[ad_1]

What’s in My Mannequin Portfolio is a brand new collection by which chief funding officers and analysts from prime RIAs within the wealth administration business element their investments and asset allocation in consumer portfolios.

Sequoia Monetary Group, which was based in 1991, has an extended historical past of serving entrepreneurial purchasers all through the lifecycle of their wealth. The RIA has grown to over $15 billion in property, and it not too long ago launched a household workplace division, referred to as Sequoia Sentinel, to offer extra specialised providers to its ultra-high-net-worth purchasers,

WealthManagement.com spoke with Nick Zamparelli, senior vp, chief funding officer, Sequoia Monetary Group, who gives a glance inside one of many RIA’s mannequin portfolios, which features a 36% allocation to options.

WealthManagement.com: What’s in your mannequin portfolio?

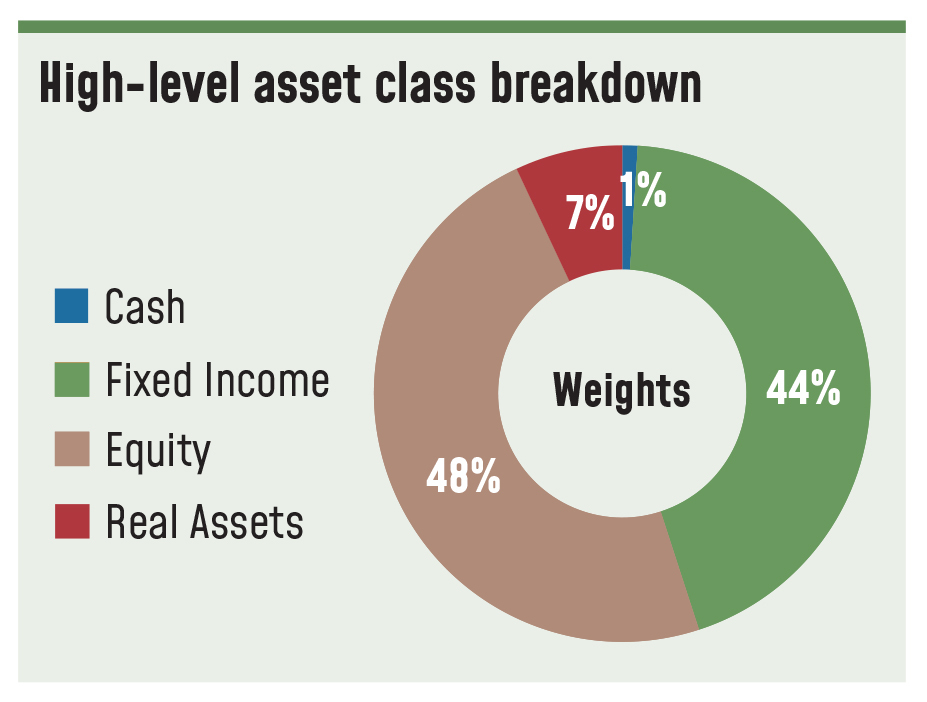

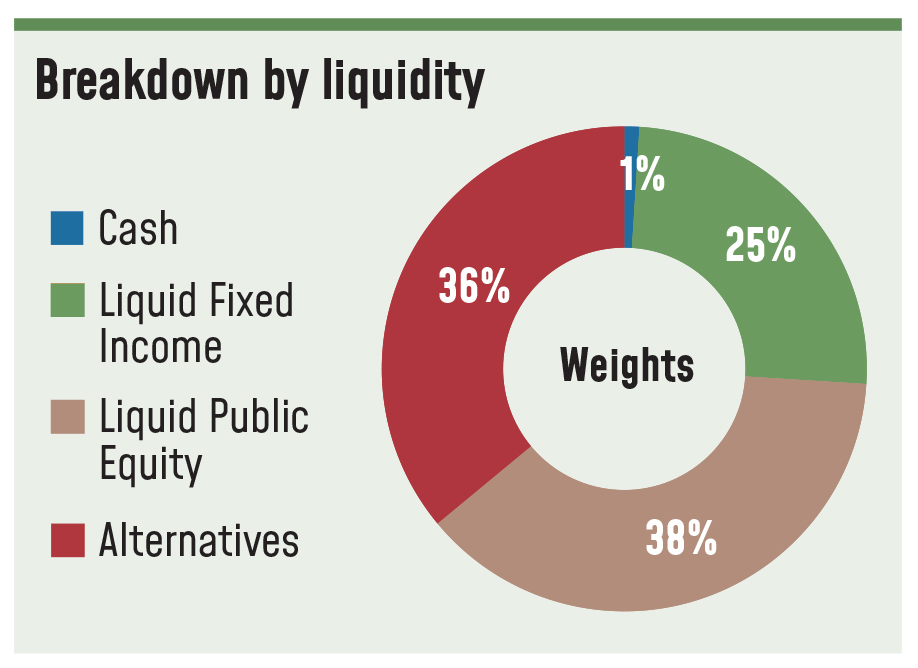

Nick Zamparelli: That is our 50/50 proxy mannequin. At a excessive stage, it contains money, mounted earnings (44%), fairness (48%), some actual property at 7%. However in case you break it out by liquidity, what you will see is that solely 25% is liquid mounted earnings. Solely 38% is liquid public fairness and 36% is alts. After which inside alts, I’ve it damaged out by non-public credit score, non-public fairness, hedge funds and actual property. We’re actually doing a great job mixing in these illiquid asset lessons, and that is actually the place we generate outsized risk-adjusted returns.

Nick Zamparelli: That is our 50/50 proxy mannequin. At a excessive stage, it contains money, mounted earnings (44%), fairness (48%), some actual property at 7%. However in case you break it out by liquidity, what you will see is that solely 25% is liquid mounted earnings. Solely 38% is liquid public fairness and 36% is alts. After which inside alts, I’ve it damaged out by non-public credit score, non-public fairness, hedge funds and actual property. We’re actually doing a great job mixing in these illiquid asset lessons, and that is actually the place we generate outsized risk-adjusted returns.

