[ad_1]

This previous week, I obtained three questions on retirement, all of which concern long-term planning at totally different levels of life.

A reader asks:

Chatting with the chums, all of us gave the impression to be comparatively shut to 1 one other when it comes to money readily available, investments available in the market and present incomes. I’d like to get your perspective as knowledgeable to know if we’re behind, on par or forward of the curve for a 28 yr outdated. My father can be in wealth administration, nonetheless nearly all of his purchasers are a lot older and have a lot totally different monetary targets than a 28 yr outdated, so an perception can be a lot appreciated.

Averages under:

-

- Money in checking acct: ~$8,000

- Investments available in the market: ~$35,000

- 401k: ~$60,000

- Annual wage: $135,000

Would like to get your ideas!

One other reader asks:

What sort of 401k return ought to a 35-40-year-old man be proud of, assuming he was extra diversified and, subsequently, didn’t match the returns of the S&P 500? I used to be at 10.9%, which is near the Vanguard Whole World Index (since 2015).

And one other reader asks:

As a long run investor, how do you determine to take income in case you are mid-40’s and investing for retirement? I wrestle with this as a result of I do know I’ll in all probability by no means get the costs I obtained up to now if I promote, however fearful of the roundtrip as effectively.

The essential abstract of those questions appears to be like like this:

- How are my funds doing?

- How is my portfolio doing?

- How do I protect my wealth?

Let’s undergo them one after the other:

How are my funds doing?

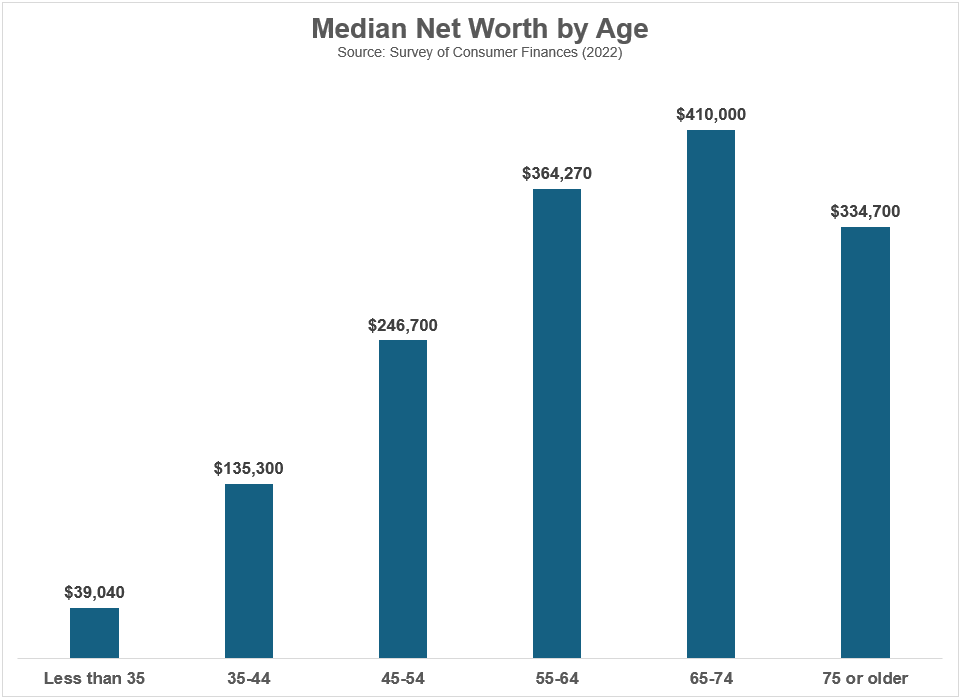

The Federal Reserve breaks out the info for median internet value by age teams:

You fall within the underneath 35 crowd so it appears to be like such as you’re doing higher than most.

