[ad_1]

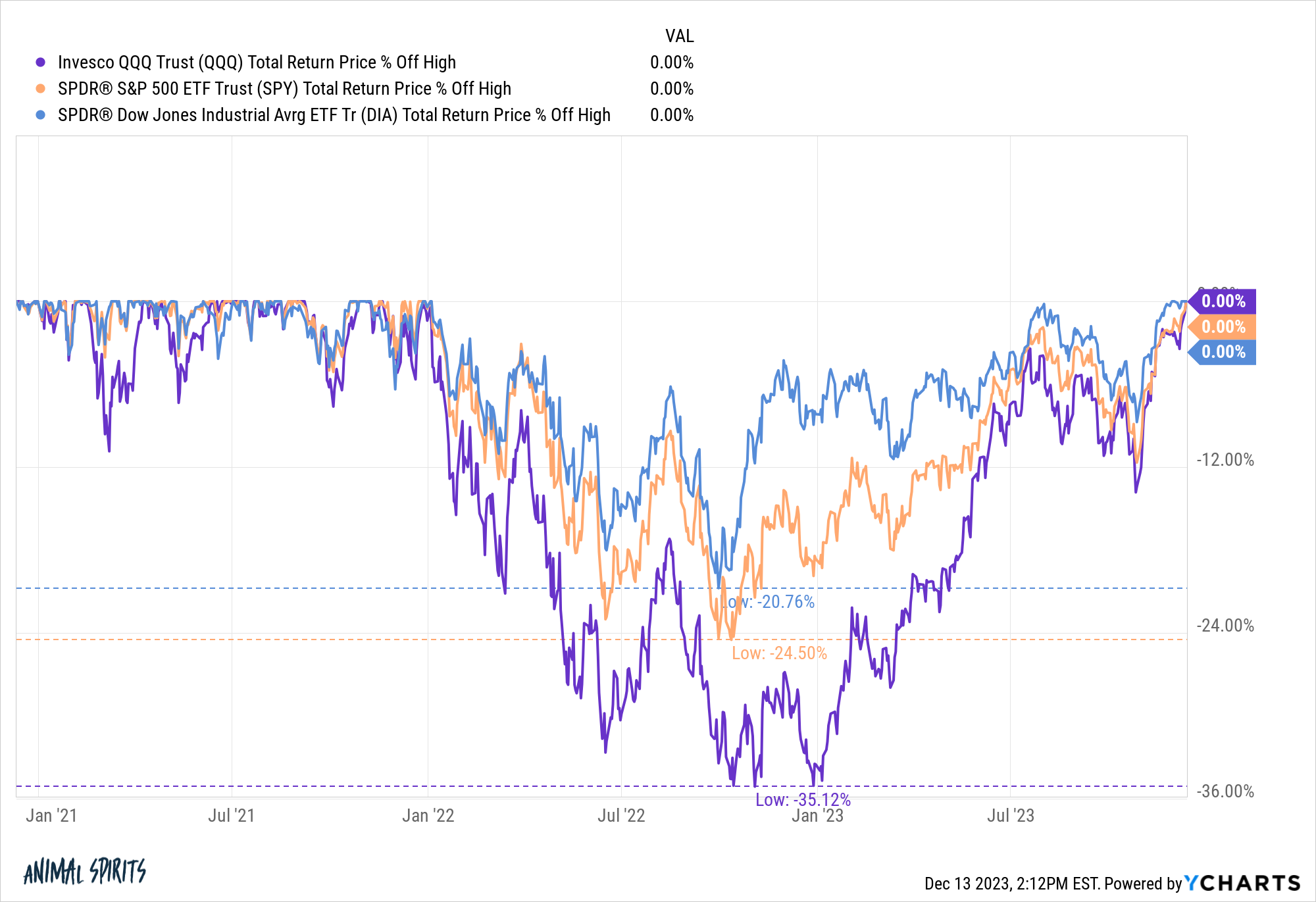

After struggling drawdowns of 21%, 25% and 35% within the bear market of 2022, the Dow, S&P 500 and Nasdaq 100 all broke even on a complete return foundation this week:

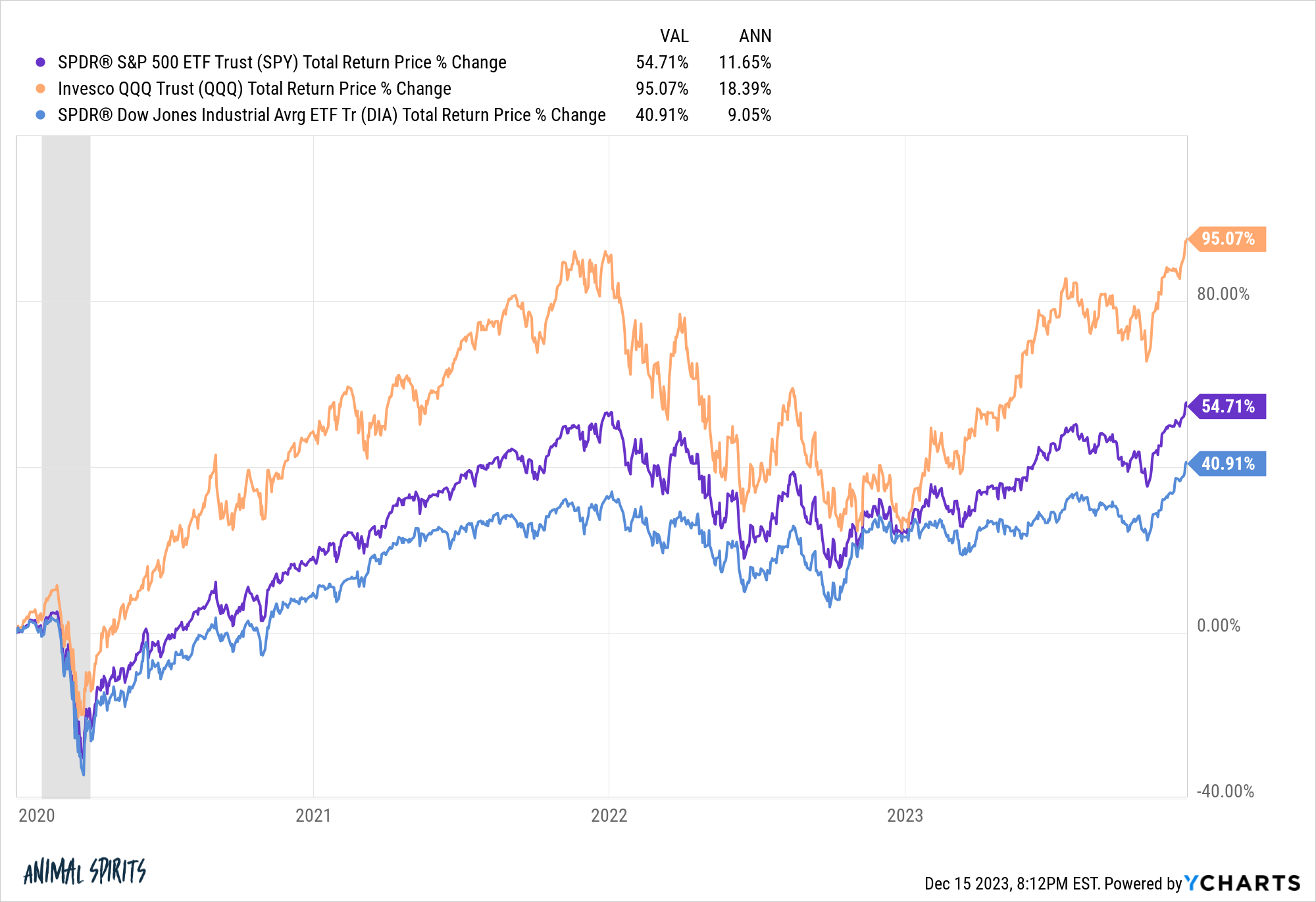

Positive which means these markets went nowhere for almost two years however simply take a look at the returns for the reason that begin of 2020:

Contemplating every thing we’ve lived by means of these returns usually are not dangerous in any respect.