The Sequoia Sentinel, Sequoia’s household workplace division, consumer has the posh of affording a fabric quantity of illiquidity of their portfolio of property. It is nice for me as an asset allocator as a result of it actually opens up our universe of funding alternatives into alts, into illiquid property. It permits us to essentially exit and search one of the best risk-adjusted returns and seize illiquidity premiums and simply be actually considerate about how we’re constructing out their funding portfolios. The general purpose clearly is to construct out considerate portfolio of property in probably the most opportunistic approach doable.

We use our personal set of capital market assumptions, which is one factor that basically differentiates us, notably within the non-public area. Non-public fairness screens nice in optimizers as a result of the usual deviation of returns seems artificially low merely as a result of it does not get marked as a lot. So, it appears to be like such as you’re producing higher than common fairness—higher than a public fairness returns at a decrease stage of threat, which everyone knows as buyers will not be true.

So, we make some changes in our mannequin, notably on customary deviation to indicate that there’s in reality extra threat in non-public fairness than public fairness, for instance. However we provide you with our customary set of capital market assumptions that we overview on an annual foundation.

WM: Have you ever made any large funding allocation modifications within the final six months or so?

NZ: For, maybe, the primary time in my profession probably the most contentious conversations inside the analysis workforce and albeit with purchasers are taking place in what must be the danger mitigating section of the portfolio. The entire fascinating conversations are happening within the mounted earnings section of the portfolio. So, to that finish, the query actually for the final 18 months is, when to begin leaning into period inside your mounted earnings section, when to tackle slightly bit extra rate of interest threat?

Numerous people had been very early—and understandably so given most would have thought that the economic system would have been extra delicate to the mountaineering cycle than it has turned out to be. Now, there’s quite a lot of the explanation why that is the case, and I believe it was missed by many market contributors that each customers and companies had been capable of time period out their debt at actually, actually low charges for a very long time.

