[ad_1]

You might have contributed to a Roth IRA after which realized later within the yr that you’d exceed the earnings restrict. You recharacterized the Roth IRA contribution as a Conventional IRA contribution and transformed it to Roth once more earlier than the tip of the yr. Your IRA custodian despatched you two 1099-R types, one for the recharacterization and one for the conversion. This submit reveals you methods to put them into the H&R Block tax software program.

Should you had carried out the recharacterizing and changing within the following yr, you would need to break up the tax reporting into two years by following Break up-Yr Backdoor Roth IRA in H&R Block, 1st Yr and Break up-Yr Backdoor Roth IRA in H&R Block, 2nd Yr. Now since you caught the issue quickly sufficient earlier than the tip of the yr, you possibly can deal with all of it in the identical yr by following this information.

Right here’s the instance situation we’ll use on this information:

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your earnings can be too excessive later in 2023. You recharacterized the Roth contribution for 2023 as a Conventional contribution. The IRA custodian moved $6,600 out of your Roth IRA to your Conventional IRA as a result of your authentic $6,500 contribution had some earnings. The worth elevated once more to $6,700 while you transformed it to Roth earlier than December 31, 2023. You obtained two 1099-R types, one for $6,600 and one other for $6,700.

Should you didn’t do any of those recharacterizing and changing, please observe our information for a “clear” backdoor Roth in The best way to Report Backdoor Roth in H&R Block Tax Software program.

Should you’re married and each you and your partner did the identical factor, you need to observe the steps beneath as soon as for your self and as soon as once more in your partner.

Use H&R Block Obtain Software program

The screenshots beneath are taken from H&R Block Deluxe downloaded software program. The downloaded software program is each cheaper and extra highly effective than H&R Block’s on-line software program. Should you haven’t paid in your H&R Block On-line submitting but, contemplate shopping for H&R Block obtain software program from Amazon, Walmart, Newegg, and lots of different locations. Should you’re already too far in getting into your knowledge into H&R Block On-line, make this your final yr of utilizing H&R Block On-line. Swap over to H&R Block obtain software program subsequent yr.

1099-R for Recharacterization

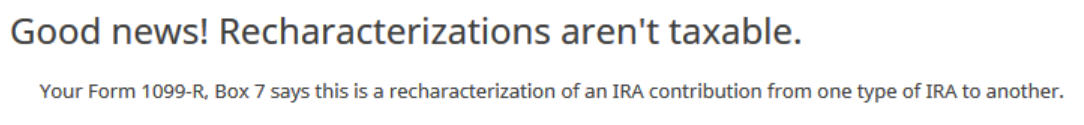

We deal with the 1099-R type for the recharacterization first. This 1099-R type has a code “N” in Field 7.

