[ad_1]

[Updated on January 28, 2024 with updated screenshots from TurboTax for 2023 tax filing.]

When mutual funds and/or ETFs that put money into overseas nations obtain dividends or curiosity, they need to pay taxes to these nations. These mutual funds and/or ETFs report back to your dealer after the tip of the 12 months how a lot they paid in overseas taxes in your behalf.

Kind 1116

If you put money into these mutual funds and/or ETFs in a daily taxable brokerage account, your dealer will report back to you the whole overseas taxes you paid by means of all of your funds and/or ETFs. The IRS permits a tax credit score for the taxes you pay not directly to overseas nations.

The overseas taxes paid are reported in Field 7 on the 1099-DIV type you obtain out of your dealer. It’s simple to deal with when the whole overseas taxes paid from all of your 1099-DIV kinds is not more than a certain quantity — $300 for single and $600 for married submitting collectively. You enter the 1099-DIV kinds into your tax software program and the software program will robotically put the whole in your tax type (Schedule 3, Line 1).

When your complete overseas taxes paid from all of your 1099-DIV kinds are over the $300/$600 threshold, you’ll want to incorporate Kind 1116 in your tax return. It’s a sophisticated type. I’ll present you the way to do that in TurboTax.

Should you use different tax software program, please learn:

Use TurboTax Obtain

The screenshots beneath got here from TurboTax Deluxe downloaded software program. The downloaded software program is approach higher than on-line software program as a result of it’s each cheaper and extra highly effective. Should you haven’t paid on your TurboTax On-line submitting but, you should purchase TurboTax obtain from Amazon, Costco, Walmart, and plenty of different locations and change from TurboTax On-line to TurboTax obtain (see directions for the best way to make the change from TurboTax).

I’ll use this straightforward situation for instance:

You obtained a 1099-DIV out of your dealer. Field 7 “International Tax Paid” on the 1099-DIV exhibits $700. 100% of this $700 got here from a mutual fund or ETF. You solely have this one 1099-DIV that has a quantity in Field 7.

1099-DIV Entries

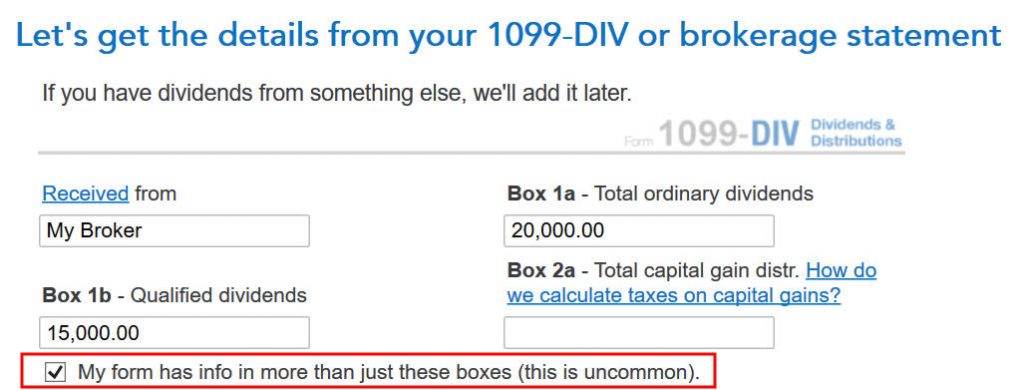

Should you imported your 1099’s, double-check that every one the numbers from the import match your downloaded copy.

Should you’re coming into your 1099-DIV manually, you need to verify a field on the 1099-DIV entry display screen to disclose the extra enter fields. Then you definitely put the overseas tax paid quantity into Field 7.

