[ad_1]

Soar to winners | Soar to methodology

Grasp dealmakers

As advisors course the ever-evolving panorama of monetary merchandise and market traits, fund wholesalers function invaluable allies, providing experience, assist, and entry to a various array of funding alternatives.

The High 50 Wholesalers of 2024 had been voted on by advisors unfold throughout the nation and stand as trusted companions, in keeping with Erika Toth, CFA, director for Japanese Canada at BMO World Asset Administration.

She additionally lists their different qualities:

-

a wonderful supply of knowledge

-

figuring out their very own and rivals’ merchandise

-

understanding portfolio development

-

realizing what sorts of clientele go well with merchandise greatest for the dangers and advantages

Toth provides, “It’s actually putting that fantastic line by being a reliable reliable associate, but in addition being persistent with out being annoying when you’re making an attempt to develop new relationships and prospect advisors.”

Dynamic Funds – Sara Dowlatshahi and Marc Mum or dad

Regardless of being in the identical agency, each High 50 Wholesalers have cast their very own profitable methods of working.

“The naked minimal is rarely ok. While you genuinely care, it exhibits in your work and also you’re in a position to ship that again to advisors”

Sara DowlatshahiDynamic Funds

Communication

Dowlatshahi, vp of enterprise improvement, maintains fixed contact with advisors.

“My high 20 advisors have entry to me, whether or not it’s my textual content, WhatsApp, or my private telephone 24/7.”

Moreover, she insists on being copied on all shopper emails to offer help at any time when vital. This extends to nonetheless replying even when she doesn’t have a right away answer.

“The expectation is that for those who can not reply with a solution, at minimal, you might want to let your shoppers know that their electronic mail or name has been acquired and also you’ll get again to them shortly.”

Dowlatshahi additionally strives to speak with shoppers organically, asking diagnostic questions in much less conventional methods.

“We’re having conferences, not solely in an workplace setting, however possibly in a espresso store the place there’s numerous various things happening. So, I weave in these shopper questions in a extra pure manner, quite than like an interview.”

Mum or dad, additionally a vp of enterprise improvement, does it otherwise by sustaining shopper relations by way of bi-weekly electronic mail updates that includes recaps and market commentary.

Citing time as an advisor’s most useful asset, Mum or dad highlights key data by electronic mail so advisors may be directed shortly to related data.

“It’s about doing these small further steps to create most affect.”

Figuring out the shopper

Evaluating the method of developing an advisor’s portfolio to constructing a house, Dowlatshahi isn’t afraid to take a position time upfront.

Her method includes:

“If I’m assembly a brand new shopper, it’s very seldom that in that first assembly, and even possibly the second assembly, we speak about product. It’s an extended gross sales course of for positive. It takes extra persistence and attending to know who they’re, nevertheless it’s much more fruitful.”

Dad and mom adopts a problem-solution oriented method when providing advisors suggestions.

“I attempt to hyperlink the traits of a product to the precise challenges of the investor. It’s typically simpler to digest this data as bullet factors, so we attempt to be as concise as attainable,” he says.

Along with telling shoppers what they’ll do, Dowlatshahi additionally informs shoppers on boundaries.

“If the product is one thing they’ll’t entry, I’ve to be conscious. If it’s one thing that they’ll’t use, they need to pay attention to it.”

“As a trusted wholesaler, my robust reference to my advisors units me aside – generally relationships are extra necessary than merchandise”

Marc Mum or dadDynamic Funds

Experience

Mum or dad ensures his information is present and sharp by way of self-directed research.

“Studying, studying, and extra studying,” he explains. “I additionally take leverage from my colleagues and attain out to my contacts to get a way of what’s happening within the area. What units me aside could be my understanding of not solely my advisor’s follow, however my understanding of my product lineup and the way it matches their enterprise.”

For Dowlatshahi, probably the most rewarding a part of the job is utilizing her perception to make advisors’ lives simpler.

“My aim is to alleviate the stress in the case of investments, like worrying a few price of return. I take that off the desk and supply advisors with options they are often comfy with.”

