[ad_1]

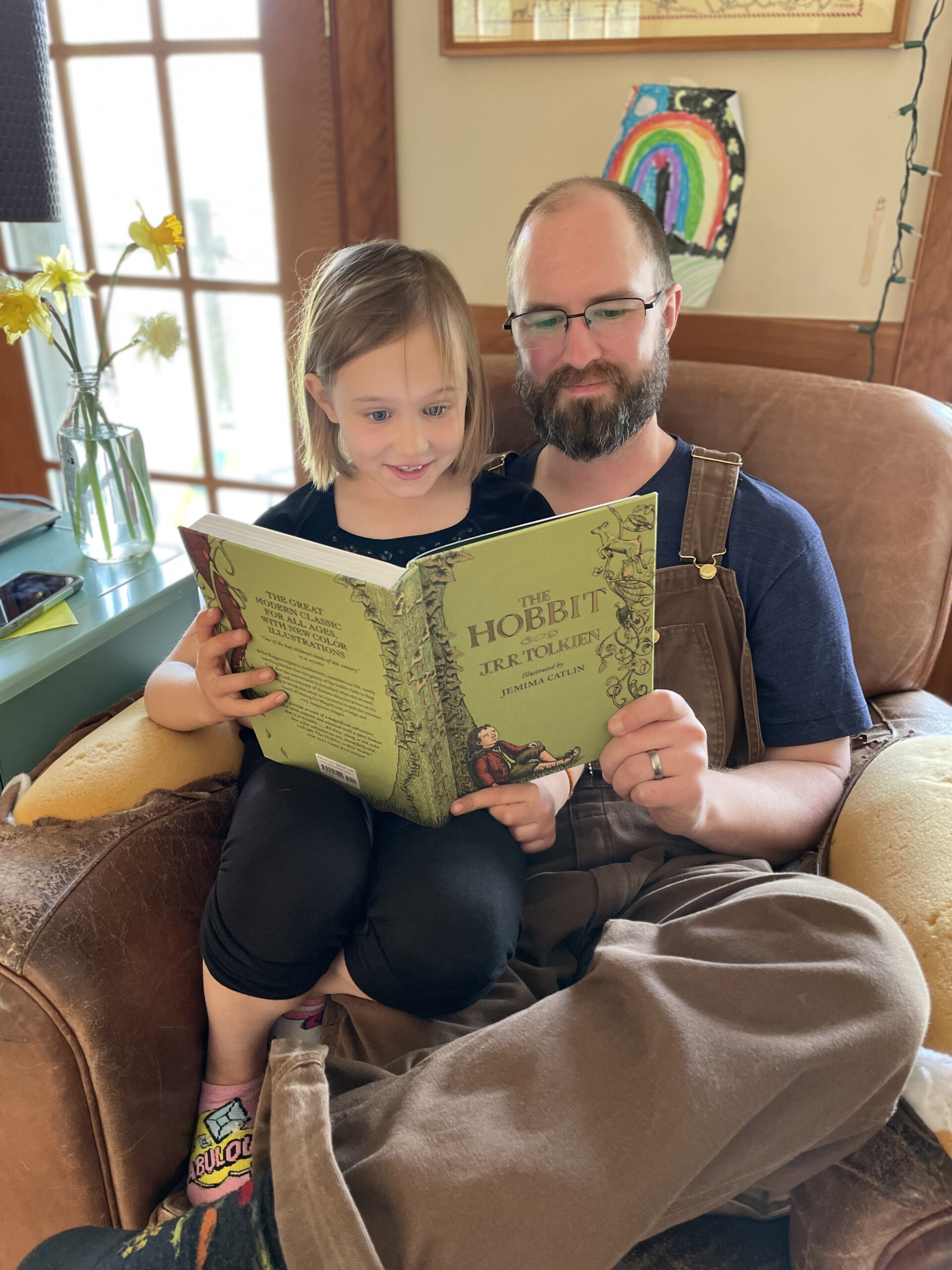

Sure certainly, we’ve welcomed a hobbit into our dwelling. Mr. FW is a widely known lover of The Lord of The Rings books and the primary motive he needed to have youngsters was to in the future learn the collection with them. He’s been working Kidwoods as much as The Hobbit by having her first learn the Fern Hole books (by John Persistence), subsequent the Redwall collection (by Brian Jacques) and at last, final month, she started studying The Hobbit to him.