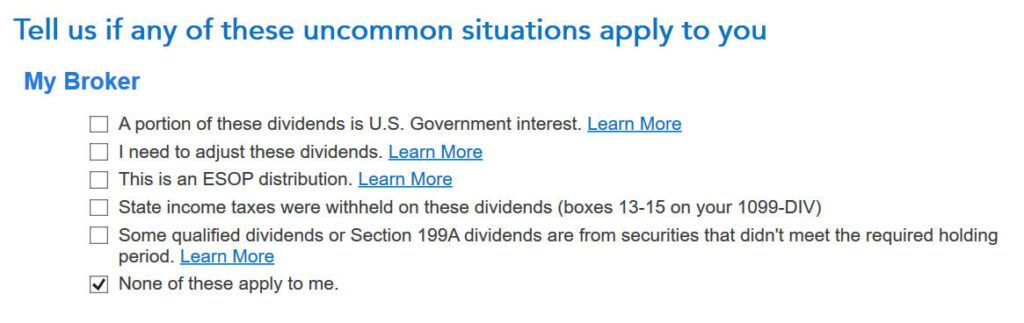

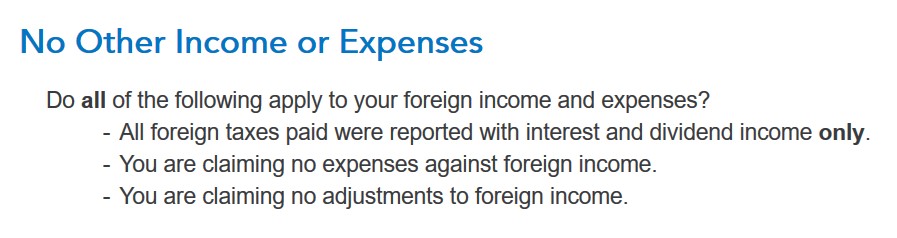

We don’t have any of those unusual conditions.

After you’re accomplished with one 1099-DIV, proceed together with your different 1099-DIV kinds. We solely have one 1099-DIV type in our instance.

International-Supply Revenue

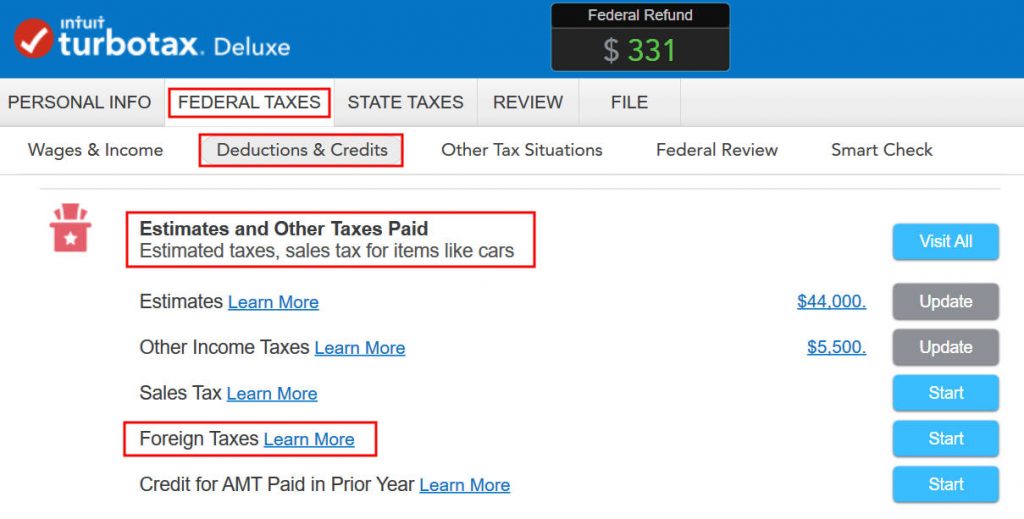

At a a lot later level, TurboTax will ask you concerning the overseas tax paid below Deductions & Credit -> Estimates and Different Taxes Paid -> International Taxes.

