[ad_1]

When analysts speak in regards to the economic system, the main focus is usually on client sentiment—to what diploma folks really feel adequate about their monetary prospects to maintain spending. As client spending drives two-thirds of the U.S. economic system, taking a look at client sentiment as a key indicator is sensible. Or does it?

Customers Don’t Lead, They React

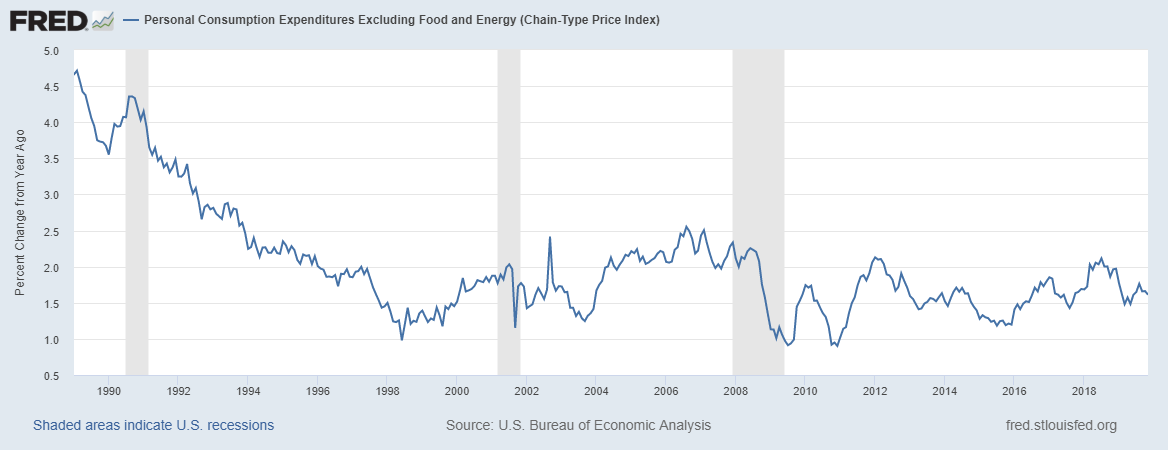

Because the chart under signifies, in the course of the previous three recessions, U.S. shoppers stored spending in the course of the downturn and solely stepped again as soon as the underside fell out of the economic system. From this information, we are able to see that client spending does a poor job as a number one financial indicator. Customers merely react to the economic system, fairly than lead it.

Enterprise Is Higher

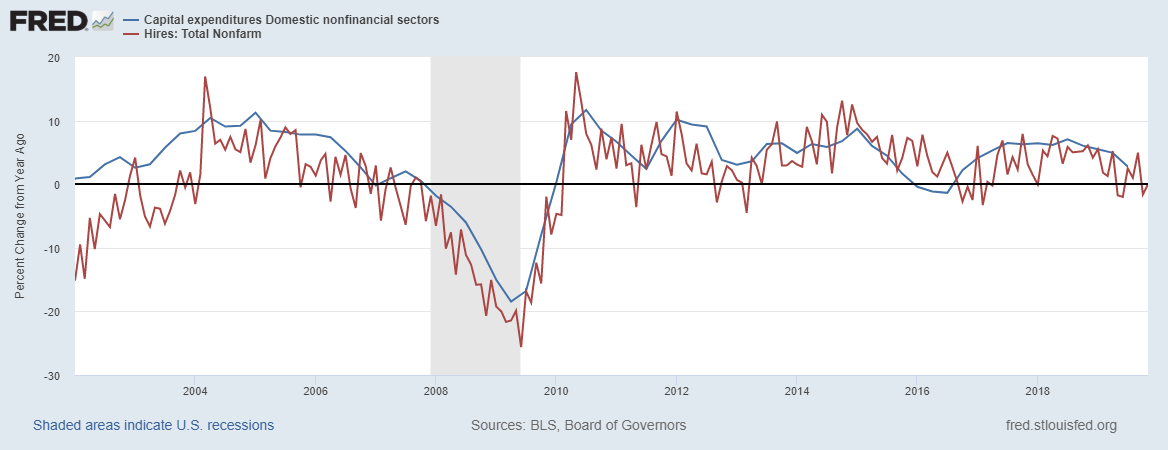

Companies, then again, can shortly regulate to financial challenges by altering the quantity of funds allotted to capital expenditures and personnel hires. As demonstrated by the chart under, these levers for enterprise improvement could be managed comparatively shortly, primarily based on the outlook for the general economic system. Accordingly, enterprise is a greater main indicator for the well being of the economic system than the buyer.