Moreover, Dowlatshahi emphasises not solely being educated, however being an efficient instructor.

“Whether or not it’s educating on ETFs or mutual fund trusts, I be sure that I’m up to the mark as a lot as attainable so I can relay data to advisors in a manner that’s digestible,” she says. “It’s satisfying to see advisors take your suggestions and implement your recommendation. Listening to them be glad and say thanks is admittedly fulfilling.”

“I ship assist, concepts, and insights to assist advisors get a greater view of the general image of their shoppers’ wants”

Amélie LaferrièreSolar Life World Investments

Solar Life World Investments – Amélie Laferrière and Zachary Sikorski

One other pair of High 50 Wholesalers have risen to the highest by navigating their very own paths whereas in the identical agency.

Communication

With regards to digital connections, wealth gross sales director Laferrière takes the ‘much less is extra’ method.

She says, “Advisors are inundated with emails so once I do ship them, I strive to ensure they’re concise and related in order that they’ll learn it. Advisors have commented that that is one thing they respect.”

To take care of contact with shoppers, Sikorski, additionally a wealth gross sales director, and his workforce host webinars and take part in trade conferences on subjects starting from retirement to due diligence.

“On this enterprise, we’re skilled communicators,” provides Sikorski. “It’s about being accessible at any time when that decision may are available.”

And he’s additionally conscious of not overusing technical phrases when there is no such thing as a want.