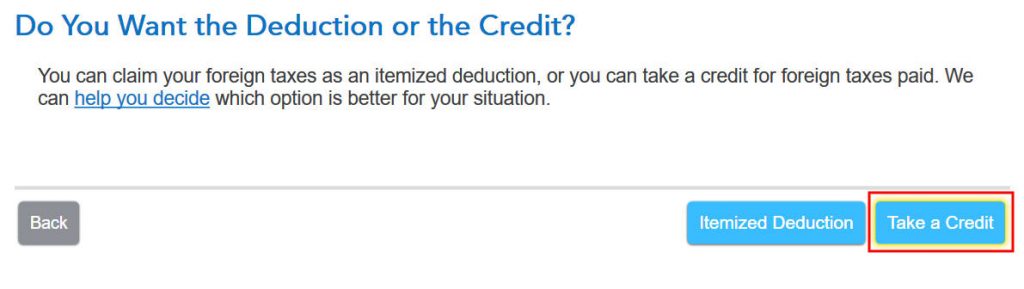

After a short introduction, the primary query is whether or not you’d wish to take a tax deduction or a tax credit score. The “aid you resolve” popup says usually you’re higher off taking the credit score. So click on on “Take a Credit score.”

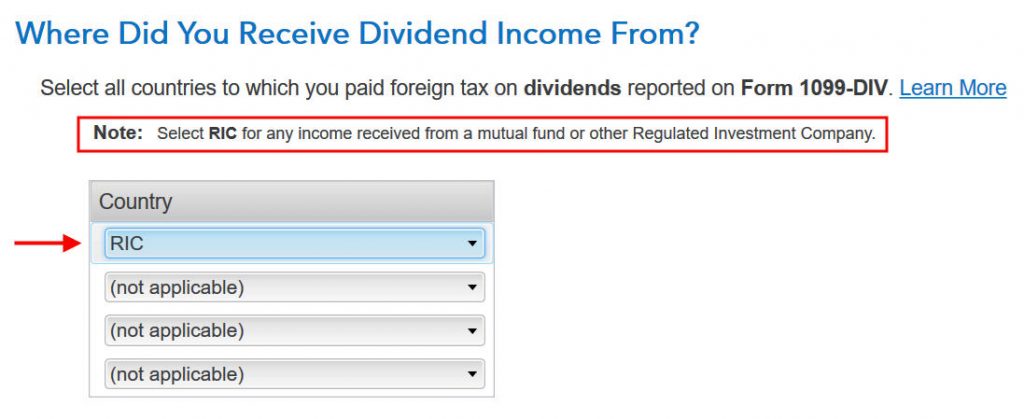

Subsequent, TurboTax asks you which of them nations you obtained dividend earnings from. A small observe says to pick RIC for any earnings obtained from a mutual fund or different Regulated Funding Firm. U.S.-based mutual funds and ETFs fall into this class.

RIC is the first merchandise within the nation dropdown.

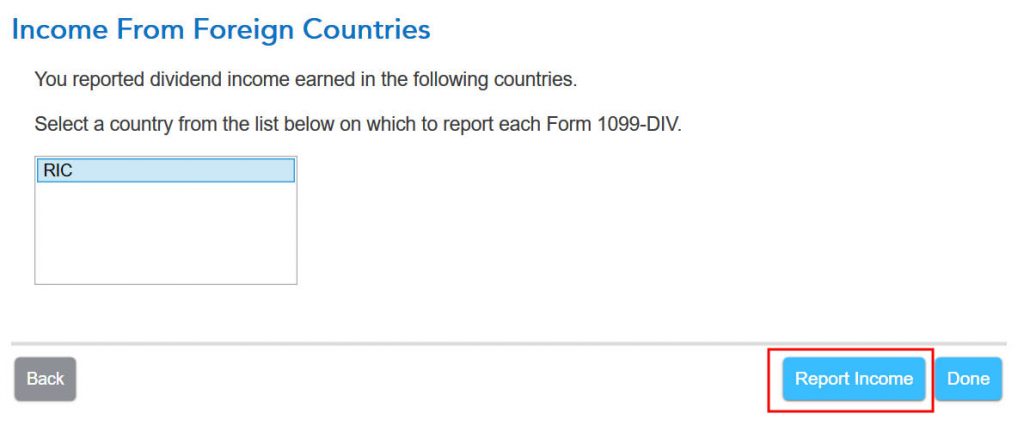

Then you definitely report earnings obtained from the nation “RIC.” Click on on “Report Revenue.”