To facilitate this love of literature, we bought a beautiful, illustrated, hard-cover copy of The Hobbit (affiliate hyperlink). Usually, we purchase zero new books–all of them come from the library or a yard sale, however this was a particular one Mr. FW needed to reward to Kidwoods.

That is now their each day afternoon behavior–she sits in his lap and reads him books. It began out as an project from her fabulous 1st grade instructor firstly of this 12 months and, wouldn’t you already know it, her studying has superior rapidly and dramatically. Having her learn aloud to him allows us to trace her progress and guarantee she’s nailing the pronunciations in addition to internalizing the context and story line. She now delights in giving me the rundown on what the characters are as much as every day!

I initially thought The Hobbit is perhaps too scary for a seven-year-old, however she LOVES it and it offers a number of alternatives to debate when characters aren’t good to one another. She will acknowledge unhealthy habits when it crops up within the story and is ready to articulate why it’s unhealthy. All in all, an lovely routine is cemented in our dwelling. The one draw back is that Littlewoods is FURIOUS she will be able to’t learn but.

Yard Sale & Thrift Retailer Scores

The opposite notable line objects this month are my yard sale and thrift retailer scores because it’s yard sale season right here in Vermont! My yard sale buddy, RW, and I’ve been hitting it exhausting early on Saturday mornings and have made some glorious hauls.

As longtime readers are effectively conscious, I make the most of yard gross sales and thrift shops to obtain the next:

- Birthday and Christmas items for our youngsters! No motive to purchase new when there are such a lot of superb second-hand toys/video games/books/puzzles obtainable.

-

The marble run: a unbelievable hand-me-down! Birthday items for different children! Anytime I discover a new, unopened, tags-on, in-package toy/e book/puzzle/craft package, I scoop it up for one of many many child birthday events we attend.

- Family decor and furnishings! I purchase all of my seasonal decor, on a regular basis decor, lamps, tables, image frames and extra from yard gross sales. Very often I would like to purchase new, however I’m capable of finding nearly all the things I would like/need from a budget used market.

- Clothes and sneakers for me and the youngsters! I get almost all of our garments second-hand, except issues like: underwear, socks, swimsuits, trainers and another specialty objects we want, equivalent to ski goggles or ski socks (if I can’t discover them used). I very hardly ever discover something used for Mr. FW–often I’ll discover a good insulated work shirt, however most males’s garments appear to be torn to shreds so we often have to purchase his stuff new.

Why Purchase Used?

I imply, actually, why not? I’ve written tomes on this previously, and for my longwinded ideas, try:

Extra Than Cash Saved: Different Advantages Of Shopping for Used

Past the astronomical quantities of cash I save by accepting hand-me-downs and thrifting it up, I’ve found a slew of non-monetary advantages of the used market:

1. Shopping for used = fewer selections, which makes us people happier.

Infinite alternative is paralyzing… and exhausting to the human psyche. It leads us to set unreasonably excessive expectations, query our decisions earlier than we even make them and blame our failures fully on ourselves… An excessive amount of alternative undermines happiness (supply: NPR).

2. Used stuff is extra environmentally pleasant.

- Used stuff avoids the embodied environmental prices of recent: packaging, transport, manufacturing, and so forth.

- Plus, it retains stuff out of the landfill!

3. Shopping for used permits for the expertise of kismet.

- Oh sure, there’s kismet to find nice used offers. I really like my storage sale scores and I delight within the sheer kismet of discovering, for instance, a $1 child doll stroller that my women ADORE.

- They adore it a lot, in reality, that I used to be thrilled to search out one other ($2) used child doll stroller in order that they’ll every push a stroller round the home on the similar time.

4. Shopping for used reduces the endowment impact.

-

My almost 100% second-hand dwelling (there’s that top chair!!) Since a lot of our stuff was bought used at a deep low cost, I’m not tremendous connected to any of it. This enables me the liberty to let it go in order that it doesn’t litter up my life. That is additionally why I’m in favor of the Plan Forward, Purchase Forward strategy.

- Since I paid nothing, or little or no, for our stuff, I don’t really feel compelled to hoard it or promote it in an effort to squeeze out a return on my funding (which is unlikely to occur, based mostly on depreciation).