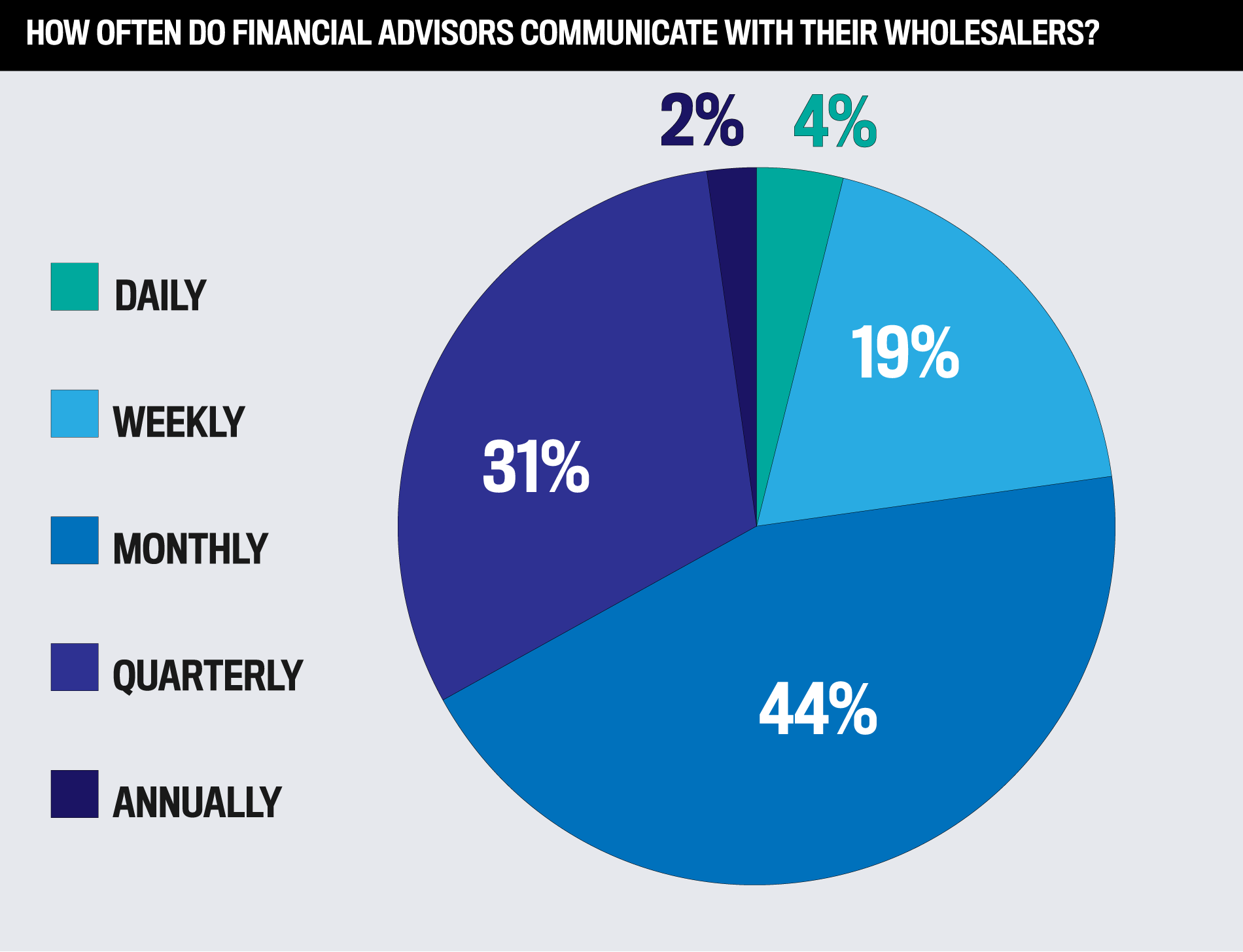

“It’s how we speak about what we speak about. It’s about making issues concise and simple to know, and having contact with advisors on a weekly, month-to-month, quarterly, semi-annual foundation.”

Figuring out the shopper

Sikorski additionally acknowledges that useful options can solely be provided after spending time understanding his shopper’s motivations.

“While you take a look at what number of choices advisors have for his or her shoppers, it’s an excessive amount of to know all the pieces. My job is to sift by way of all the knowledge on the market and supply related options that make sense.”

Laferrière ensures she’s up to the mark on shopper enterprise dealings by way of analyzing informative video content material.

“I get despatched quarterly movies from a few of our subadvisors, so I wish to hearken to these as a result of it’s a fast replace that helps me keep on high of their methods.”

“I place myself as a long-term associate for advisors by supporting their follow and serving to them achieve insights to finally higher serve their shoppers”

Zachary SikorskiSolar Life World Investments

Experience

For Sikorski and Laferrière, working in a big agency with numerous choices means product information takes time to develop.

Solar Life World Investments options embody:

-

mutual funds

-

segregated funds

-

payout annuities

-

insurance coverage GICs

“The training curve is certainly steep,” provides Laferrière. “You may’t be taught all of this in a single yr. It takes a very long time for anyone to be as much as par by way of information.”

Striving to ship holistic product experience, Sikorski says, “It’s about bringing extra schooling across the makes use of of the merchandise, how they can be utilized in numerous manners, what the tax benefits, or in some instances, the disadvantages are in implementing a type of methods.”

With over a decade within the trade, Sikorski notes that whereas product information is essential, the position of fund wholesalers has modified in recent times.

“Product experience has at all times been a core operate, however there’s now extra of a give attention to really understanding an advisor’s enterprise from their perspective, their targets, and their ache factors. The position has advanced to focus extra on partnership, empathy, and including worth by way of lively listening.”

Laferrière leverages her breadth of information to tailor product options for shoppers.

“I’m very educated in the case of tax planning, property planning, portfolio development, and the varied platforms that advisors function on. I can actually information them in what we do, what they do, and the way we are able to greatest assist them.”

“My understanding of {the marketplace} helps advisors with their asset allocation selections and finally helps them develop their enterprise in a constant and steady manner”

David RoyInvico Capital

Invico Capital – David Roy

Communication

For the vp of gross sales (East), well timed contact is essential to long-term partnerships.

“I don’t await them to name me first. You have to handle your shoppers regularly and anticipate that they will wish to hear from you,” he explains.

Roy left the restaurant enterprise in 2000 to affix the funding trade.

“When a head chef tells me to alter black pepper to white pepper, he means now, he doesn’t imply tomorrow. I’ve at all times labored with that immediacy in thoughts.”

