[ad_1]

Pocketsmith

Strengths

- Aggregates your monetary accounts on a single platform

- Routinely imports transactions as much as 90 days previous

- Multi-currency functionality

- Free plan accessible

- 30-day free trial on paid plans

Weaknesses

- No funding monitoring functionality

- Cannot pay payments by the app

- The free plan is kind of restricted

- Premium plans are dear

- Restricted buyer assist

If you happen to’re in search of a top-notch budgeting app, PocketSmith deserves a better look. Whereas it lacks a number of the fancy add-ons of another budgeting apps, like funding administration instruments, it’s acquired every part you want on the budgeting facet.

On this PocketSmith assessment, we’ll cowl the important thing options, plans and pricing, and execs and cons. We’ll even share a number of PocketSmith options.

Desk of Contents

- What Is PocketSmith?

- PocketSmith Options

- Dashboards

- Stay Financial institution Feeds

- Multi-Forex Functionality

- Finances Forecasting

- Finances Calendar

- What-If Situations

- Web Price Monitoring

- Advisor Entry

- How PocketSmith Works

- A “Killer” Search Engine

- PocketSmith Cell App

- PocketSmith Desktop App

- PocketSmith Safety

- Buyer Assist

- No Ads

- PocketSmith Pricing & Charges

- Methods to Signal Up with PocketSmith

- PocketSmith Execs and Cons

- Alternate options to PocketSmith

- FAQs

- Ought to You Signal Up with PocketSmith?

What Is PocketSmith?

Primarily based in New Zealand, PocketSmith was launched in 2008, making it one of many extra established private finance software program apps. You should utilize it to trace all of your monetary accounts on a single platform. By including your financial institution, mortgage, and bank card accounts, and even your investments, you possibly can see the massive image in addition to the small print in every account.

PocketSmith doesn’t simply hold working totals in your account balances. It should additionally make projections as to the place your account balances are headed (so far as 60 years into the long run).

Most individuals have quite a few financial institution accounts unfold throughout a number of banks, lenders, funding accounts, and even retirement accounts, making it very sophisticated to know the place you stand financially at any given second.

PocketSmith addresses this drawback by bringing all of your accounts collectively on one app that means that you can monitor and make changes the place mandatory.

By gathering your entire accounts on a single platform, you have got the flexibility to make adjustments to your finances. For instance, chances are you’ll determine to dedicate extra funds to paying off debt, increase financial savings and investments, and so forth.

As a cloud-based app, PocketSmith means that you can hyperlink accounts from 49 nations around the globe, together with all main banks within the US, Canada, Australia, New Zealand, and the UK. It is a crucial characteristic in a worldwide economic system the place each folks and cash routinely cross worldwide borders.

PocketSmith Options

PocketSmith provides extra options than we are able to adequately cowl on this assessment, however we’ve listed crucial ones under.

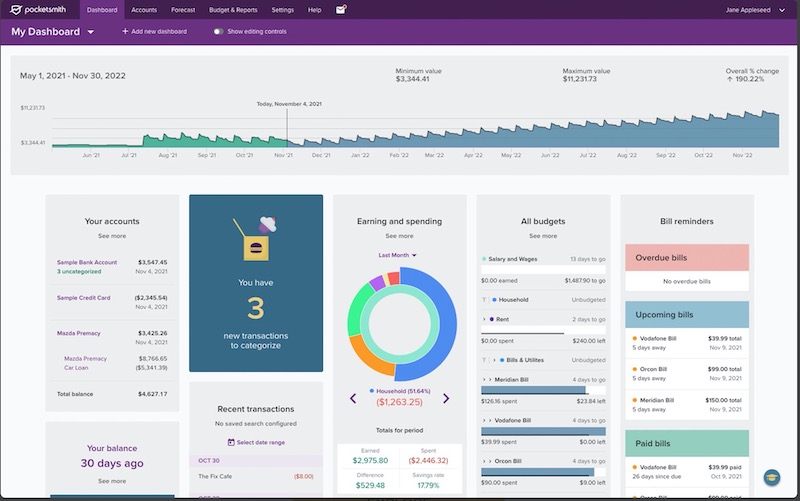

Dashboards

PocketSmith’s dashboard allows you to view your present account balances, forecasts, and cash metrics. Every plan allows you to construct a number of dashboards, making it simpler to personalize your funds.

For instance, you possibly can monitor your web price, evaluate earnings to spending, and assessment your lively budgets and financial savings objectives. The “Your subsequent seven days” and alerts options are additionally useful in estimating incoming bills and deposits to keep away from monetary surprises.

Stay Financial institution Feeds

This characteristic is offered on the three paid plans. It means that you can join your PocketSmith account to 1000’s of monetary establishments in 49 nations and have your transactions routinely categorized. Transactions can both be routinely imported or you possibly can select to add them manually.

