[ad_1]

One of the best ways to do a backdoor Roth is to do it “clear” by contributing *for* and changing in the identical 12 months — contribute for 2023 in 2023 and convert in 2023, contribute for 2024 in 2024 and convert in 2024, and contribute for 2025 in 2025 and convert in 2025. Don’t break up them into two years reminiscent of contributing for 2022 in 2023 and changing in 2023 or contributing for 2023 in 2024 and changing in 2024. When you did a “clear” backdoor Roth, please comply with How To Report Backdoor Roth In TurboTax (Up to date).

Nevertheless, many individuals didn’t know they need to’ve achieved it “clear.” Some individuals thought it was pure to contribute to an IRA after the 12 months was over between January 1 and April 15 of the next 12 months. Some individuals contributed on to a Roth IRA and solely came upon their earnings was too excessive after they did their taxes the next 12 months. They needed to recharacterize the earlier 12 months’s Roth IRA contribution as a Conventional IRA contribution and convert it once more to Roth after the very fact.

While you contribute for the earlier 12 months and convert (or recharacterize and convert within the following 12 months), you need to report them in your tax return in two completely different years: the contribution in a single 12 months and the conversion within the following 12 months. It’s extra complicated than a straight “clear” backdoor Roth however that’s the worth you pay for not understanding the best approach. This submit exhibits you easy methods to do the primary 12 months. A follow-up submit will present you easy methods to do the second 12 months.

I’m displaying two examples — (1) a direct contribution to a Conventional IRA for the earlier 12 months; and (2) recharacterizing a Roth contribution for the earlier 12 months as a Conventional contribution. Please see which instance matches your situation and comply with alongside accordingly.

Use TurboTax Obtain

The screenshots under are from TurboTax Deluxe downloaded software program. The downloaded software program is approach higher than on-line software program. When you haven’t paid in your TurboTax On-line submitting but, you should purchase TurboTax obtain from Amazon, Costco, Walmart, and lots of different locations and swap from TurboTax On-line to TurboTax obtain (see directions for easy methods to make the swap from TurboTax).

Contributed for the Earlier Yr

Right here’s the instance situation for a direct contribution to the Conventional IRA:

You contributed $6,500 to a Conventional IRA for 2023 between January 1 and April 15, 2024. You then transformed it to Roth in 2024.

Since you transformed in 2024, you received’t get a 1099-R in your conversion till January 2025. You’ll report the conversion in 2024 in your 2024 tax return. As a result of your contribution was *for* 2023, you might want to report it in your 2023 tax return.

When you contributed to a Conventional IRA in 2023 for 2022, every little thing under ought to’ve occurred in your 2022 tax return. In different phrases,

You contributed $6,500 to a Conventional IRA for 2022 between January 1 and April 15, 2023. You then transformed it to Roth in 2023.

Then it’s best to’ve gone by way of the steps under in your 2022 tax return. When you didn’t, it’s best to repair your 2022 return.

When you first contributed to a Roth IRA after which recharacterized it as a Conventional contribution, please soar over to the following instance.