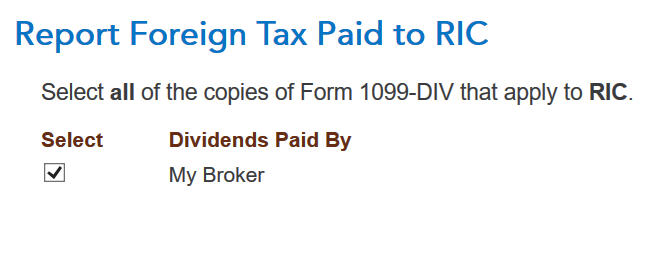

Now you say overseas tax paid from which 1099-DIVs had been paid to the nation RIC. If all of your overseas taxes paid had been from mutual funds and/or ETFs, choose all of your 1099-DIV’s which have a quantity in Field 7.

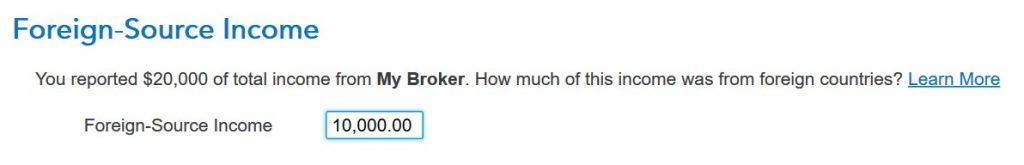

TurboTax asks you the way a lot of the dividend in your 1099-DIV was from overseas nations.

This info isn’t on the 1099-DIV itself. Your dealer could have included supplemental info with the 1099-DIV. For example, Constancy gives the breakdown of complete overseas earnings in its 1099 package deal.

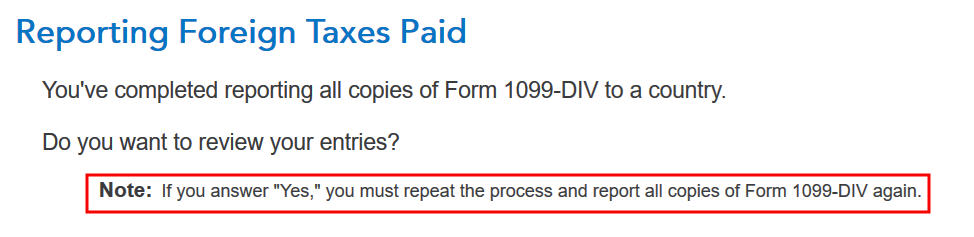

TurboTax asks whether or not you’d wish to evaluate the 1099-DIV kinds you entered earlier than. We reply “No” right here as a result of we already entered the 1099-DIV kinds accurately.

Simplified Limitation for AMT

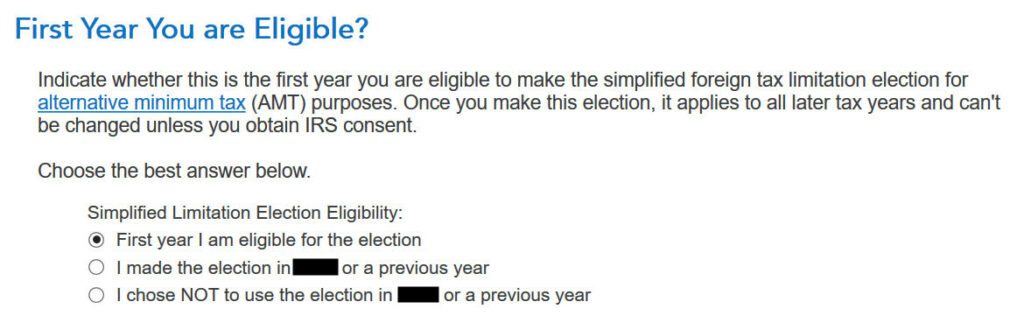

Now it asks you a few “simplified overseas tax limitation election.” If that is the primary 12 months you encounter this, select the primary possibility.