Remember to select the mid-tier Flourish or top-tier Fortune plan if you must hyperlink accounts from a number of nations. The app makes use of Yodlee to attach most world accounts.

Multi-Forex Functionality

This can be probably the most attention-grabbing characteristic of the PocketSmith app. If in case you have monetary property unfold throughout a number of nations, the app will present computerized forex conversions based mostly on day by day alternate charges. All accounts, regardless of the place they’re positioned, will probably be transformed into your property forex. It even supplies in depth alternate fee assist for Bitcoin, gold, silver, and different different currencies.

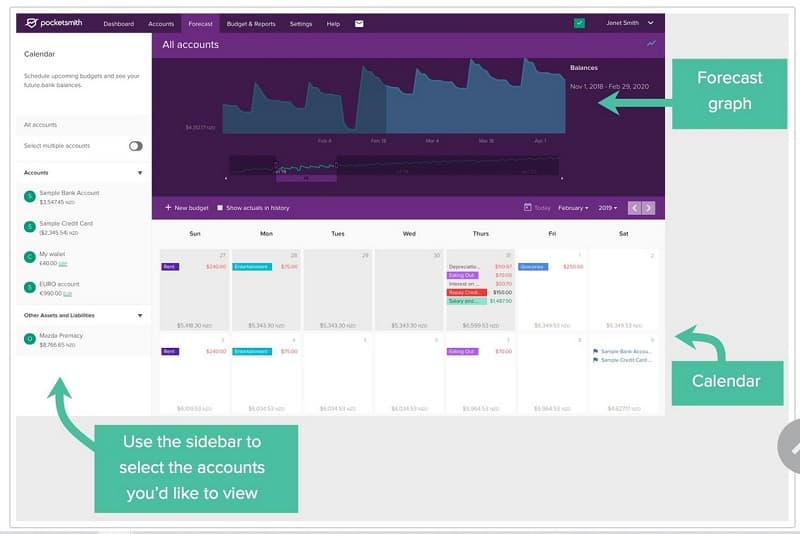

Finances Forecasting

As soon as your account balances have been imported (or manually entered) into the app, you may make projections forecasting future values out to anyplace from six months to so long as 60 years. The forecasting will even embody curiosity projections and graphs for visible presentation.

Finances Calendar

The Finances Calendar is the center of the PocketSmith budgeting system, permitting you to create day by day, weekly, or month-to-month budgets after which arrange alerts to maintain you on monitor. The app actually shows a calendar providing you with a visible presentation of what payments are due and when.

What-If Situations

This characteristic lets you run completely different eventualities to check outcomes from the very starting. You’ll have the ability to see the outcomes of accelerating debt funds or financial savings contributions and different methods.

Web Price Monitoring

PocketSmith’s Web Price Monitoring characteristic allows you to see how a lot cash is available in and the way a lot goes out frequently (which is able to assist you to make wanted adjustments). The app can subtract your liabilities out of your property, so it retains a working whole of your web price (the one most vital quantity in your monetary existence).

Advisor Entry

If you happen to need assistance managing your funds, you may give one other PocketSmith consumer entry to your account to supply direct administration.

How PocketSmith Works

Listed here are a number of methods to entry the PocketSmith platform to securely and simply entry your information.

A “Killer” Search Engine

PocketSmith’s search engine allows you to discover transactions in a matter of seconds (together with older ones). It’s potential to filter occasions by account, quantity, date, label, phrase exclusion, and different in-depth screens.

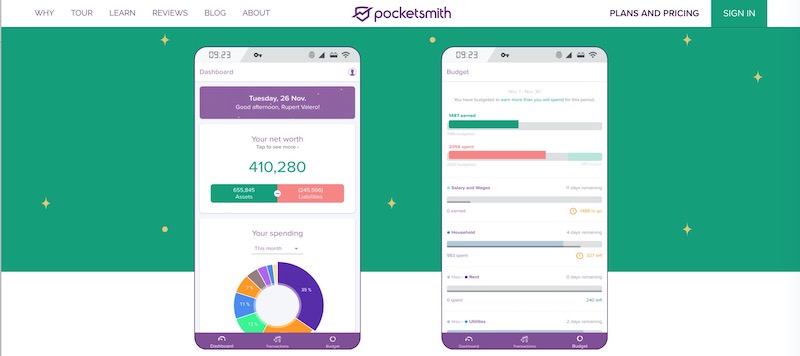

PocketSmith Cell App

You may entry your PocketSmith account utilizing your cellular machine. The app is offered at The Apple App Retailer for obtain on iOS units (11.0 or later). It’s appropriate with iPhone, iPad, and iPod Contact. It’s additionally accessible at Google Play for Android units (5.0 and up).