So, this fast improve that we noticed on Fed funds actually did not have an effect on their lives but. Now the query will turn out to be simply how for much longer. The Fed talks about lagged and variable results of rate of interest hikes. All of that stuff remains to be seeping into the economic system. And there’ll come a time when each customers and companies must refinance their debt. And in the event that they needed to do it at present—which they do not, fortunately—you then would see that financial sensitivity that individuals had been anxious about. However we’ve not seen it but.

So, the most important change we have remodeled the previous six months is leaning into period of bid as charges have backed up.

I am attempting to determine a ballast within the portfolio from a threat perspective that offsets my return searching for property, my fairness threat, if you’ll. And the place charges are at present, I believe you may lastly say that, hey, if we actually get a contraction within the economic system, that mounted earnings at present goes to assist offset a few of that fairness threat as a result of charges will are available they usually’ll are available fairly aggressively. Everybody’s ready for charges to come back down, but when they arrive down for the improper causes, it is not a great factor for the fairness market. So, in the event that they’re coming down as a result of there are actual financial considerations, it is not going to be favorable to equities as a result of, whereas multiples could profit, the denominator actually will not be going to learn.

I am attempting to determine a ballast within the portfolio from a threat perspective that offsets my return searching for property, my fairness threat, if you’ll. And the place charges are at present, I believe you may lastly say that, hey, if we actually get a contraction within the economic system, that mounted earnings at present goes to assist offset a few of that fairness threat as a result of charges will are available they usually’ll are available fairly aggressively. Everybody’s ready for charges to come back down, but when they arrive down for the improper causes, it is not a great factor for the fairness market. So, in the event that they’re coming down as a result of there are actual financial considerations, it is not going to be favorable to equities as a result of, whereas multiples could profit, the denominator actually will not be going to learn.

WM: Have you ever made any modifications on the fairness aspect?

NZ: We have added some quick publicity to our fairness guide. We did that round April or Might. We’re not betting that the market goes down, however we wish to take a number of the volatility out of the potential modifications in fairness markets. It is turned out to be an actual profit to the portfolio as a result of it served the aim of tamping down the volatility of our fairness returns.

WM: What differentiates your portfolio?

NZ: The analysis course of, in and of itself, actually differentiates us from our rivals. If we’re searching for publicity to a sure asset class, I’ve obtained seasoned professionals which can be material consultants that may actually discover one of the best methods to articulate these desired exposures. And these guys have a Rolodex. They are not out doing a recent search each time. They have sufficient expertise of their space of experience the place they have a bench, they have a roster, they have a Rolodex to select from.

WM: What are your prime contrarian picks?

NZ: One is small cap shares. Have they underperformed and for a great cause. With the speed atmosphere that we’re in, quite a lot of small cap shares, the iShares Russell 2000 Worth ETF (IWM) for instance, is riddled with firms which have lower than stellar steadiness sheets and must entry the capital markets to fund their development. They usually cannot do it on this atmosphere. That stated, it is an space of development that we actually need publicity to, and we’re very cognizant of the truth that over lengthy intervals of time, small cap shares have outperformed. In order that’s an space that we’re trying to lean into proper now.

Worldwide fairness is one other space of the market that has underperformed for 15 to 16 years now. Once we begin to see development alternatives broaden out globally, you are going to see a possibility for worldwide shares and rising markets to essentially begin to outperform. You additionally will get a profit if we ever see the greenback weaken. That shall be an enormous good thing about proudly owning worldwide equities and rising market equities. We’re additionally beginning to take a look at some bond proxy fairness sectors which have simply been decimated.

WM: What funding automobiles do you employ?

NZ: We’ll go from passive to very, very energetic. We’ll use passive ETFs the place we do not suppose the market is inefficient sufficient to pay for energetic administration. For instance, we are going to attempt to make use of passive tax advantaged methods to get our U.S. massive cap publicity, which is a really environment friendly market and really troublesome for energetic managers to outperform, notably given the focus in that area. However within the areas the place it is much less environment friendly—worldwide markets, rising markets, small caps—we are going to exit and discover who we expect are one of the best technique managers. So, we’ll use ETFs, we’ll use mutual funds, we’ll use non-public partnerships.