Figuring out the shopper

Because the wholesale trade shifts from gross sales to service, Roy has noticed advisors turning into much less involved with ‘wining and eating’ and extra targeted on working with wholesalers who perceive their enterprise.

“Once I first received began, it was all about ‘what are you doing for income this month’? That was the query you’d lead with once you received an advisor on the telephone. They might have fee targets for themselves and for his or her companies. That’s gone,” he says.

Roy brings worth to advisors by ensuring he’s updated on the subject material. “You’ve actually received to know your transient. When I’m being utilized as a useful resource, and finally as an extension of an advisor’s workforce, that’s how I do know I’ve executed my job.”

Experience

Specializing in the renewable power sector, Roy supplies advisors with fashionable options.

“It’s essential that I keep on high of the broader understanding of power investing as a result of there’s lots of noise round renewables. It’s necessary that I proceed to make the case once I current options that this can be a viable funding for the long run.”

For Roy, being a profitable wholesaler means offering schooling and collaborating with like-minded advisors.

“In case you are an funding advisor, chances are high you’re profitable, and chances are high you will have exceptionally good folks abilities, and are very clever your self. I get to take care of very high-quality, very clever folks day in and time out. And that for me is the perfect a part of the job.”

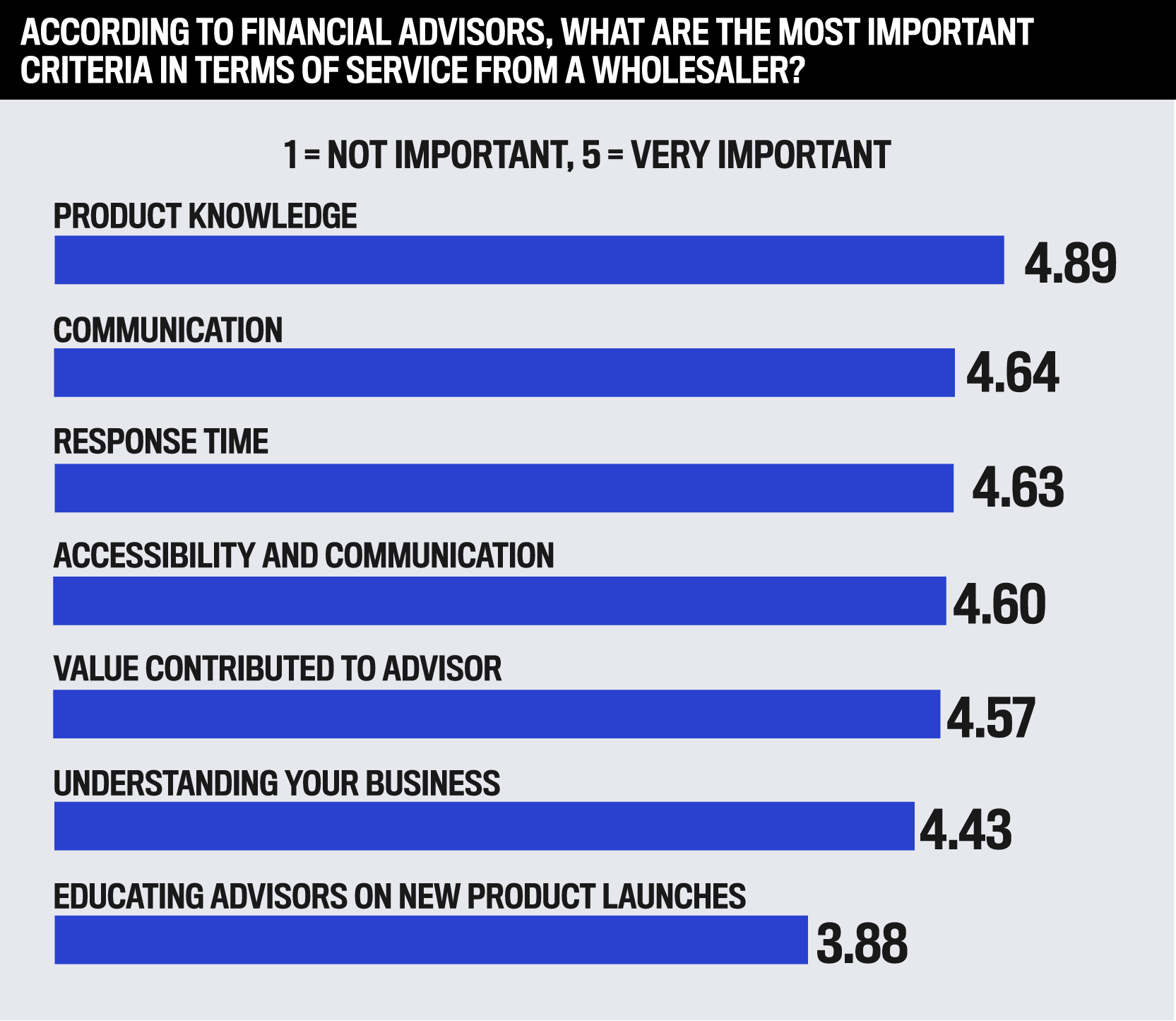

What monetary advisors need from Canada’s High Wholesalers

Tons of of advisors shared with WP what they anticipate from the trade’s greatest wholesalers. A few of their insights had been:

-

“One who identifies challenges in our enterprise and works collectively to seek out holistic options that clear up an issue”

-

“Skilled, immensely educated on their product and their rivals, and has a optimistic perspective”

-

“Is trustworthy about how their product compares to comparable merchandise from different corporations and understands the relative strengths/weaknesses”