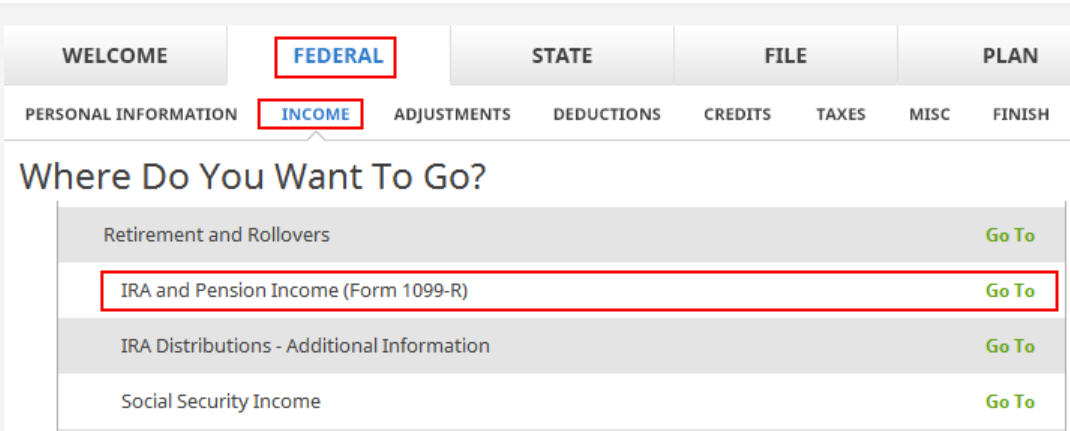

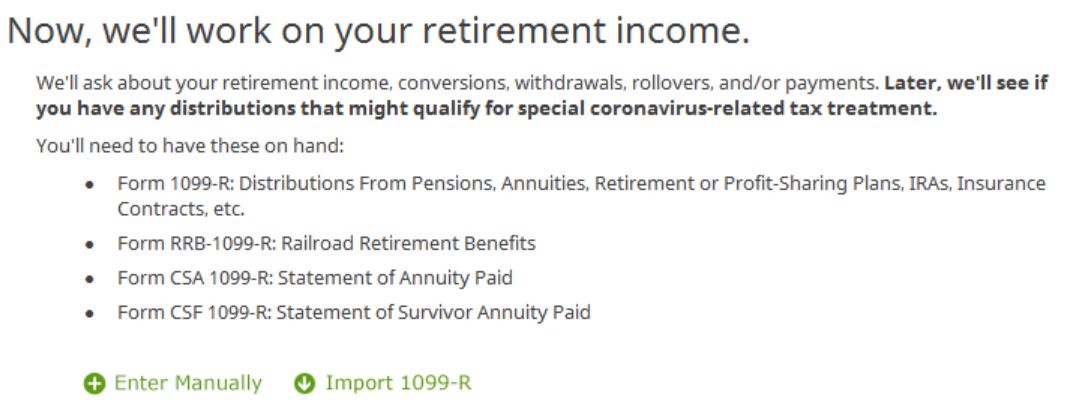

Click on on Federal -> Earnings. Scroll down and discover IRA and Pension Earnings (Kind 1099-R). Click on on “Go To.”

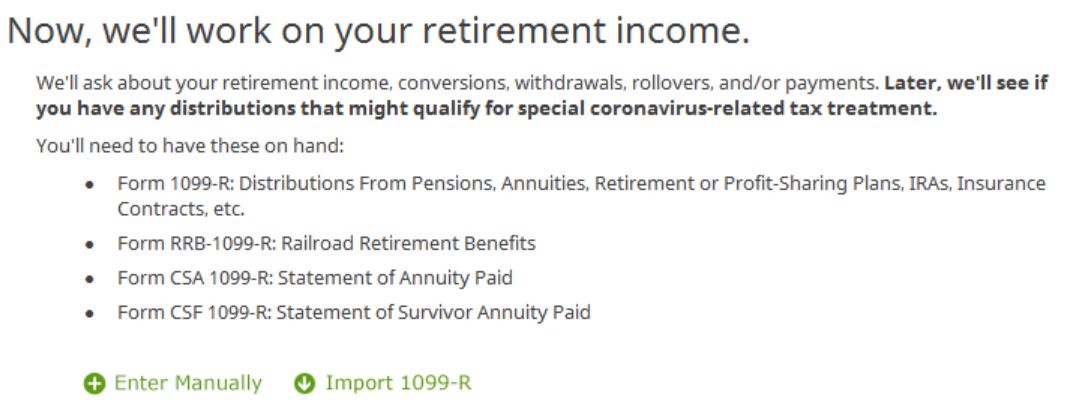

Click on on Import 1099-R when you’d like. I present handbook entries with “Enter Manually” right here.

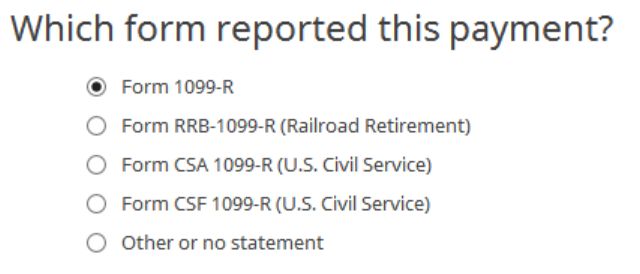

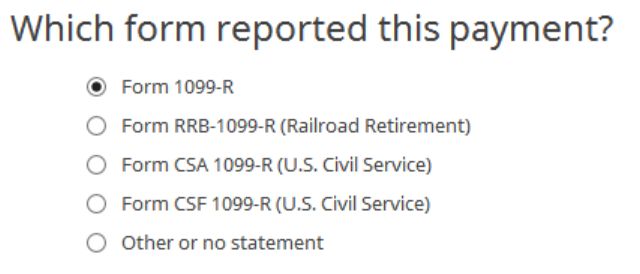

Only a common 1099-R.

