[ad_1]

In keeping with typical monetary planning, it’s necessary for high-net-worth people to self-insure for long-term care bills. At Commonwealth and Ash Brokerage, our insurance coverage associate, we might agree that whereas there’s some fact to this concept, most purchasers (together with high-net-worth ones) ought to take into account transferring the chance of long-term care. However that is to not say it is proper for each high-net-worth consumer.

The query, then, is how will you decide in case your purchasers ought to self-insure for long-term care? To information you thru this decision-making course of, take into account the next these 5 steps:

-

Take a look at your assumptions.

-

Take into account revenue, not internet value.

-

Set lifelike revenue wants.

-

Focus on the influence on legacy plans.

-

Supply alternate options.

Let’s take a better look.

1) Take a look at Your Assumptions

Defective assumptions may cause loads of hurt. You might assume that each consumer with $1 million in property (or $2 million, $3 million, and so forth) ought to self-insure for long-term care with out first discussing the problem with these purchasers. Or maybe your purchasers assume they’ve greater than sufficient property to self-insure, with out understanding the true price of a long-term care occasion. When you do not test these assumptions, your purchasers could find yourself taking losses that may’t be recouped.

2) Take into account Earnings, Not Internet Value

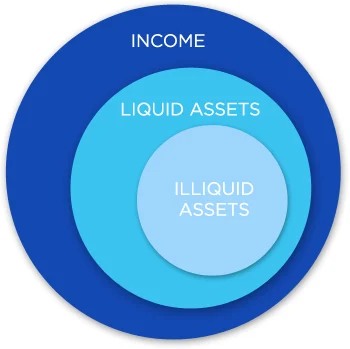

Many people use revenue to pay for long-term care bills, so figuring out whether or not to self-insure ought to be a query of liquidity, not solvency. Though it might sound intuitive to make use of internet value as a gauge for a consumer’s capability to self-insure, revenue is definitely the extra correct indicator.

Now, chances are you’ll be pondering, cannot my purchasers promote property from their portfolios to pay for long-term care? Certainly, they’ll. However liquidating property could be fairly costly, and it will possibly jeopardize their total monetary planning methods.

As family revenue is drained to pay for long-term care bills, purchasers could reallocate liquid property (e.g., brokerage and retirement accounts) to pay for his or her month-to-month wants. After all, these transactions could have penalties, together with tax ramifications and penalties. Plus, with out these property to drive it, your purchasers’ future retirement revenue may take successful as properly.

You also needs to take into account the challenges of changing illiquid property, similar to actual property, into liquid property. It might not be doable for purchasers to liquidate these property, or they might take a considerable loss on the sale or face tax penalties.

3) Set Life like Earnings Wants

Prices for long-term care range relying on the geographic space and the extent of care wanted. In Massachusetts, the common month-to-month nursing dwelling invoice is $12,015, and a few purchasers’ care may complete greater than $13,000 per thirty days. Let us take a look at an instance to assist illustrate this level.

Bob has a month-to-month retirement revenue of $18,000. This revenue helps his and his partner’s life-style, together with their dwelling, actions with household and grandchildren, hobbies, and charities. If Bob wants long-term care companies at a price of $13,000 per thirty days, solely $5,000 stays to help the partner’s life-style.

Bob can not spend an extra $13,000 per thirty days—maybe indefinitely—and nonetheless meet all his different monetary obligations. As such, he ought to take into account different sources of long-term care funding, similar to a long-term care insurance coverage coverage, to cowl a part of the long run prices.

4) Focus on the Affect on Legacy Plans

Most high-net-worth purchasers have a legacy plan, which dictates the place they need their cash to go after they die. In the event that they self-insure for long-term care bills, the legacy plan will undoubtedly be affected. Monies they deliberate for relations or charities will now go to the well being care system. Is that this a suitable state of affairs to your purchasers?

5) Supply Alternate options

A few of your high-net-worth purchasers could resolve that self-insuring is not for them. If so, it is time to consider their different choices.

Conventional long-term care insurance coverage (LTCI). As a consequence of higher-than-expected claims prices, the standard long-term care area has seen a gentle erosion of accessible merchandise and a pointy enhance in pricing for each new and present protection. Lifetime advantages, as soon as an possibility on

most insurance policies, have been changed by a lot shorter profit durations. The monetary dangers of prolonged long-term care occasions can definitely be mitigated with these plans, however now not can they be eradicated. Even well-covered people could need to self-insure to a level.

Life insurance coverage coverage with a long-term care rider. For these purchasers who wish to self-insure for long-term care however do not wish to reposition a big sum of property, life insurance coverage is an efficient various. A life insurance coverage coverage permits for annual premiums fairly than single premiums. Plus, as a result of the coverage is underwritten, the dying advantages are likely to exceed these from linked-benefit merchandise.

Linked-benefit merchandise. These merchandise mix the options of LTCI and common life insurance coverage, making them engaging for purchasers who’re involved about paying premiums after which by no means needing long-term care. By repositioning an present asset, they’ll leverage that cash for long-term care advantages, a dying profit if long-term care isn’t wanted, or each. The policyholder maintains management of the property, releasing up retirement property for different makes use of. Here is an instance of how this may work:

Nicole is a high-net-worth consumer. She’s 65 and married, and he or she beforehand declined LTCI as a result of she feels that she has sufficient cash to self-insure, together with $200,000 in CDs that she calls her “emergency long-term care fund.” You realize, after all, that if she ever wants long-term care, this $200,000 will not go far, and he or she could need to make up the shortfall with different property.

However here’s what Nicole may acquire if she repositions $100,000 to buy a linked-benefit coverage:

-

A dying advantage of $180,000 (revenue tax-free)

-

A complete long-term care fund of $540,000 (leveraging her $100,000 greater than fivefold)

-

A month-to-month long-term care advantage of $7,500 (which might final for at least 72 months)

-

A residual dying advantage of $18,000 if she makes use of her whole long-term care fund

Care coordinators. Many purchasers who want care desire to remain of their houses, however there are a lot of challenges that include organising dwelling care. Each conventional LTCI and linked-benefit insurance coverage present policyholders with care coordinators who might help facilitate this transition. These coordinators supply a really high-level concierge service, which may make a troublesome time rather less disturbing.

Sound Monetary Planning

Serving to purchasers navigate the various challenges of long-term care with empathy is among the most dear companies you possibly can supply, whether or not or not they select to self-insure. LTCI not solely protects property but additionally offers revenue to pay for care, permitting purchasers’ portfolios to proceed supporting their life-style and obligations—and retaining their retirement plans on monitor. Some individuals name LTCI liquidity insurance coverage. I desire to consider it as sound monetary planning.

Editor’s Observe: This publish was initially revealed in March 2019, however we have up to date it to deliver you extra related and well timed data.

[ad_2]