-

“Somebody who understands my funding philosophy and brings me the ideas from the managers of the funds they signify”

-

“Very quick to answer questions. In-depth information of their product and the encircling landscapes that may have an effect on the efficiency of their product”

-

“One that desires to be a associate and never a salesman. They perceive our enterprise mannequin and wish to see the place they might match. They should comply with up and supply after-sales service as effectively”

- Alain Desbiens

BMO World Asset Administration - Alex Heron

Pimco - Andrew D’Iorio

Manulife Funding Administration - Blaise Bolland

Canoe Monetary - Chad Pardi

Canada Life - Chris Lorenzi

Capital Group - Christian Ricci

Canoe Monetary - Christian Tucci

Manulife Funding Administration - Cliff Cassiday

Harvest ETFs - Colin Inexperienced

BMO World Asset Administration - Cynthia Maisonneuve

CMLS Asset Administration - Dan Mondou

Previously at Desjardins - David Roy

Invico Capital - Emile Bouchard

Vanguard - Eric Desrossiers

Canoe Monetary - Greg McNaughton

iA Clarington Investments - Haiqi Gao

Manulife Funding Administration - Jay Tailor

Constancy Investments - Jessie Dawe

Dynamic Funds - Jordan Kaczmarzyk

Constancy Investments - Josh Mays-Quinn

Harvest ETFs - Krystian Urbanski

Bridgeport Asset Administration - Lauren Smith

TD Wealth - Laurent Xavier Possa

Mackenzie Investments - Lyes Birem

Alignvest - Marc Mum or dad

Dynamic Funds - Mark Jones

Canoe Monetary - Mark Shimmin

Manulife Funding Administration - Murray Porubanec

Constancy Investments - Nate Histead

Constancy Investments - Naureen Perwani

Mackenzie - Ogi Todorovic

Constancy Investments - Rachid Boufarsi

Manulife Funding Administration - Razi Madi

TD Wealth - Richard Petrungaro

Dynamic Funds - Richard Wazny

Dynamic Funds - Sara Dowlatshahi

Dynamic Funds - Sarah Ford

EdgePoint Wealth Administration - Scott Hickerson

Picton Mahoney - Sebastien Faucher

Constancy Investments - Stephen Andrus

BMO World Asset Administration - Tanja Mirazic

Manulife Funding Administration - Tom Hanger

Constancy Investments

[ad_2]