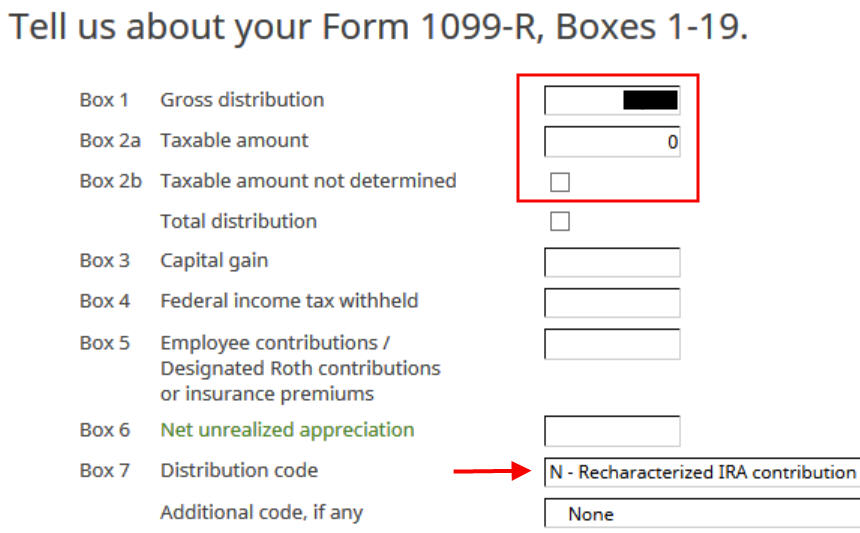

The 1099-R type for the recharacterization reveals the quantity moved from the Roth IRA to the Conventional IRA in Field 1. The taxable quantity is 0 in Field 2a and the “Taxable quantity not decided” field isn’t checked. The code in Field 7 is “N.”

The “IRA/SEP/SIMPLE” field could or is probably not checked in your type. It isn’t checked in our type.

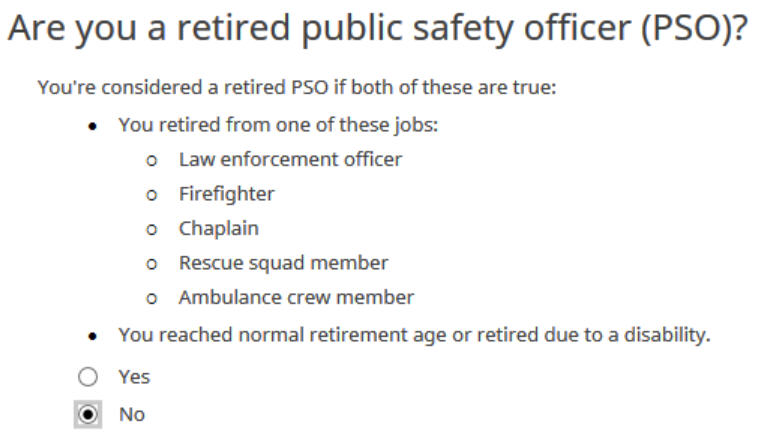

Not a retired public security officer.

We like to listen to that.

You’re carried out with the primary 1099-R type. Click on on “Enter Manually” so as to add the second when you don’t have already got each 1099-R types imported.

1099-R for Conversion

The 1099-R for the Roth conversion has both a code “2” or code “7” in Field 7.

The second 1099-R type can also be a daily 1099-R.

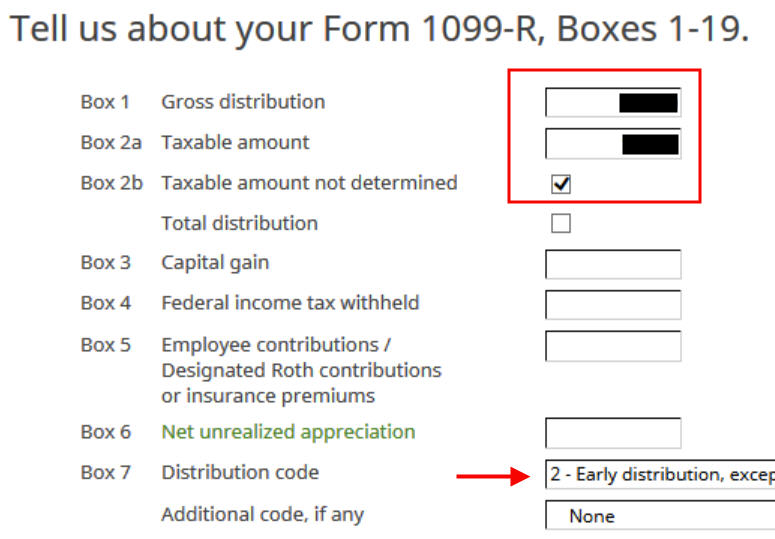

It’s regular to see the conversion reported in Field 2a because the taxable quantity when Field 2b is checked to say “Taxable quantity not decided.” The code in Field 7 is “2″ while you’re beneath 59-1/2 or “7” while you’re over 59-1/2.

