[ad_1]

House costs up 39.9% nationally since COVID’s begin, says PropTrack

New PropTrack report has highlighted the astounding development in residence costs for the reason that pandemic started, with a nationwide surge of 39.9%.

“From fears of sharp falls by means of the pandemic, to predictions of steep declines when rates of interest started to rapidly climb, residence costs have defied the expectations of many,” mentioned Eleanor Creagh (pictured above), senior economist at PropTrack.

This surprising resilience all through this four-year interval has been influenced by components reminiscent of provide, inhabitants development, rental market situations, and rates of interest.

Regional markets outshine capitals

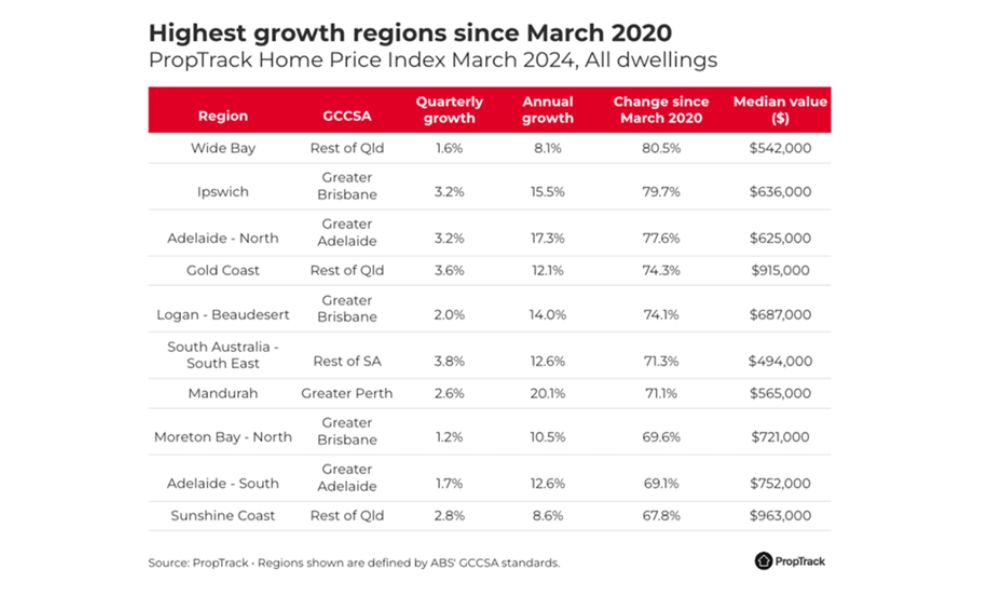

The previous yr noticed capital metropolis markets outperform regional areas, but for the reason that pandemic’s begin, regional residence costs have considerably outperformed their capital metropolis counterparts, besides in WA and NT. Regional Queensland leads the expansion with a 66.5% enhance, demonstrating the continued attraction of those areas.

Shifts in housing preferences

The pandemic precipitated a shift in the direction of smaller family sizes, house, and way of life over proximity to the CBD.

“Closed worldwide borders and extra time at residence precipitated housing preferences to shift,” Creagh mentioned, noting the surge in coastal and regional property costs.

Challenges for first-time consumers

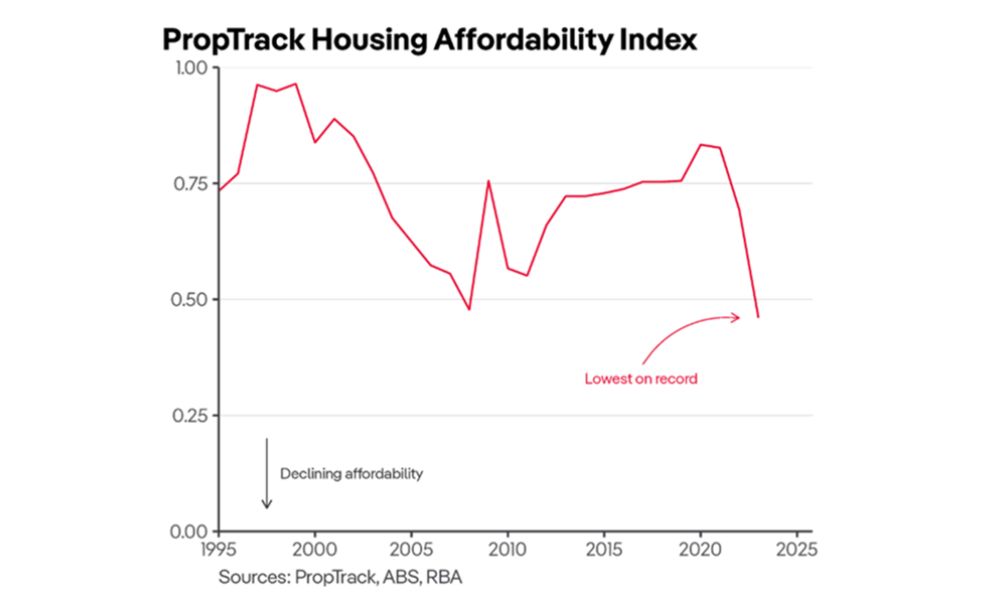

Regardless of the market’s upturn, challenges loom for first-time consumers, notably these with decrease incomes. The numerous value surge over the previous 4 years has exacerbated housing affordability, hitting its worst degree in three many years. Nevertheless, present householders have seen fairness features, cushioning them from the high-interest charge setting.

Housing provide struggles to maintain up

With the inhabitants rising on the quickest tempo in 72 years and internet migration surging, the highlight is on the housing scarcity. The constructing trade faces increased financing prices, materials prices, labour shortages, and an uptick in insolvencies, slowing the supply of latest housing.

“It’s clear we’re not constructing sufficient properties,” Creagh mentioned.

Get the most well liked and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE day by day publication.

Sustain with the most recent information and occasions

Be part of our mailing record, it’s free!

[ad_2]