[ad_1]

Kat and her husband Jay stay within the Okinawa Prefecture of Japan the place Jay is stationed as a Captain within the U.S. Marine Corps. They’re childfree by alternative and have an lovely canine named Sadie. Though they’re simply 29, they’ve been diligently saving, investing and planning for the date when Jay will get out of the army.

Kat and her husband Jay stay within the Okinawa Prefecture of Japan the place Jay is stationed as a Captain within the U.S. Marine Corps. They’re childfree by alternative and have an lovely canine named Sadie. Though they’re simply 29, they’ve been diligently saving, investing and planning for the date when Jay will get out of the army.

Their aim is to achieve monetary independence by that deadline, which is now 5 to eight years away. Kat would really like our assist figuring out if this can be a cheap aim and, if not, recommendation on what they need to do to make it possible.

What’s a Reader Case Examine?

Case Research tackle monetary and life dilemmas that readers of Frugalwoods ship in requesting recommendation. Then, we (that’d be me and YOU, expensive reader) learn by their scenario and supply recommendation, encouragement, perception and suggestions within the feedback part.

For an instance, take a look at the final case research. Case Research are up to date by members (on the finish of the put up) a number of months after the Case is featured. Go to this web page for hyperlinks to all up to date Case Research.

Can I Be A Reader Case Examine?

There are 4 choices for people eager about receiving a holistic Frugalwoods monetary session:

- Apply to be an on-the-blog Case Examine topic right here.

- Rent me for a non-public monetary session right here.

- Schedule an hourlong name with me right here.

→Unsure which possibility is best for you? Schedule a free 15-minute chat with me to study extra. Refer a good friend to me right here.

Please be aware that area is proscribed for the entire above and most particularly for on-the-blog Case Research. I do my greatest to accommodate everybody who applies, however there are a restricted variety of slots accessible every month.

The Objective Of Reader Case Research

Reader Case Research spotlight a various vary of economic conditions, ages, ethnicities, areas, targets, careers, incomes, household compositions and extra!

Reader Case Research spotlight a various vary of economic conditions, ages, ethnicities, areas, targets, careers, incomes, household compositions and extra!

The Case Examine collection started in 2016 and, to this point, there’ve been 102 Case Research. I’ve featured of us with annual incomes starting from $17k to $200k+ and internet worths starting from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured homosexual, straight, queer, bisexual and polyamorous individuals. I’ve featured ladies, non-binary of us and males. I’ve featured transgender and cisgender individuals. I’ve had cat individuals and canine individuals. I’ve featured of us from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured individuals with PhDs and other people with highschool diplomas. I’ve featured individuals of their early 20’s and other people of their late 60’s. I’ve featured of us who stay on farms and folk who stay in New York Metropolis.

Reader Case Examine Pointers

I in all probability don’t must say the next since you all are the kindest, most well mannered commenters on the web, however please be aware that Frugalwoods is a judgement-free zone the place we endeavor to assist each other, not condemn.

There’s no room for rudeness right here. The aim is to create a supportive atmosphere the place all of us acknowledge we’re human, we’re flawed, however we select to be right here collectively, workshopping our cash and our lives with constructive, proactive solutions and concepts.

And a disclaimer that I’m not a skilled monetary skilled and I encourage individuals to not make severe monetary selections based mostly solely on what one particular person on the web advises.

I encourage everybody to do their very own analysis to find out the perfect plan of action for his or her funds. I’m not a monetary advisor and I’m not your monetary advisor.

With that I’ll let Kat, at present’s Case Examine topic, take it from right here!

Kat’s Story

Hello Frugalwoods! I’m Kat, I’m 29, and my husband Jay is nearly 29. We’re childfree and have one adopted canine named Sadie. We presently stay in Japan the place Jay works as a US Marine Corps Captain. We met in 2015 on a research overseas journey, obtained married in 2017, and have moved 9 occasions since then! We like to journey, hike and camp, snorkel within the ocean, go on lengthy walks with our canine, watch films, and skim.

Hello Frugalwoods! I’m Kat, I’m 29, and my husband Jay is nearly 29. We’re childfree and have one adopted canine named Sadie. We presently stay in Japan the place Jay works as a US Marine Corps Captain. We met in 2015 on a research overseas journey, obtained married in 2017, and have moved 9 occasions since then! We like to journey, hike and camp, snorkel within the ocean, go on lengthy walks with our canine, watch films, and skim.

