[ad_1]

A reader asks:

What would you advise as a substitute for getting on the “actual property ladder”?

Saving and ready for decrease rates of interest? Or investing out there till you possibly can put down a bigger down cost?

Providing recommendation on the house shopping for course of is even more durable than providing funding recommendation with out extra context. Investing is private however your dwelling scenario has much more idiosyncratic dangers concerned.

The place you reside. The native actual property market. The variety of homes obtainable on the market. Your tastes and preferences for a home. Your monetary scenario. Your price range.

So I’m going to reply this query by way of the lens of what I might do on this scenario. What would I do if I used to be out there for a home proper now?

Everybody is aware of this is likely one of the most difficult markets ever for these attempting to purchase their first dwelling.

It looks as if everyone seems to be priced out of the market proper now however greater than one-third of all consumers over the previous yr had been first-time homebuyers.

Exercise within the housing sector is down however there are nonetheless hundreds of thousands of homes altering arms this yr.

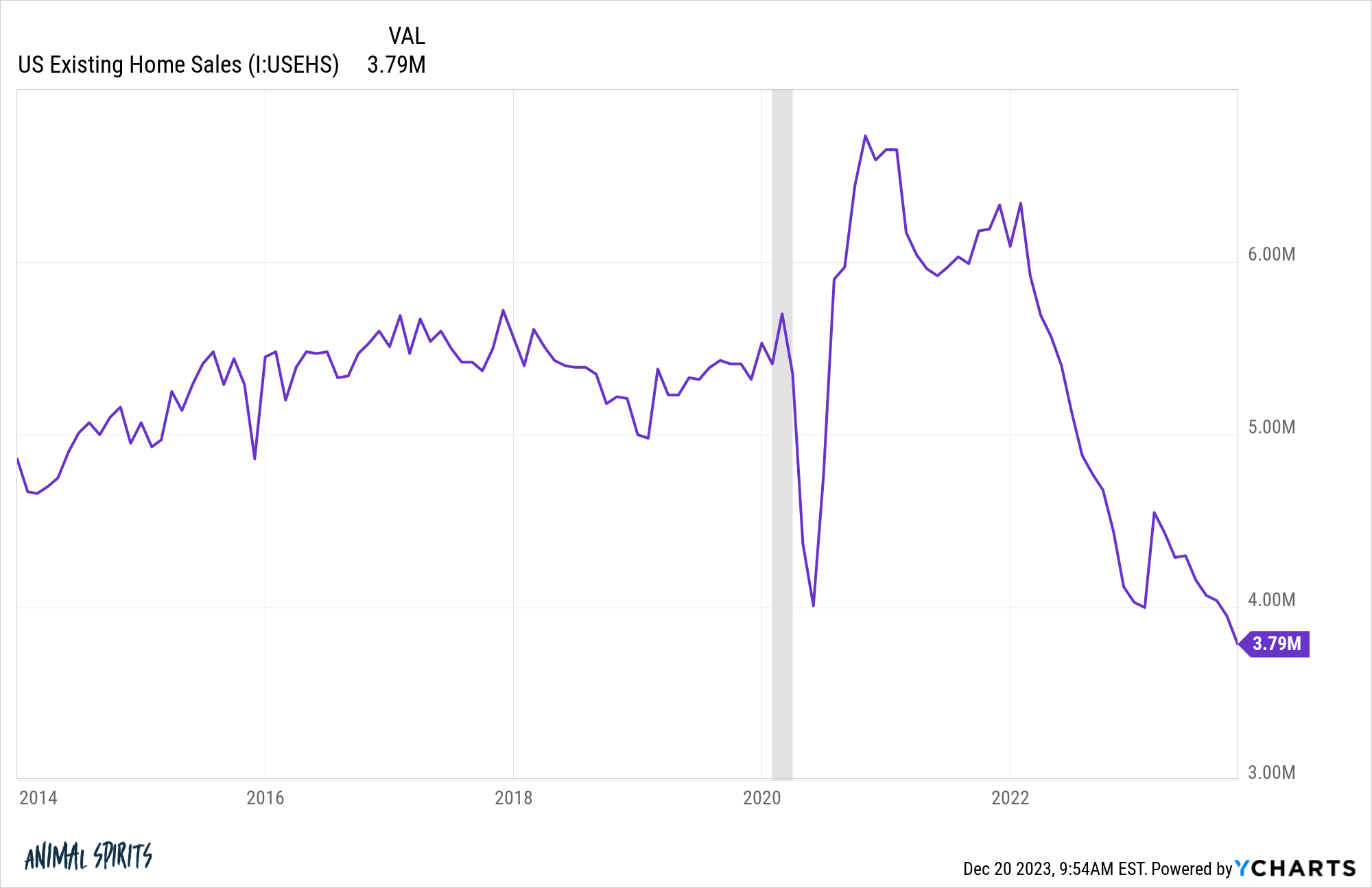

Current dwelling gross sales have been crashing:

The one time current dwelling gross sales had been decrease this century was on the depths of the 2008 monetary disaster.

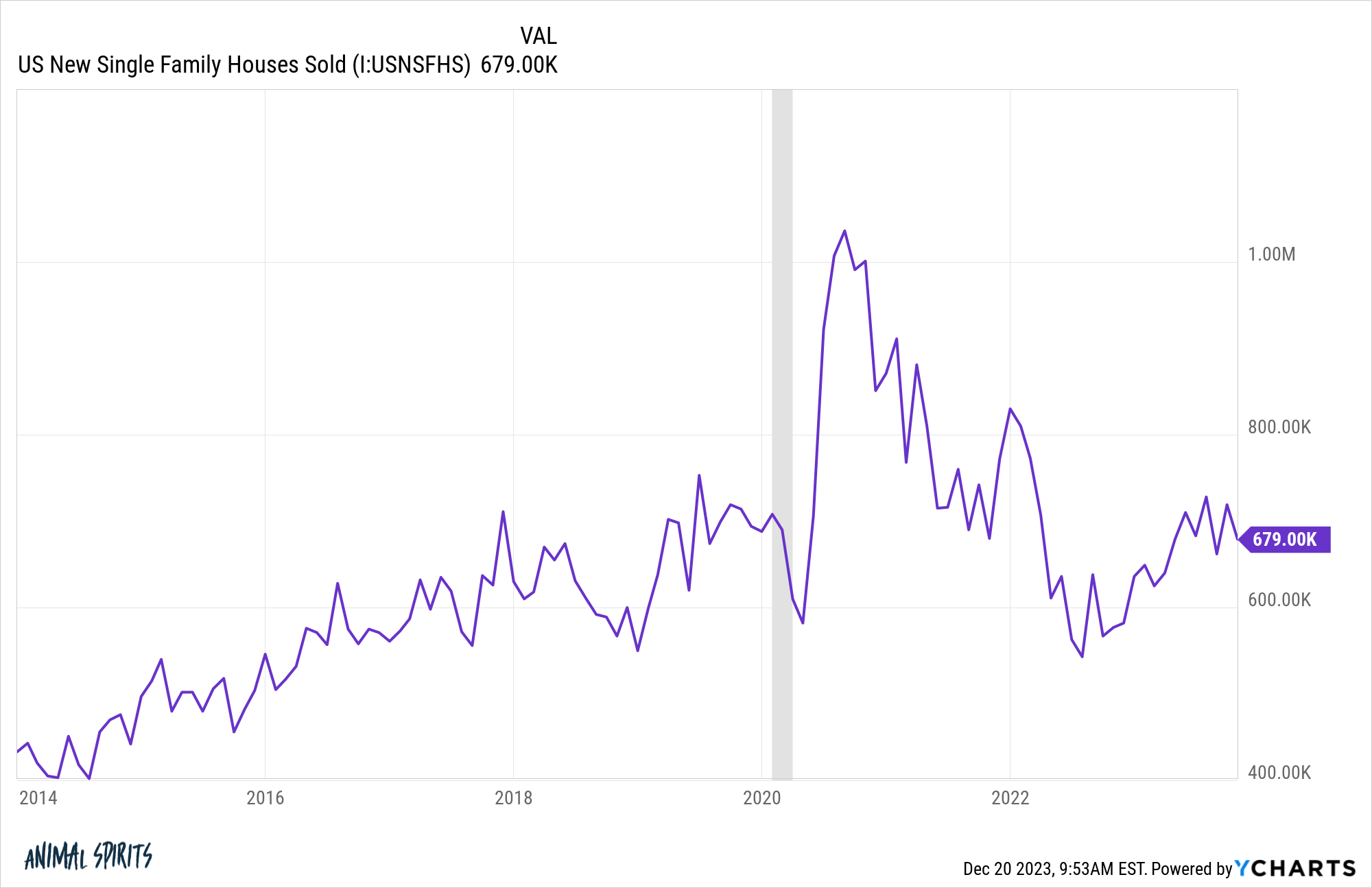

Now have a look at new dwelling gross sales:

They’ve been rising over the course of this yr regardless of mortgage charges hitting 8%.

