[ad_1]

Rising up in Guelph, Ont., within the 1870s, Arthur Cutten was a whiz with numbers and a shark at marbles, routinely capturing essentially the most coveted orbs (“glassies,” in the event you’re curious) from his less-skilled classmates. That aggressive spirit served him properly years later, when 19-year-old Cutten—desperate to distance himself from authorized troubles his banker father had introduced upon the household—set out for Chicago with $90 in his pocket.

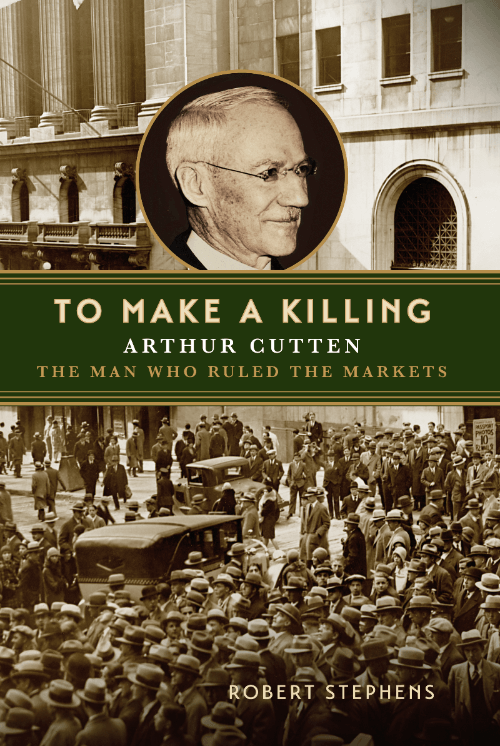

It was within the Windy Metropolis that Cutten grew to become a extremely influential inventory and commodities speculator, first revered for his prowess after which loathed for … properly, you’ll must learn Robert Stephens’ fascinating new biography to seek out out. To Make a Killing: Arthur Cutten, the Man Who Dominated the Markets particulars Cutten’s path to immense wealth and notoriety, beginning along with his early days working the Chicago Board of Commerce’s well-known “wheat pit” and ending with all of the makings of a true-crime drama: homicide, mobsters and (possibly) hidden treasure. We share an excerpt under. —MoneySense Editors

The Apprentice

Arthur Cutten took a room in a boarding home at Dearborn and Ontario Streets on the North Aspect for $6 per week. He discovered work in a ironmongery shop on Lake Road, incomes barely greater than his lease. A collection of menial jobs adopted, every lasting just a few weeks or months. He labored as a inventory boy in Marshall Discipline’s Wholesale Retailer, the place he shortly got here to the conclusion that he “was not designed to be a service provider.”

His subsequent stints have been as a retailer salesman at Atwood’s Haberdashery after which as a clerk at Charles H. Besley Firm (a machinists’ provide and copper and brass items enterprise) the place he toiled from 7 a.m. to six p.m. and was so drained after work that he would simply go to mattress. He moved on to Hately Brothers, packers and provision exporters, the place he stayed for a quick time.

His solely type of leisure was enjoying baseball on Saturday afternoons. He was a member of the Hyde Parks, which went up in opposition to different novice groups, such because the Idlewilds (made up of Northwestern College college students) and Douglaston. To Arthur’s chagrin, among the golf equipment began bringing in skilled gamers, which spoiled the competitors and led to the breakup of the league.

After greater than a yr, Arthur was having a reasonably boring time of it. However he had discovered an vital lesson. “I had found that the acquisition of capital, way more than luck, was apt to manipulate the destiny of a person attempting to advance himself from obscurity.”

Then, in July 1891, he landed a place that might change his life.

It was with A. Stamford White & Co., a inventory, bond, and commodities brokerage home that additionally specialised in shopping for meats for export to England, France, Germany, and different nations. His boss, whose identify the corporate bore, was a portly, whiskered gentleman and a fixture on the alternate.

Arthur was employed as a bookkeeper and clerk. As a part of his job, he was required to go to the alternate flooring within the mornings to acquire the opening costs of grains and different commodities. On his first go to, he was awestruck. Males crowded across the buying and selling pits the place they purchased and offered, utilizing hand alerts and barking their orders, closing offers value a whole bunch of 1000’s of {dollars} with out something written down, a terrific hubbub of pleasure and commotion the place fortunes have been misplaced and gained. “Neither baseball careers nor bugle calls nor anything had a lot energy to stir my thoughts and feelings,” he exclaimed.

Each time he might, Cutten frolicked within the Pigeon Roost, a small space above the pits, the place he might research the motion. There on the alternate flooring, sitting in a chair tilted again in opposition to a pillar, was Jim Patten himself. He was chewing gum, as regular, his huge crimson mustache shifting in a large arc. The Cudahy brothers have been circling the supply pit, able to promote tens of millions of kilos of meat if the worth was proper. William Bartlett and Frank Frazier, their eyes riveted on wheat costs, conferred with Patten as they plotted their subsequent marketing campaign.

Cutten typically ate at Kohlsaat’s restaurant within the outdated Royal Insurance coverage Constructing. It was one of many first lunch counters in Chicago the place prospects sat on stools and have been served sandwiches and different quick-service meals, their hats nonetheless on their heads, crowded elbow to elbow. On one event, he discovered himself sitting subsequent to Benjamin P. Hutchinson.

