[ad_1]

In late-2019, The Economist put out a 150 web page report referred to as The World in 2020 that supplied some predictions for the approaching yr in geopolitics and the financial system.

The difficulty was filled with ideas and concepts from CEOs, economists, scientists, politicians and enterprise leaders about what was coming within the yr forward.

These thought leaders have been anxious concerning the lasting impacts of Brexit, the upcoming U.S. presidential election, China’s position as a world superpower, local weather change and extra. They weren’t anxious an excessive amount of a couple of recession or a inventory market crash or something associated to a healthcare panic.

Clearly, nobody knew how badly the Covid epidemic would disrupt life as we knew it heading into 2020.

How may anybody probably predict what was coming?

To their credit score, The Economist issued a mea culpa in a follow-up on the finish of 2020:

Nicely, we didn’t see that coming. Like nearly everybody else, we have been blindsided by the outbreak of covid-19, the primary circumstances of which have been recognized in December 2019. In addition to causign loss of life and hardship world wide, and the delay or cancellation of occasions giant and small, one of many pandemic’s much less essential side-effects was to invalidate most predictions for 2020, together with our personal.

We anticipated a world slowdown, however not the most important financial contraction because the Despair. We anticipated persevering with Sino-American tentions over Chinese language exports, however not of the viral selection. We appeared ahead to motion to scale back greenhouse gsa emissions, however not an 8% annual discount, the biggest because the second world conflict, because the pandemic throttled transport and industrial exercise.

The pandemic actually modified the trajectory of the world eternally.

Nobody may have predicted what would occur or the potential ramifications from how we dwell to the place we work to the costs we pay to the place folks dwell to the wages folks earn and on and on down the road.

However that’s the purpose.

We didn’t see that coming needs to be your default assumption in relation to threat evaluation. The dangers aren’t all the time going to be as massive as a pandemic however issues not often comply with the script in relation to how folks assume issues will work out.

When “everybody” does really feel sure about the best way issues are going to work out, it often doesn’t occur that means. This headline from October 2022 is an ideal instance:

We’re nonetheless ready on that recession. Any day now.

Right here’s a newer article from one yr later:

This story was plus or minus a day or so from the height in yields. The ten yr Treasury topped out at 5% in October; it’s now under 4%.

We people are unhealthy at forecasting the long run due to current bias, availability bias and overconfidence. Nevertheless it’s additionally true that predicting the long run is unattainable as a result of a lot of what occurs is unattainable to foretell because the world is inherently unpredictable.

That is true of each short-term forecasts and long-term forecasts.

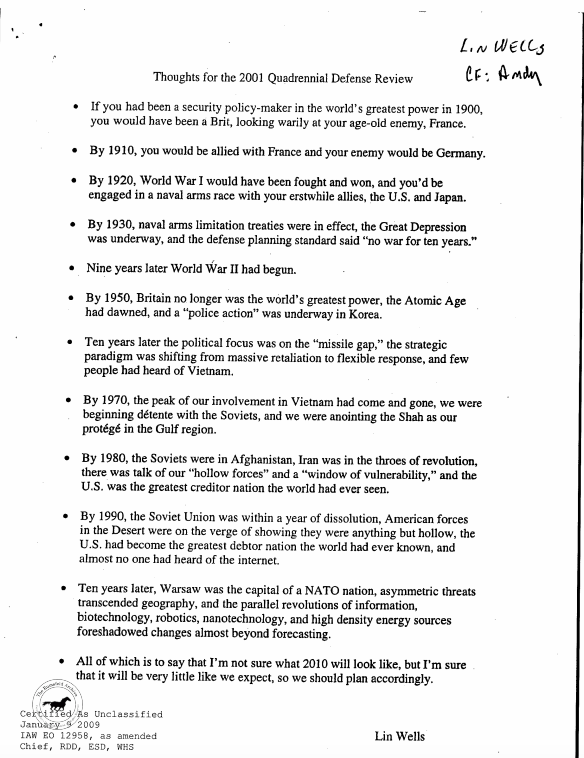

Lin Wells labored on the Pentagon for each the Invoice Clinton and George W. Bush administrations. Wells drafted the next doc for Bush in April 2001:

The kicker right here is my favourite a part of the memo:

All of which is to say that I’m unsure what 2010 will appear to be, however I’m certain that it will likely be little or no like we anticipate, so we must always plan accordingly.

Lower than six months later got here 9/11. The primary decade of this century included two wars, two gigantic inventory market crashes, a housing bubble (and bust), a gentle recession and the worst monetary disaster because the Nice Despair.

Wells was proper — nobody had a clue how issues would look in 2010 again in 2001.

I’ve some ideas on issues that would occur in 2024 however there’s a good likelihood these ideas can be confirmed ineffective as a result of one thing sudden will change issues up.

The inventory market may very well be up or down relying on rates of interest, the inflation fee, financial progress, earnings, investor sentiment or one thing else fully out of left discipline.

The subsequent massive threat is never the one everyone seems to be speaking about or planning forward for.

I’m not saying we shouldn’t make forecasts. Everybody basically must make forecasts concerning the future to outlive.

Firms have to make forecasts to plan for the long run to determine their investments, outlays and hiring choices.

Households have to make forecasts to plan out their spending, borrowing and consumption patterns.

Buyers have to make forecasts to set baseline expectations of positive aspects or losses for monetary planning functions.

Individuals who go on trip want to have a look at the climate forecast in order that they know what to pack for the journey.

Forecasting is ok. Everybody has to consider the long run, whether or not they prefer it or not.

Nevertheless it’s essential to grasp how typically life will get in the best way of your expectations. Surprises happen extra typically than anybody may think about.

One thing shocking will occur in 2024.

Simply don’t be stunned that you just’re stunned when it does.

Additional Studying:

No One Is aware of What Will Occur

[ad_2]