[ad_1]

The passing of Daniel Kahneman, an Israeli-American creator and psychologist, received me considering. Like me, Kahneman had deep ties to my hometown of Chicago. Whereas we by no means met, I admired his Nobel Prize-winning work in behavioral economics and his rationalization of the necessary position of psychology in monetary resolution making. As an illustration, he pioneered work that included the “remorse minimization technique,” which helped buyers devise a portfolio based mostly on how a lot they felt they may threat and nonetheless sleep at night time. He additionally quantified “loss aversion,” noting that folks really feel the sting of an funding loss extra considerably than the enjoyment of a achieve. He additionally quantified that making more cash doesn’t essentially make you happier. Relying on the place you reside, Kahneman discovered that incomes greater than $70,000 to $90,000 a 12 months received’t make you happier so long as you’re assembly primary dwelling bills.

One of many issues that my enterprise associate, Craig Stone, and I discuss on a regular basis is the qualitative aspect of planning. That’s very totally different from the quantitative aspect, the place most advisors prefer to spend their time. We’ve discovered little or no cohesion between what the household needs and what will get placed on paper. I can’t let you know how typically an legal professional or CPA calls me on the final minute and says: “Randy. I’ve received a consumer with this drawback. What’s the answer?”

It’s like strolling into a physician’s workplace and saying: “Doc. I don’t have time to do checks or X-rays. Simply write me a prescription.”

In these conditions, I inform the advisor I’m comfortable to assist, however it’s powerful to suggest an answer till I perceive who your consumer is, how they’re wired and their objectives for themselves and their family members. It’s about taking time to have significant discussions with purchasers and asking questions that nobody else is keen to ask. Typically, you have to problem purchasers and push again to reach at the absolute best resolution. To do this, you want a mix of math, authorized and psychology expertise. Our career is stuffed with people who find themselves glorious at math and authorized points however not as achieved in understanding human emotion and psychology.

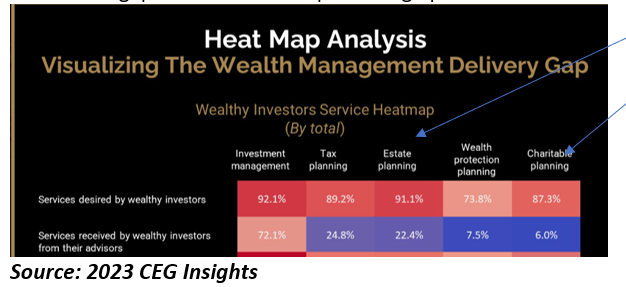

And that’s why there’s such an enormous hole between what profitable purchasers need and the companies they are saying they’re receiving from their advisors. As an illustration, in a 2023 survey of over 1,100 rich buyers and monetary advisors by CEG Insights (see chart under), 91% of rich buyers sought estate-planning companies. Nonetheless, solely 22% mentioned they have been receiving these companies from their advisors – a niche of practically 70 proportion factors! Additional, 87% of rich buyers mentioned they sought charitable planning companies from their advisors, however solely 6% obtained these companies– a niche of greater than 80 proportion factors!

What will get taught in each monetary course and certification program nowadays is the technical/analytical construction of planning. Not a lot time is spent on understanding the human thoughts. And that’s an enormous drawback as a result of planning solely from a math and authorized perspective means there’s at all times a definitive reply to each query or difficulty. All the pieces balances out. You’re allowed to do that. You aren’t allowed to try this. There’s not a variety of grey space right here. However that’s what actual life is all about.

So, advisors should develop empathy, deep listening expertise and good query formulation. Many suppose these expertise are innate, however I’ve discovered you can study to develop these “delicate expertise.” The problem is that almost all authorized and monetary practitioners decide how these intangibles match into their enterprise mannequin. They will’t determine find out how to receives a commission for that sort of experience. However the trendy advisor must method every consumer as an individual, not as a case. You could know their values and motivations as a result of what we’re attempting to perform should final for a number of generations. We need to do it proper the primary time; we don’t need to hold doing it repeatedly.

One other drawback with advisor coaching is that new professionals aren’t studying find out how to present their vulnerability. They don’t prefer to admit to purchasers that they don’t at all times know the reply. However generally, you should be brutally trustworthy about what you’re good at (and most educated about) and what you’re not. The leaders of the pack are those that know what they’re greatest and leverage these expertise whereas they rent one of the best folks they will discover to fill of their information and experience gaps.

If a consumer trusts you with intimate particulars about their property planning and legacy giving, “faking it until you make it” isn’t going to fly. They’ve an excessive amount of cash, and a number of generations of their household rely upon you to assist them make the suitable choices. Put your ego apart and get the coaching you want, or discover a expert skilled to help you. It’s as if we’ve misplaced a complete technology of property and reward planners due to the 2017 Tax Cuts & Jobs Act that raised the exemption restrict to the stratosphere (till 2026). Quickly we’ll be enjoying catchup in a really huge and painful approach.

Randy A. Fox, CFP, AEP is the founding father of Two Hawks Consulting LLC. He’s a nationally recognized wealth strategist, philanthropic property planner, educator and speaker.

[ad_2]