PocketSmith Desktop App

Along with a cellphone and pill app, laptop customers can obtain a desktop app for MacOS (11 or newer), Home windows 10 & 11, and Linux (Debian-based distributions). The desktop app has extra integration instruments than the default cloud-based browser version.

PocketSmith Safety

Financial institution feeds are delivered by third-party suppliers Yodlee and Salt Edge (within the UK and EU) and are set in “read-only.” This limits the app to gathering and displaying your info with out allowing direct entry to your accounts. The app additionally makes use of two-factor authentication by sending a code to your cellular machine to facilitate logging in.

Buyer Assist

PocketSmith buyer assist is offered by e mail solely. As a result of PocketSmith relies in New Zealand, assist is offered from 5:00 pm to 1:00 AM Jap Time. Count on responses to take as much as someday.

No Ads

All PocketSmith plans supply an ad-free expertise because the platform depends on month-to-month subscriptions to pay the payments. This additionally implies that PocketSmith received’t promote your information or promote third-party merchandise, like some free budgeting apps.

PocketSmith Pricing & Charges

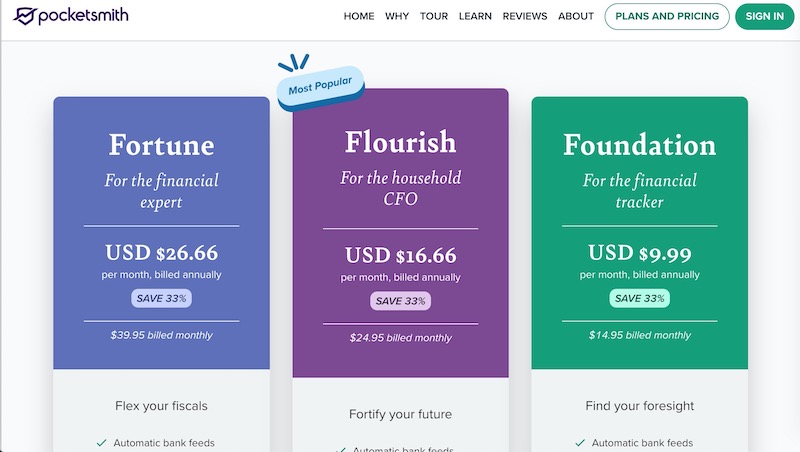

PocketSmith provides 4 pricing plans, together with a free choice, so you possibly can choose the one which has the options you need and matches inside your finances. Contemplate paying upfront for an annual subscription to get probably the most reasonably priced fee versus paying month-to-month. You may check out the paid plans with a 30-day free trial.

Free

This entry-level plan doesn’t cost a subscription charge and is ample for primary budgeting. It requires guide inputs of your monetary info however provides 12 budgets for 2 accounts and as much as six months’ finances projections.

Basis

The primary of the premium plans value $14.95 per 30 days, or $9.99 if you happen to pay yearly ($120). Basis provides each computerized and guide transaction importing with computerized financial institution feeds and categorizations for as much as six banks in a single nation.

It additionally supplies limitless budgets for as much as 10 accounts and lets you make finances projections for as much as 10 years.

Flourish

Flourish is PocketSmith’s mid-tier paid plan and prices $24.95 month-to-month or $200 yearly. With Flourish, you possibly can join as much as 18 banks throughout a number of nations with 18 dashboards. Subscribers can get pleasure from as much as 30 years of projections too.

Fortune

Fortune is PocketSmith’s top-of-the-line plan. It provides all of the options of the Flourish plan, nevertheless it extends to incorporate limitless accounts from all nations and finances projections out to as many as 60 years. The plan is offered at $39.95 per 30 days, however you’ll save $160 on an annual foundation by paying a flat charge of $319 for the entire yr.

Use our Pocketsmith promotion code to get 50% off the primary two months of Premium – enter the code 50OFFPREMIUM-5G7T to obtain the low cost.

Methods to Signal Up with PocketSmith

To get began with PocketSmith, you’ll want to supply your e mail tackle and create a username and password. You’ll additionally must learn and acknowledge a number of disclosures, together with the Phrases of Service and the Refund, Privateness, and Cookie insurance policies. As soon as that’s performed, you possibly can hit “Create My New Account” and get began.

From there, choose the plan choice you need – Free, Basis, Flourish, or Fortune.

This may decide the way you’ll hyperlink your accounts, what number of accounts you possibly can hyperlink, the variety of budgets you possibly can create, and the size of the finances projections you may make.

You may also improve your plan at any time (for instance, switching from the Free plan to the Basis plan or from the Basis plan to the Flourish plan, as your funds enable). Conversely, you too can downgrade from one of many paid accounts to the free plan.

