[ad_1]

The time may lastly be proper for small- to midsize-registered funding advisory companies to incorporate Salesforce—particularly Monetary Companies Cloud for Monetary Advisors—when they’re searching for a brand new CRM.

What may make FSC for Advisors extra compelling is the information out in the present day that Attune WealthData powered by BridgeFT is now out there on the Salesforce AppExchange.

Bear with me and take into consideration this, maybe such as you would consider one thing constructed with LEGO.

Attune WealthData is a Salesforce AppExchange utility. This implies it’s a turnkey product that plugs instantly into Salesforce CRM and works proper out of the field.

What does it do?

When it comes to the larger image, it implies that small-to-midsize advisors can now ponder the usage of Salesforce and get turnkey entry to multi-custodian information feeds proper out of the field with out having to go step-by-step working with a CRM supplier after which different account aggregation suppliers to do the identical factor.

The applying was a collaboration with BridgeFT, one other third-party expertise supplier whose specialties embody offering multi-custodial account aggregation of end-client information, which might now be pumped, utilizing Attune WealthData, instantly into Salesforce.

Advisors have been taken with utilizing Salesforce for the 17 years I’ve lined advisor expertise.

Early on, this included small and midsize advisory retailers for quite a lot of causes, starting from buzz and hype exterior the insular third-party advisor expertise ecosystem to the thriving third-party developer ecosystem round Salesforce, and since even again then, it was considered a platform that would develop and scale with an advisory store.

Sadly, Salesforce remained bored with that small-to-midsize phase and it even took just a few years for the mega-company to appreciate that giant advisory companies wanted and have been more and more demanding their very own model of Salesforce.

Which will have all modified.

