[ad_1]

By Whitney Mapes, Elwyn Panggabean, Angela Ang, and Agnes Salyanty

Over the previous 12 months and a half, Ladies’s World Banking has collaborated with Financial institution Negara Indonesia (BNI), one of many Indonesia’s largest state-owned banks concerned in distributing advantages of the PKH (Program Keluarga Harapan or Household Hope Program), a conditional money switch program for low-income households, to develop an account activation resolution for PKH beneficiaries. This mission, carried out with assist from the Ministry of Social Affairs (MoSA) of Indonesia, goals to construct the aptitude of ladies PKH recipients to actively use their BNI accounts to develop their financial savings.

Collectively, we developed a holistic resolution that helps PKH beneficiaries achieve the data, capabilities, and sensible abilities wanted to save cash inside their BNI account and equips them with obligatory monetary instruments to efficiently construct their financial savings habits.

From January to March 2021, in partnership with BNI, we carried out a pilot of the answer throughout 5 villages in Bogor, West Java to guage how properly it helps beneficiaries construct their financial savings capability. The pilot launched the answer to five PKH facilitators and 25 peer group leaders via coaching periods, who then shared it with over 1,200 PKH beneficiaries; amongst these, one-third of the beneficiaries obtained the complete resolution supplies, whereas the remaining obtained extra restricted supplies as a consequence of logistical constraints throughout Covid-19.

Resolution impression on financial savings data and habits

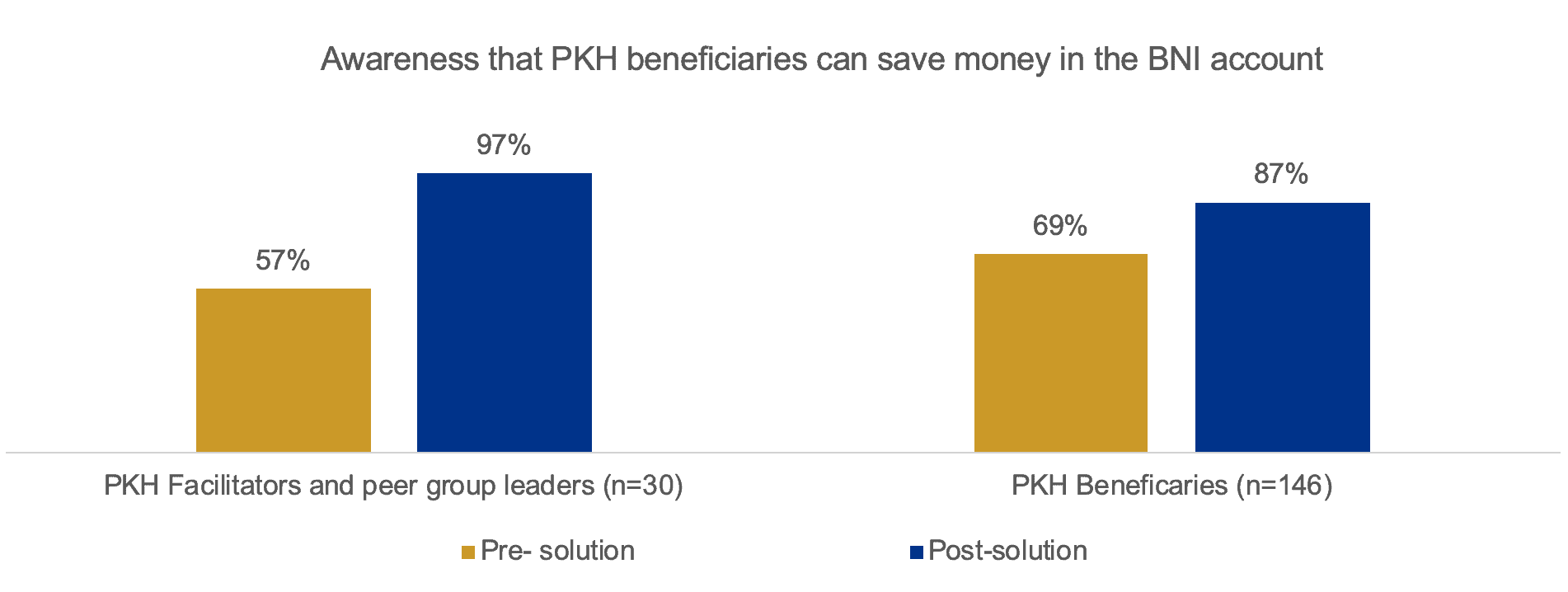

Regardless of challenges introduced by the pandemic, the answer led to a major data shift amongst all pilot members concerning their BNI account and its advantages (Determine 1).