What feels most urgent proper now? What brings you to submit a Case Examine?

After I initially utilized for a Reader Case Examine, Jay had a one-hour commute to work on high of an extended work day. He was waking up at 4am and getting residence between 7 and 10 pm. We’ve since moved and he now has a 20 minute commute! So, that’s one main drawback solved.

The opposite primary subject is that I would really like us to be financially impartial by the point Jay will get out of the army in 5 to eight years. I need us to have choices, relatively than feeling like we have to leap into new careers the second he leaves the army. As we close to this self-imposed deadline, the aim is feeling increasingly more daunting.

We wish to benefit from our restricted time in Japan – touring, having cultural experiences, and spending time in nature. However this conflicts with our bigger aim of desirous to be financially impartial.

Put up-Navy Life Plans

Jay would want to serve for 20 years in an effort to get a pension. We’re as an alternative hoping to fund our personal retirement so he doesn’t want to remain in that lengthy. He loves what he does, however it’s draining. After he leaves the army, we might want to buy our personal healthcare. And not using a pension or incapacity discharge, Jay received’t be eligible for VA care. He’s open to serving within the reserves, which might proceed his healthcare.

We aren’t positive the place we wish to calm down. Ideally, we are going to journey full time for just a few years after Jay will get out of the army. Some states we’re contemplating for our residence base are Oregon, Washington, Montana, Vermont (or one other northeastern state), and Minnesota. We’d like a progressive group close to mountaineering trails with housing that we are able to afford. We might love solutions! Our households are fairly scattered now, so we possible received’t stay close to most of them.

What’s the perfect a part of your present life-style/routine?

We love the place we stay. We’re very privileged to get to stay in a stupendous place and expertise a brand new lifestyle.

We love the place we stay. We’re very privileged to get to stay in a stupendous place and expertise a brand new lifestyle.

I’m additionally having fun with my free time. I’ve primarily labored as a author previously. I most just lately labored as a kitchen assistant at a good friend’s restaurant, however resigned as a consequence of our current transfer. So, I’m presently between jobs, as one may say. I’m utilizing this time to handle the entire home labor and life administration duties, study the Japanese language, spend time in nature, and skim. Now that we have now web at our new home, I’ll attempt to choose up some freelance work with a former employer, however I’m not but positive the way it will work out with the time zone distinction between the US and Japan.

What’s the worst a part of your present life-style/routine?

Jay’s troublesome job and lengthy work hours. What little time we have now collectively is usually spent resting and getting ready for the subsequent week. We’re on reverse ends of the spectrum proper now – he’s overworked and drained, whereas I’m in want of social time and a problem.

The place Kat Needs to be in Ten Years:

- Funds: Financially impartial, residing comfortably off of our investments.

- Way of life: Touring typically with a house base within the states. A number of high quality time collectively.

- Profession: Satisfying part-time work, volunteer work, homesteading, and/or a inventive passion enterprise that we run collectively.

Kat & Jay’s Funds

Earnings

| Merchandise | Variety of paychecks per 12 months | Gross Earnings Per Pay Interval | Deductions Per Pay Interval (with quantities) | Web Earnings Per Pay Interval |

| Jay’s Earnings | 12 | $9,638 | taxes: $1,226 life and dental insurance coverage: $43 TSP contributions: $1,864 TOTAL deductions: $3,133 |

$6,505 |

| Annual internet complete: | $78,048 |

Money owed: $0

Belongings

| Merchandise | Quantity | Curiosity/sort of securities held/Inventory ticker | Identify of financial institution/brokerage | Expense Ratio | Account Sort |

| Joint Brokerage Account | $183,256 | VTSAX, some VTIAX | Vanguard | 0.0004 | Investments |

| Thrift Financial savings Plan | $105,239 | C Funds | The Federal Retirement Thrift Funding Board | 0.0006 | Retirement |

| Excessive Yield Financial savings Account | $40,170 | Earns 4.75% APY | CIT | emergency financial savings | |