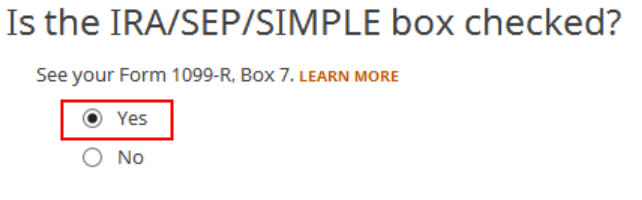

The “IRA/SEP/SIMPLE” field is checked on this 1099-R type for the Roth conversion.

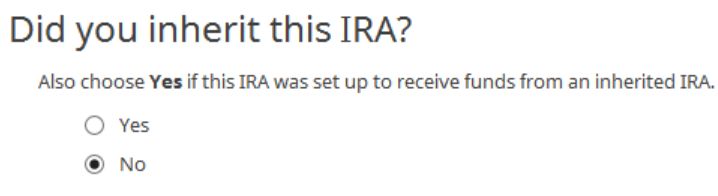

Didn’t inherit it.

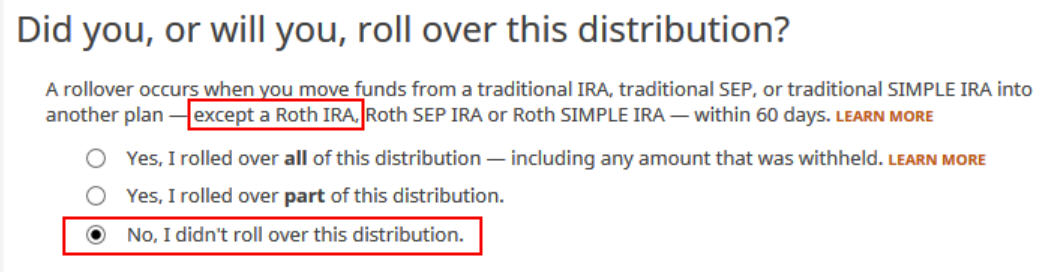

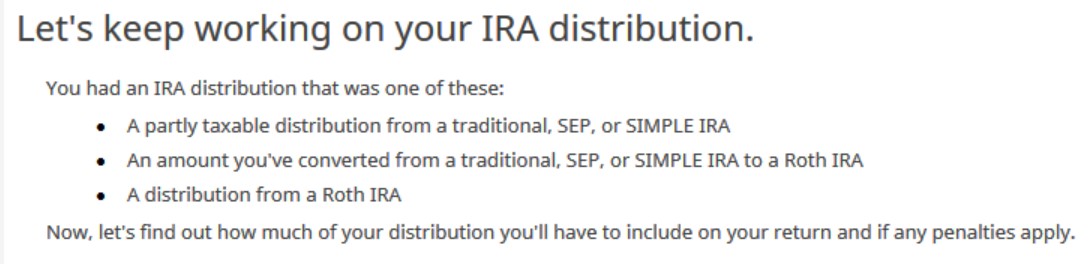

Transformed, Did Not Roll Over

This is a vital query. Learn rigorously. Reply No, since you transformed, not rolled over.

Now reply Sure, you transformed.

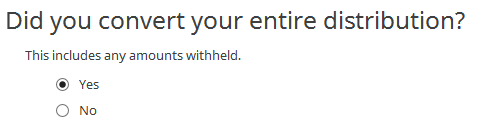

We transformed all of it.

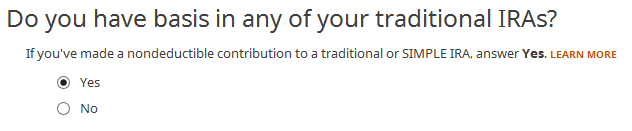

It’s safer to reply “Sure” right here as a result of you possibly can all the time say your foundation was zero when the software program asks you what it was.

The refund meter drops so much at this level. Don’t panic. It’s regular and solely short-term. It should come again up after we proceed.

You might be carried out with one 1099-R. Repeat the above in case you have one other 1099-R. Should you’re married and each of you transformed to Roth, take note of whose 1099-R it’s while you enter the second. You’ll have issues when you assign each 1099-R’s to the identical particular person after they belong to every partner. Click on on “Completed” when you’re carried out with all of the 1099-Rs.

H&R Block has just a few extra questions.

The wording is complicated right here however you need to reply “Sure.” You recharacterized a Roth IRA contribution as a Conventional IRA contribution. It counts.

