[ad_1]

Tax refunds contain the quantity of taxes you pay out of your paycheck all year long. Understanding how they work can provide you extra management over your cash and keep away from any surprises as soon as tax season rolls round.

What’s a tax refund?

A tax refund is cash that the federal government offers again when you paid extra in taxes all year long than you owed. This overpayment outcomes from employers withholding an excessive amount of cash out of your paychecks.

As an alternative of ready for a yearly refund, you possibly can modify your tax withholding to keep away from overpaying your taxes and preserve extra of your paycheck month-to-month. We’ll clarify how beneath.

How do tax refunds work?

Whereas a tax refund might seem to be a nice monetary shock, it’s simply the federal government returning the additional cash you paid them in taxes. In different phrases, cash that might have been in your pocket all year long.

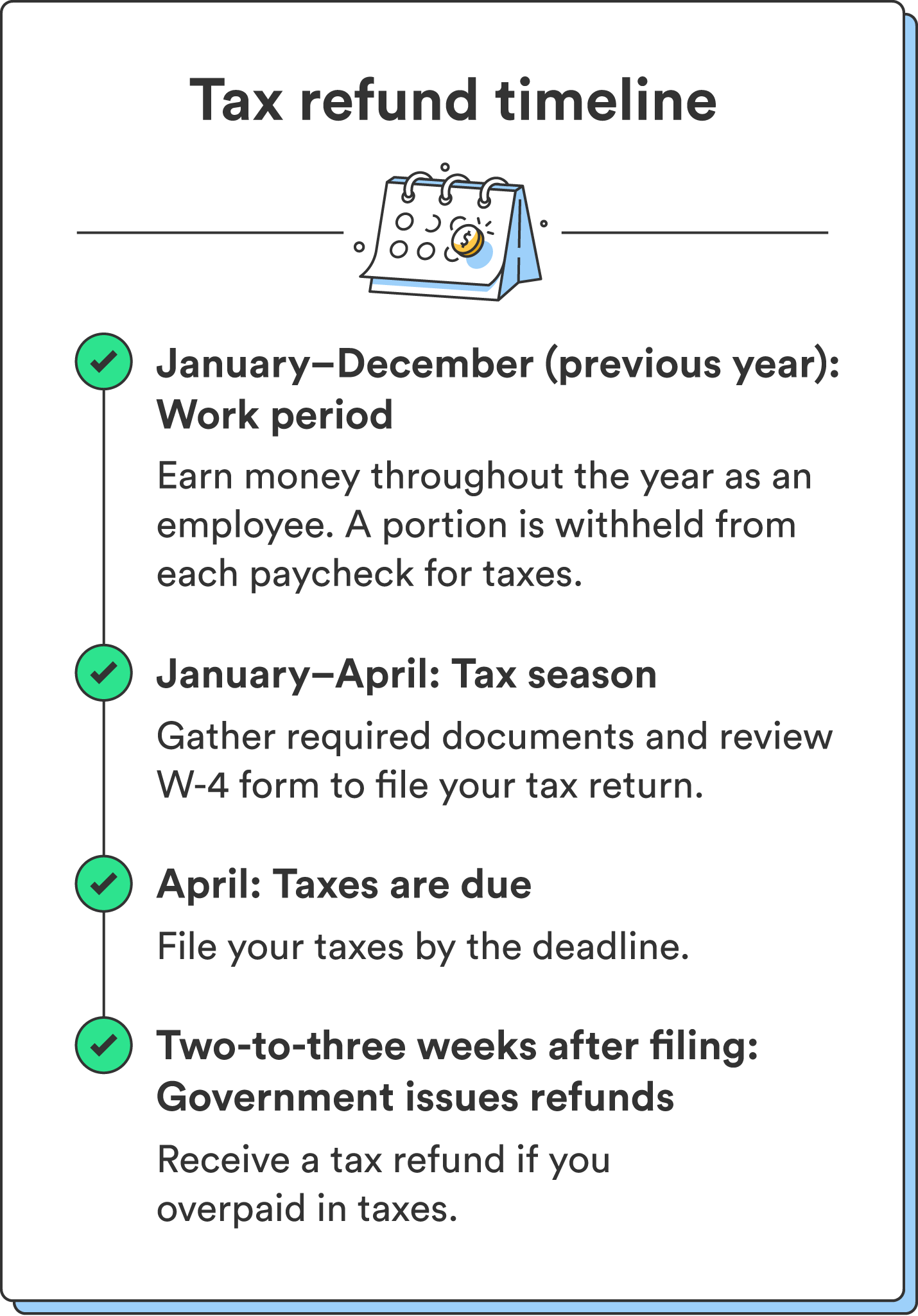

Right here’s a breakdown of how tax refunds work:

- Earnings taxes: If you earn cash, your employer sends a portion of your paycheck to the IRS to cowl the revenue taxes you owe.