| Kat Roth IRA | $26,057 | VTSAX | Vanguard | 0.0004 | Retirement |

| Jay Roth IRA | $23,041 | VTSAX | Vanguard | 0.0004 | Retirement |

| Brokerage Account | $10,044 | Mutual funds | Vanguard | 0.001 | Investments |

| Checking Account | $4,710 | Earns 0.01% APY | Chase | Checking | |

| TOTAL: | $392,517 |

Autos

| Car make, mannequin, 12 months | Valued at | Mileage | Paid off? |

| 2001 Daihatsu Mira Gino | $1,800 | 87,000 | Sure |

| 2004 Mitsubishi Pajero Mini | $2,700 | 87,000 | Sure |

| Complete: | $4,500 |

Bills

| Merchandise | Quantity | Notes |

| Housing | $1,900 | lease, insurance coverage, trash, gasoline, electrical, water, web (paid in yen) |

| Journey | $546 | flights, airport parking, lodging, canine sitter, transit |

| Groceries | $459 | |

| ATM Withdrawals | $160 | Money continues to be extensively utilized in Japan. Used for points of interest, occasions, and small eating places. |

| Family Items | $133 | family necessities, cleansing provides, furnishings, gardening |

| Eating places | $121 | |

| Cell Telephones | $108 | supplier: SoftBank |

| Auto | $99 | Two automobiles and two drivers. Private Harm Legal responsibility Insurance coverage (PDI), Japanese Obligatory Insurance coverage (JCI), annual highway tax, toll highway charges, US driver’s license renewal charges, upkeep |

| Canine Care | $71 | |

| Charitable Giving | $63 | |

| Subscriptions | $62 | Apple Music, iCloud storage, Hulu, Duolingo, Microsoft, VPN |

| Clothes & Sneakers | $55 | |

| Leisure & Hobbies | $54 | portray class, bowling, movie show, cultural occasions, snorkeling and mountaineering gear, e book membership books |

| Private Care | $51 | |

| Gasoline | $49 | |

| Well being Insurance coverage | $0 | coated as a part of Jay’s compensation |

| Month-to-month subtotal: | $3,931 | |

| Annual complete: | $47,172 |

Credit score Card Technique

| Card Identify | Rewards Sort? | Financial institution/card firm |

| Capital One Quicksilver | Money Again | Capital One |

| US Financial institution Money+ | Money Again | US Financial institution |

| Chase Freedom Limitless | Money Again | Chase |

| Chase Freedom | Money Again | Chase |

Kat’s Questions For You:

Does it appear possible for us to “retire” between the ages of 34-37? Or at the least get out of the army at that age and each work part-time?

Does it appear possible for us to “retire” between the ages of 34-37? Or at the least get out of the army at that age and each work part-time?- If not, what do we have to reduce on to attain this aim?

- What sort of paid work ought to I pursue subsequent? Any solutions for timezone-flexible distant work?

- How can Jay and I higher join throughout occasions once we’re on reverse ends of the work/life steadiness spectrum?

Liz Frugalwoods’ Suggestions

Kat and Jay carry us an attention-grabbing Case Examine at present and I’m excited to dig in and see what’s potential for these two! They’ve made wonderful frugal decisions through the years, as evidenced by their lack of debt and spectacular internet value. Let’s get proper to Kat’s questions!

Kat’s Query #1: Does it appear possible for us to “retire” between the ages of 34-37 (in 5-8 years)? Or at the least get out of the army at that age and each work part-time?

This query is based upon how a lot they intend to earn, spend and make investments over the subsequent 5-8 years. Let’s check out the place issues stand now and make some projections for his or her future.

Asset Overview

It’s uncommon that I don’t have suggestions for a Case Examine topic to alter one thing about their asset allocation, however Kat and Jay hit a house run right here! I don’t assume I’ve any edits to recommend! Right here’s why:

Money owed: $0

Crucially, Kat and Jay are utterly debt-free, which opens up numerous choices for them. Once you’re not beholden to debt, your mounted month-to-month prices could be very, very low. Mounted prices are stuff you can not change–like your lease/mortgage, insurance coverage, and many others–and if debt repayments aren’t a part of that image, you’re mechanically spending much less and saving extra each single month.

Crucially, Kat and Jay are utterly debt-free, which opens up numerous choices for them. Once you’re not beholden to debt, your mounted month-to-month prices could be very, very low. Mounted prices are stuff you can not change–like your lease/mortgage, insurance coverage, and many others–and if debt repayments aren’t a part of that image, you’re mechanically spending much less and saving extra each single month.