Look to the CFOs

We must also look past the headlines and contemplate the actions of the company leaders writing the checks—the CFOs—to trace shifts in enterprise sentiment. As a harbinger of financial developments, these shifts give us beneficial perception into elements that would quickly be influencing the broader economic system. Right here, we’re lucky to have the Duke CFO World Enterprise Outlook, which is a joint enterprise of Duke College and CFO Journal.

The Duke CFO World Enterprise Outlook, accomplished on a quarterly foundation since July 1996, is a world survey of CFOs from each private and non-private firms. The survey asks about company spending, employment developments, and optimism relating to the economic system. To drill down into the optimism part, questions get into particular particulars relating to sentiment in regards to the respondent’s personal firm, the U.S. economic system, and the broader economic system. By capturing the CFO’s expectations for the subsequent 12 months, the survey can make clear future development developments.

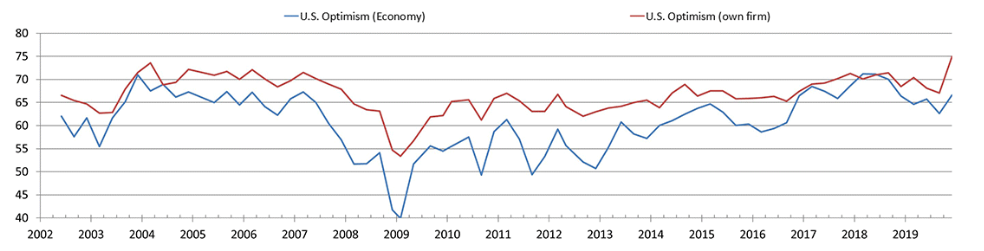

CFOs, on the whole, are presently optimistic about how their corporations are positioned for the subsequent 12 months. As for his or her optimism in regards to the common economic system, their ideas have modified over time. Wanting again, CFOs had been much less optimistic in regards to the U.S. economic system on the finish of 2007 and in early 2008. Throughout the lengthy bull market that adopted the monetary disaster, each firm-specific optimism and broad financial optimism moved increased. Then, in 2019, as issues relating to international commerce flared, CFO sentiment as soon as once more began to shift downward. The chart under captures these modifications in sentiment.

CFO views on the mixture economic system could be understood by taking a look at their approvals for capital expenditures and R&D tasks. During times of subdued or declining optimism in regards to the economic system, CFOs anticipate that their corporations will in the reduction of on capital and R&D spending. This development was evident within the September 2019 survey, which captured the height of world commerce uncertainty that was pushed by each day bulletins relating to the U.S. and China commerce coverage. Subsequently, the destructive expectations on company spending had been reversed within the responses to the December survey. At that time, the commerce rhetoric quieted down and the section one deal had been signed.

Monitoring the Well being of the Financial system

Towards the tip of 2019, enterprise sentiment clearly indicated that the overall well being of the economic system was inching into the difficulty zone. This threat gave buyers trigger for concern. Lately, nevertheless, sentiment has bounced increased, which may result in an uptick in enterprise spending. In flip, increased spending may function a tailwind for the U.S. economic system for the subsequent couple of quarters. The state of affairs will bear watching, nevertheless, as enterprise sentiment may shortly flip and change into a headwind for the economic system. Thus, it’s solely considered one of a number of indicators that we should actively monitor to know the present and future well being of the economic system.

Editor’s Notice: The unique model of this text appeared on the Impartial

Market Observer.

[ad_2]