- It relieves me from being held hostage by the endowment impact, which happens when, “…a person locations a better worth on an object that they already personal than the worth they’d place on that very same object if they didn’t personal it” (supply).

5. Shopping for used is enjoyable! So enjoyable.

- Just like kismet, I discover second-hand procuring enjoyable. It’s not disturbing as a result of if a yard sale doesn’t have something I would like? I simply transfer on. Conversely, if I do occur to search out a fantastic deal, it’s trigger for frugal celebration!

- One more reason I discover storage sale procuring so pleasant is that I’ve a BGSGP (greatest storage sale gal pal). With our forces mixed, we’re storage sale professionals. We plan which Saturdays we wish to storage sale, we stand up early these mornings, go away our husbands and youngsters at dwelling, and quest forth for finds. Storage saleing–like most issues–is healthier with pals.

- Plus we now have some hilarious tales, just like the time a man tried to persuade us VERY EARNESTLY that his previous, small cooler was price $40…

6. Shopping for used and handing stuff down creates group.

- Once I store at a storage sale, I’m giving cash to my neighbors, which I really like. Their stuff will get a brand new life, I get a fantastic deal, they make a couple of dollars, and everyone seems to be joyful.

- My cycle of receiving and giving hand-me-downs additional enhances a group mentality of sharing, lending, borrowing and simply usually caring for one another.

- I used to be over at a good friend’s home final week and noticed our previous high-chair (which was handed right down to us) in her kitchen. I hadn’t handed it alongside to her, so I requested her to relay the chain of occasions:

- Just a few years in the past, I gave the excessive chair to good friend A, who handed it right down to good friend B, who handed it right down to good friend C (who’s at the moment utilizing it). That made me SO SO SO HAPPY!!! It’s a unbelievable excessive chair that’s now been by ~7 children and remains to be going sturdy!!!!!!

7. Shopping for used takes much less time than shopping for new.

- It takes drastically much less time than procuring new. There’s a false impression that it’s extra time consuming, however that’s a fallacy in case you do it the appropriate method.

- My BGSGP and I don’t go to storage gross sales each weekend–that might be far too time consuming! Storage sale season in Vermont is confined to the summer season months, so she and I scout out the most certainly goldmine gross sales upfront and do strategic strikes. We go early for the perfect choice and are often dwelling by late morning.

- Be aware: we’re not at all times profitable, however then we’ve got nice tales together with, however not restricted to, the $40 nasty previous (and small) cooler. P.S. I simply seemed it up and that cooler is at the moment $22 new… LOL

I Nonetheless Spend Loads Of Cash

…on different issues (equivalent to eating places and occasional outlets!). From my perspective, if I can get completely great things used for reasonable, why purchase it new? I can’t get completely good used lunches out with my husband, however I certain as heck can get unbelievable used bikes for my children. It’s all about saving the place it’s straightforward to save lots of so as to spend in different areas.

Need Assist With Your Cash? Ebook a Monetary Seek the advice of With Me!

Cash is terrifying for lots of people and many people don’t know the place to begin.

That’s the place I are available.

I demystify private finance and break it down into manageable steps. I clarify the place to begin, the place to go and how you can confidently handle your cash by yourself.

My session periods–and ensuing written monetary plans–are complete, holistic, and all-encompassing of every individual’s funds. I take a look at earnings, money owed, property, mortgages, bills, investments, retirement accounts, anticipated social safety, bank card technique and extra. I run by each facet of an individual’s monetary life alongside their longterm targets and aspirations.

I assist individuals work out how you can make their cash allow them to stay the life they need.

Need assistance along with your cash?

- Rent me for a personal monetary session right here.

- Schedule an hourlong name with me right here.

- Schedule a 30 minute name with me right here.

→Undecided which choice is best for you? Schedule a free 15-minute chat with me to study extra. Refer a good friend to me right here.

I Love the Free Cash Monitoring Instruments from Private Capital… now known as Empower!

I exploit and suggest a free on-line service known as Empower to prepare our cash. It tracks our spending, web price, investments, retirement, all the things. Whereas the title is totally different, the free web price monitoring and cash group instruments are the identical!

Understanding the place your cash’s at is without doubt one of the best methods to get a deal with in your funds. You can’t make knowledgeable selections about your cash in case you don’t understand how you’re spending it or how a lot you have got. When you’d prefer to know extra about how Empower works, try my full write-up.