Web value: $392,517

Since they haven’t any debt to service, all of their belongings rely in direction of their internet value. Properly carried out, you two!

Investments: At Vanguard

It’s apparent Kat and Jay have carried out their analysis (and skim numerous Frugalwoods!) as a result of their funding decisions are virtually precisely what I’d do. They’ve chosen a brokerage, Vanguard, with a wonderful status for low-fee complete market index funds. That is evident in how low the expense ratios are on all of their investments. Expense ratios are what you pay a brokerage to take a position your cash and, since they’re charges, you need them to be as little as potential.

They’re invested aggressively in virtually 100% shares, which for my part makes numerous sense since they’re younger and have plenty of years earlier than they’ll be drawing down this cash. Typically, you wish to make investments aggressively while you’re younger after which lower your threat publicity as you close to retirement age. The previous adage in investing is high-risk=high-reward and low-risk=low reward.

Their number of Vanguard’s VTSAX as their major funding can be one thing I’d do because it’s a complete market index fund, which suggests they’re invested throughout your entire inventory market. This reduces threat since they’re well-diversified throughout each sector of the market. It’s the other of stock-picking whereby you restrict your self to only one or two firms and actually hope that they don’t tank. Investing in one thing like VTSAX is the epitome of not placing your entire eggs in a single basket. A superb plan!

Money: In a high-yield financial savings account

Kat and Jay have their money stashed precisely the place I’d advise: in a high-yield financial savings account. Their rate of interest of 4.75% on this account is phenomenal! The one teensy be aware I’ve is that they’re overbalanced on money.

Kat and Jay have their money stashed precisely the place I’d advise: in a high-yield financial savings account. Their rate of interest of 4.75% on this account is phenomenal! The one teensy be aware I’ve is that they’re overbalanced on money.

Between their checking and financial savings, they’ve $44,880, which is WAY greater than they’d want in an emergency fund. An emergency fund needs to be round three to 6 months’ value of your spending. For Kat and Jay, this $44k is sort of what they spend in a whole 12 months. The downsides of getting a lot money are that: money loses worth (as a result of it doesn’t sustain with inflation) and there’s a chance price to not having it invested available in the market. Having nearly all of their money in such a high-yield financial savings account mitigates these dangers considerably, however it’s nonetheless an underutilization of this cash.

Technically, they need to retain simply six months’ value of residing bills in money and dump the remaining into their taxable funding account.

Nevertheless, given their degree of funding sophistication, I’ve to think about they’ve a motive for maintaining this a lot in money, however I did wish to level it out. Once they close to the time for Jay to go away the army, they’ll wish to have a very good buffer of money available, however since that’s at the least 5 years away, I see no motive to sit down on that a lot money within the meantime. However, in the event that they plan to purchase a home in 5 years? This might make sense as their downpayment financial savings.

Let’s refer again to Kat and Jay’s final ten-year aim:

Kat acknowledged they wish to be “Financially impartial, residing comfortably off of our investments.”

→What does that really imply?

Once we discuss monetary independence on this context, we imply the power to:

Once we discuss monetary independence on this context, we imply the power to:

- Now not must work for cash;

- Have sufficient invested to allow a secure price of withdrawal to cowl your entire residing bills;

- Have the power to do that till you die.

The important thing to creating this work is definitely pretty simple:

- It’s a must to earn a ample amount of cash throughout your early working years;

- It’s a must to save and make investments the overwhelming majority of this cash;

- It’s a must to maintain your bills low sufficient to allow you to do that.

An individual who makes $1M per 12 months but in addition spends $1M per 12 months won’t be able to achieve monetary independence. That particular person resides paycheck to huge paycheck. They’re utterly reliant upon their job to fund their life-style. A lay-off can be a disaster for them as a result of, regardless of having a ridiculously excessive earnings, in the event that they don’t save any of it, they don’t have anything to fall again on.

Alternatively, an individual who (like Jay & Kat) earns $78,048 per 12 months however solely spends $47,172 yearly, will be capable of make investments the $30,876 distinction annually. That is the amazingly simple arithmetic behind FIRE (monetary independence, retire early).

You will have two levers right here: earnings and bills.

You possibly can enhance earnings, you possibly can lower bills, you are able to do each.