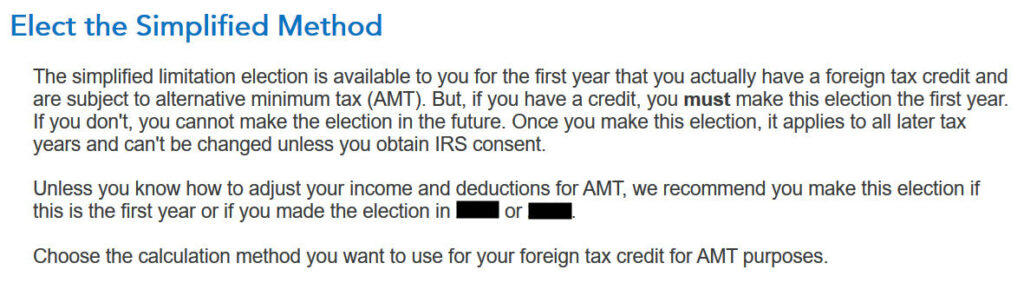

TurboTax suggests it is best to elect the simplified technique. Click on on Elect Simplified Calculation.

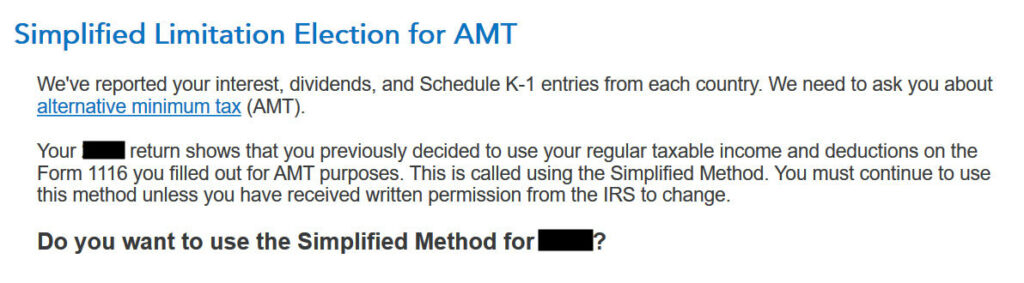

Should you used TurboTax final 12 months and also you already elected the simplified technique, TurboTax reminds you that it is best to proceed with the simplified technique. Reply “Sure” right here.

Changes

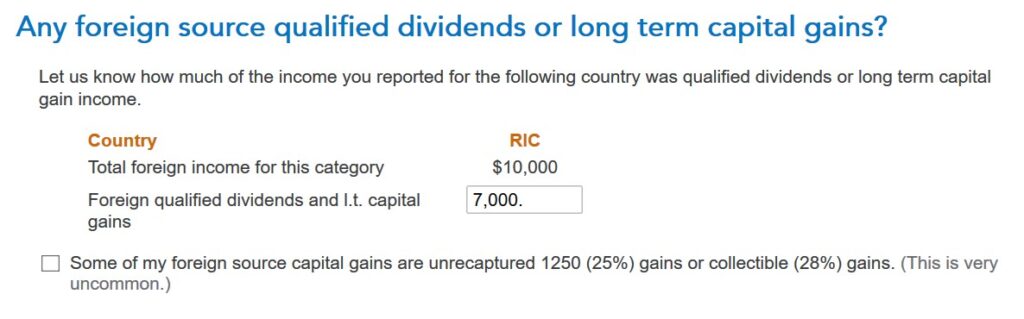

That is essential however simple to overlook. Click on on “No” to set off extra questions. We gave the whole foreign-source earnings in a earlier display screen however we didn’t get an opportunity to say how a lot of the earnings is from certified dividends or long-term capital good points. It makes a distinction.