My colleague Nick Maggiulli constructed a useful calculator on his web site that lets you drill down even additional. You’ll be able to enter your age and internet value to see the place you rank along with your particular peer group:

This particular person ranks within the high quartile of 28-year-olds.1

Peer rankings may also help you perceive your house on the earth however I’m at all times extra involved about the way you’re doing relative to your previous self. Crucial side of retirement planning once you’re younger is slowly however absolutely making enhancements:

- Are you making more cash over time?

- Are you saving extra of that cash over time?

- Are you growing your financial savings charge over time?

- Are you bettering your private funds over time?

Regardless of your age, there’ll at all times be individuals richer and poorer than you. Your internet value issues much less at age 28 than the habits you’re creating.

You’re on the precise path so long as you’ve got a double-digit financial savings charge and increase your earnings by benefiting from your profession.

How is my portfolio doing?

Portfolio efficiency will be difficult in the event you don’t know the right way to benchmark it appropriately.

It actually relies on what you put money into. Are you invested in index funds or actively managed funds? Are you in all shares or do you’ve got a extra diversified portfolio?

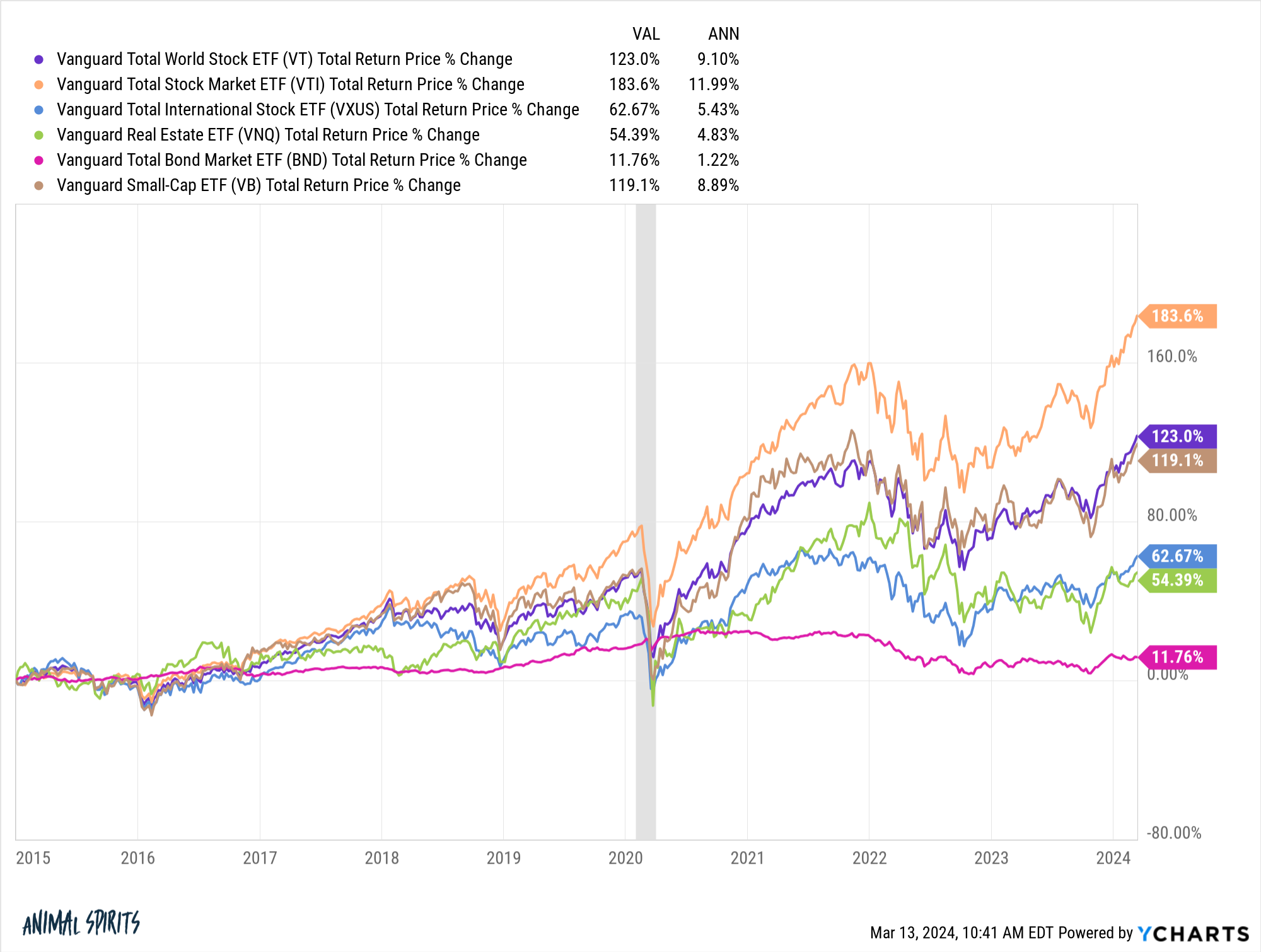

Simply have a look at the annual returns for varied asset courses and areas since 2015:

Should you maintain a diversified portfolio however evaluate it to a complete U.S. inventory market index or the S&P 500, you can be dissatisfied.

Nonetheless, the U.S. inventory market is just not the precise benchmark for a diversified portfolio. You’ll be able to evaluate your U.S. massive cap funds or holdings to the overall U.S. inventory market however all the things else needs to be benchmarked in opposition to index funds with related exposures.

Should you maintain a 60/40 portfolio, the S&P 500 is just not your benchmark. Should you maintain a globally diversified portfolio, the S&P 500 is just not your benchmark.

One of many causes I really like investing in index funds is as a result of they’re actually the benchmark. Should you maintain a complete U.S, whole worldwide and whole bond market index fund, these are your benchmarks.

Should you personal a globally diversified portfolio of all shares a complete world index fund is an efficient benchmark.

You simply need to be sure you’re evaluating apples to apples when benchmarking.