There’s a bit extra to it because you HAVE to aggressively make investments this distinction–as Jay and Kat have carried out.You can not maintain all of this in money and count on to turn into financially impartial. You want the compounding curiosity of spending many a long time invested within the inventory market.

There’s a bit extra to it because you HAVE to aggressively make investments this distinction–as Jay and Kat have carried out.You can not maintain all of this in money and count on to turn into financially impartial. You want the compounding curiosity of spending many a long time invested within the inventory market.

Over time, historic fashions point out that the market returns a roughly 7% annual common. In fact previous efficiency doesn’t promise future success, however, it’s all we have now to go on. That’s why I query Kat and Jay’s overbalance on money. Whereas the 4.75% rate of interest their money makes in its high-yield financial savings account is nice, historical past signifies that cash will carry out higher for you within the inventory market (once more, a ~7% annual return on common, over many a long time).

Residing Off Your Investments

This implies you might have sufficient invested available in the market that you just’re capable of withdraw a secure share yearly to cowl your residing bills. So once more, however two variables: how a lot you spend and the way a lot you might have invested. People quibble about what share constitutes a “secure price of withdrawal,” however probably the most generally cited is 4%.

How to do that math:

4% of your investments = the quantity you possibly can withdraw to stay on yearly

If we take a look at Kat and Jay’s present full internet value of $392,517, 4% of that’s $15,700 per 12 months. Based mostly on their present spending degree of $47,172, that’s not sufficient for them to stay on. We are able to do backwards math to find out how a lot they’d want in an effort to spin off $47k a 12 months. That reply is ~$1.2M (4% of $1.2M = $48k).

Whereas that’s the quantity for at present, it’s robust to undertaking into the longer term as a result of there are such a lot of unknowns in Kat and Jay’s scenario, together with:

- Jay’s annual wage for the subsequent 5-8 years

- Kat’s annual wage for the subsequent 5-8 years

- What the inventory market will do over the subsequent 5-8 years

- Their post-military stateside annual spending, which may change dramatically relying upon:

- In the event that they’re paying for their very own medical insurance

- The place they determine to calm down

- In the event that they purchase a house

- How a lot their lease/mortgage is within the US

- Inflation

In gentle of that, we are able to’t exactly mannequin out precisely what their monetary scenario will probably be in 5-8 years, however we are able to completely do some back-of-the-envelope math to offer them a way of route.

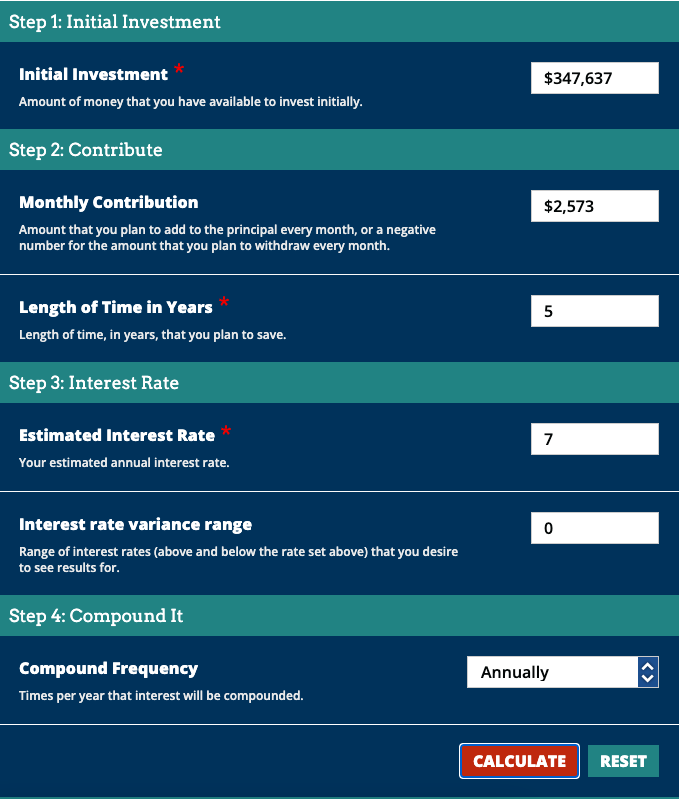

To do that, I used my favourite compound curiosity calculator:

I enter the quantity Kat and Jay presently have invested available in the market ($347,637) in addition to the quantity they’re capable of make investments every month ($2,573) assuming they make investments their full $30,876 annual distinction between their earnings and bills. I went with a flat 7% market return.