“Outdated Hutch” was well-known among the many merchants and sellers for having as soon as been the shrewdest operator on the Chicago Board of Commerce (CBOT). Again within the spring of 1888 he engineered a nook in wheat. He started buying futures contracts at round eighty-six cents a bushel. Costs slowly rose by means of the summer season as he purchased up the provision. Edwin Pardridge, his outdated nemesis within the pits, was shorting – promoting contracts within the perception that wheat was headed decrease and that he would have the ability to cowl his place at depressed costs and make a revenue on the distinction. After which an early frost swept over the Purple River Valley destroying a big a part of the crop, and by September wheat was at two {dollars}. “Outdated Hutch” made tens of millions.

Cutten had heard the tales about this legendary speculator – how he had began as a shoe and boot producer in Massachusetts, moved to Chicago the place he grew rich by supplying meat to the Union Military in the course of the Civil Battle, and established the Chicago Packing and Provision Firm in addition to the Corn Change Financial institution.

With no phrase passing between them, Cutten watched in fascination as this tall, skinny man slurped at his soup. Hutchinson was wearing garments that had been modern on the time of Abraham Lincoln some thirty years earlier. His coat was buttoned on the high, and his doeskin pants didn’t attain his ankle bones. Beneath the huge brim of a black slouch hat, his fierce eyes and hawk nostril gave him the look of a predator. After which “Outdated Hutch” was gone, like an apparition, disappearing into the afternoon.

Along with his new job at A.S. White & Co., Cutten was now capable of afford barely higher lodging, sharing a room in a giant home. The residence, situated close to Congress Road and Michigan Avenue, even had electrical gentle. The lease was forty {dollars} a month.

The younger apprentice was studying the intricacies of buying and selling in commodities. One in every of his first observations in regards to the pits was that the loudest voices weren’t at all times essentially the most profitable merchants. Secrecy was essential to assembling a giant operation. He found that those that actually performed the grain markets properly have been severe college students of climate patterns, insect infestations, world provide and demand figures, and a number of different components. He watched the good ones and located that they purchased and offered primarily based on the data they’d acquired, not on the guidelines and gossip proffered by others. They lower their losses shortly however allowed their good points to mount.

These have been classes he would apply all through his profession. It was an schooling that he might have had nowhere else. He was studying from the masters, and Cutten was an astute observer of human nature. He acknowledged that it was greed and worry that fuelled the markets, and he noticed that each the irrational good points pushed by goals of simple cash and the terrifying plunges induced by panic have been golden alternatives for these few who might management their feelings and commerce with the quiet confidence of their convictions.

He revered the large gamers, they have been his heroes and his position fashions. In case you might survive by your wits, in the event you might outmanoeuvre your opponents and beat them on the recreation, that was success. There was no room for sympathy. There was solely the rating.

It took 5 years, however lastly Arthur persuaded his boss that he was able to work as a full-time dealer within the pits. On 11 November 1896, Cutten grew to become a member of the Chicago Board of Commerce. A. Stamford White gave him an eight-hundred-dollar mortgage to cowl his membership value.

He could be shopping for and promoting commodities on behalf of purchasers, and his beginning wage could be $150 a month. As properly, the agency would allow him to scalp for himself – make short-term trades on small value actions in corn, wheat, rye, barley, and oats as a way to complement his wages.

Cutten arrived that morning, stopped outdoors the Board of Commerce constructing, and caught his breath. He regarded up on the huge construction, constructed of metal and granite, Chicago’s tallest on the time. Two giant statues, one representing Agriculture and the opposite Business, stared down from the capstone above the primary entrance. He stepped inside and entered the eighty-foot-high nice corridor that was adorned by a stained-glass skylight and large marble columns.

He obtained his first order and nervously walked out onto the alternate flooring. He was twenty-six. Along with his skinny mustache, starched shirt, and new buying and selling jacket, he regarded just like the rookie he was. Veteran merchants gave him the once-over after which turned again to their enterprise as if he was of no consequence.

Cutten moved purposely to the corn pit and, within the open-outcry technique, shouted out an order to purchase 100 September corn (100,000 bushels for supply in September). He took twenty-five thousand bushels from every of 4 males and the order was crammed. “I used to be exalted. This was, for me, a form of knighthood.” He would add later: “The day I first walked onto the ground of the alternate as a member was a scarlet one for me; and no surprise for it was within the pits that I discovered how one can make cash.”

Cutten discovered how one can commerce on margin (placing up solely a portion of the fee to extend his potential returns) and to purchase and promote for fractions of a cent. He grew to become skilful in shifting from lengthy positions (shopping for securities with the expectation that they might enhance in worth) to brief positions (borrowing securities and promoting them, hoping to purchase them again later at a lower cost) and again once more in minutes. He not often traded greater than ten thousand bushels at a time however made 20 to 30 trades a day. The cash was good, however he knew that he was by no means going to get actually wealthy. Scalping, by its nature, was brief time period, and he’d by no means have the ability to catch the large swings. He wished greater than a cushty residing. He wished to make a killing.

This text is excerpted from To Make A Killing: Arthur Cutten, the Man Who Dominated the Markets (McGill–Queen’s College Press, February 2024) with permission from the writer.

Learn extra about investing:

- The perfect dividend shares in Canada

- Greatest on-line brokers in Canada

- What ought to Canadian traders do: Promote or maintain with most popular share losses?

- What Canadian traders can do in occasions of world disaster and conflict

- Are Vanguard Canada ETFs and different funds at all times an excellent funding?

The put up The life and occasions of an unique “bankster” appeared first on MoneySense.

[ad_2]