Contributed to Conventional IRA

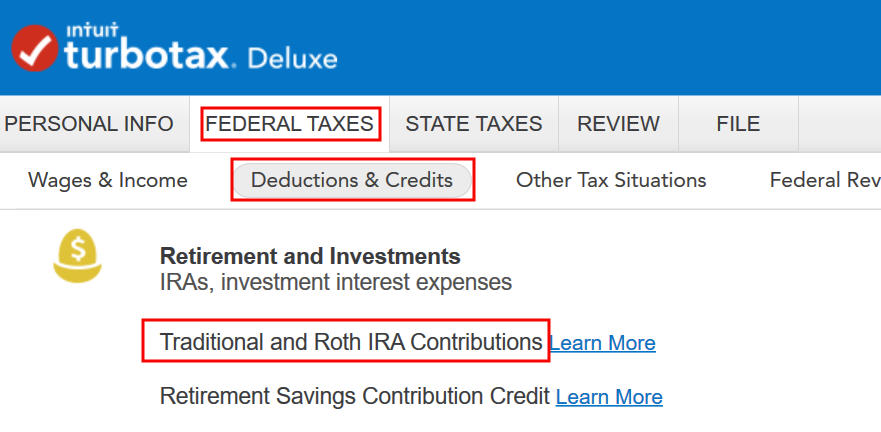

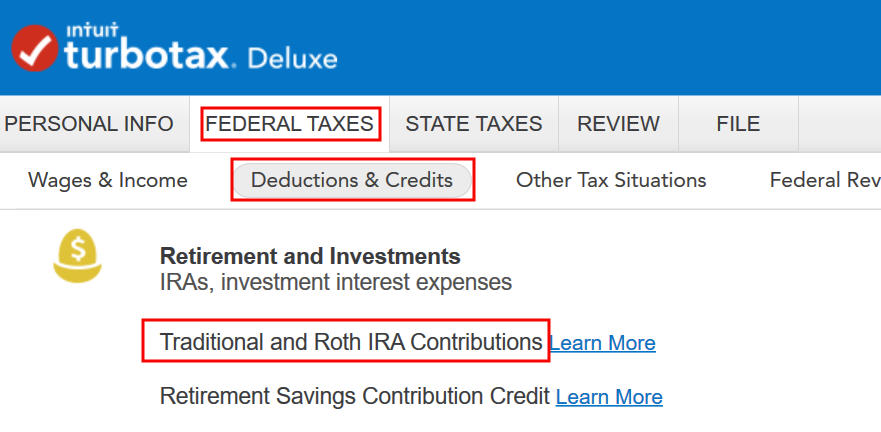

Go to Federal Taxes -> Deductions & Credit -> Conventional and Roth IRA Contributions.

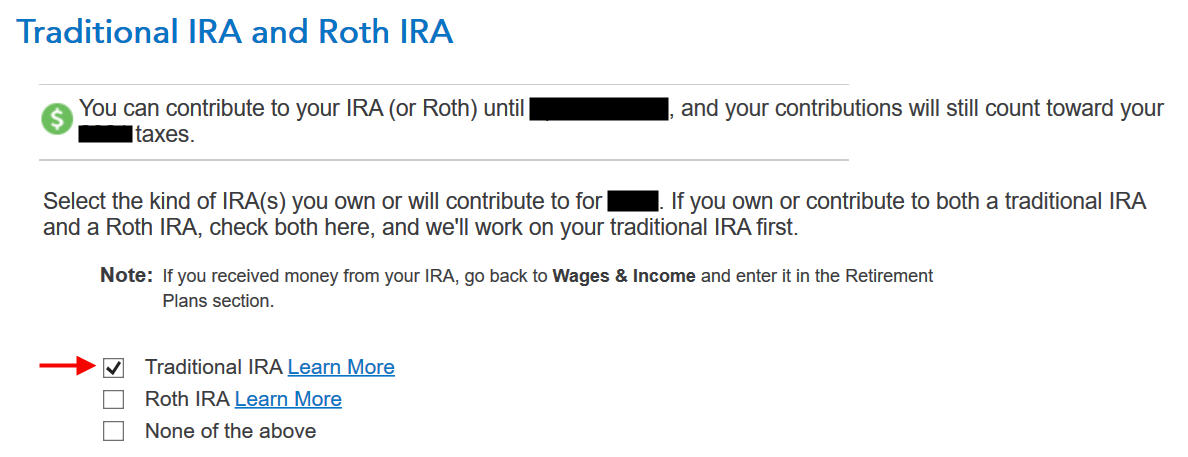

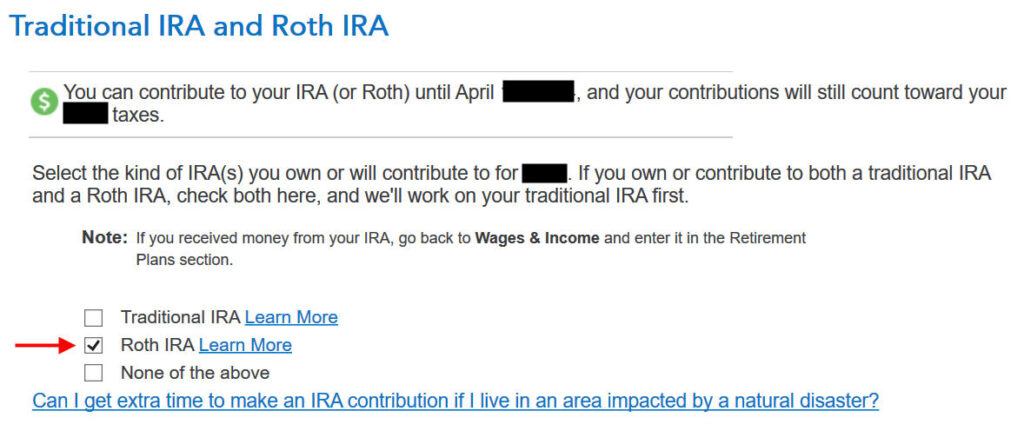

Verify the field for Conventional IRA since you contributed to the Conventional IRA immediately. See the following instance if you happen to contributed to a Roth IRA first after which recharacterized it.

TurboTax provides an improve however we don’t want it. Select to proceed in TurboTax Deluxe.