NZ: We’ll go from passive to very, very energetic. We’ll use passive ETFs the place we do not suppose the market is inefficient sufficient to pay for energetic administration. For instance, we are going to attempt to make use of passive tax advantaged methods to get our U.S. massive cap publicity, which is a really environment friendly market and really troublesome for energetic managers to outperform, notably given the focus in that area. However within the areas the place it is much less environment friendly—worldwide markets, rising markets, small caps—we are going to exit and discover who we expect are one of the best technique managers. So, we’ll use ETFs, we’ll use mutual funds, we’ll use non-public partnerships.

We’ve our personal inside partnerships that we have created to get publicity to quite a lot of illiquid asset lessons. We’ve our personal technique referred to as Area of interest Credit score, which is in non-traditional areas of mounted earnings, like dislocation funds, distressed funds, extra opportunistic areas of the market that transcend simply merely choosing excessive yield, for instance. And on the non-public fairness aspect, we’ve got a collection of classic funds. We’ll discover methods throughout the spectrum of enterprise all the way in which to late stage buyout. A few of these are accredited funds, some are Certified Purchaser funds. Most of our purchasers within the household workplace are QPs.

WM: What are the alternatives you see in actual property proper now? Are there any specific segments that you are going after or constructions you’re utilizing?

NZ: In non-public markets, we truly exit and purchase direct offers. So we personal some industrial workplace buildings in suburban Philadelphia. We personal some scholar housing initiatives—one at Penn State, one at College of Delaware, one on the College of Alabama. Our scholar housing portfolio is performing very, very nicely. Our industrial workplace is struggling a bit.

We discovered that by proudly owning and working particular person actual property property, we might generate a reasonably wholesome yield for our purchasers. And moderately than underwriting the credit score high quality of an organization in mounted earnings, you are actually underwriting the credit score high quality of the tenant and the intentions of the tenant.

We’ll use every so often actual property funds. For instance, we have invested in an industrial actual property fund the place it was simply industrial and warehouse actual property area.

And we additionally will use public REITs. Proper now I might counsel that public REITs, which have already discounted the values of the underlying property by way of the general public markets, could also be extra fascinating methods, at the least tactically, to get publicity to actual property than what you are able to do within the non-public markets. It’s actually troublesome on this financing atmosphere to get an actual property deal to pencil out once you’re taking over debt at these ranges. It has been very, very troublesome so as to add new direct actual property alternatives to the portfolio. There shall be misery, and we’ve got capital to deploy. So, we shall be opportunistic there for positive.

WM: How are you addressing the inflationary atmosphere inside the portfolio?

NZ: Equities is usually a actual hedge in opposition to inflation. Proper now, if we’re anxious about something, we’re anxious concerning the shopper. The patron in our view, from what we will see for the actual time information that we’re listening to from firms, is getting extra discerning, and the extra discerning they get, the tougher it is going to be for firms to move by means of pricing. The tougher it’s for firms to move by means of pricing, the extra they run into margin points. So, you throw that margin headwind up in opposition to rates of interest and hastily you have obtained a possible for earnings to underperform versus estimates.

WM.com: How a lot are you holding in money and why?

NZ: For us, there are two causes to carry money: One is frictional only for consumer bills, which generally is 1% on a regular basis, not a fabric quantity. Or, we might use it as a tactical allocation inside our mounted earnings portfolio. If we had been actually good, we might’ve gone to all money and T-bills in the beginning of this yr, after which proper round now we might’ve swapped that into one thing lengthy period. We’ll try this every so often to handle the period of our mounted earnings portfolio.

WM.com: Are you incorporating ESG into the portfolio? If that’s the case, how?

NZ: ESG has been actually robust for us as a result of it is an space the place we do not essentially belief quite a lot of the knowledge that we’re getting so far as what makes one thing engaging from an ESG perspective. We have not gotten fully snug with the information. That stated, quite a lot of our ESG-related investments are consumer pushed. So, when we’ve got a consumer that has a specific hankering for one thing or they’ve a specific view or they need publicity to one thing or they wish to keep away from one thing, we are going to work with them and discover one of the best methods to try this. We’ll dig in and do some actual diligence to search out them areas the place they’ll be ok with their investments.

[ad_2]