Listed below are the outcomes:

If the market returns 7% annually and Kat and Jay proceed to take a position $30,876 yearly, they’d have ~$665k in 5 years. Let’s flip to our secure price of withdrawal share now to see what they’d have:

4% of $665,138.69 = $26,605.54 accessible to spend annually

This nonetheless wouldn’t be sufficient to cowl their present degree of bills, however, one in all Kat’s questions is whether or not or not they’d be capable of work part-time to make up the distinction. Completely! Incomes more cash is all the time going to make this math higher.

This nonetheless wouldn’t be sufficient to cowl their present degree of bills, however, one in all Kat’s questions is whether or not or not they’d be capable of work part-time to make up the distinction. Completely! Incomes more cash is all the time going to make this math higher.

State of affairs #1: Retire from the Navy in 5 Years and Enact “Coast FI”

Whereas absolutely retiring in 5 years isn’t actually potential with their present numbers, they might definitely have Jay go away the army and discover part-time jobs that pay sufficient to cowl their residing bills.

The concept behind Coast FI is that you just now not want your fully-loaded full-time job with retirement and advantages and as an alternative, simply must earn sufficient to cowl your bills. Thus, you’re now not investing for retirement or in your taxable funding account, however you’re additionally not drawing down something out of your investments. You’re letting your investments “coast” and develop till they’re substantial sufficient to enact a 4% withdrawal.

On this occasion, your spending instantly dictates how a lot it’s worthwhile to earn at your job.

What Would Occur If They Retired in Eight Years As an alternative?

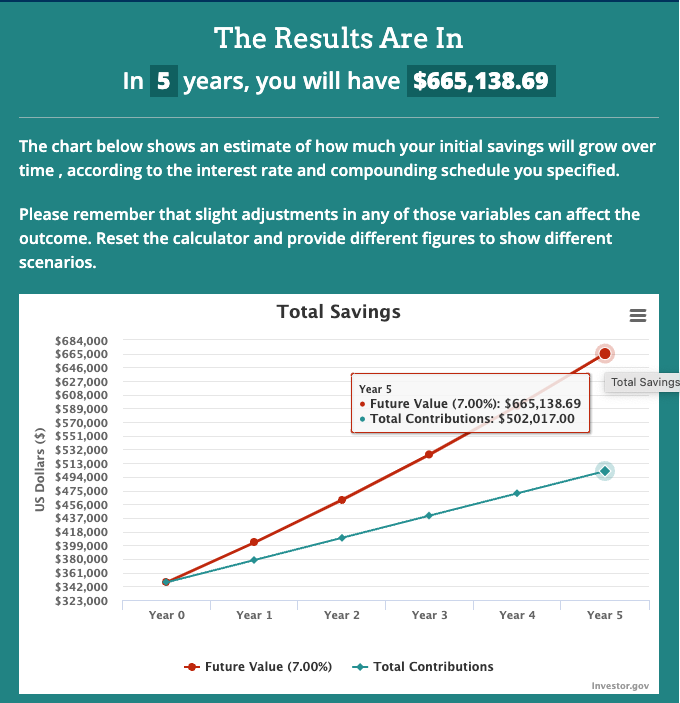

Kat famous that their aim is 5 to eight years, so let’s bump the timeline out three years and see what the calculator says:

With the entire identical variables as above, and three years longer available in the market, the image adjustments dramatically:

4% of $914,086.75 = $36,563.47

This brings Kat and Jay loads nearer to their present spending degree. The problem right here, once more, is that we don’t know what their incomes or the market will do throughout this time interval. Nevertheless, they will make the most of this calculator to find out how they’re progressing in direction of their aim.

Will They Run Out Of Cash Earlier than They Die?

