[ad_1]

Every advisor is exclusive in how they appeal to their shoppers or which packages they use. They count on a whole lot of flexibility. Our objective is to offer a set of instruments. We discuss to the advisors very often about their wants. We conduct market evaluations and have a look at what’s on the market, together with improvements. We have a look at software program that has excessive penetration within the business. We all the time preserve our ears near the bottom and supply them with the very best platforms. It’s all the time a dialogue. It’s not us saying, “That is the stack. Go use it.”

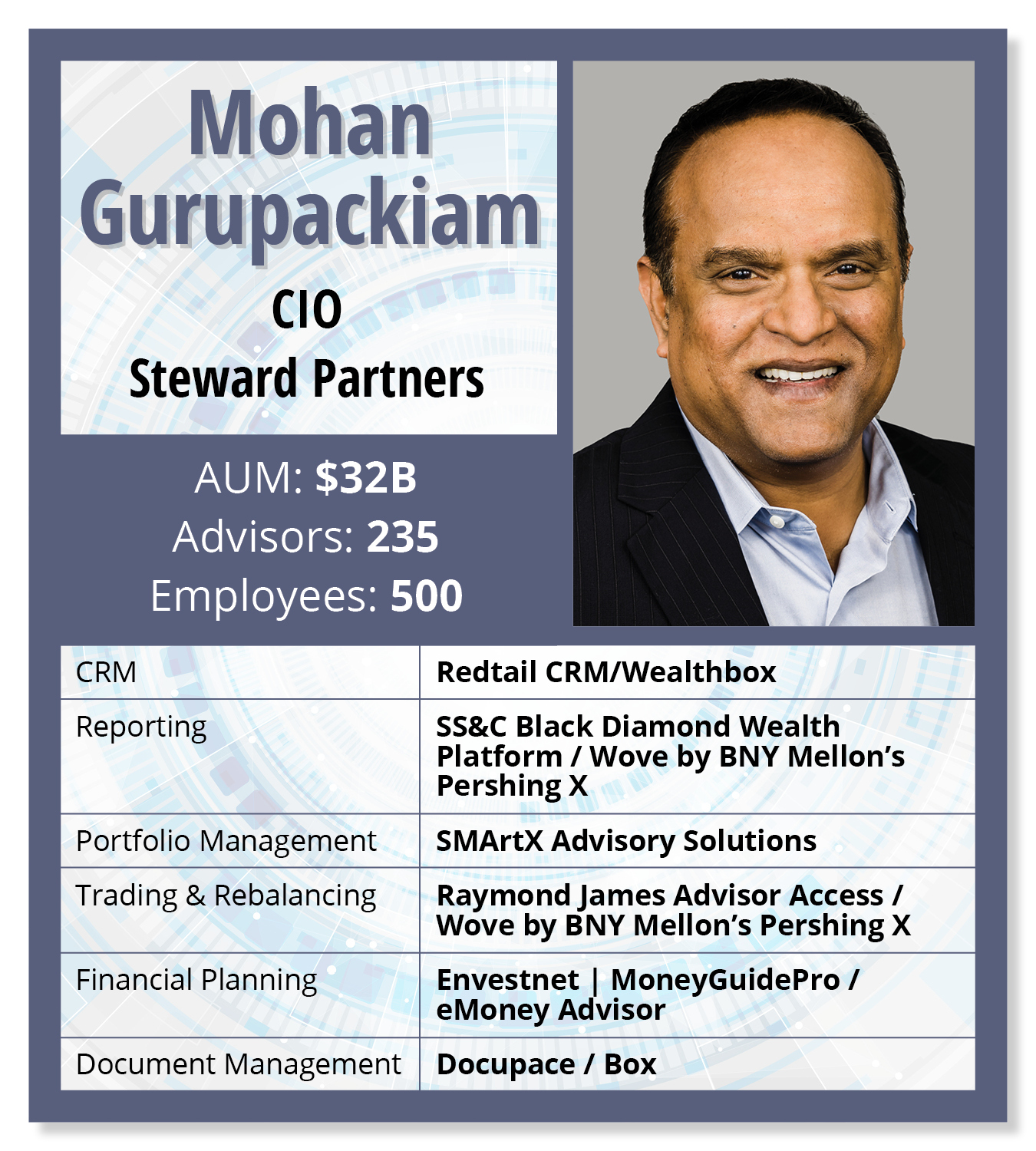

CRM: Redtail CRM / Wealthbox

We assist Redtail CRM and Wealthbox. The custodian the advisor makes use of might also have a homegrown CRM. In these instances, these will praise them.

We assist Redtail CRM and Wealthbox. The custodian the advisor makes use of might also have a homegrown CRM. In these instances, these will praise them.

Portfolio Reporting: SS&C Black Diamond Wealth Platform / Wove by BNY Mellon’s Pershing X

There are some platforms the place we have now determined to conduct extra thorough due diligence. An excellent instance could be efficiency reporting. We’re within the means of transferring from SS&C Black Diamond Wealth Platform to Wove by BNY Mellon’s Pershing X. Now we have a number of strains of enterprise, and we’d like one thing sturdy at an affordable value level. As we assist all these instruments, one of many points we run into is the necessity for constant knowledge throughout the board. That’s often probably the most vital ache level that advisors speak about. Availability of information is big for them. That’s one of many causes we’re taking a look at utilizing Wove by BNY Mellon’s Pershing X. It’ll permit us to normalize the information. We are able to see the complete ebook of enterprise on a single pane of glass. There are knowledge feeds that we are able to ship to all our enterprise platforms.

Monetary Planning: Envestnet | MoneyGuidePro / eMoney

We use MoneyGuidePro by Envestnet, however we are actually in conversations with eMoney. Now we have heard from the advisors that they might additionally like eMoney as an ordinary.

Consumer Information Gathering: PreciseFP / Jotform

Consumer knowledge gathering has been choosing up a whole lot of steam. No one likes types. Whether or not it’s advisors or prospects, they’re shifting in direction of digital data-gathering strategies. We assist Jotform.

PreciseFP is one other platform that we have now been utilizing in a number of methods. We’re additionally utilizing their sturdy advisor transition platform. Now we have grown our enterprise by recruitment. Many of the account development is available in by way of transitions. We would have liked one thing specialised. We constructed a streamlined advisor transition platform that can assist the complete course of. This contains once you begin speaking to a recruit about how we accumulate knowledge. We assist each protocol and non-protocol transfers. We are able to push the data to the custodial again places of work in a streamlined trend. For a rising agency like us, that was an enormous problem we needed to overcome.

AI Assistant: CogniCor

AI Assistant: CogniCor

Now we have realized many questions from our advisors may be answered extra effectively in actual time utilizing an AI-based software. We’re rolling out an AI-based software from CogniCor so the advisor can use and entry all of the obtainable data. It’s tough for advisors to take a look at 500 pages of coverage documentation. Advisors can ask extra particular questions. That could be very environment friendly.

Administration of Retirement and Held-Away Belongings: Pontera

We’re rolling out Pontera, a platform permitting advisors to handle 401(ok)s. It’s in a pilot part now and we might be rolling out to a extra intensive set of advisors quickly. It’s a wonderful alternative for advisors to have the ability to handle the complete ebook of enterprise for his or her shoppers. For traders who’re somewhat bit older, a whole lot of their belongings sit in 401(ok)s. That’s not an asset that has been monetized properly but. An advisor will not be touching that.

As informed to reporter Rob Burgess and edited for size and readability. The views and opinions are usually not consultant of the views of WealthManagement.com.

Need to inform us what’s in your wealthstack? Contact Rob Burgess at [email protected].

[ad_2]