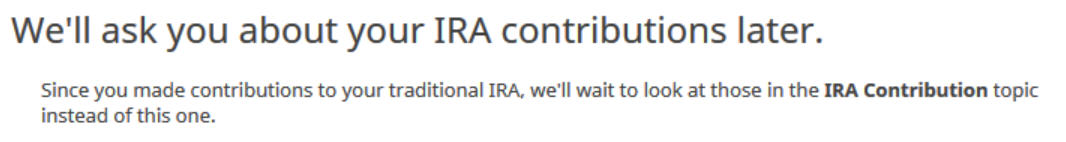

H&R Block will wait till you additionally enter your 2023 contribution. Your refund meter continues to be depressed however don’t fear.

Roth IRA Contribution Recharacterized to Conventional

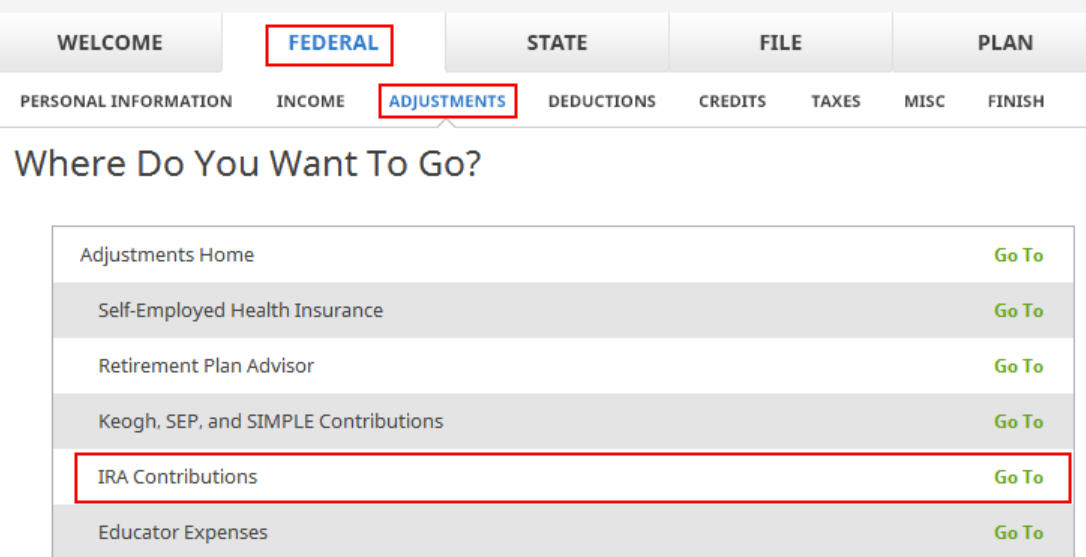

Click on on Federal -> Changes. Discover IRA Contributions. Click on on “Go To.”

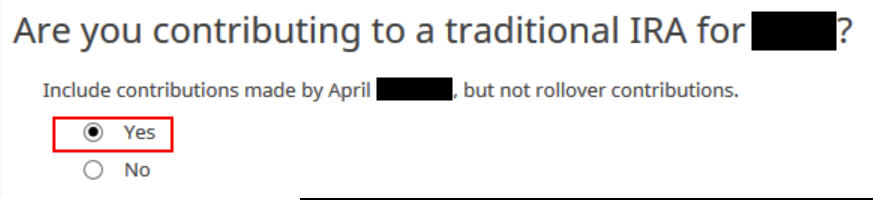

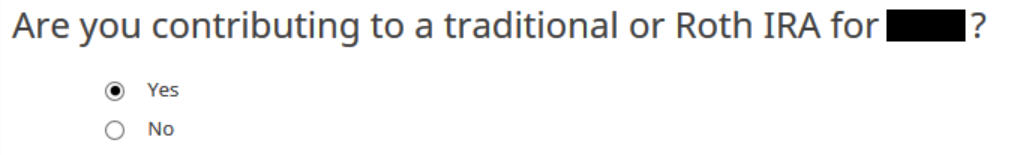

Reply “Sure” since you contributed to an IRA for the yr in query.

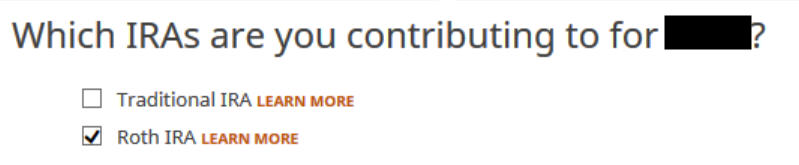

Verify the field for Roth IRA since you initially contributed to a Roth IRA earlier than you recharacterized your contribution.