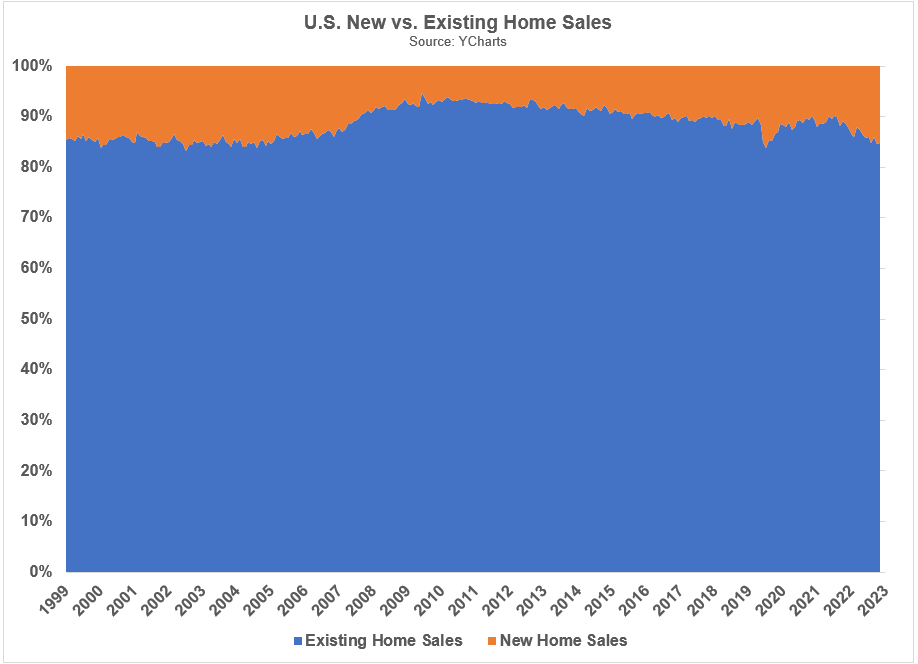

Right here is the breakdown of latest versus current dwelling gross sales on a relative foundation for the reason that begin of the twenty first century:

Throughout the housing increase of the 2000s, 15-16% of all gross sales had been new properties. After the housing bubble popped and the 2008 monetary disaster set in, new dwelling gross sales crashed to a low of simply 5% of whole gross sales by 2010.

New dwelling gross sales slowly however absolutely gained market share all through the 2010s, however we’ve seen a breakout up to now 2-3 years again as much as 15% of whole gross sales.

Why is that this the case in a world of upper inflation and mortgage charges?

Homebuilders personal the land. They’re not simply going to sit down on it like a home-owner with a 3% mortgage fee locked in. They’re incentivized to promote.

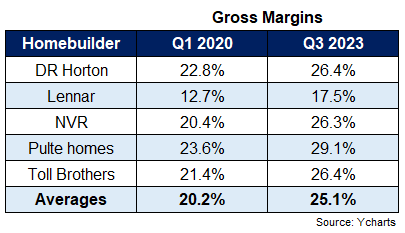

Surprisingly, margins for homebuilders have improved this cycle. Take a look at the gross margins for the most important publicly traded homebuilder shares from the beginning of the pandemic to now:

Margins elevated 25% throughout the board, on common, through the highest inflation we’ve seen in 4 many years.

Provide chain issues induced enter prices to rise, so builders countered that by elevating costs. However now that enter prices like the value of lumber have come again to earth, homebuilders aren’t reducing costs.

However they’re serving to consumers by shopping for down mortgage charges for them.