How do I protect my wealth?

Investing in center age will be difficult since you’re straddling two camps. I wrote about this a number of weeks in the past:

It’s best to personal some monetary property at this stage of life so it’s good to see costs rise.

However you also needs to be getting into your prime incomes years so bear markets needs to be welcomed.

One of many hardest components about truly constructing wealth is the losses are likely to sting extra as a result of there’s more cash at stake.

A ten% loss on a $100,000 portfolio means you’re down $10,000. Should you lose 10% on a $1,000,000 portfolio, that’s a lack of $100,000. This looks like an apparent level however greenback indicators matter much more than percentages as your nest egg grows.

I perceive this concept of locking in income. Contemplating the market surroundings we’ve lived by means of, in the event you’ve been saving and investing for 15-25 years, you ought to be sitting on some wholesome features.

Let’s say you promote some shares to loosen up a bit — then what?

Are you timing the market or altering your asset allocation? There’s an enormous distinction.

Decreasing your fairness threat as you age could make sense, however you have to be express when making this sort of transfer. Don’t simply promote shares since you really feel like it’s best to. Have a plan of assault.

Some individuals make sweeping allocation modifications, say, instantly going from 100% in shares to a 90/10 or 80/20 portfolio. Others favor extra of a glide path the place you slowly however absolutely diversify your portfolio as you age. That might imply promoting 1-2% of your shares every year till you hit your new allocation goal.

Or you can construct up a brand new allocation with future contributions. Some individuals prefer to over-rebalance when the inventory market is up rather a lot. Others favor a scientific rebalancing course of that’s carried out mechanically at prespecified instances.

There actually are not any proper or flawed solutions since nobody is aware of the long run.

The largest factor is making a plan after which sticking with it.

You don’t wish to let excessive (or low) inventory costs flip you into an novice market timer.

We spoke about all of those questions on the most recent version of Ask the Compound:

My colleague and RWM monetary advisor, Ben Coulthard, joined me on the present to debate these questions and extra.

Additional Studying:

The Evolution of Retirement

1The query didn’t listing any money owed so I’m simply utilizing property right here to calculate internet value.

[ad_2]