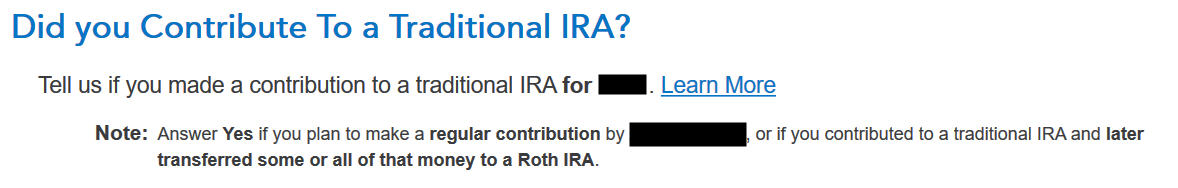

We already checked the field for Conventional however TurboTax simply needs to verify. Reply Sure right here.

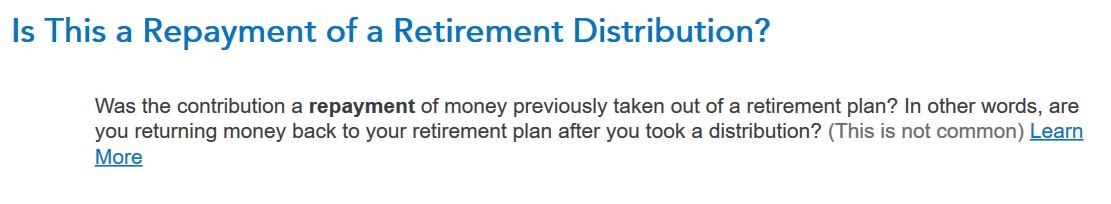

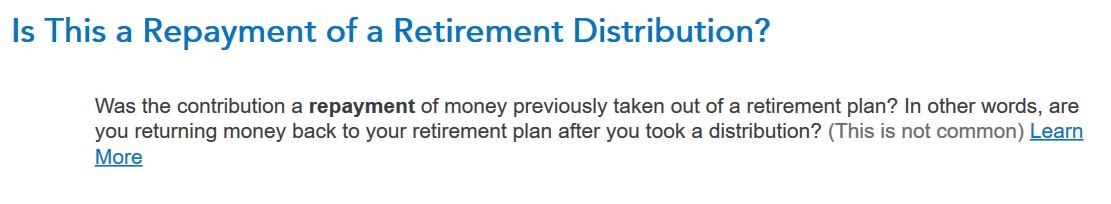

It was not a reimbursement of a retirement distribution.

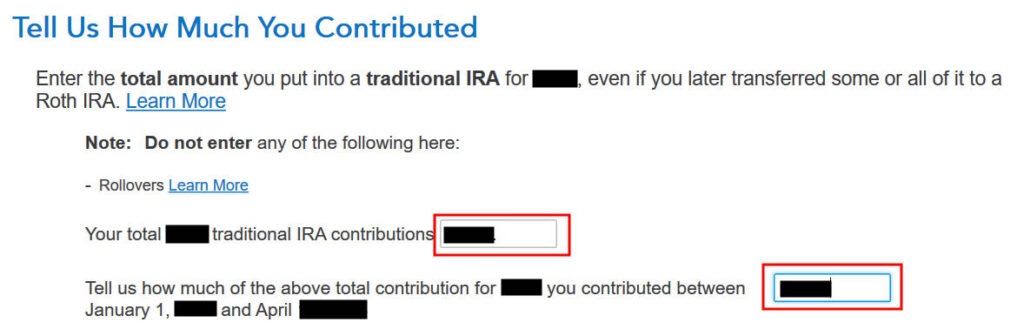

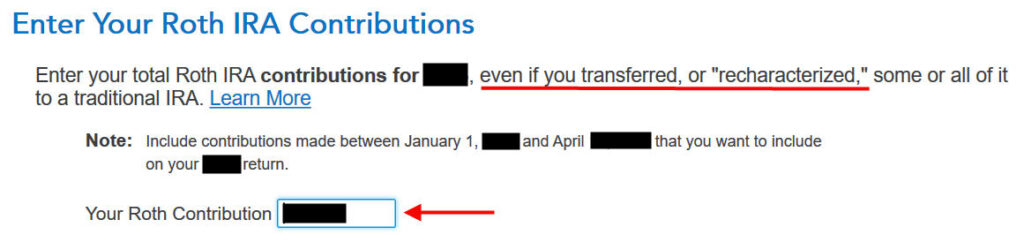

Enter your contribution quantity in each containers. The primary field says you contributed. The second field says you contributed in 2024, not in 2023.