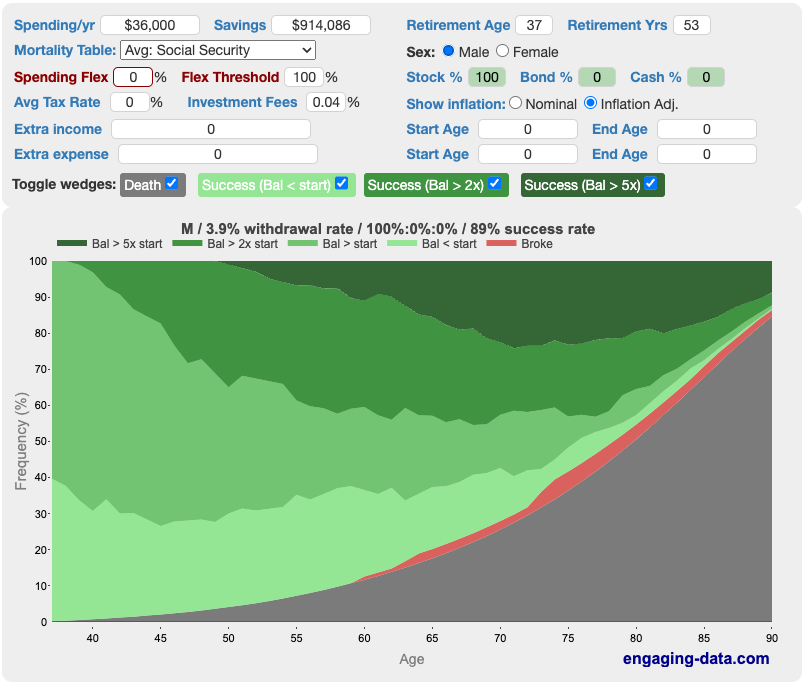

The following query Kat and Jay must reply is whether or not or not they’d run out of cash earlier than they die. To grapple with that, I flip to the Wealthy, Broke or Lifeless? calculator, which units out to reply simply this question:

As we are able to see, if Jay and Kat retired at age 37 and lived to age 90, they’d have an 89% probability of not operating out of cash earlier than they died. I don’t love that success price. I personally am extra comfy with one thing like a 98% – 100% probability of success, however once more, all of that is theoretical and we are able to’t know exactly what’s going to occur.

Social Safety?

One other main variable right here is Social Safety. Kat and Jay don’t know their anticipated Social Safety payout, which may change the above calculation by fairly a bit. In the event that they’d like to do that math on their very own, they will enter their anticipated SS within the above calculator beneath the part “further earnings” together with the age at which they count on to begin taking SS.

Kat and Jay can work out their anticipated Social Safety advantages by following these directions on how one can retrieve their earnings tables from ssa.gov (the federal government’s Social Safety web site).

Can Kat & Jay Attain FI in 5-8 Years?

The ultimate reply is that we don’t know. What we do know is that Kat and Jay are completely on the fitting path for reaching Monetary Independence. They’re doing all the fitting issues by:

The ultimate reply is that we don’t know. What we do know is that Kat and Jay are completely on the fitting path for reaching Monetary Independence. They’re doing all the fitting issues by:

- Sustaining a very good wage

- Maintaining their bills low

- Correctly and aggressively investing the distinction between their earnings and bills

- Avoiding debt

→In the event that they proceed on this path, they are going to ultimately attain Monetary Independence, little doubt about it.

When precisely that will probably be will depend on plenty of variables we don’t know proper now, which I articulated above:

- Jay’s annual wage for the subsequent 5-8 years

- Kat’s annual wage for the subsequent 5-8 years

- What the inventory market will do over the subsequent 5-8 years

- Their post-military stateside annual spending, which may change dramatically relying upon:

- In the event that they’re paying for their very own medical insurance

- The place they determine to calm down

- In the event that they purchase a house

- How a lot their lease/mortgage is within the US

- Inflation

- Their anticipated Social Safety payouts

- In the event that they’d love to do Coast FI or pursue full FIRE

Kat subsequent requested: If we’re not on observe to achieve FI in 5-8 years, what do we have to reduce on to attain this aim?

I refer Kat again to my oversimplification of FIRE math and the 2 levers she and Jay can impression:

I refer Kat again to my oversimplification of FIRE math and the 2 levers she and Jay can impression:

- Earnings

- Bills

If Kat finds a job that works with their life-style, that would definitely velocity up their progress in direction of FI. However, because it stands, in the event that they’re keen to increase their timeline and have Jay work longer, she doesn’t must get a job. It’s actually all about how aggressive they wish to be with these two variables.

