[ad_1]

2023 was a very good 12 months for the inventory market.

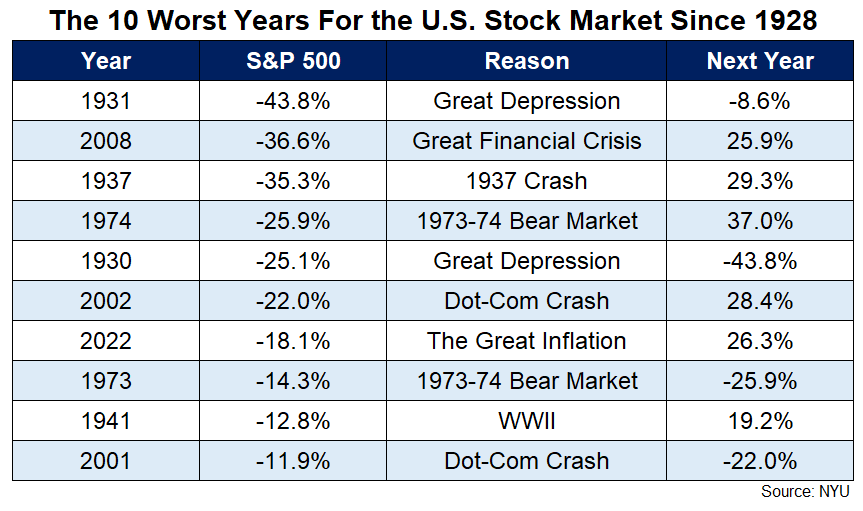

Unhealthy years within the inventory market are usually adopted by good years (however not all the time):

The apparent follow-up right here is: What occurs after good years? Or how typically will we see good years adopted by good years?

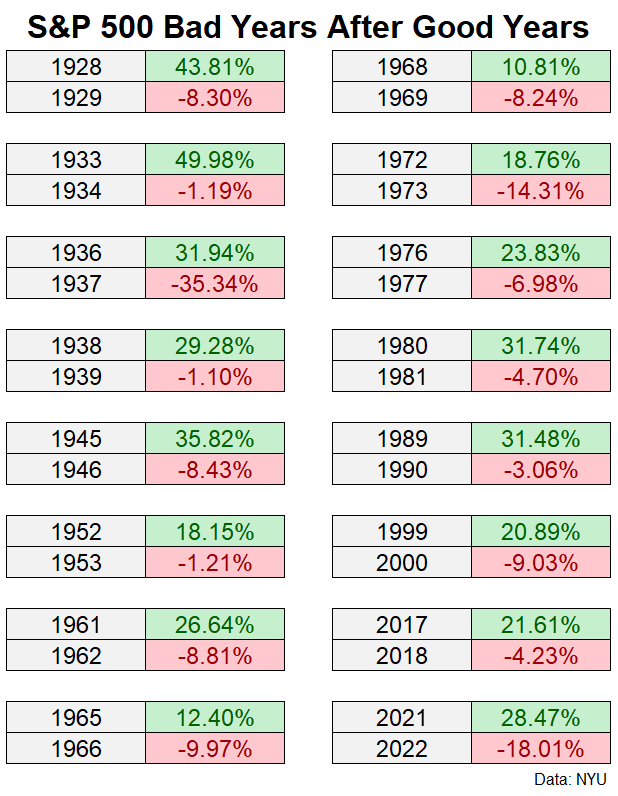

There are, after all, unhealthy years that comply with good years, similar to there are good years that comply with unhealthy years. Listed below are the entire down years following a double-digit up 12 months since 1928 for the S&P 500:

This occurred as just lately as 2022 following the blowout 12 months in 2021.

Human psychology causes many people to continuously fear one thing unhealthy has to occur after one thing good occurs.

The beneficial properties can’t final.

All the excellent news is priced in.

The straightforward cash has been made.

Shares are priced for perfection, yada, yada, yada.

