[ad_1]

(Bloomberg Opinion) — When you’re simply waking as much as the snapback rally in Treasuries, you’ve in all probability missed the enjoyable. Since Oct. 19, 10-year Treasury yields have dropped 82 foundation factors, erasing many of the practically three-month 103-basis-point surge that started with Fitch Rankings’ downgrade of the US and got here to a head with the outbreak of the Israel-Hamas warfare.

That doesn’t imply that the summer time panic was an entire head faux; simply that it was wildly overdone. Confronted with a collection of destructive surprises, bond buyers opted to promote first and ask questions later. Now, mercifully, we’ve entered the sober evaluation stage of the cycle. And my studying of the proof suggests the market as soon as once more has the story proper (for now).

Curiosity Charges

There are nonetheless plenty of excellent questions on what began the selloff within the first place, and it feels useful to start with what it wasn’t: a big realignment of rate of interest expectations.

A really primary mannequin of 10-year Treasury yields assumes they need to mirror common rate of interest expectations over the approaching decade (plus some “time period premium”; extra on that later).

Up to now a number of months, the near-term financial coverage debate has revolved round whether or not or not the Federal Reserve would push charges one other 25 foundation factors larger to a peak vary of 5.5%-5.75% and the way lengthy they’d keep there. On the peak of the hysteria, futures markets implied barely higher than even odds that central bankers would tighten once more. Theoretically, that shouldn’t have moved the needle on the 10-year yield by quite a lot of foundation factors. Fed funds futures present that markets fully priced out that final hike in the midst of November and, as an alternative, now assume about 125 foundation factors in cuts via the tip of 2024.

One other variable, after all, is longer-term coverage fee expectations. The place will charges settle when the inflation struggle is over and the economic system has returned to regular state? For years, Fed policymakers have urged that the long-run steady-state fee was round 2.5%, an estimate that encompasses the idea that inflation will settle round 2% and a “impartial” actual fee of about 0.5% can be acceptable to maintain it there. But when both of these assumptions have been now not appropriate, it might justify a extra everlasting improve in 10-year Treasury yields.

And that certainly often is the case, after all. Some buyers have argued that, amongst different issues, the world is coming into a interval of deglobalization — a shift that began with the populism of former President Donald Trump and was supported by the Covid-19 supply-chain debacles and, in the end, the outbreak of main wars in Europe and the Center East. Because the argument goes, that will make the Fed’s 2% inflation goal more durable to realize.

But it surely’s uncertain the change is wherever as large because the preliminary Treasury transfer urged — not less than in keeping with the measured calculations of main sellers. Eight instances a yr, the New York Fed asks its buying and selling counterparties the place they see coverage charges settling within the longer run. For years, these forecasters usually agreed with the Fed’s evaluation of two.5%, however there was a transparent shift upward within the survey interval that closed in late October to about 2.75%. If the shift in expectations holds and we assume coverage will quickly tread a gradual path again to the larger “regular state,” it might indicate a 10-year yield of round 3.1%.

‘Darkish Matter’