A quantitative survey revealed that PKH Facilitators and Group Leaders, who’re appointed as program ambassadors, elevated dramatically (by 40 proportion factors following the coaching) their data of the power to make use of the account to save cash.

As well as, there was additionally a modest enhance in beneficiaries’ understanding of how one can use their BNI account for monetary transactions past financial savings, equivalent to remittances, cellphone top-ups, and invoice funds. Consequently, practically all PKH Beneficiaries (90%) expressed curiosity in utilizing their BNI account to save lots of, switch and pay for his or her payments sooner or later.

These outcomes counsel that the answer supplies and coaching successfully enhance the account data of PKH Beneficiaries and program ambassador. That is notably essential as a consequence of journey restrictions and social distancing measures carried out as a consequence of Covid-19, so we count on a rise in digital transactions as soon as beneficiaries grow to be more and more accustomed to the account and how one can use it.

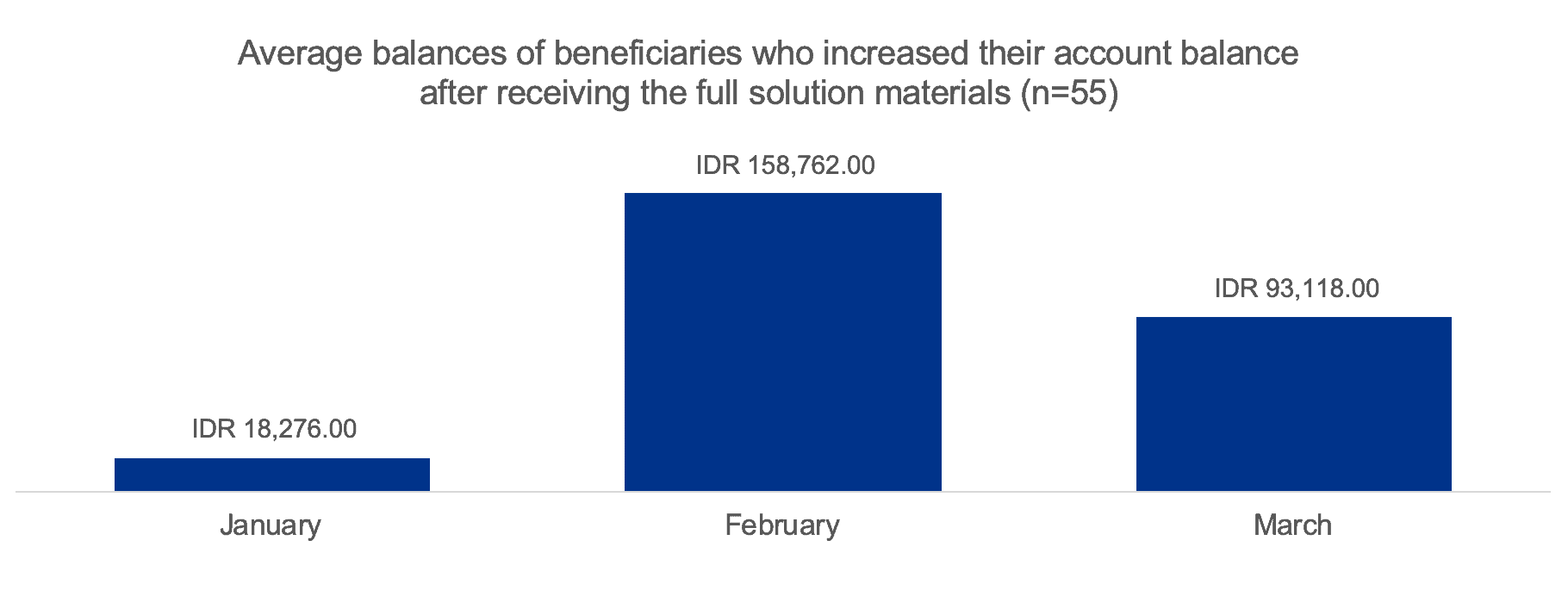

Throughout the pilot, beneficiaries have additionally made progress on beginning to save and conduct different monetary transactions (e.g., sending and obtain cash, invoice funds, cellphone top-up). In two months, the variety of beneficiaries who carried out at the very least one transaction tripled in comparison with their earlier account exercise, not together with any transactions associated to cashing out their PKH cost and system generated transactions. Equally, the variety of transactions carried out by beneficiaries additionally tripled. This new habits continues to pattern upward and even elevated in March when beneficiaries didn’t obtain their PKH cost.