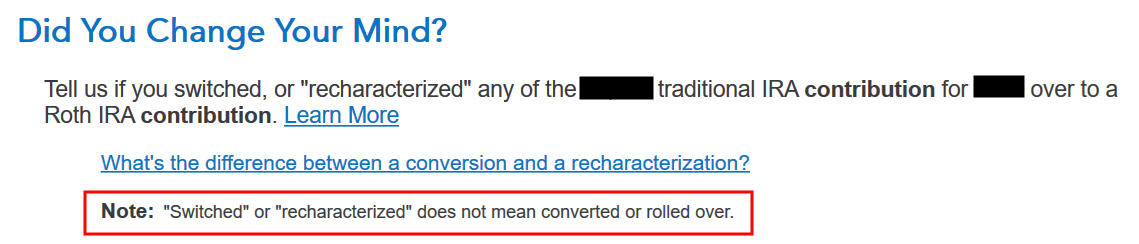

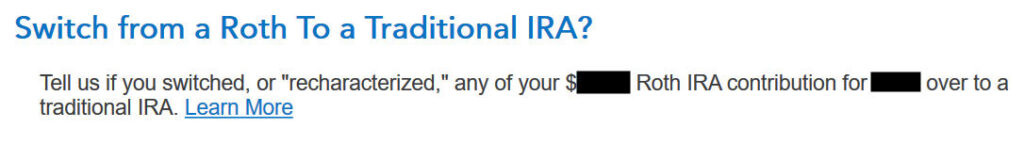

Transformed, Did Not Recharacterize

It is a essential query. Reply “No.” You transformed the cash, not switched or recharacterized.

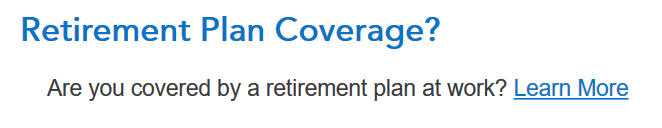

You might not get this query if TurboTax sees that you just’re lined by a retirement plan at work from Field 13 in your W-2. Reply sure if you happen to’re lined by a retirement plan however the field in your W-2 wasn’t checked.

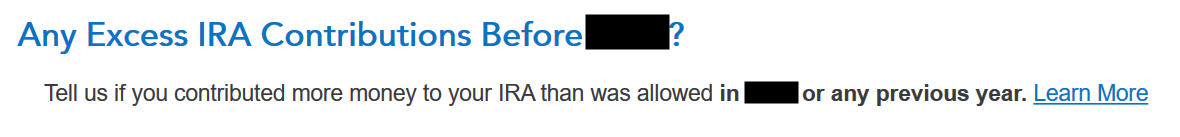

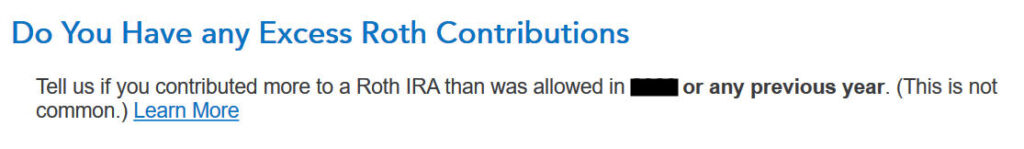

You could have extra contributions provided that you contributed over the restrict. Don’t do this.

Foundation

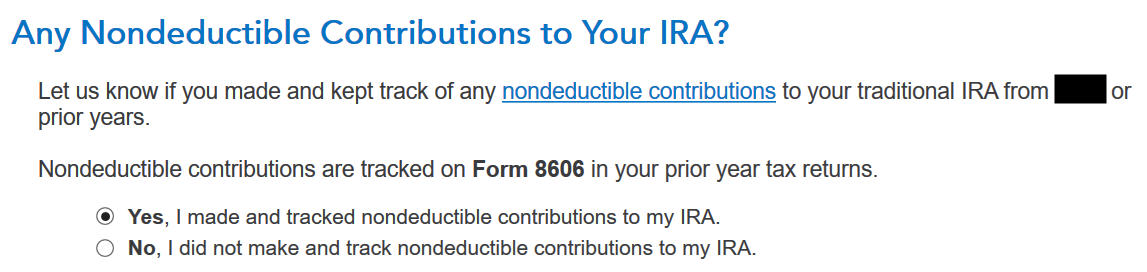

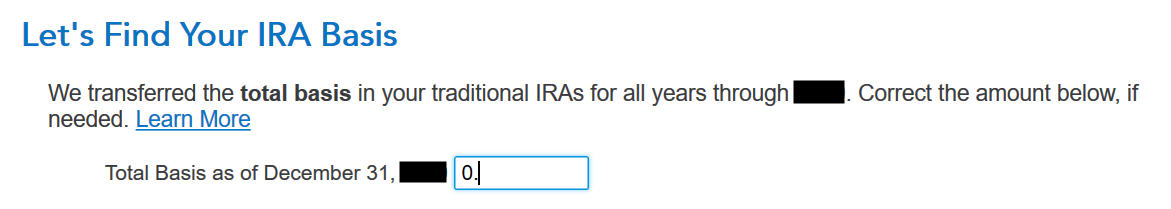

You possibly can reply No if that is the primary time you contributed to a Conventional IRA however answering Sure with a 0 has the identical impact and it means that you can appropriate errors.