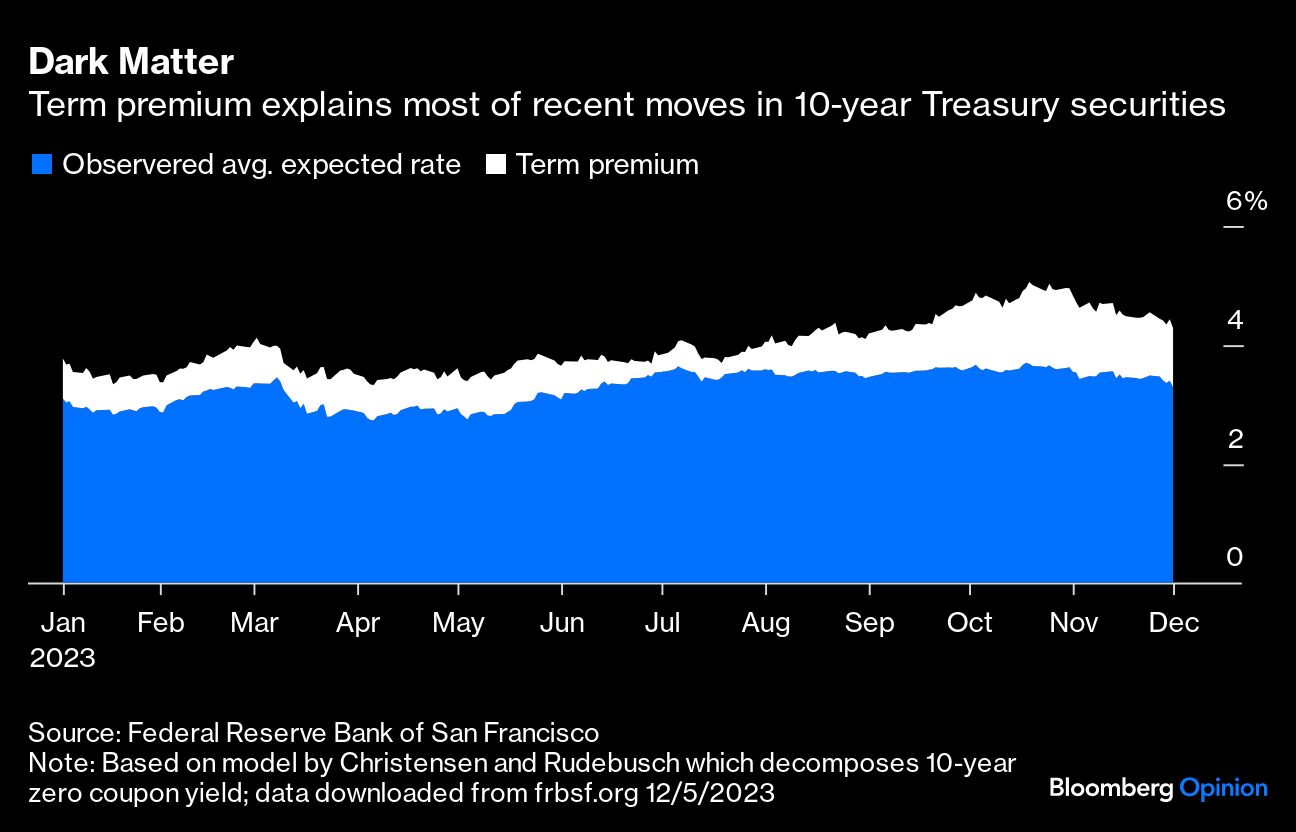

So how can we clarify the extra 106 foundation factors (give or take) that’s baked into prevailing market 10-year yields? That’s the “term-premium” — or as Minneapolis Fed President Neel Kashkari has characterised it, the “darkish matter.”

The time period premium is the plug quantity for every thing within the yield that we will’t clarify. It represents your hopes and goals; or, alternatively, your worries and nightmares — the stuff that sounds too nutty to incorporate in your baseline forecast. It’s itself very exhausting to quantify, and the assorted off-the-shelf estimates of the time period premium are all over. However they typically all agree that the premium moved up by so much from August via October, and has since come again all the way down to a big diploma. And it’s the transfer in time period premium that has largely pushed the general transfer in yields.

Right here is a well-liked Treasury yield decomposition mannequin from Jens H.E. Christensen and Glenn D. Rudebusch that’s revealed by the San Francisco Fed:

Why did the time period premium transfer up? Principally, it was a confluence of things that elevated that all-important concern and uncertainty. Geopolitics was clearly a near-term driver, and market individuals have been proper to fret. As my colleagues in Bloomberg Economics lately described, the wars in Ukraine, Africa and now the Center East have killed greater than 100,000 folks this yr and stand to actual the largest financial value for the reason that finish of World Warfare II.

For all of the very actual human tragedy, it’s all the time been exhausting to say precisely how these occasions would have an effect on the broader world economic system and, subsequently, the long-run rate of interest setting. Some observers could have been scared by the run-up in oil costs after Hamas’s assault on southern Israel, whereas others may need targeted on the notion that spreading navy conflicts risked hastening the transfer towards deglobalization, basically placing the deflationary results of offshoring and vibrant worldwide commerce networks in reverse.

However the preliminary spike in oil costs has been fully worn out, and the deglobalization hyperlink all the time concerned plenty of storytelling and guesswork. In the meantime, the worst-case situation by which the Israel-Gaza battle unfold to contain the US and Iran appears to have light. One quantitative measure of each day geopolitical danger — an index created by Dario Caldara and Matteo Iacoviello — means that market uncertainty has certainly abated.

The opposite piece of the term-premium puzzle is the gaping US funds deficit and the associated glut of debt issuance. The deficit, after all, is clearly a difficulty that fiscal authorities within the US should tackle in the long term, and it has apparent ramifications for bond yields. Understandably, many individuals imagine that credit score danger is a foolish notion within the US, as a result of the federal government controls the world’s reserve forex. It may well print its method out of any pickle. However whether or not you see the deficit as a credit score situation or an inflation situation, it’s clearly nonetheless an issue.

An issue for as we speak? Most likely not. In some unspecified time in the future, the nation must both bump up in opposition to some extraordinary good luck — a stellar run of robust productiveness and financial progress, as an example — or our leaders must transfer to a extra sustainable fiscal trajectory. But the expertise of 1 much more indebted nation — Japan — means that this state of affairs can drag on for a substantial time period.

As unhealthy because the US deficit has regarded in 2023, it has already begun to slender a bit as deferred tax revenues (Californians received a delay as a consequence of winter storms) have are available. Little doubt, the issue would get ugly once more shortly if rates of interest keep larger than financial progress (driving up curiosity bills quicker than tax income), however the gradual normalization of Fed coverage presumably beginning subsequent yr ought to allay these issues.

Many years of latest US historical past present that bondholders usually agree that the US isn’t a credit score danger. Aside from a quick interval within the early Nineteen Eighties, bond yields and time period premia have proven basically no relationship to the scale of the funds deficit. As soon as in a blue moon, a compelling narrative modifications that, as was the case within the early a part of the Reagan administration, when buyers frightened that deliberate tax cuts and spending initiatives have been incorrect for an economic system nonetheless contending with inflation and excessive rates of interest.

In some unspecified time in the future, bond vigilantes could lose endurance once more, promoting securities to protest irresponsible fiscal coverage and forcing change. However the expertise of the previous a number of weeks means that we’re not there but.

So What?

Nobody is aware of what the “proper” time period premium is, after all. A number of fashions put the 20-year-average premium earlier than the Covid-19 pandemic at shut to at least one share level, and that looks as if nearly as good an assumption as any for one thing so inherently unpredictable.

If rates of interest are set to common round 3.1% over the subsequent decade (inclusive of present charges) and the time period premium settles in at round 100 foundation factors, then 4.1% is an affordable guesstimate for the 10-year Treasury yield. At 4.16% on the time of writing, we’re not very far off in any respect. So the times of stock-like complete returns in Treasury markets could also be behind us for some time. That’s the factor with markets pushed by sentiment and tales; should you blink, they depart you within the mud. But when, as an alternative, the market is certainly shifting right into a interval of extra sober evaluation, then boring and predictable could be a welcome growth.

Extra From Bloomberg Opinion:

Need extra Bloomberg Opinion? OPIN

To contact the creator of this story:

Jonathan Levin at [email protected]

[ad_2]