And not using a holistic image of your funds, there’s no approach to set financial savings, debt reimbursement or funding targets. It’s a should, of us. Empower (which is free) is a good way for me to systematize our monetary overviews because it hyperlinks all of our accounts collectively and offers a complete image of our web price.

When you don’t have a stable thought of the place your cash’s at–or the way you’re spending it–think about attempting Empower (notice: the Empower hyperlinks are affiliate hyperlinks).

Credit Playing cards: How We Purchase Every thing

We purchase all the things we are able to with bank cards as a result of:

-

It’s simpler to trace bills. No guesswork over the place a random $20 invoice went; all of it reveals up in our month-to-month expense report from Empower. I additionally spend much less cash as a result of I KNOW I’m going to see each expense listed on the finish of the month.

- We get rewards. Bank card rewards are a easy approach to get one thing for nothing. By way of the playing cards we use, we get money again in addition to resort and airline factors for getting stuff we have been going to purchase anyway.

- We construct our credit score. Since we don’t have any debt, having a number of bank cards open for a few years helps our credit score scores. It’s a grimy fable that carrying a stability in your bank card helps your credit score rating–IT DOES NOT. Paying your playing cards off IN FULL each month and maintaining them open for a few years does assist your rating.

For extra on my bank card technique, try:

Money Again Playing cards to Contemplate

When you’re now cash-back curious, there are a variety of playing cards available on the market providing fairly good money again percentages. Listed here are a number of I believe are deal:

Blue Money Most popular® Card from American Categorical

- 6% money again at U.S. supermarkets on as much as $6,000 per 12 months in purchases (then 1%).

6% money again on choose U.S. streaming subscriptions. - 3% money again at U.S. gasoline stations and on transit (together with taxis/rideshare, parking, tolls, trains, buses and extra).

- 1% money again on different purchases.

- Earn a $250 assertion credit score after you spend $3,000 in purchases in your new Card throughout the first 6 months

- $0 intro annual charge for the primary 12 months, then $95. Charges and charges particulars right here.

- Phrases apply

Blue Money On a regular basis® Card from American Categorical

- 3% money again at U.S. supermarkets (on as much as $6,000 per 12 months in purchases, then 1%).

- 3% Money Again at U.S. gasoline stations, on as much as $6,000 per 12 months, then 1%.

- 1% money again on different purchases.

- Earn as much as $250 – Right here’s How: Earn as much as $150 again whenever you store with PayPal. Earn 20% again as an announcement credit score on purchases whenever you use your new Card to take a look at with PayPal at retailers within the first 6 months of Card Membership, as much as $150 again. Plus, earn $100 again as an announcement credit score after you spend $2,000 in purchases in your new Card within the first 6 months of Card Membership.

- No annual charge. Charges and charges particulars right here.

- Phrases apply.

Capital One Quicksilver Money Rewards Credit score Card

- 1.5% money again on each buy, daily.

- $200 money bonus after you spend $500 on purchases inside 3 months from account opening.

- No annual charge.

Capital One SavorOne Money Rewards Credit score Card

- Limitless 3% money again on eating, leisure, well-liked streaming companies and at grocery shops (excluding superstores like Walmart and Goal).

- 1% again on all different purchases.

- 8% money again on tickets at Vivid Seats by January 2023.

- $200 money bonus after you spend $500 on purchases throughout the first 3 months from account opening.

- No annual charge.

- Earn an additional 1.5% on all the things you purchase (on as much as $20,000 spent within the first 12 months), which is price as much as $300 money again:

- 6.5% on journey bought by Chase Final Rewards

- 4.5% on eating and drugstores

- 3% on all different purchases.

- After your first 12 months (or $20,000 spent), you earn:

- 5% money again on Chase journey bought by Chase Final Rewards

- 3% money again on drugstore purchases and eating at eating places, together with takeout and eligible supply service

- Limitless 1.5% money again on all different purchases.

- No annual charge.

When you’re concerned with journey rewards, individuals love the Chase Sapphire Most popular® Card. You may earn 60,000 bonus factors after you spend $4,000 on purchases within the first 3 months from account opening, which is $750 whenever you redeem by Chase Final Rewards.

