination. There are many individuals who merely don’t have the bandwidth of their life to handle their funds successfully.

In order that they outsource.

These things could be arduous when you don’t know what you’re doing or produce other stuff happening in your life that requires your full consideration.

Many individuals have higher issues to spend their time on than excited about their portfolio or monetary plan on a regular basis.

It’s also possible to let another person stress about your cash so that you don’t must.

You’re anxious about key particular person threat. I’ve talked to loads of prospects through the years who’re completely snug and able to managing their very own cash.

However typically occasions they’ve acquired a monopoly over the household funds. They know the assorted accounts the place the cash is saved. They’ve all of the passwords. They handle the portfolio. They deal with the taxes.

And their partner is out of the loop.

I perceive how this occurs. Numerous relationships divide and conquer.

What occurs to your loved ones if one thing occurs to you? What when you’ve got a well being scare or get hit by a bus?

Having a staff that may assist your loved ones is a type of insurance coverage in your dependents.

You’ve made an enormous mistake. I do know a solo practitioner who runs his personal RIA and frequently turns down enterprise. He tells prospects: You aren’t able to be my shopper but. Come again to me in a couple of years after you’ve made some errors.

He solely desires to work with shoppers he deems prepared to purchase into his type of wealth administration.

Some folks solely come to the conclusion they need assistance after they’ve made a crippling error with their cash.

You’re confronted with an enormous monetary determination. Large monetary choices are hardly ever black or white however slightly a shade of gray. You’ll be able to go down the rabbit gap of trade-offs and turn out to be paralyzed with concern you’ll make the unsuitable selection.

The very best monetary advisors don’t simply inform you what to do; they offer you a greater decision-making framework to make good decisions time and again.

Some folks search monetary recommendation to assist make extra knowledgeable choices.

You want a monetary plan or assist defining your targets. The quantitative stuff is the simple a part of the method. There are many advisors who can stroll you thru the spreadsheets and Monte Carlo simulations.

It’s the qualitative facets of economic planning that really matter.

What are you going to do along with your time?

What’s your relationship with cash?

What are your goals and aspirations, and the way can your monetary plan assist you fulfill them?

How will you use your cash to fund contentment in life?

The timing of the advisor determination is dependent upon how a lot your causes for searching for recommendation are weighing on you.

The excellent news is there isn’t any hurt in having a handful of conversations with totally different advisors. You don’t must signal a blood oath after your first assembly.

You’ll be able to store round a little bit to see how totally different advisors deal with issues like monetary planning, portfolio administration, tax planning, property planning, insurance coverage providers, and many others.

Belief is a key part in any service enterprise and monetary recommendation is not any totally different in that respect.

It is best to actually discover somebody you belief to handle your cash however ensure that it’s additionally somebody who may help relieve no matter cash stresses you’ve got in life.

We lined this query on the newest version of Ask the Compound:

Josh Brown joined me once more this week to debate questions on profession recommendation for youthful advisors, when it is smart to rent a monetary advisor for retirement, 401ks vs. brokerage accounts and how one can deploy money within the face of all-time highs within the inventory market.

Additional Studying:

How Wealthy Are the Child Boomers?

[ad_2]