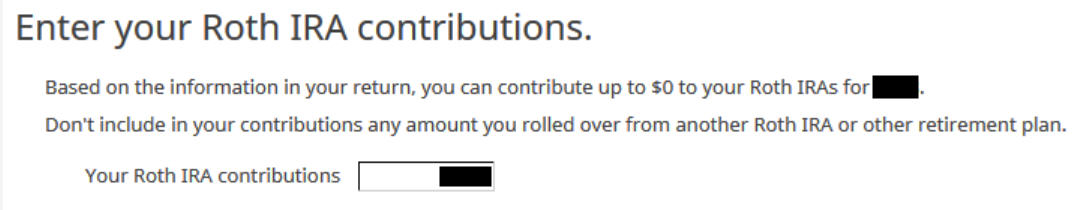

Enter your authentic contribution quantity. It’s $6,500 in our instance.

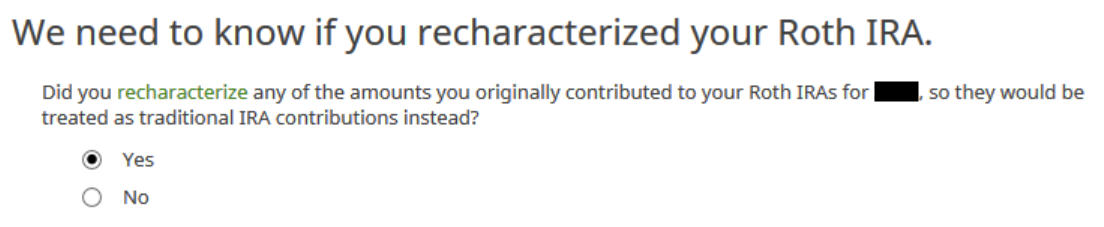

Reply Sure since you recharacterized the contribution.

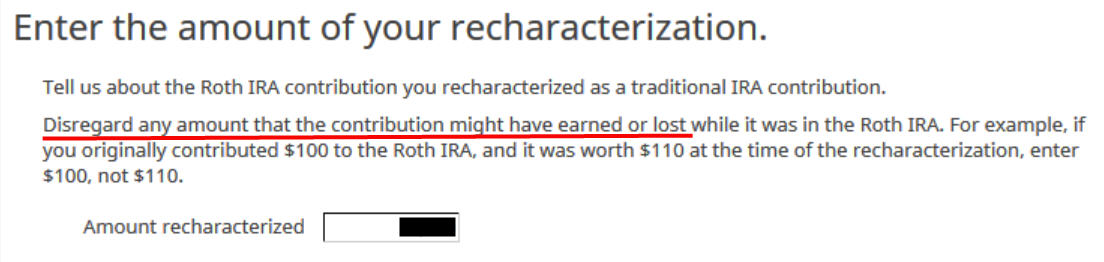

The quantity right here is relative to the unique contribution quantity. Should you recharacterized the entire thing, enter $6,500 in our instance, not $6,600 which was the quantity with earnings that the IRA custodian moved into the Conventional IRA.

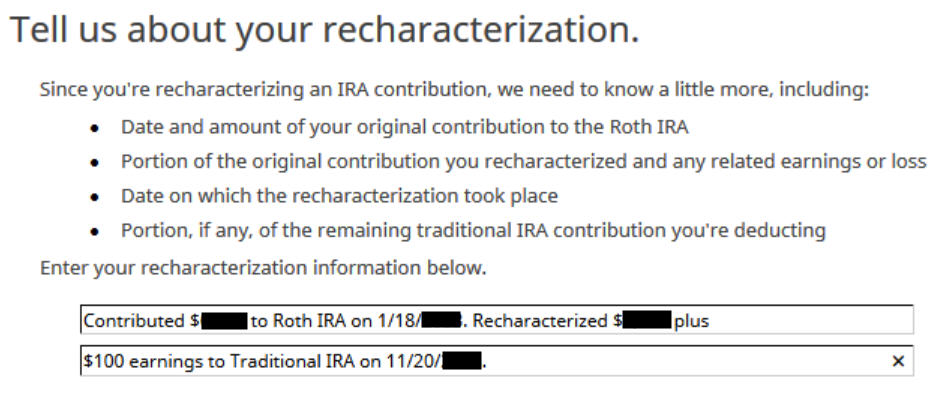

The IRS requires a quick assertion to explain your recharacterization.