That might be the case this time round. Perhaps the market has gotten forward of itself. Perhaps shares have already priced in a comfortable touchdown and a number of Fed fee cuts in 2024.

The nice occasions by no means final eternally, so it’s affordable for buyers to think about draw back dangers after issues go effectively.

It’s additionally essential to recollect the nice occasions can last more than you assume.

It’s onerous to think about the inventory market might follow-up 2023 with one other large achieve contemplating the S&P 500 gained greater than 26% final 12 months.

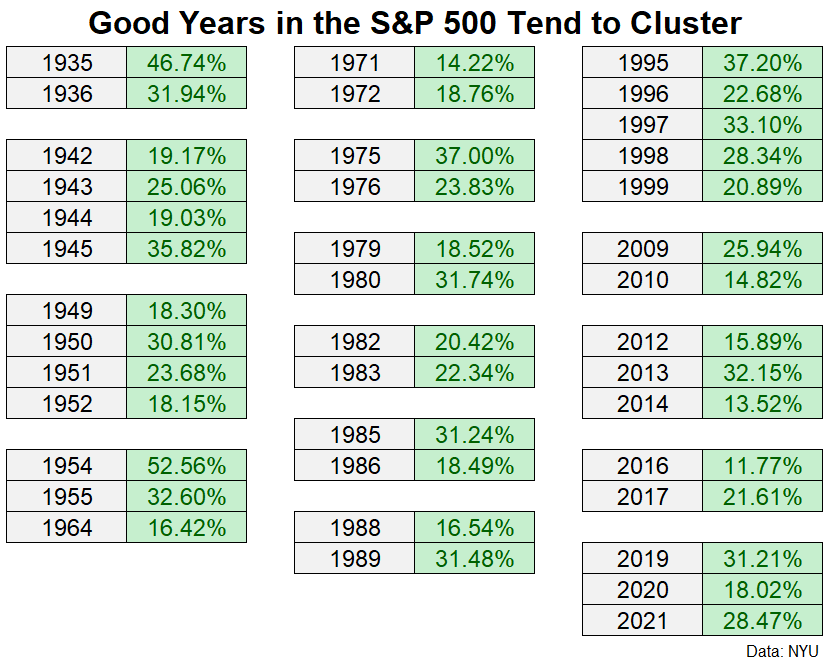

However good years are likely to cluster within the inventory market.

I regarded again on the annual returns for the S&P 500 since 1928 to seek out occasions when large beneficial properties had been adopted by extra large beneficial properties.

It occurs extra typically than you assume.

Listed below are the double-digit up years that had been adopted by double-digit up years:

I discovered 15 separate clusters spanning 40 years in whole. That’s greater than 40% of the time.

You don’t must go too far again in inventory market historical past to discover a time after we had a string of fine years in a row. The 2019-2021 stretch was fairly darn good with +31%, +18% and +28% back-to-back-to-back.

After all, that stretch was adopted by the horrible 2022 efficiency.

The ramp-up to the dot-com bubble from 1995-1999 was an all-time run with 5 years in a row of 20%+ beneficial properties however there have been loads of intervals the place good years bunch up.

There have been 4 12 months runs of fine outcomes from 1942-1945 and 1949-1952. We had fairly good returns from 2012-2014 as effectively.