That is usually zero if that is the primary time you contributed to a Conventional IRA. When you put in a quantity since you didn’t perceive what it was asking, now’s the possibility to appropriate it.

Make It Nondeductible

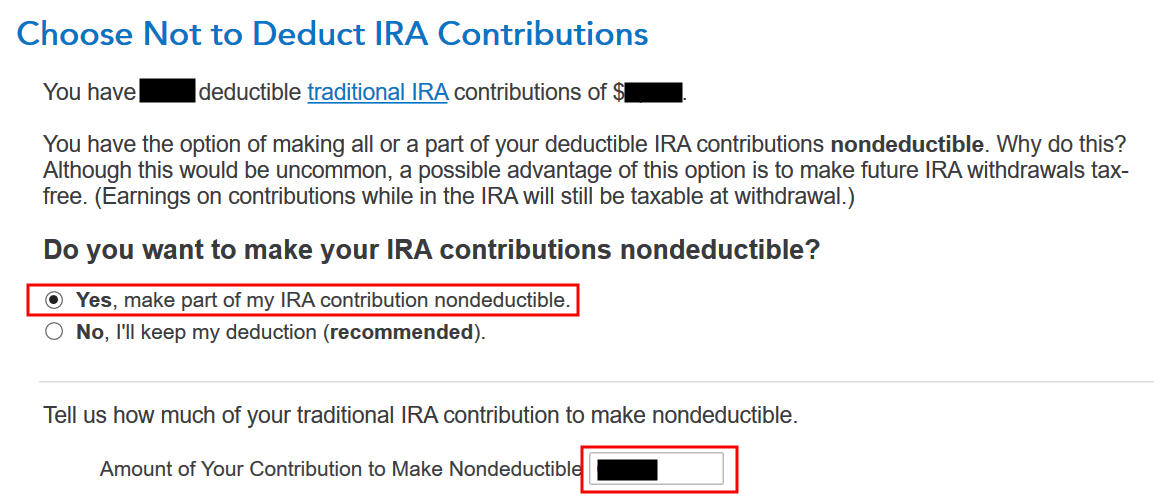

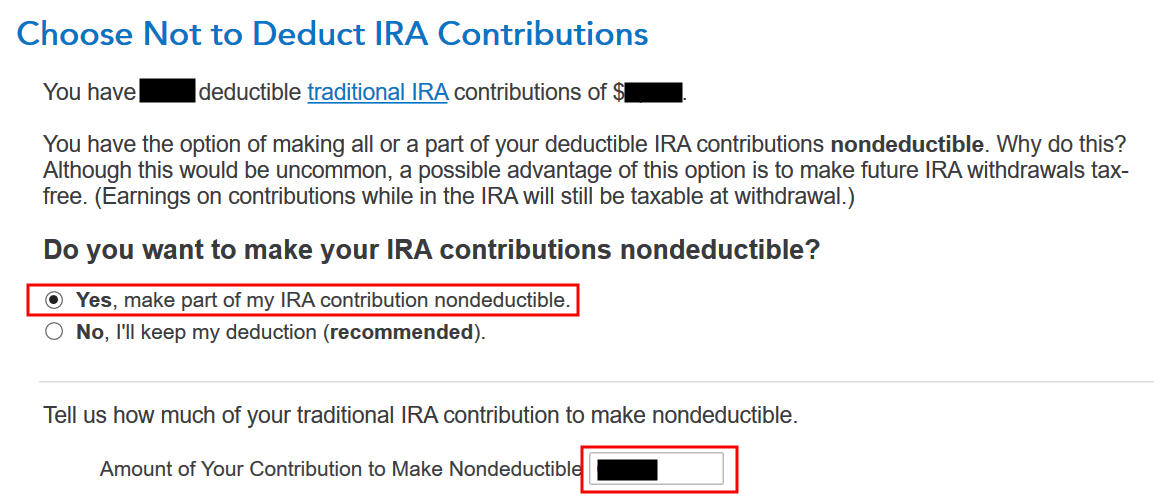

TurboTax received’t present you this if it sees clearly that your earnings is simply too excessive to qualify for a deduction. When you see this query, it means you’ve the choice to take a deduction or decline the deduction. Taking the deduction in 2023 will make your conversion in 2024 taxable. It’s less complicated if you happen to make your full Conventional IRA contribution nondeductible, after which your 2024 Roth conversion received’t be taxable. Enter the quantity of your contribution within the final field. It was $6,500 in our instance.