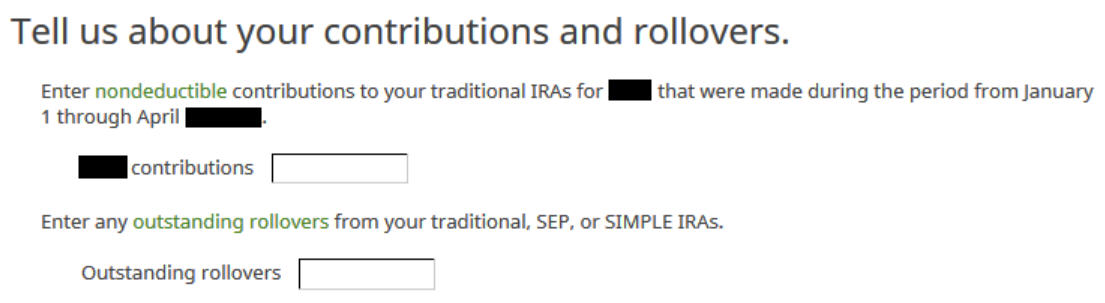

Depart the bins clean since you recharacterized earlier than the tip of 2023.

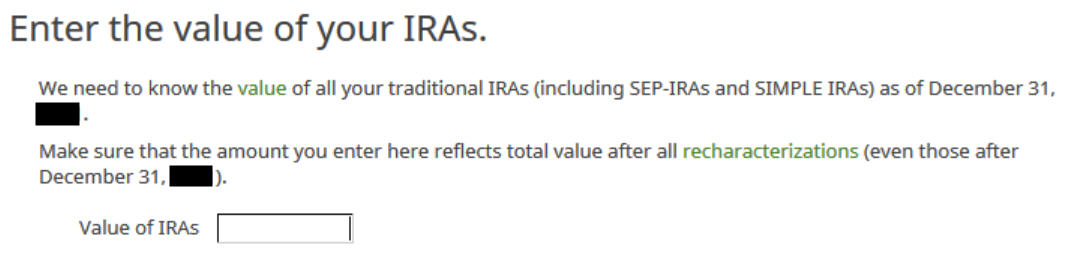

The field ought to be clean or zero while you emptied all of your Conventional IRAs after changing 100% to Roth. Should you had just a few {dollars} of earnings after you transformed and also you left them within the account, get the worth out of your year-end statements and put it right here. The software program will apply the pro-rata rule.

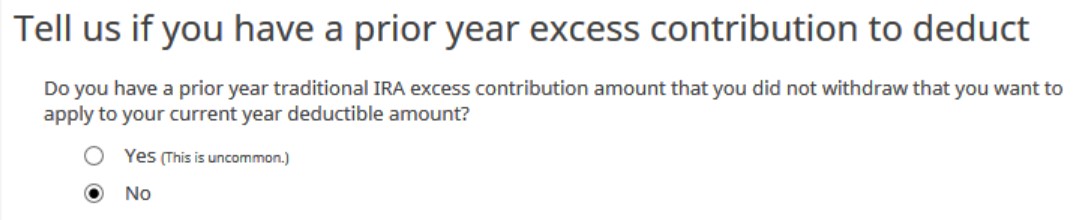

No extra contribution.

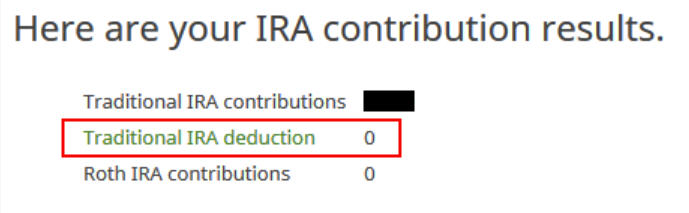

0 in Conventional IRA deduction means it’s nondeductible. Should you see a deduction right here it means the software program thinks you qualify for a deduction. You don’t have a alternative to say no the deduction. Click on on Subsequent. Repeat in your partner if each of you contributed to a Roth IRA for 2023 after which recharacterized earlier than the tip of 2023.

Now the refund meter ought to return up.

Taxable Earnings

You’re carried out with the 2 1099-R types and your Roth IRA contribution recharacterized to Conventional. Let’s take a look at how they present up in your tax return. Click on on Varieties on the highest and open Kind 1040 and Schedules 1-3. Click on on Cover Mini WS. Scroll right down to strains 4a and 4b.

Line 4a reveals the sum of your two 1099-R types. It’s $13,300 in our instance ($6,600 recharacterization plus $6,700 conversion). That is regular. Line 4b reveals that $201 is taxable once we anticipate it to be the $200 in earnings (contributed $6,500, transformed $6,700). That is additionally regular as a consequence of rounding.