Right here’s a deal I discovered on the Pulte Houses web site:

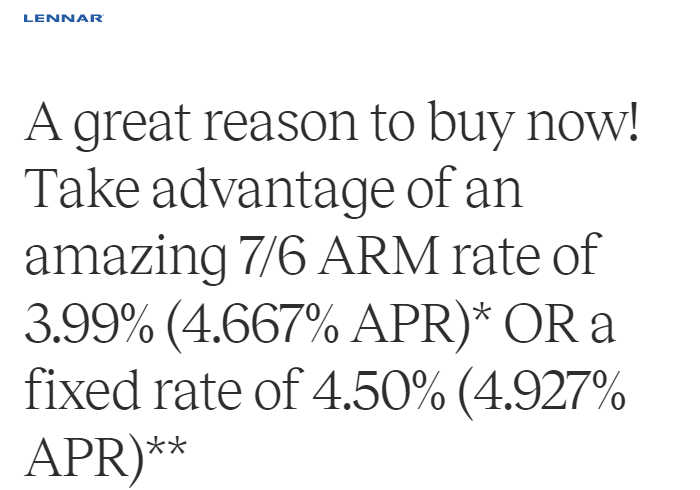

And a good higher one for Lennar:

And a good higher one for Lennar:

Homebuilders don’t prefer to decrease costs as a result of it may anger consumers who’re already locked in the next worth. However they will cross alongside financial savings by shopping for down mortgage charges to extra affordable ranges.

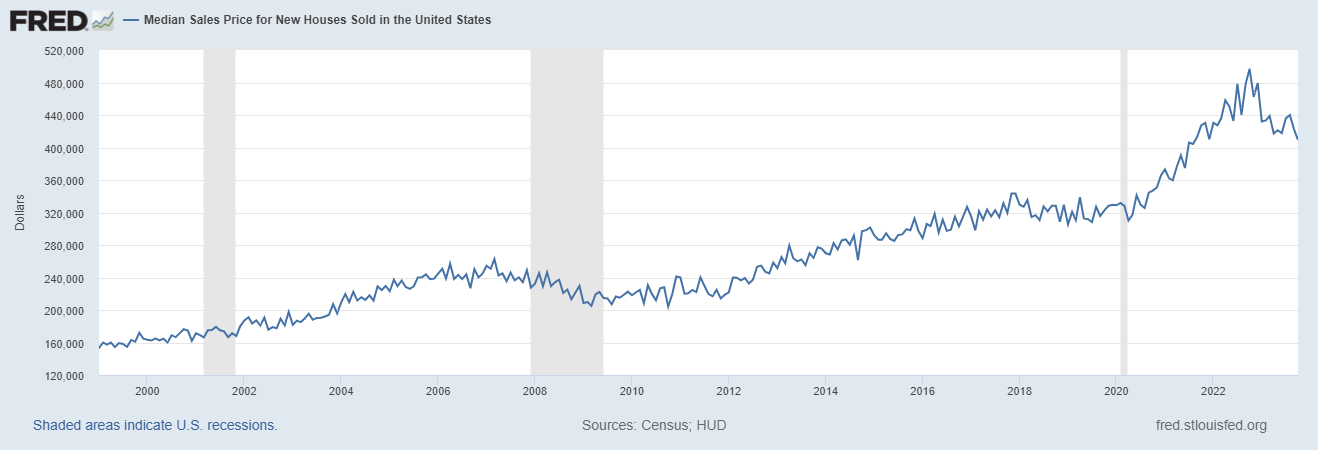

There’s one other profit to the rise in new dwelling gross sales. Take a look at the median worth of latest properties offered:

It’s fallen from a excessive of almost $500,000 to $409,000. How is that attainable if housing costs are at all-time highs?