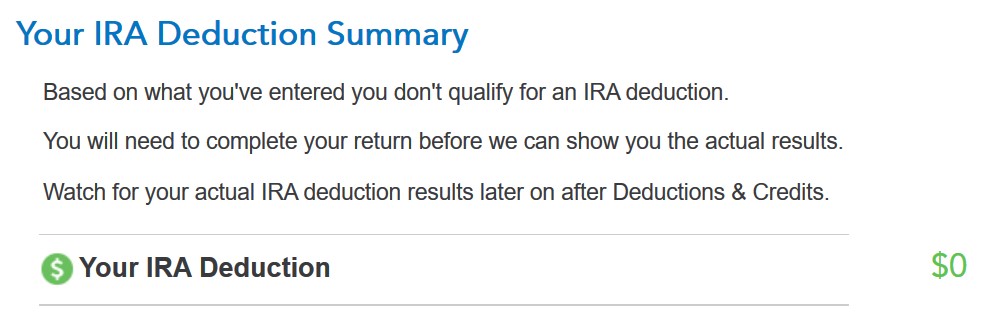

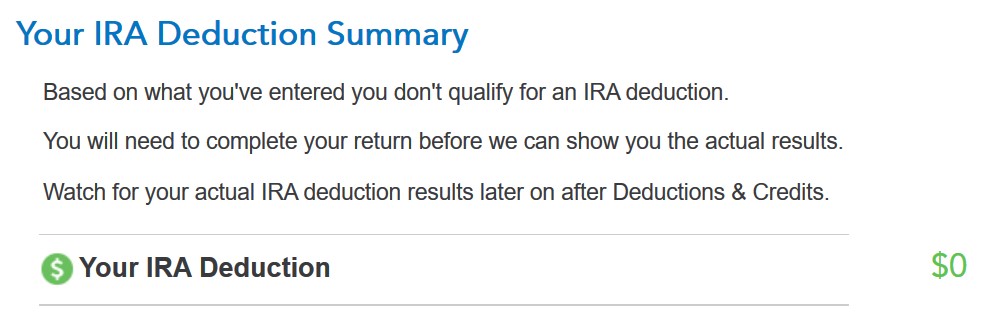

Your Conventional IRA deduction is zero, which is OK as a result of it makes your conversion in 2024 not taxable.

Type 8606

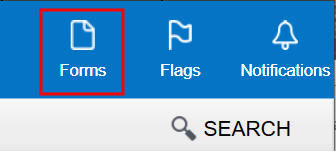

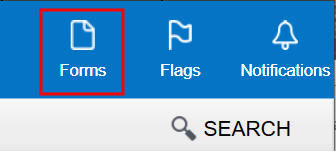

Let’s check out Type 8606. Click on on Kinds on the highest proper.

Discover “Type 8606-T” within the checklist of kinds within the left pane. It’s best to see that solely strains 1, 3, and 14 are stuffed in together with your contribution quantity. It’s essential to see the quantity in Line 14. This quantity will carry over to 2024. It’s going to make your conversion in 2024 not taxable.

Break the Cycle

When you’re at it, it’s best to break the cycle of contributing for the earlier 12 months and create a brand new behavior of contributing for the present 12 months. Contribute to a Conventional IRA for 2024 in 2024 and convert in 2024.

You’re allowed to transform greater than as soon as in a single 12 months. You’re allowed to transform a couple of 12 months’s contribution quantity in a single 12 months. Your bigger conversion continues to be not taxable whenever you convert each your 2023 contribution and your 2024 contribution in 2024. Then you’ll begin 2025 recent. Contribute for 2025 in 2025 and convert in 2025.

Recharacterized Earlier than Changing

Now let’s take a look at our second instance situation.

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your earnings was too excessive whenever you did your taxes in 2024. You recharacterized the Roth contribution for 2023 as a Conventional contribution earlier than April 15, 2024. The IRA custodian moved $6,600 out of your Roth IRA to your Conventional IRA as a result of your unique $6,500 contribution had some earnings. You then transformed it to Roth in 2024.

Since you transformed in 2024, you received’t get a 1099-R in your conversion till January 2025. You’ll report the conversion in 2024 in your 2024 tax return. As a result of your contribution was for 2023, you might want to report it in your 2023 tax return.