Kind 8606 reveals these for our instance:

| Line # | Quantity |

|---|---|

| 1 | 6,500 |

| 3 | 6,500 |

| 5 | 6,500 |

| 13 | 6,499 (as a consequence of rounding, ought to be 6,500) |

| 14 | 1 (as a consequence of rounding, ought to be 0) |

| 16 | 6,700 |

| 17 | 6,499 (as a consequence of rounding, ought to be 6,500) |

| 18 | 201 (as a consequence of rounding, ought to be 200) |

Swap to Clear Backdoor Roth

You prevented having to separate your IRA contribution and Roth conversion in two totally different tax returns by recharacterizing in the identical yr and changing earlier than December 31. Nonetheless, you needed to do the additional work along with your IRA custodian and observe all these steps on this information while you do your taxes.

It’s a lot better to go along with a “clear” backdoor Roth from the get-go. If there’s any chance that your earnings shall be over the restrict once more, merely contribute to a Conventional IRA for 2024 in 2024 and convert it to Roth in 2024.

You’re allowed to do a clear backdoor Roth even when your earnings finally ends up beneath the earnings restrict for a direct contribution to a Roth IRA. It’s a lot less complicated than the complicated recharacterize-and-convert maneuver. Then you definately solely must observe our information for a clear backdoor Roth in The best way to Report Backdoor Roth in H&R Block Tax Software program.

Troubleshooting

Should you adopted the steps and you aren’t getting the anticipated outcomes, right here are some things to test.

Recent Begin

It’s finest to observe the steps recent in a single cross. Should you already went backwards and forwards with totally different solutions earlier than you discovered this information, a few of your earlier solutions could also be caught someplace you not see. You possibly can delete them and begin over.

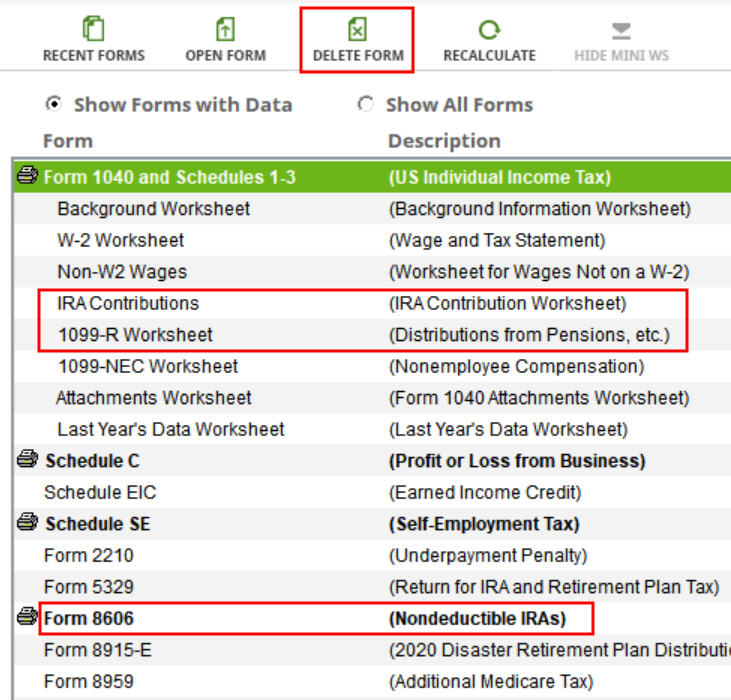

Click on on Varieties and delete IRA Contributions Worksheet, 1099-R Worksheet, and Kind 8606. Then begin over by following the steps right here.

Conversion Is Taxed

Should you don’t have a retirement plan at work, you might have a better earnings restrict to take a deduction in your Conventional IRA contribution. If in case you have a retirement plan at work however your earnings is low sufficient, you’re additionally eligible for a deduction in your Conventional IRA contribution. The software program provides you the deduction if it sees that your earnings qualifies. It doesn’t provide the alternative of constructing it non-deductible. You see this deduction on Schedule 1 Line 20.

Taking this deduction makes your conversion taxable. The taxable Roth IRA conversion and the deduction in your Conventional IRA contribution offset one another to create a wash. That is regular and it doesn’t trigger any issues while you certainly don’t have a retirement plan at work or when your earnings is sufficiently low.

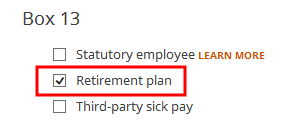

Should you even have a retirement plan at work, possibly the software program didn’t see it. Whether or not you might have a retirement plan at work is marked by the “Retirement plan” field in Field 13 of your W-2. Perhaps you forgot the test it while you entered the W-2. Double-check the “Retirement plan” field in Field 13 of your (and your partner’s) W-2 entries to verify it matches the W-2.

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you’re paying 5-10x an excessive amount of. Discover ways to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]