[ad_1]

Fb thrives—the remainder of tech, not a lot

Whereas all 4 of the tech titans that introduced quarterly earnings this week managed to beat their predicted earnings and income targets, solely Fb introduced earnings that actually bought traders excited.

Massive tech earnings highlights

All numbers beneath are in U.S. foreign money.

- Microsoft (MSFT/NASDAQ): Earnings per share of $2.93 (versus anticipated of $2.78) and revenues of $62.02 billion (versus $61.12 billion predicted).

- Alphabet (GOOGL/NASDAQ): Earnings per share of $1.64 (versus anticipated of $1.59) and revenues of $86.31 billion (versus $85.33 billion predicted).

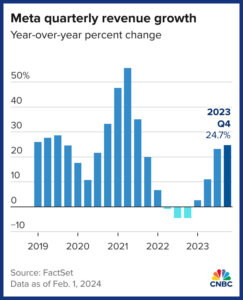

- Meta (META/NASDAQ): Earnings per share of $5.33 (versus $4.96 predicted) and revenues of $40.1 billion (versus $39.18 billion predicted).

- Apple (AAPL/NASDAQ): Earnings per share of $2.18 (versus $2.10 predicted) and income of $119.58 billion (versus $117.91 billion predicted).

With Meta, sometimes called Fb, asserting wonderful advert income development, decreased bills, and even introducing its first-ever dividend ($0.50 a share), it was no shock to see share costs pop in after-hours buying and selling on Thursday. That mentioned, the 14% surge (on prime of a 12% year-to-date achieve) caps off an unimaginable run for Fb that has seen the share worth quadruple since November 2022. This excellent news comes regardless of the digital actuality unit at Fb dropping $4.65 billion this quarter (which is about what your entire firm of Air Canada is price as a comparability).

When Microsoft and Alphabet launched earnings on Tuesday, it was puzzling to see the strong earnings outcomes result in substantial drops in share costs for each corporations. This worth motion was probably resulting from sky-high expectations that led to outsized worth run-ups in 2023 and the primary month of 2024.

Contemplating that greater image is necessary, as Microsoft continues to be up over 7% yr up to now, and Google (regardless of an 8% loss on Wednesday) is up practically 2% to date in 2024.

Each Google and Microsoft introduced that their cloud computing companies had been massive development vectors, and that layoffs had been within the works within the title of cost-cutting and effectivity.

Apple had comparable earnings outcomes to Google and Microsoft, as they beat their earnings projections however share costs had been down 4% in after hours buying and selling on Thursday, as a number of purple flags had been obvious of their quarterly earnings numbers. Most notably, a 13% gross sales lower in China, and decreased income steering for iPhones going ahead. The inventory is principally flat year-to-date.

CP and Brookfield preserve a gradual hand on the revenue tiller

On our aspect of the border this week, the notable earnings calls included Brookfield Infrastructure and CP Rail.

Canadian earnings highlights

All figures in Canadian {dollars}, except in any other case acknowledged.

- Brookfield Infrastructure Corp (BIP/TSX): Earnings per share got here in at a lack of USD$0.20 (versus optimistic USD$0.11 predicted) and revenues had been USD$4.97 billion (versus USD$2.03 billion predicted).

- Canadian Pacific Kansas Metropolis Ltd. (CP/TSX): Earnings per share got here in at $1.18 (versus $1.12 predicted) and revenues had been $3.78 billion (versus $3.68 billion predicted).

Earlier than you get too frightened about these wonky outcomes from Brookfield, remember the fact that their reported numbers are sometimes fairly difficult to make sense out of resulting from their distinctive company construction and accounting practices. On condition that the huge infrastructure conglomerate is commonly shopping for and promoting massive utilities, its quarterly numbers can look deceptive. On this occasion, the market took the information in stride, as BIP was up over 1% on the day.

[ad_2]