[ad_1]

Many individuals purchased I Bonds final yr when charges have been excessive. As inflation has come down and rates of interest have gone up elsewhere, some are planning to promote their I Bonds to purchase new I Bonds at a better fastened charge. I Bonds bought between Might 2020 and October 2022 have a 0% fastened charge for all times. The fastened charge on new I Bonds to be introduced on November 1 might probably go increased, presumably to 1.5%. See Money Out Outdated I Bonds to Purchase New Ones for a Higher Charge.

I selected to purchase TIPS for higher inflation safety than I Bonds after I bought a few of my I Bonds on August 1. The cash went into Constancy’s TIPS fund (ticker FIPDX). The yield on 5-year TIPS is above 2% as I’m penning this on August 30, 2023. I’m planning to promote extra older I Bonds on October 1 to purchase extra shares in that TIPS fund. Please learn extra on this in Higher Inflation Safety with TIPS Than I Bonds.

Most individuals go by the default tax therapy on I Bonds and defer taxes on the curiosity till they promote (see I Bonds Tax Remedy Throughout Your Lifetime and After You Die). By default, TreasuryDirect doesn’t withhold any taxes from the proceeds as a result of the IRS doesn’t require tax withholding on curiosity funds. Banks sometimes don’t withhold taxes once they pay curiosity in financial savings accounts or CDs both. You obtain a 1099 from TreasuryDirect subsequent yr and report the curiosity revenue in your tax return.

Some folks want to have taxes withheld even when tax withholding isn’t required. Taxes paid by withholding are assumed to have been paid all year long. It helps with some timing points.

Should you’d wish to have TreasuryDirect withhold taxes while you promote I Bonds, right here’s find out how to do it.

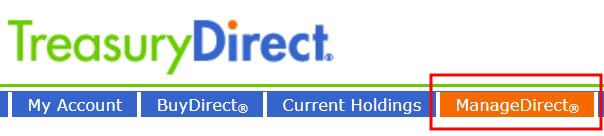

Log in to your TreasuryDirect account and click on on “ManageDirect” on the highest.

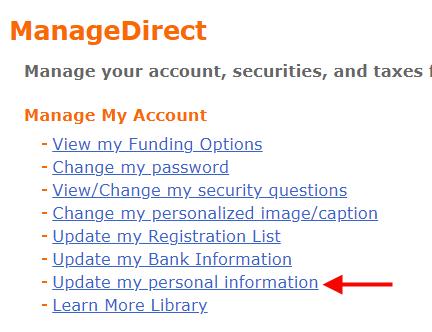

Click on on “Replace my private data” underneath the heading “Handle My Account.”

Reply a safety query. Scroll to the underside. Change the “Withholding Charge” from the default 0% to your required charge (as much as 50%). This new withholding charge will probably be used on all future gross sales. Should you purchase common Treasuries at TreasuryDirect, it impacts funds from these common Treasuries as nicely.

The withholding charge applies solely while you promote I Bonds. It doesn’t scale back the curiosity credited to your I Bonds whilst you nonetheless maintain them.

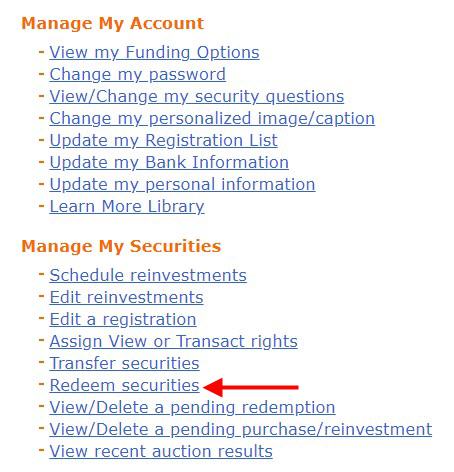

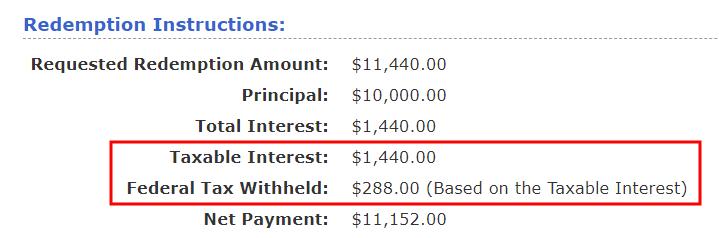

To promote (money out) your I Bonds, return to ManageDirect and click on on “Redeem securities.” You will note this on the assessment web page after you choose the I Bonds to money out:

I set the withholding charge to twenty% for this check. TreasuryDirect is aware of how a lot curiosity is included within the sale. The withholding charge solely applies to the curiosity portion, to not the gross quantity. TreasuryDirect doesn’t withhold state taxes as a result of I Bonds are exempt from state taxes.

Should you select to have TreasuryDirect withhold taxes, the quantity withheld for federal revenue tax will probably be in Field 4 of Kind 1099-INT along with the curiosity quantity in Field 3. Tax software program will take them into consideration while you enter each quantities from the 1099 type. Be sure you obtain the 1099 type from TreasuryDirect subsequent yr. TreasuryDirect will ship an e-mail when the shape is prepared however it’s best to set a reminder in your calendar in case you miss the e-mail.

Having TreasuryDirect withhold taxes from the sale is totally elective. I select not to do this as a result of I want to pay quarterly estimated taxes myself, but it surely works completely nicely if you happen to want withholding.

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you might be paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]