Large caveat to bank card utilization: you MUST pay your bank card payments in full each single month, with no exceptions. When you’re involved about your capability to do that, or assume utilizing bank cards may immediate you to spend extra, follow a debit card or money. However when you have no downside paying that invoice in full each month? I like to recommend you bank card away, my good friend! (notice: the bank card hyperlinks are affiliate hyperlinks).

Money Again Earned This Month: $81.64

The silver lining to our spending is our money again bank card. We earn 2% money again on each buy made with our Constancy Rewards Visa and, this month, we spent $4,081.76 on that card, which netted us $81.64.

Not some huge cash, but it surely’s cash we earned for getting stuff we have been going to purchase anyway! Because of this I really like money again bank card rewards–they’re the best approach to earn one thing for nothing.

To see how this provides up over the course of a 12 months, try How I Made $712.59 With My Money Again Credit score Card.

The place’s Your Cash?

One other straightforward approach to optimize your cash is by placing it in a high-yield financial savings account. With these accounts, curiosity works in your favor versus the rates of interest on debt, which work in opposition to you.

Having cash in a no or low curiosity financial savings account is a waste of assets–your cash is sitting there doing nothing. Don’t let your cash be lazy! Make it give you the results you want! And now, take pleasure in some explanatory math:

Let’s say you have got $5,000 in a financial savings account that earns 0% curiosity. In a 12 months’s time, your $5,000 will nonetheless be… $5,000.

Let’s say you as a substitute put that $5,000 into an American Categorical Private Financial savings account, which–as of this writing–earns 4% in curiosity (affiliate hyperlink). In a single 12 months, your $5,000 could have elevated to $5,200. Which means you earned $200 simply by having your cash in a high-yield account.

And also you didn’t need to do something! I’m a giant fan of incomes cash whereas doing nothing. Is anyone not a fan of that? Apparently so, as a result of anybody who makes use of a low or no curiosity financial savings account is NOT creating wealth whereas doing nothing. Don’t be that individual. Be the one that earns cash whereas sleeping.

Sure, We Solely Paid $28.24 for Cell Cellphone Service (for 2 telephones)

Our cellular phone service line merchandise just isn’t a typ0 (though that definitely is). We actually and actually solely paid $28.24 for each of our telephones (that’s $14.12 per individual for these of you into division). How is such trickery potential?!? We use an MVNO!

What’s an MVNO?

Glad you requested as a result of I used to be going to inform you anyway: It’s a cellular phone service re-seller.

MVNOs are the TJ Maxx of the cellular phone service world–the identical service, A LOT cheaper. When you’re not utilizing an MVNO, switching to at least one is a straightforward, slam-dunk, do-it-right-away method to economize each single month of each single 12 months perpetually and ever amen.

Listed here are a number of MVNOs to contemplate:

For extra, I’ve a full chart of suppliers and their costs right here: Find out how to Save Cash on Your Cell Cellphone Invoice with an MVNO: I Pay $12 a Month*

*the quantity we pay fluctuates each month as a result of it’s calibrated on what we use. Think about that! We solely pay for what we use! Will wonders ever stop. These MVNO hyperlinks are affiliate hyperlinks.

Expense Report FAQs

- Wish to understand how we handle the remainder of our cash? Take a look at How We Handle Our Cash: Behind The Scenes of The Frugalwoods Household Accounts

- Don’t you have got a rental property? Sure! We personal a rental property (also called our first dwelling) in Cambridge, MA, which I talk about right here and extra just lately, right here too

- Why do I share our bills? To offer you a way of how we spend our cash in a values-based method. Your spending will differ from ours and there’s no “one proper method” to spend and no “good” funds.

- Are we probably the most frugal frugal individuals on earth? Completely not! My hope is that by being clear about our spending, you may achieve insights into your individual spending and be impressed to take proactive management of your cash.

- Questioning the place to begin with managing your cash? Take my free, 31-day Uber Frugal Month Problem.

- Need assist along with your cash? Rent me for a monetary session or name. Undecided what which means? Begin with a free 15-minute name.

- When you’re concerned with different issues I really like, try Frugalwoods Recommends.

- Why don’t you purchase all the things domestically? We do our greatest to assist our local people and purchase as a lot of our meals as potential immediately from our farmer neighbors. Our city doesn’t have any shops, so we depend on on-line ordering and massive field shops for requirements. The closest shops are 45 minutes away and we go a number of occasions a month to refill on what we are able to’t get from our neighbors or on-line.