- W-4 Type: As an worker, you specify the quantity of taxes you need withheld from every paycheck in your W-4 kind.

- Annual tax submitting: When you file your taxes, guarantee your annual tax return precisely particulars your earnings, deductions, and credit.

- Calculating tax legal responsibility: The federal government calculates how a lot you owe in taxes based mostly on the knowledge you supplied in your tax return.

- Evaluating withheld quantity: The IRS compares the quantity you withheld to your precise tax legal responsibility.

You’ll obtain a tax refund when you’ve paid an excessive amount of in taxes. It’s possible you’ll owe the IRS further taxes when you’ve underpaid.

Whereas a tax refund might seem to be a nice monetary shock, it’s simply the federal government returning the additional cash you paid them in taxes. In different phrases, cash that might have been in your pocket all year long.

Right here’s a breakdown of how tax refunds work:

- Earnings taxes: If you earn cash, your employer sends a portion of your paycheck to the IRS to cowl the revenue taxes you owe.

- W-4 Type: As an worker, you specify the quantity of taxes you need withheld from every paycheck in your W-4 kind.

- Annual tax submitting: When you file your taxes, guarantee your annual tax return precisely particulars your earnings, deductions, and credit.

- Calculating tax legal responsibility: The federal government calculates how a lot you owe in taxes based mostly on the knowledge you supplied in your tax return.

- Evaluating withheld quantity: The IRS compares the quantity you withheld to your precise tax legal responsibility.

You’ll obtain a tax refund when you’ve paid an excessive amount of in taxes. It’s possible you’ll owe the IRS further taxes when you’ve underpaid.