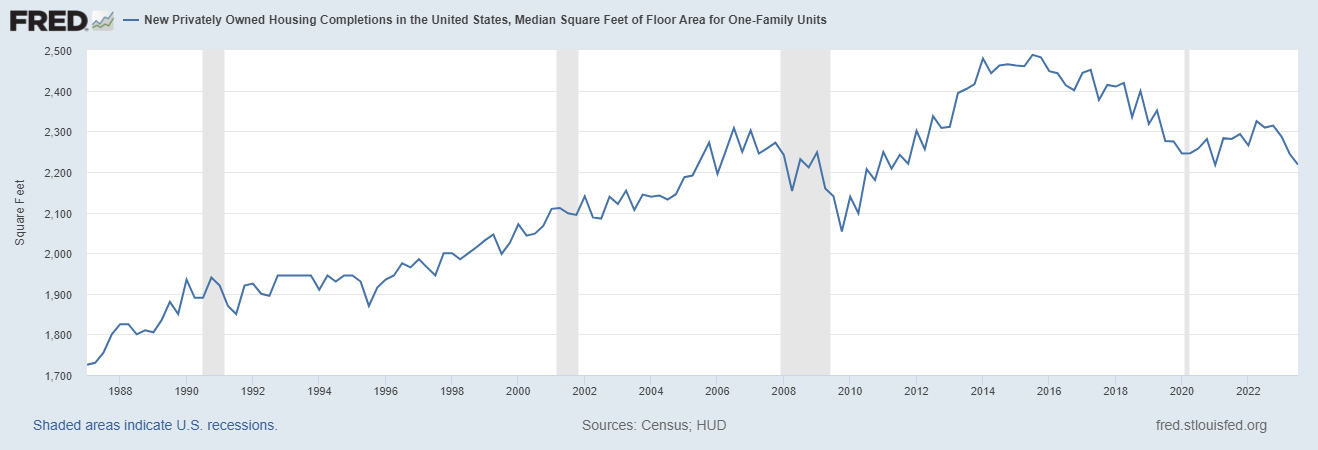

Effectively, it’s not that new dwelling costs are crashing; it’s that builders are establishing smaller homes:

This can be a good factor!

Builders are literally making extra new starter properties.

The low provide within the current housing market means it’s going to be troublesome to seek out what you’re searching for. Demand nonetheless exceeds provide within the housing market. If mortgage charges fall farther from right here, my guess is demand will are available in even stronger than provide. That would imply extra bidding wars in sure areas.

If I had been out there for a home I might skip the present dwelling market altogether and construct.

You may get a decrease mortgage fee and construct a home to suit your wants and needs.

Anecdotally, I’m seeing new properties go up in each nook and cranny they will discover land the place I stay. That wasn’t the case final decade.

I’ve gone by way of the constructing course of a number of occasions. There are professionals and cons to going by way of a builder versus shopping for an current dwelling.

Professionals embrace:

- You get a brand new home the place you get to choose all the pieces out. Which means new all the pieces so decrease upkeep prices going ahead.

- No bidding wars. No back-and-forth haggling with realtors and residential sellers who’ve an inflated view of their dwelling’s worth.

- You possibly can get a decrease mortgage fee (that is in all probability extra true with the nationwide builders slightly than the native builders).

- You get a while to determine all the pieces out whereas the home is being constructed. There’s no rush to maneuver immediately.

Cons embrace:

- The fee will possible be larger than you suppose with add-ons and such.

- The variety of selections it’s a must to make may be overwhelming. Cupboards and counter tops are enjoyable however how about grout shade? Trim? Doorknobs? Cupboard handles? It’s loads in the event you’ve by no means been by way of the method.

- It might probably take longer than you suppose. You’re sure to get delays due to provides, inspections, labor shortages, and so on. This isn’t a quick course of. It’s a must to be affected person.

- You possibly can’t get right into a home immediately.

- There may not be land obtainable the place you need to stay.

Like most monetary selections, this one entails trade-offs.

My largest lesson from these previous few years of craziness in housing is don’t to attempt to time this market.

There have been individuals who had been fearful about costs going up 20% in 2020 or 2021 who needed to attend for a ten% pullback that by no means occurred. Then they missed 3% mortgage charges.

When you can’t afford it, you possibly can all the time save for an even bigger down cost or maintain renting.

However if you wish to purchase a home and you’ll afford it, go for it.

Don’t attempt to time the housing market.

And perhaps look to construct if you wish to keep away from competitors on such a big buy.

We coated this query on the most recent version of Ask the Compound:

Taylor Hollis joined me once more this week to debate questions on bond losses, diversifying your inventory market publicity, the precise inquiries to ask your monetary advisor, and the way to consider municipal bonds in a portfolio.

Additional Studying:

How Demographics Are Shaping the Housing Market

[ad_2]