One in every of my least favourite phrases in all of investing is the straightforward cash has been made.

Creating wealth within the monetary markets is by no means simple.

You’re pressured to take care of fixed uncertainty, volatility, concern, greed, and an infinite stream of noise.

It solely ever feels simple within the rearview mirror.

Simply take into consideration every thing buyers have needed to take care of these previous few years:

- The pandemic triggered us to show off the economic system for 1-2 months within the spring of 2020.

- The unemployment charge shot as much as 14%.

- We had no concept how lengthy the pandemic would final or once we would discover a vaccine.

- March 2020 was one of many worst months in inventory market historical past.

- Rates of interest fell to historic lows.

- Oil costs went unfavourable.

- We skilled the quickest bear market from all-time highs to down 30% ever.

- Then shares got here roaring again.

- There was a meme inventory/crypto bubble.

- Inflation got here again from the lifeless to achieve its highest degree in 40 years.

- We had a nasty bear market in 2022.

- The Fed took short-term charges from 0% to five% in a rush.

- The bond market noticed its worst crash in historical past.

- The 60/40 portfolio had certainly one of its worst years ever.

For the previous two years buyers have been inundated with predictions of a recession, a repeat of the Seventies, stagflation, a housing market crash and worse.

None of this stuff occurred.

It’s unbelievable how nicely issues have labored out these previous few years all issues thought of. There aren’t any counterfactuals however issues have turned out a lot worse.

Sure, the fiscal response from the federal government was immense however it wasn’t a foregone conclusion it will work. Definitely nobody predicted this financial end result forward of time.

This was an financial experiment not like something we’ve ever tried earlier than.

Inflation has not been enjoyable to take care of however issues may have been far worse contemplating Russia invaded Ukraine when costs have been already spiraling uncontrolled. Inflation may have been much more disagreeable than it has been if the worldwide provide chain hadn’t healed in a comparatively brief time frame.

The Fed may have damaged issues after they raised charges from 0% to five% so quick. The explanation so many economists and pundits have been predicting a recession in 2022 and 2023 is as a result of we’ve by no means introduced inflation down from such lofty heights with out an financial contraction.

If you happen to injected Jerome Powell with fact serum I’m guessing he would let you know there was no method a tender touchdown was doable 15-18 months in the past.

The truth that we’ve accomplished so so far is an financial miracle.

Perhaps we go right into a recession or one other bear market in 2024 or 2025 or each time. It’s certain to occur in some unspecified time in the future.

No matter how issues turned out, I want to give kudos to those that caught with their funding plan all through this ordeal.

If you happen to dutifully greenback price averaged in when shares have been falling give your self a pat on the again. You probably did the best factor.

If you happen to rebalanced your portfolio when shares fell, nice job.

If you happen to rode out the losses with out panic-selling on the backside, good work.

If you happen to ignored the individuals who have been screaming at you day-after-day about how a lot worse issues have been going to get, excellent efficiency.

If you happen to saved your asset allocation in place when individuals on the Web have been making an attempt to pitch you ridiculous funding choices, good on you.

If you happen to didn’t take a look at your 401k stability for the previous couple of years, you’re higher off for it in the long run.

If you happen to did nothing to your portfolio as a result of that’s what your plan known as for, I applaud you.

Look, the clock by no means runs out on the markets. The sport by no means ends. Bull markets flip into bear markets which flip into bull markets and spherical and spherical it goes.

All the things is cyclical.

There can be more durable occasions forward in some unspecified time in the future. There can be crashes that make the 2020 and 2022 bear markets look quaint by comparability.

However generally it’s good to sit down again and admire the way you dealt with sure elements of the cycle.

Staying the course is more durable than it sounds.

Additional Studying:

Everyone seems to be Irrational

[ad_2]