For fee functions, you’ll must pay utilizing both a Visa or MasterCard, and you may cancel your subscription at any time. Remember to allow abroad funds or use a card with out a international transaction charge, because the cost originates from New Zealand.

At this level, you possibly can start the method of connecting your numerous monetary accounts to the app. PocketSmith connects with greater than 12,000 establishments around the globe, enabling you to import info reasonably than enter it manually (although on two of the plans, you do have the choice to do guide entry).

Financial institution feeds could be added both from the Account Abstract or Guidelines pages.

Whenever you arrange financial institution feeds, you possibly can import as much as 90 days of transaction historical past. Every time the financial institution feed refreshes, it should seek for transactions inside the earlier 28 days. There’s additionally the aptitude to start out your transaction historical past from an earlier date (although you’ll must observe particular procedures to make that occur).

You may also import accounts and transactions from the next software program:

PocketSmith Execs and Cons

Execs:

- Aggregates your monetary accounts on a single platform

- Routinely import transactions as much as 90 days previous out of your completely different financial institution accounts

- Capability to import information from well-liked private finance apps

- Multi-currency functionality

- Free plan accessible

- 30-day free trial on paid plans

Cons:

- No funding monitoring functionality

- Can’t pay payments by the app

- The free plan is kind of restricted

- Premium plans are dearer than different paid-budget software program

- Buyer assist could be very restricted (e mail solely)

Alternate options to PocketSmith

The next budgeting apps are price a glance earlier than you enroll with PocketSmith.

Lunch Cash

Lunch Cash supplies multi-currency assist, can immediately import banking transactions, and has customizable finances classes, tags, and guidelines. This desktop-first platform additionally connects to crypto wallets and might add CSV paperwork for guide transactions.

Use it to create a month-to-month finances and calculate your web price. Take pleasure in a 30-day free trial and pay $10 per 30 days. Annual subscriptions are additionally accessible with a “pay what’s honest” pricing mannequin from $40 to $150 per yr.

Sadly, Lunch Cash doesn’t have a cellular app, so if you happen to choose to entry your finances on-the-go, chances are you’ll need to look elsewhere.

Learn our Lunch Cash assessment for extra.

Tiller

Individuals who love utilizing spreadsheets to finances and monitor their monetary information are warming to this follow will really feel at house with Tiller. This cloud-based software program integrates with Google Sheets and Microsoft Excel to routinely sync together with your financial institution and funding accounts.

All customers begin with the Basis Template, which supplies a high-level overview of your latest transactions and monetary progress. You may add customizable templates for almost any budgeting technique to personalize the platform. The annual value is $79.

Learn our Tiller Cash assessment for extra.

Rocket Cash

Contemplate Rocket Cash in order for you a free budgeting app that excels at monitoring bills and making primary month-to-month budgets. It might additionally search for methods to scale back your month-to-month spending however solely updates your account stability as soon as per day.

The premium model supplies limitless budgets, web price monitoring, invoice cancellation concierge, shared accounts, and real-time account syncing. You’ll pay between $3 and $12 per 30 days however can get pleasure from a complimentary subscription if in case you have an lively Rocket Mortgage mortgage.

Learn our Rocket Cash assessment for extra.

FAQs

PocketSmith helps over 12,000 monetary establishments in 49 nations, together with all main banks within the US, New Zealand, Australia, and the UK.

Sure. PocketSmith is offered in Canada and connects to a number of main monetary establishments north of the border.

You Want A Finances (YNAB) is a premium budgeting app that follows a zero-based budgeting strategy and is one in all our highest-rated budgeting instruments right here at Pockets Hacks. That stated, the very best budgeting app is the one which’s best for you. And if the options PocketSmith provides higher align with the way you handle your funds, then chances are you’ll choose it to YNAB.

Ought to You Signal Up with PocketSmith?

PocketSmith is without doubt one of the prime pure budgeting apps in the marketplace. It performs features no different budgeting app does, notably the multicurrency characteristic, which lets you preserve accounts in monetary establishments worldwide and monitor balances in your house forex.

With 4 plan ranges, every with its personal charge construction, you possibly can select the plan that can work finest inside your finances.

The 2 main negatives of the app are that it doesn’t supply a bill-paying functionality or any funding administration options. Nonetheless, in case your major aim is to combination all of your monetary accounts and supply budgeting capabilities, PocketSmith handles these features expertly.

Whereas customer support is a matter, the Study Middle library of subjects is unusually complete. It’s doubtless you’ll discover solutions to no matter questions you have got someplace in that part.

If you happen to’d like extra info or if you happen to’d like to join the app, go to PocketSmith.

[ad_2]