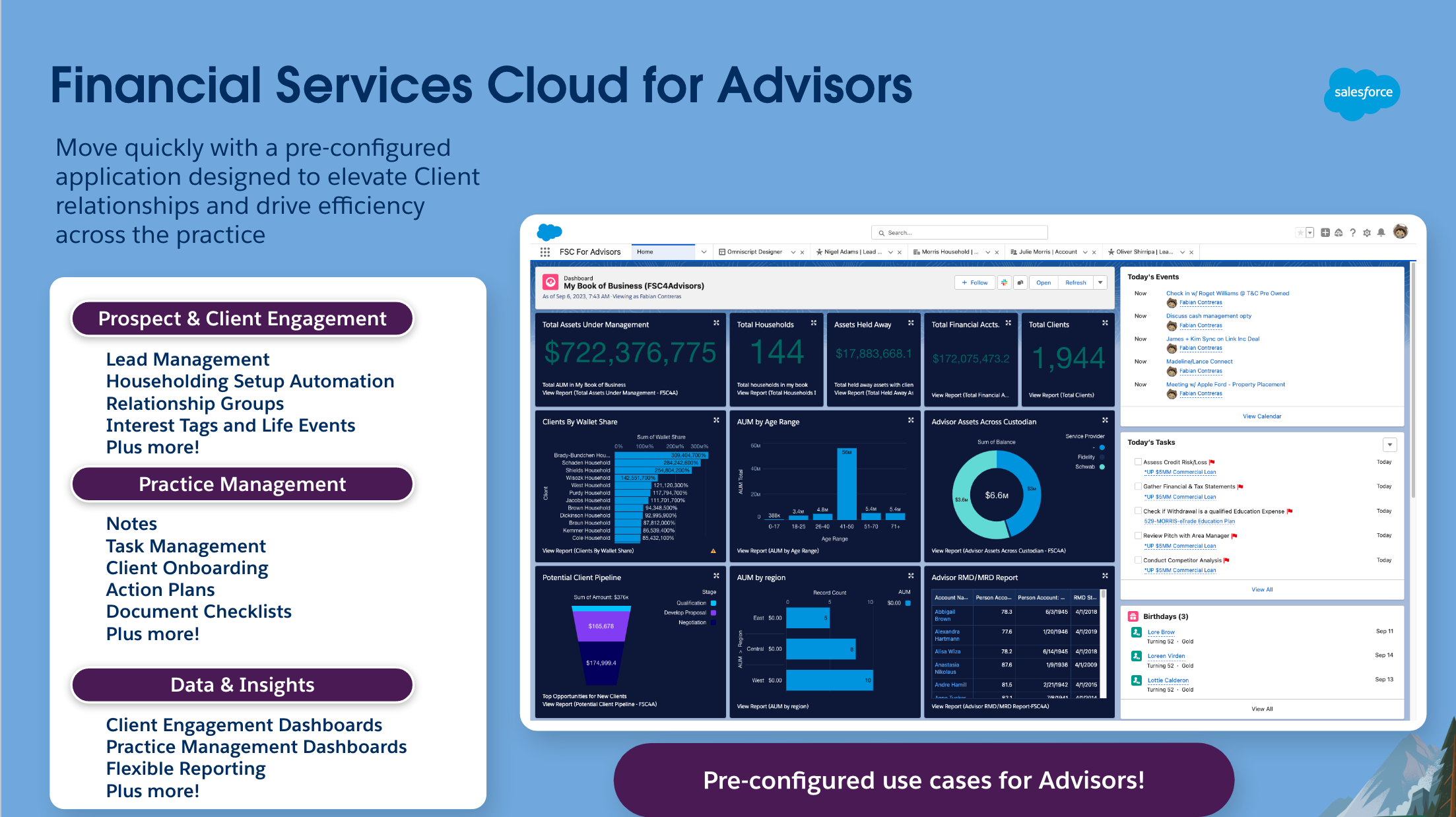

A screenshot of FSC for Advisors with monetary accounts powered by Attune.

Understand that in the present day’s information just isn’t primarily about FSC for Advisors; it’s a “new” product, in accordance with Drew Seelig, a senior director of World Wealth & Asset Administration Options & Technique at Salesforce, one that has been out there for some months (extra on what makes it totally different in a bit).

“We [Salesforce] are checked out as an enterprise resolution, [with Salesforce FSC for Advisors] we’re bringing the identical chassis that large retailers are utilizing,” Seelig stated.

He stated with FSC for Advisors, smaller companies have an deliberately extra restricted set of key capabilities turned on by default permitting the companies to “get instant worth.”

And together with Attune, there may be an ecosystem of over 280 monetary companies associate integrations out there on the Salesforce AppExchange.

Requested how the newer FSC for Advisors program differs from conventional third-party Salesforce overlay firms, together with XLR8 or AppCrown, which presupposed to do the identical factor, his response was easy.

“There’s a level the place these turnkey options are too restricted and so they [advisors] have to [further] customise,” stated Seelig.

Chris Sommers, a serial entrepreneur, and early worker at Salesforce (he joined the corporate in 2003 and stayed for six years), is the founding father of Attune Options and stated he sympathized with advisors at smaller retailers.

He had been with Salesforce for its 10,000-user rollout for Merrill Lynch previous to the 2008 monetary disaster and stated he understood the gulf that exists between companies of that dimension and the wants of companies within the small-to-midsize impartial phase.

“When Salesforce got here to me to ask me to construct what turned of Attune I used to be serious about going to all of the custodians myself and noticed what a Herculean activity it was going to be and was later launched to BridgeFT,” Sommers stated.

“What this [Attune and Salesforce FSC] is doing is paring it down,” simply to what options and part items a smaller agency wants, he stated.

BridgeFT CEO Joe Stensland stated that price, for these advisors, was additionally high of thoughts.

“One of many large questions for us was how do they/we be sure that for a really low price that the custodial information feeds are baked into it?” he stated.

“And we didn’t begin to create a Salesforce app, Salesforce went to Chris to construct one,” Stensland was fast to level out.

He added the present collaboration is step one and stated BridgeFT and Attune deliberate to roll out different options, together with absolutely built-in family and account-level efficiency calculations, in addition to observe administration analytics throughout a number of custodians. Additionally on the roadmap are shopper reporting and price billing functions embedded instantly into an advisory agency’s FSC Advisor iteration.

Whereas the pricing for Attune WealthData powered by BridgeFT is printed on the AppExchange web site as $30 monthly per person, there is no such thing as a related transparency for Salesforce FSC for Monetary Advisors.

The corporate declined to offer particular pricing, however Salesforce hinted that restricted-use licenses for small-to-midsize companies would are available at considerably lower than the $300 to $500 per person monthly that bigger advisory companies pay.

“Within the quickly evolving monetary panorama, our FSC for Advisors program stands out by providing a competitively priced resolution that harnesses the ability of Salesforce expertise, particularly tailor-made for the RIA market,” the corporate launched in a press release.

[ad_2]