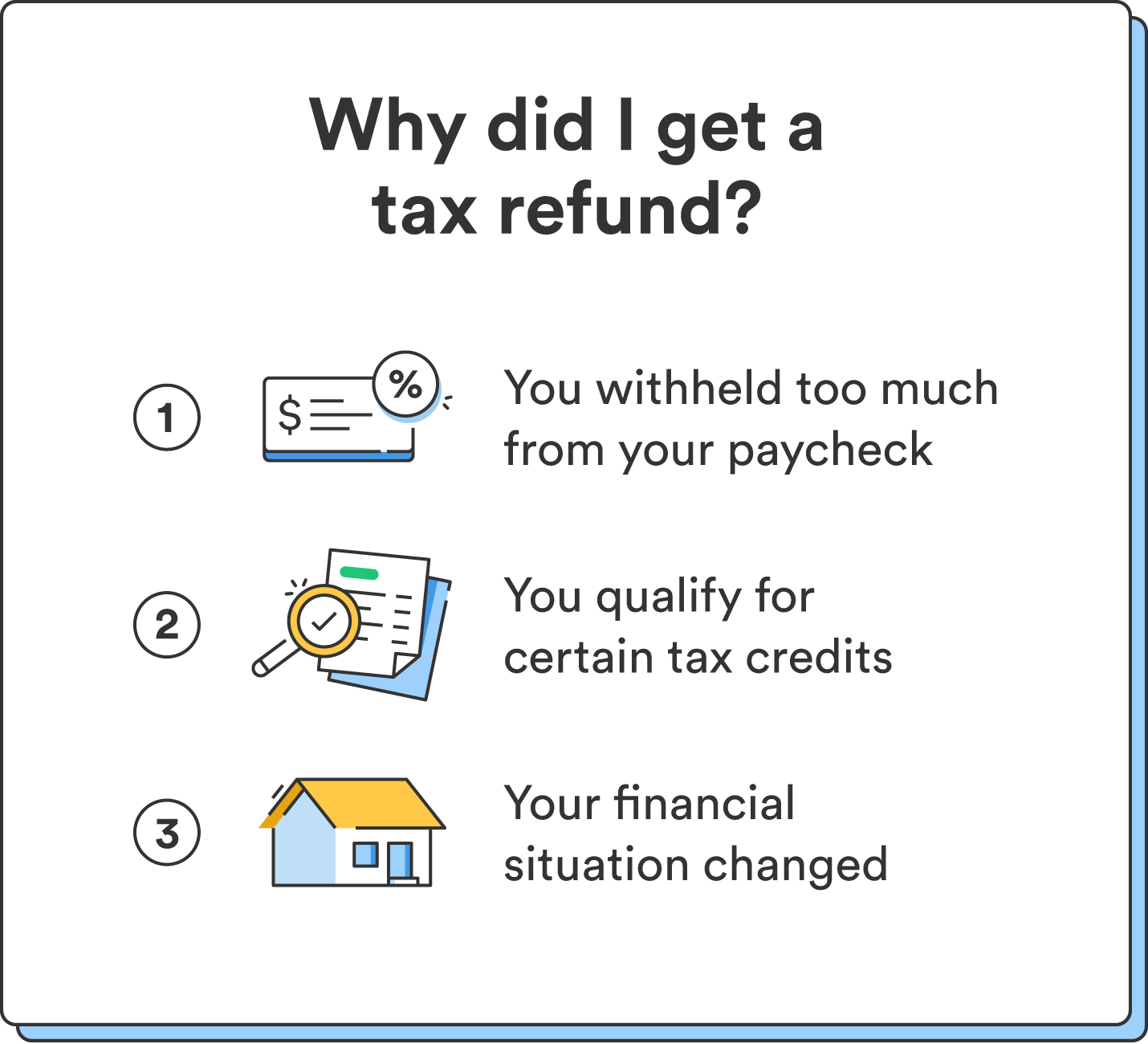

Causes you could obtain a tax refund

Listed here are three widespread eventualities that may result in receiving a tax refund:

- Withholding an excessive amount of out of your paychecks: For those who stuffed out your W-4 to have the next withholding quantity that exceeds how a lot you owe in taxes, you will have extra money taken from every paycheck than needed, leading to a tax refund.

- Receiving refunds for tax credit and deductions: “Refundable” tax credit and deductions, just like the Earned Earnings Tax Credit score (EITC) or the Baby Tax Credit score, can result in a refund even with low tax legal responsibility.1 For instance, when you qualify for a refundable tax credit score of $1,000 however solely owe $800 in taxes, the IRS returns the additional $200 as a refund.

- Experiencing modifications in your monetary state of affairs: Important life modifications, like getting married, having a toddler, or shopping for a house, can influence your tax state of affairs. These modifications might result in further tax credit or deductions, rising the probability of a refund.

When will I get my tax refund?

The precise timeframe for receiving your tax refund varies, however you possibly can anticipate to obtain your refund inside 21 days when you file your taxes on-line and request direct deposit.2 This timeline can change relying on the IRS’s workload and any points along with your return.

Learn how to replace your tax withholding quantity

As an alternative of ready for a yearly refund, you possibly can modify your tax withholding to keep away from overpaying your taxes and preserve extra of your paycheck month-to-month.

Prior to now, that will imply adjusting the knowledge you entered for Allowances in your W-4. Nonetheless, the IRS redesigned Type W-4, and it not contains this part. The up to date format routinely matches your withholding to your precise tax legal responsibility.³

That mentioned, you possibly can enter an extra withholding quantity in Step 4(c) of Type W-4 when you want your employer withhold extra taxes than needed from every paycheck.³

It’s also possible to use the IRS Tax Withholding Estimator instrument to find out probably the most correct withholding in your state of affairs.

Take the stress out of tax season

As an alternative of ready for a yearly tax refund, studying the ins and outs of how tax refunds work will help you retain extra of your hard-earned cash all year long (examine how a lot of your paycheck it is best to save). Make the most of instruments just like the IRS Withholding Estimator and, if needed, replace your W-4 to match your monetary state of affairs.

If you’re able to file, discover out when you will pay your taxes with a bank card.

FAQs about tax refunds

Nonetheless have questions on tax refunds? Discover solutions beneath.

How do I test the standing of my tax refund?

To test the standing of your tax refund, use the IRS’s The place’s My Refund? instrument. You need to use this instrument starting 24 hours after the IRS receives your tax return when you filed on-line or 4 weeks after mailing a paper return.4

What ought to I do with my tax refund?

For those who obtain a tax refund, think about using it strategically to additional your monetary targets. Whether or not constructing an emergency fund, paying down debt, or investing in long-term financial savings, your refund can contribute to a safer monetary future.

Does everybody get a tax refund?

Not everybody receives a tax refund. It relies on components like revenue, deductions, and tax credit. Whereas some might get a refund, others may owe further taxes or have a steadiness that breaks even.

The put up What Is a Tax Refund, and How Does It Work? appeared first on Chime.

[ad_2]