[ad_1]

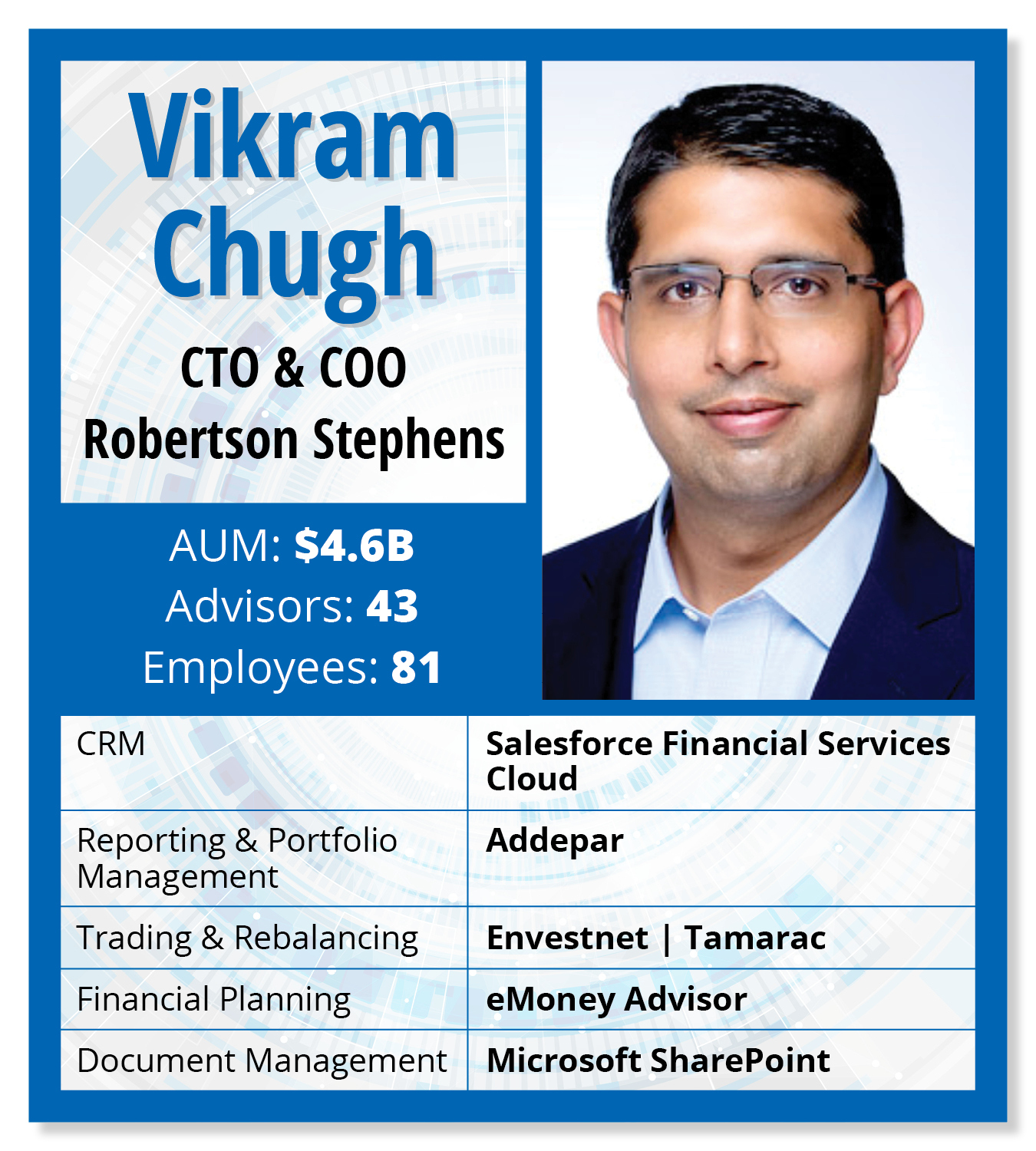

We’ve constructed an end-to-end expertise stack from scratch, one piece at a time. We began as a really small RIA with two advisor groups in a single workplace location. Since then, we’ve grown to twenty advisor groups in 18 places.