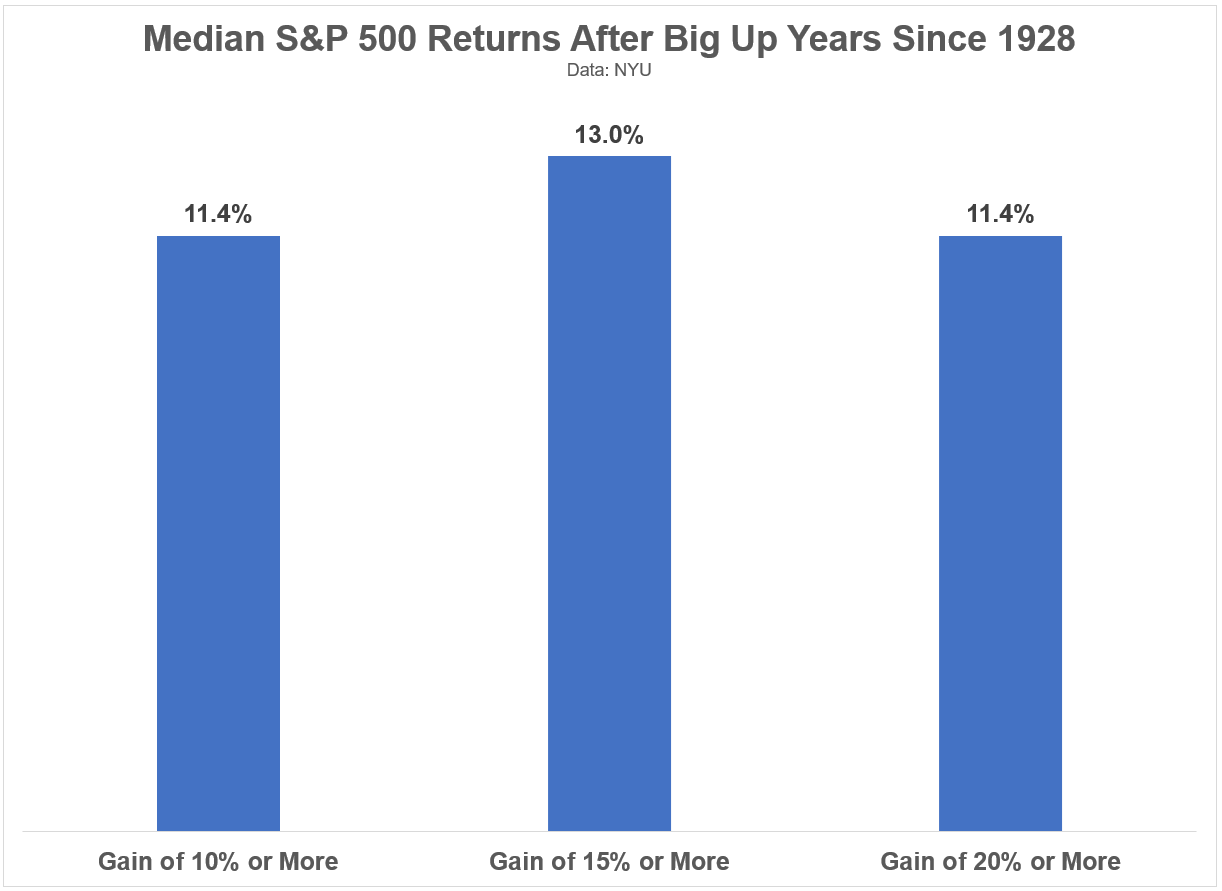

These are the median returns for the S&P 500 within the ensuing 12 months following beneficial properties of 10% or extra, 15% or extra and 20% or extra:

There have been beneficial properties 70% of the time following 10%+ beneficial properties, 70% of the time following 15%+ beneficial properties and 65% of the time following 20%+ beneficial properties.

All of which is to say there’s not a lot you may glean from 2023 returns when you’re on the lookout for some kind of sample.

Many occasions good returns are adopted by good returns however typically good returns are adopted by losses.

That is what makes investing within the inventory market equal elements exhilarating and infuriating, particularly within the brief run.

How about long term returns?

The median 10 12 months whole returns following 10%+, 15%+ and 20%+ up years had been +173%, +234% and +188%, respectively over the previous 95 years.1

Future returns are the one ones that matter however brief run returns get the entire consideration.

Sensible buyers give attention to the long term and keep away from permitting the brief run to dictate funding selections.

Additional Studying:

2023: It Was a Good 12 months

1That was annual returns of 11%, 13% and 11%, respectively.

[ad_2]