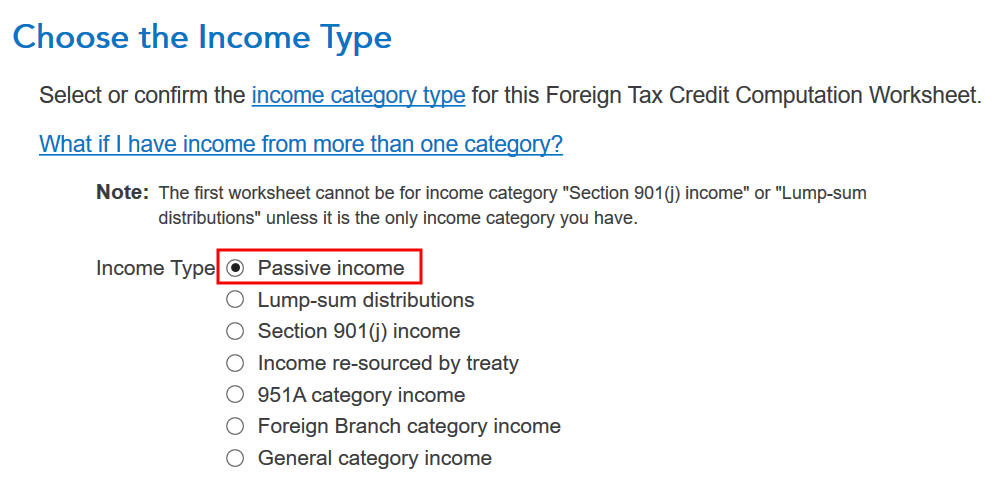

Dividends fall within the Passive Revenue sort.

You discover the whole foreign-source certified dividends and long-term capital good points from the 1099 supplemental supplies out of your dealer.

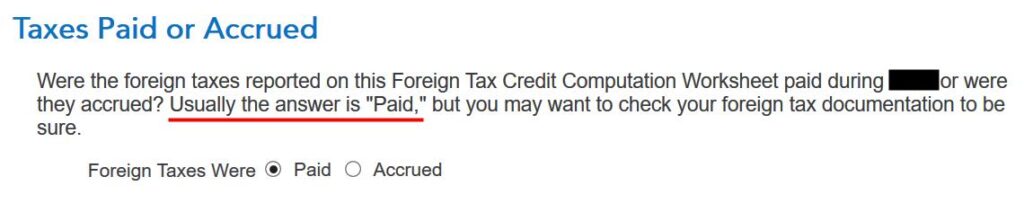

Go together with the default “Paid.”

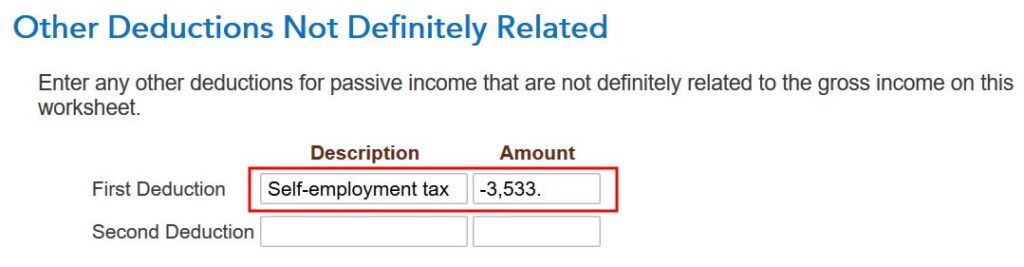

By default all of your above-the-line deductions are categorized as “not positively associated” to your overseas earnings. You probably have a deduction that’s positively associated to your U.S. earnings, such because the deductible 1/2 of your self-employment tax when your self-employment is 100% U.S., enter it right here as a unfavorable quantity to again it out.

Proceed clicking by means of and settle for the default in lots of screens after this one.