However Mrs. Frugalwoods, Don’t You Pay For X, Y, Or Even Z???

Questioning about frequent bills you don’t see listed under?

When you’re questioning about the rest, be at liberty to ask within the feedback part!

Alright you frugal cash voyeurs, feast your eyes on each greenback we spent in Might:

| Merchandise | Quantity | Notes |

| Groceries | $879.72 | |

| Eating places | $493.81 | |

| Family provides & dwelling enchancment supplies & some clothes | $469.98 | Thrilling objects equivalent to: toothpaste, shampoo, laundry cleaning soap, dishwasher detergent, socks for each children, socks for me, craft provides, and residential enchancment provides. |

| Preschool | $420.00 | One of many remaining preschool funds of our lifetime! |

| String trimmer | $293.15 | This Battery String Trimmer for reducing down all of the small bushes and huge bushes attempting to eat our home (affiliate hyperlink). |

| New summer season/fall wardrobe for Mr. FW | $223.91 | Shirts, shorts, pants, swim trunks and extra! |

| Beer & wine | $204.54 | |

| Gasoline for the automobiles | $181.69 | |

| Annual household move to our native seashore | $150.00 | |

| Vermont DMV | $140.00 | Annual Registration for the Subaru Outback |

| Pole Noticed Attachment | $126.94 | This pole noticed attachment for pruning our fruit bushes (affiliate hyperlink). |

| Espresso outlets & a number of lunches out with pals | $118.54 | Espresso outlets & a number of lunches out with pals |

| Dentist appointment for me | $114.00 | We don’t have dental insurance coverage so we simply pay out of pocket.

This was for my common 6-month cleansing and check-up. |

| Money | $100.00 | For storage gross sales, child! |

| Utilities: Web | $72.00 | |

| Health club Rings and mount | $71.99 | To enhance our higher physique energy, Health club Rings and a Mount (affiliate hyperlink).

Presently put in in our basement and used each day by Mr. FW. I would like to begin as effectively… |

| Haircut | $69.00 | For me! |

| Thrift Retailer scores | $62.89 | Clothes for me and the ladies, sneakers for the ladies, bikes for them and a few family decor/provides. |

| Instruments | $57.88 | A brand new sillcock to interchange our damaged one in addition to some instruments for job: this instrument and likewise this instrument (affiliate hyperlink). |

| Liz dinner out with ski women | $52.84 | |

| CO2 canister | $44.62 | 20 lbs of C02 for our hacked Sodastream, seltzer-on-tap system. |

| Medical health insurance premium | $41.74 | By way of the Reasonably priced Care Act |

| Oil filter for mower | $39.27 | This oil filter for our mower (affiliate hyperlink). |

| Utilities: Electrical | $36.59 | We’ve photo voltaic; that is our month-to-month base value for remaining grid tied. |

| Cellphone service for 2 telephones! | $28.24 | Thanks, low-cost MVNO! |

| Extra guitar strings! | $27.55 | Mr. FW is sounding critically good! Extra guitar strings (affiliate hyperlink). |

| A hobbit | $22.78 | A beautiful copy of The Hobbit (affiliate hyperlink). |

| Alternative cupboard hinges | $17.71 | One thing nobody informed us about having children: you’ll have to substitute the hinges on your entire low cupboards (affiliate hyperlink). Usually. |

| Propane | $14.59 | |

| Spotify | $13.77 | |

| Alternative bathroom paper roll holder | $12.71 | One thing nobody informed us about having children: you’ll have to substitute your TP holder after the youngsters knock the previous one off the wall so many occasions that it merely can’t be screwed again in (affiliate hyperlink). |

| Writing pill | $12.55 | This factor is price its weight in gold. My in-laws gave one in every of these writing tablets to Littlewoods for her birthday a number of years in the past and the ladies had been sharing it (largely efficiently), but it surely was time to provide one to Kidwoods to protect familial unity (affiliate hyperlink). |

| Rechargeable batteries | $10.99 | AAA rechargeable batteries (affiliate hyperlink). |

| Alternative doorknob | $10.50 | One thing nobody informed us about having children: you’ll have to substitute doorknobs periodically after your children twist them so exhausting they now not operate (affiliate hyperlink). |

| Parking | $5.00 | Within the huge metropolis! |

| TOTAL: | $4,641.49 |

How was your Might?

[ad_2]