[ad_1]

Shops and eating places love reward playing cards. It’s rumored that Starbucks has round $1.6 billion in saved worth on reward playing cards. That’s a $1.6 billion interest-free mortgage from its clients.

I do know we’re a contributor of round $25 or so – it’s handy to load up the app and pay for espresso that method. We don’t thoughts leaving a couple of bucks on a Starbucks reward card to facilitate the transaction.

It’s gotten so fashionable that even our native mother and pop eating places, locations with only a single location, are providing reward playing cards. It’s doable as a result of they’ve partnered with fee processors, like Toast, to deal with the success.

Consequently, they’re in a position to do one thing that may additionally prevent cash – give you reductions whenever you purchase reward playing cards.

That’s the topic of immediately’s very fast publish – how to economize by making the most of vacation reward card low cost affords.

Desk of Contents

How does this hack work?

Quite simple – a retailer will normally give you some sort of bonus whenever you purchase their reward playing cards. They don’t supply this all year long, it’s usually accessible across the holidays as a result of they know folks like to offer out reward playing cards.

To the shop, the pitch is simple – purchase (after which reward) our reward playing cards and also you get slightly bonus your self.

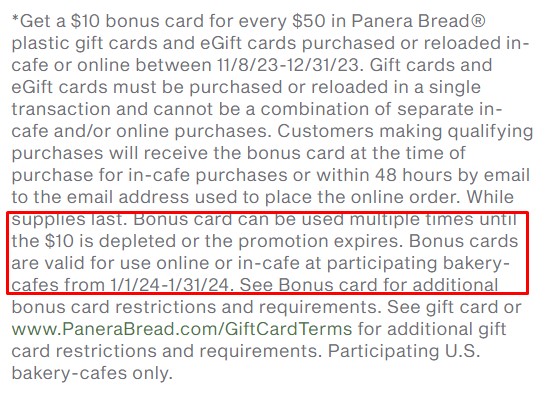

Take a look at this supply from Panera Bread:

For each $50 in reward playing cards you purchase, you get a $10 reward card for your self. That’s a bonus of 20% in your present spend.

Different shops and eating places could do the supply in another way.

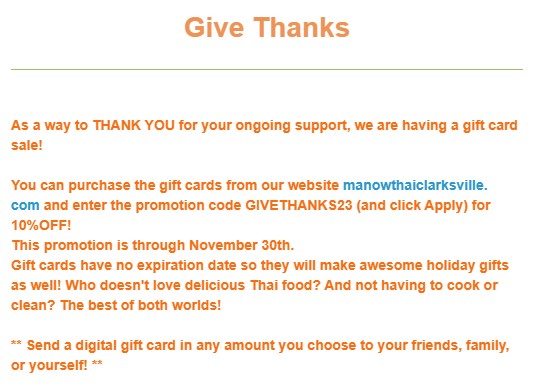

We have now a neighborhood Thai restaurant that’s providing reward playing cards at 10% off. From now till November thirtieth, purchase a present card and use their promotion code to get 10% off. The reward card has no expiration date, no restrictions, and it’s a easy 10% off a pay as you go meal.

For those who’re so daring, you possibly can theoretically calculate how a lot you spend in a yr and pre-pay. The one threat is the chance value of your cash being in that reward card or that the restaurant goes out of enterprise!

Who doesn’t love scrumptious Thai meals???

Make sure you learn the wonderful print!

Within the case of the Panera Bread supply, the $10 bonus card is accessible for us from January 1st, 2024 by means of January thirty first, 2024. It’s solely a month to make use of it, so don’t go loopy shopping for bonus playing cards except you already know you possibly can spend them in that one month time-frame.

*Get a $10 bonus card for each $50 in Panera Bread® plastic reward playing cards and eGift playing cards bought or reloaded in-cafe or on-line between 11/8/23-12/31/23. Reward playing cards and eGift playing cards have to be bought or reloaded in a single transaction and can’t be a mixture of separate in-cafe and/or on-line purchases. Clients making qualifying purchases will obtain the bonus card on the time of buy for in-cafe purchases or inside 48 hours by e mail to the e-mail handle used to position the net order. Whereas provides final. Bonus card can be utilized a number of instances till the $10 is depleted or the promotion expires. Bonus playing cards are legitimate to be used on-line or in-cafe at collaborating bakery-cafes from 1/1/24-1/31/24. See Bonus card for added bonus card restrictions and necessities. See reward card or www.PaneraBread.com/GiftCardTerms for added reward card restrictions and necessities. Collaborating U.S. bakery-cafes solely.

With the Thai restaurant supply, there was no wonderful print or potential gotchas. It was a straight up 10% off their reward card, a pleasant little low cost for prepaying.

Join e mail lists

The easiest way to study these affords is to enroll in the e-mail lists of the shops and eating places you frequent. You’ll get loads of Black Friday and vacation promotional e mail, however you’ll actually get a majority of these affords despatched to you as properly.

By being on the e-mail checklist, you be sure to don’t miss out on the affords.

Keep in mind don’t overspend

A reduction is just a reduction should you’re saving cash that you simply’re in any other case already spending. We are able to look again by means of our bills to see how a lot we’ve spent at numerous eating places (Chipotle can be very excessive on that checklist – our son loves that place!) and funds accordingly.

Know the restrictions of the assorted apps too. For instance, Chipotle solely allows you to use one reward card per buy on the app. So if they provide one thing like a $10 reward card, it turns into a little bit of a ache to make use of within the app since you solely get one reward card at a time (I don’t consider such a restriction exists in-store).

[ad_2]