Just like our first instance, if you happen to did the identical in 2023 for 2022, it’s best to’ve achieved every little thing under whenever you did your taxes for 2022. In different phrases,

You contributed $6,500 to a Roth IRA for 2022 in 2022. You realized that your earnings was too excessive whenever you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Conventional contribution earlier than April 15, 2023. The IRA custodian moved $6,600 out of your Roth IRA to your Conventional IRA as a result of your unique $6,500 contribution had some earnings. You then transformed it to Roth in 2023.

Then it’s best to’ve taken all of the steps under final 12 months in your 2022 tax return. When you didn’t, you might want to repair your 2022 return.

Contributed to Roth IRA

Go to Federal Taxes -> Deductions & Credit -> Conventional and Roth IRA Contributions.

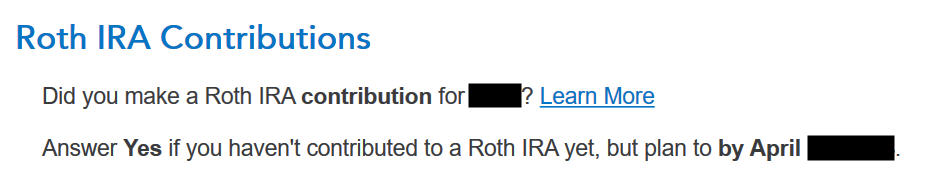

Verify the field for Roth IRA since you initially contributed to a Roth IRA.

We already checked the field for Roth IRA however TurboTax simply needs to verify.

It was not a reimbursement of a retirement distribution.

Enter the quantity of your unique Roth contribution. It was $6,500 in our instance.

Recharacterized

Now we confess that we recharacterized the contribution as a Conventional IRA contribution. Reply Sure right here.

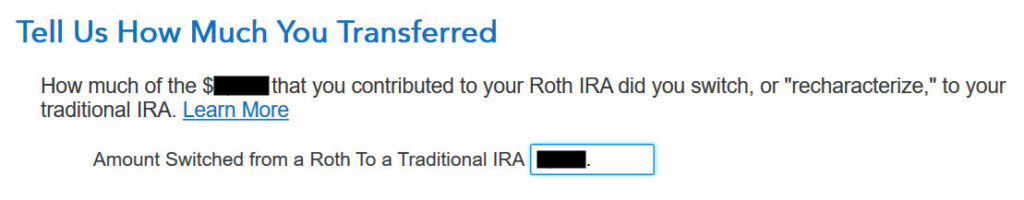

The quantity right here is relative to the unique contribution quantity. When you recharacterized the entire thing, enter $6,500 in our instance, not $6,600 which was the quantity with earnings that the IRA custodian moved into the Conventional IRA.

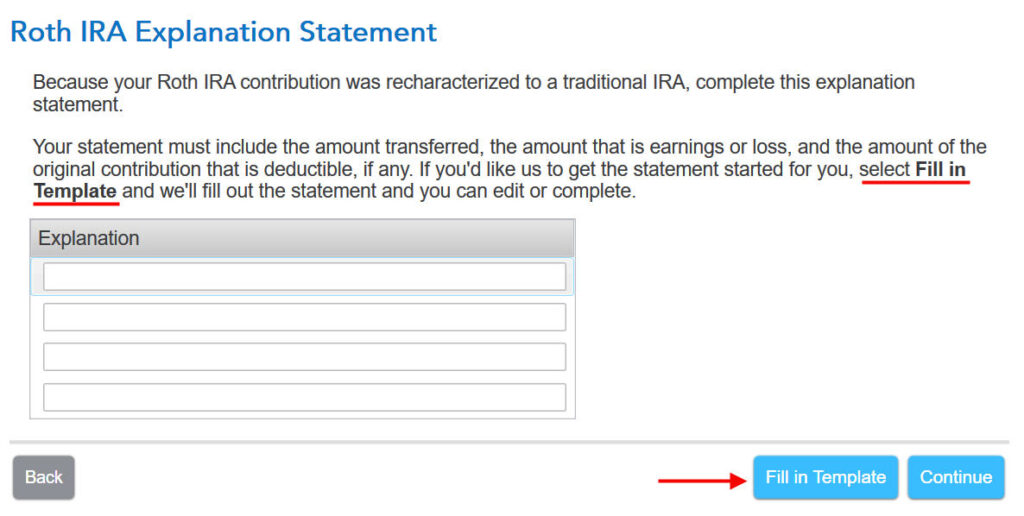

The IRS needs a press release to clarify the recharacterization. Click on on “Fill in Template.”