You possibly can construct an built-in system leveraging these particular person elements with fashionable software program. That provides you a lot flexibility in the event you personal the mixing throughout these totally different techniques. If a more recent system comes alongside, you may substitute that whereas maintaining the remainder of the tech stack the identical.

We’ve invested quite a bit in constructing integrations. We do integrations the place it makes probably the most sense. We’ve given thought to the advisor’s workflow. We’ve put the advisor within the middle of our whole tech stack. We thought of their interactions throughout the board as we constructed out.

We’ve invested quite a bit in constructing integrations. We do integrations the place it makes probably the most sense. We’ve given thought to the advisor’s workflow. We’ve put the advisor within the middle of our whole tech stack. We thought of their interactions throughout the board as we constructed out.

CRM/Advertising and marketing/Workflows: Salesforce Monetary Companies Cloud

For CRM, we’ve all the time had Salesforce. We went into it understanding it could take us a while to get probably the most out of that system. We’re getting there now.

We’re specializing in investing in it and constructing out our workflows and integrations with third-party techniques. We be ok with how we’ve constructed varied integrations into our CRM system. Advisors ought to spend most of their time in CRM.

We spent loads of time constructing out our advertising functionality in Salesforce. We are able to observe any interactions we’ve had with prospects and purchasers and any electronic mail communications. We’ve built-in Salesforce into Zoom, our conferences and telephone system.

Anytime we name a shopper or a potential shopper via our Zoom system, it captures the decision in Salesforce. We are able to go in there and replace our notes from the dialog. We’re constructing out a complete ecosystem.

We rating on any interplay we’ve had with a shopper. We observe in the event that they open a selected hyperlink in an electronic mail and the way a lot time they spend on an article. We are attempting to seize combination engagement scores throughout these prospects and purchasers, which helps us change into extra considerate about tips on how to market to them.

We’ve additionally been utilizing Salesforce as a workflow system. Any time there may be an advisor request for our operations, wealth planning or investments groups, all of it originates via Salesforce. Anytime an advisor desires to arrange a brand new shopper account, these actions are captured inside Salesforce. We’re constructing out newer workflows each day based mostly on our necessities.

Portfolio Administration/Reporting: Addepar

Now we have additionally all the time had Addepar. Its techniques are constructed with a strong information structure. It helps us seize information from the custodians that we use, in addition to held-away property. It helps us seize data on different investments and merchandise we need to report on in our shopper’s portfolio.

We spent a lot time constructing our information reporting and evaluation capabilities, particularly for high-net-worth and ultra-high-net-worth purchasers.

Monetary Planning: eMoney

We pull the Addepar information into the eMoney platform. It’s constructed as a wealth planning software. Past the custodian information you’re pulling from Addepar into eMoney, it’s also possible to seize data throughout the board on a shopper, together with their insurance coverage and trusts and property planning. We additionally just like the money circulation modeling capabilities inside eMoney and use that quite a bit with our purchasers.

We pull the Addepar information into the eMoney platform. It’s constructed as a wealth planning software. Past the custodian information you’re pulling from Addepar into eMoney, it’s also possible to seize data throughout the board on a shopper, together with their insurance coverage and trusts and property planning. We additionally just like the money circulation modeling capabilities inside eMoney and use that quite a bit with our purchasers.

Buying and selling/Rebalancing: Envestnet | Tamarac

We used Blaze Portfolio initially, however we switched to Envestnet | Tamarac. It was extra concerning the diploma of freedom round managing portfolios. Most new purchasers come to us with present portfolios.

If you happen to take anyone’s present portfolio and attempt to map it to a brand new asset allocation or asset class schema, you need to map their holdings versus your suggestions. To have the ability to try this successfully and think about any friction associated to the transition, tax prices, buying and selling prices or anything that comes with the transition, you want a system with a number of levels of freedom.

You should have the power to seize quite a few variables and be capable of do it in the simplest manner for the shopper. The system offers us the power to handle the shopper’s journey. That’s why we made that transition.

As advised to reporter Rob Burgess and edited for size and readability. The views and opinions should not consultant of the views of WealthManagement.com.

Need to inform us what’s in your wealthstack? Contact Rob Burgess at [email protected].

[ad_2]