International Taxes Paid

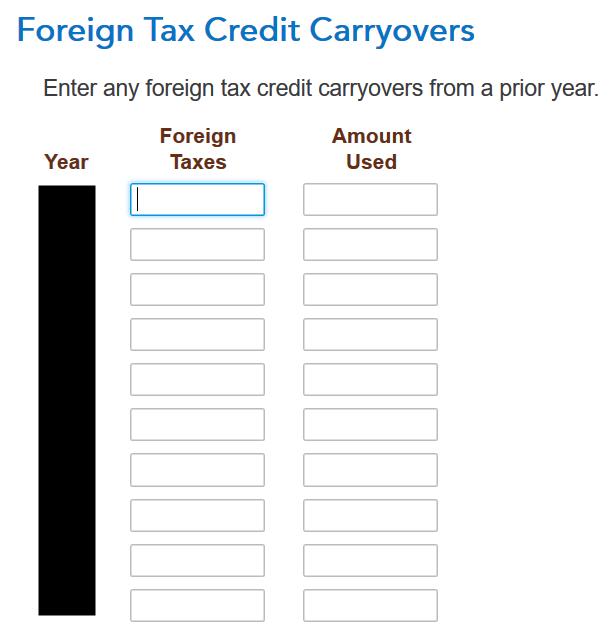

We don’t have any carryover from earlier years in our instance. A carryover is created once you paid extra in overseas tax than the tax credit score you’re allowed. Your leftover overseas tax paid is first carried again to the earlier 12 months after which carried over to the next 12 months. You probably have carryovers from earlier years, they’ll present up right here.

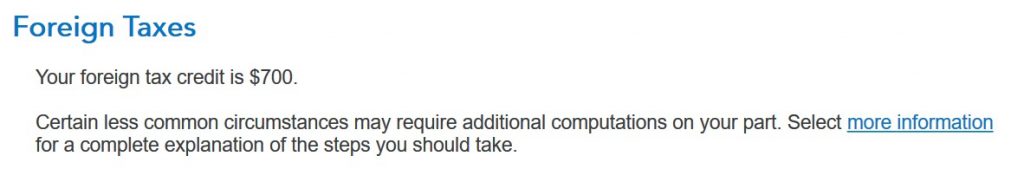

After going by means of all these, we’re getting 100% credit score for the $700 overseas tax paid. Woo-hoo! You might get lower than 100% credit score relying in your earnings composition. If that’s the case, the credit score you may’t take this 12 months will carry over to subsequent 12 months.

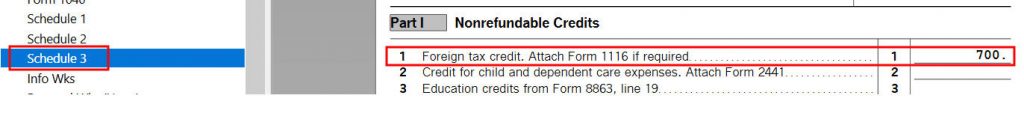

Confirm on Schedule 3

You’ll be able to confirm that you simply’re getting the overseas tax credit score by clicking on Types on the high proper. Discover Schedule 3 within the left navigation pane and have a look at the quantity on Line 1. You can even have a look at Kind 1116. It appears awfully sophisticated.

Extra International Tax Credit score

We obtained 100% of the overseas taxes paid as a tax credit score in our instance. Should you paid larger overseas taxes on a decrease US earnings, you might not have the ability to take 100% of the credit score. TurboTax will inform you that you simply’ll have to attend till subsequent 12 months to take a portion of the credit score.

Carrying over a part of the credit score to the next 12 months requires submitting a Kind 1116 Schedule B. TurboTax will robotically generate Schedule B once you want it.

Abstract

TurboTax works once you paid extra overseas taxes than the $300/$600 threshold that requires a Kind 1116. You’ll have to assemble the overseas earnings from the 1099 supplemental info out of your brokers. After it’s all stated and accomplished, you’re getting a tax credit score for taxes you paid to overseas nations by means of your mutual funds and/or ETFs.

Finishing Kind 1116 is sophisticated even with TurboTax. You’ll have an additional complication in carryovers once you don’t get to make use of 100% of the credit score. I attempt to keep away from this example by placing mutual funds and ETFs that put money into overseas nations in a tax-advantaged account. See Too A lot Trouble in Claiming International Tax Credit score on IRS Kind 1116.

Say No To Administration Charges

If you’re paying an advisor a share of your belongings, you might be paying 5-10x an excessive amount of. Discover ways to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]