If their final precedence is to achieve full FIRE in 5-8 years, then Kat wants to seek out the highest-paying job she will, they each must work as many hours as they are often paid for and they should reduce their spending to the bone.

That’s the acute model and it’s however one possibility. The opposite choices all fall someplace in between. There’s no proper or unsuitable right here, it’s only a query of what they need most:

- Do they need work/life steadiness now and an extended timeline to FI?

- Or, do they wish to work nonstop for the subsequent 5-8 years in an effort to absolutely retire of their 30s?

Kat’s Query #3: What sort of paid work ought to I pursue subsequent? Any solutions for timezone-flexible distant work?

See above: the highest-paying she will discover in the event that they wish to FIRE ASAP. When it comes to distant work, that is definitely a increase time for that. When it comes to which job, I defer to the clever Frugalwoods readers who’ve charted these waters already.

See above: the highest-paying she will discover in the event that they wish to FIRE ASAP. When it comes to distant work, that is definitely a increase time for that. When it comes to which job, I defer to the clever Frugalwoods readers who’ve charted these waters already.

I don’t know precisely what Kat’s work historical past is, however she talked about she’s been a author previously. In my expertise as a contract author for varied magazines and on-line publications, this can be a utterly timezone-flexible job. The consumer doesn’t care what time of day you’re writing at, they only needs the piece delivered by deadline.

Freelance writing doesn’t pay very effectively, however it could possibly be one thing for Kat to discover as an add-on to a different job. Since she doesn’t want the advantages of a full-time place, she may cobble collectively plenty of freelance gigs. That being stated, if she did discover a US-based employer with an identical 401k/403b retirement plan, that would definitely assist with their FIRE math.

At current, Kat will not be eligible to contribute to her personal IRA since she doesn’t have earned earnings; however, she may look into opening a spousal IRA.

Kat’s Query #4: How can Jay and I higher join throughout occasions once we’re on reverse ends of the work/life steadiness spectrum?

It’s so exhausting to really feel at odds along with your partner’s schedule and vitality degree. I’m wondering in the event that they’ve thought-about establishing an evenings/weekends schedule that might allow them to each get what they want from their time collectively?

For instance, possibly Saturday mornings are designated for them to hike along with the understanding that Jay wants Saturday afternoons to decompress and watch a film. Maybe by articulating how they wish to divide up their time they’ll be capable of come to some settlement on what’ll work greatest for every of them.

For instance, possibly Saturday mornings are designated for them to hike along with the understanding that Jay wants Saturday afternoons to decompress and watch a film. Maybe by articulating how they wish to divide up their time they’ll be capable of come to some settlement on what’ll work greatest for every of them.

Moreover, Kat famous that numerous their time collectively is used to arrange for the subsequent week. If she’s not working, I’m wondering if she may think about shifting all of that prep work to through the weekdays when Jay is at work? Laundry, home cleansing, errands, meal prep, and many others may all happen whereas Jay’s at work in order that the weekends are reserved completely at no cost/leisure time collectively.

Abstract

- Maintain doing what you’re doing. You’ll attain FIRE ultimately in case you proceed on this path.

- Decide how essential the 5-8 12 months FIRE timeline is:

- If FIRE-ing ASAP is the precedence, Kat must get a well-paying job, it’s worthwhile to reduce your spending to the bone and shovel cash into your investments.

- If Coast FI in just a few years is interesting, think about what part-time jobs you may each take pleasure in working to cowl your bills.

- There are infinite prospects right here and it’s best to really feel assured that you’ve the idea to assist whichever path you select.

- Check out how a lot money you might have available and be sure that it is smart along with your timeline for leaving the army, shopping for a home, and many others.

- Contemplate shifting all prep/family work to the weekdays to order the weekends at no cost/leisure time.

- Contemplate making a weekend schedule that ensures each of you’re getting what you want out of your downtime collectively.

Okay Frugalwoods nation, what recommendation do you might have for Kat? We’ll each reply to feedback, so please be happy to ask questions!

Would you want your personal Case Examine to look right here on Frugalwoods? Apply to be an on-the-blog Case Examine topic right here. Rent me for a non-public monetary session right here. Schedule an hourlong or 30-minute name with me, refer a good friend to me right here, schedule a free 15-minute name to study extra or e-mail me with questions (liz@frugalwoods.com).

[ad_2]