By the top of the pilot interval, the variety of beneficiaries who had financial savings of their account elevated from 19 to 55. We discovered that 6% of beneficiaries elevated the financial savings steadiness of their account by at the very least 10%, when the PKH disbursement was excluded. We additionally noticed a major enhance of beneficiaries’ common financial savings steadiness from IDR18,276 ($1.26) to IDR93,118 ($6.41), unique of the PKH cost.

This means that the answer helps positively change the habits of PKH beneficiaries to determine financial savings and broader account utilization. Considerably, even amongst this group of low-income ladies, there’s a recognition and want to begin and construct capability to save lots of.

Key takeaways

Whereas the answer efficiently improved account data and a change in financial savings behaviors, the pilot surfaced key classes that may assist us to enhance and replicate the financial savings account activation resolution and enhance its long-term impression. This contains the next:

Lesson #1: In-person coaching is simpler for pilot members

PKH beneficiaries face varied challenges when collaborating in and comprehending distant coaching as a consequence of restricted digital literacy, and environmental challenges that impression their means to focus. To treatment these points, we held a follow-up in-person, one-on-one coaching. Although this required extra time and cautious navigation as a consequence of restrictions on in-person gatherings, these 1:1 coaching periods have been simpler in speaking the answer and guaranteeing program ambassadors may cross the data on to PKH beneficiaries.

Lesson #2: Beneficiaries save extra when their peer group chief acts as a financial savings position mannequin

As in comparison with PKH facilitators, peer group leaders proved to be the simpler program ambassador. We additionally realized that peer group leaders’ personal financial savings exercise strongly influenced the financial savings behaviors of PKH beneficiaries, since ladies usually tend to begin saving after they see their group chief additionally use her BNI account to save cash.

Lesson #3: Beneficiaries’ literacy limits resolution efficacy

The supplies supplied to clarify the answer are simplest when distributed in full. Nonetheless, the written resolution supplies are usually not efficient for PKH beneficiaries who couldn’t learn or use these supplies on their very own, require extra intensive steerage and assist from their peer group leaders.

Lesson #4: Program incentives ought to give fast rewards to steadiness long-term financial savings advantages

Whereas PKH beneficiaries are motivated by money rewards tied to the financial savings program, they discovered the necessities of the inducement construction sophisticated and disliked needing to attend till the top of the pilot to obtain rewards. They’re extra occupied with an easier incentive scheme and money rewards they’ll make the most of instantly that serve to additional inspire extra financial savings deposits.

Subsequent steps and implications for the financial savings activation resolution

As a subsequent step, BNI plans to make use of the pilot outcomes and classes to rollout an adjusted resolution to extra PKH beneficiaries. Profitable resolution implementation may have constructive impacts for each beneficiaries and the BNI enterprise. The fast profit for beneficiaries is guaranteeing a method by which to construct their financial savings, effectuate a brand new habits and belief in digital companies, and strengthen monetary resilience. In the long term, we additionally estimate that this resolution will empower and improve the prosperity of PKH beneficiaries by enabling them to entry different monetary services and products. For the Financial institution, it additionally guarantees to generate larger income by rising buyer loyalty, common account balances, transactions past cashing out their advantages, and corresponding will increase in brokers’ transactions and commissions.

Lastly, this collaboration has essential implications for policy-makers on the efficient future design of presidency assist and subsidy packages. It’s not enough to provide beneficiaries an account; it’s equally essential to supply them with important data and techniques that construct their capabilities and confidence to make use of monetary instruments made obtainable and derive most advantages. Importantly, this resolution is replicable for different FSPs who distribute the PKH or different related G2P packages.

Ladies’s World Banking’s work with BNI is supported by the Australian Authorities via the Division of Overseas Affairs and Commerce and the Caterpillar Basis.

[ad_2]