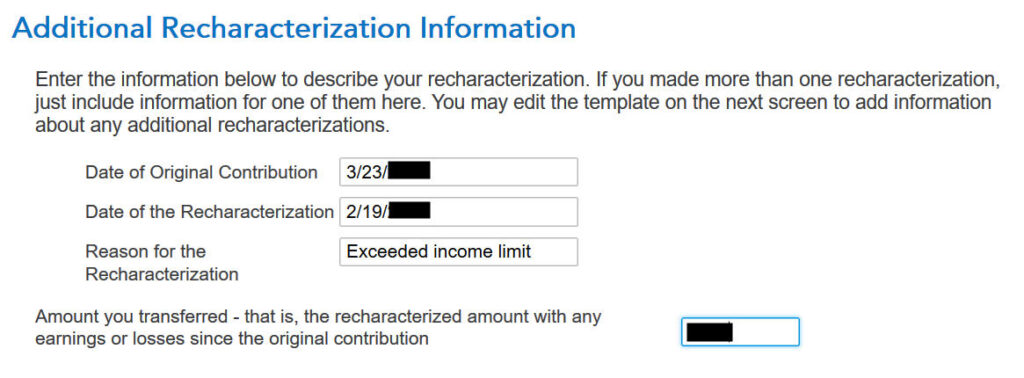

Fill within the dates of your unique contribution and your recharacterization. The quantity within the final field consists of earnings. It’s $6,600 in our instance.

Roth Foundation

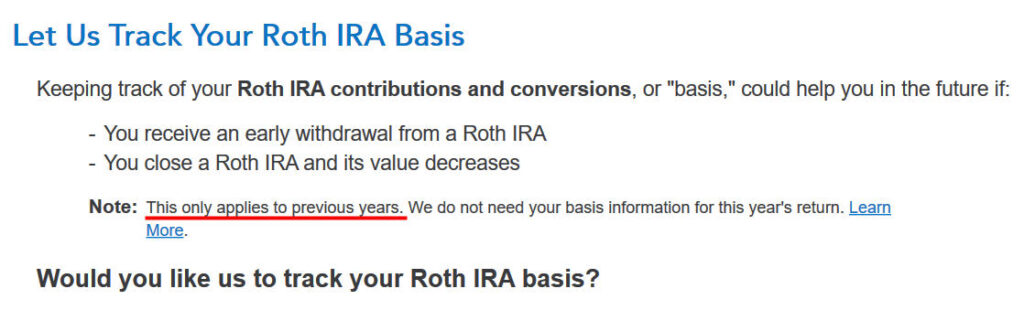

When you take up this supply from TurboTax to trace your Roth IRA foundation, it’s going to ask you questions on earlier years, which is extra bother than it’s price to me. I answered No. You don’t want to trace your Roth IRA foundation if you happen to’re planning to withdraw out of your Roth account solely after age 59-1/2 and after you’ve had a Roth IRA for 5 years. See Roth IRA Withdrawal After 59-1/2 in TurboTax.

No extra contributions.

Make It Nondeductible

TurboTax exhibits this solely when it sees your earnings qualifies for a deduction. You could have the choice to take the deduction or decline the deduction. Taking the deduction in 2023 will make your conversion in 2024 taxable. It’s less complicated if you happen to make your full contribution nondeductible after which your 2024 Roth conversion received’t be taxable. Enter the quantity of your unique contribution within the final field. It was $6,500 in our instance.

Your Conventional IRA deduction is zero, which is OK as a result of it makes your conversion in 2024 not taxable.

Type 8606

Let’s check out Type 8606. Click on on “Kinds” on the highest proper.

Discover “Type 8606-T” within the checklist of kinds within the left pane. It’s best to see that solely strains 1, 3, and 14 are stuffed in together with your unique contribution quantity. After recharacterizing, it’s as if you happen to contributed on to a Conventional IRA to start with. It’s essential to see the quantity in Line 14. This quantity will carry over to 2024. It’s going to make your conversion in 2024 not taxable.

Swap to Clear Backdoor Roth

When you are at it, it’s best to swap to a clear backdoor Roth for 2024. Somewhat than contributing on to a Roth IRA, seeing that you just exceed the earnings restrict, recharacterizing it, and changing it once more, it’s best to merely contribute to a Conventional IRA for 2024 in 2024 and convert it to Roth in 2024 if there’s any chance that your earnings shall be over the restrict once more.

You’re allowed to do a clear backdoor Roth even when your earnings finally ends up under the earnings restrict for a direct contribution to a Roth IRA. It’s a lot less complicated than the complicated recharacterize-and-convert maneuver.

You’re allowed to transform greater than as soon as in a single 12 months. You’re allowed to transform a couple of 12 months’s contribution quantity in a single 12 months. Your bigger conversion continues to be not taxable whenever you convert each your 2023 contribution and your 2024 contribution in 2024. Then you’ll begin 2025 recent. Contribute for 2025 in 2025 and convert in 2025.

Say No To Administration Charges

If you’re paying an advisor a proportion of your belongings, you might be paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]