[ad_1]

With a rising gender hole in monetary inclusion in Bangladesh, it’s crucial to grasp the behavioral limitations ladies face when participating with digital monetary companies. Passive account openings, restricted use circumstances, the function of money and lack of differentiation are contributors to low utilization, stopping ladies from being financially included and monetary service suppliers from untapping the super market alternative ladies have in Bangladesh.

In keeping with the World Findex, the share of cellular cash accounts has jumped from three % in 2014 to 21 % in in 2017 in Bangladesh. On the similar time, the gender hole in account possession has widened—from 9 % in 2014, to 29 % in 2017, representing a disturbing pattern affecting the progress of ladies’s monetary inclusion in Bangladesh. Moreover, a overwhelming majority of ladies who do have accounts are utilizing them much less often than males.

Girls’s World Banking is aware of that ladies in Bangladesh will be promising digital monetary companies (DFS) prospects, however the query is: Precisely how will digital monetary companies work for girls in Bangladesh?

The plain reply is to design options primarily based on deep understanding of ladies purchasers in Bangladesh. Establishing the fitting partnerships, conducting qualitative and quantitative analysis on the bottom to raised perceive the monetary wants and limitations that ladies face are essential to opening up the market alternative to serve the 41.3 million un- and under-banked Bangladeshi ladies.

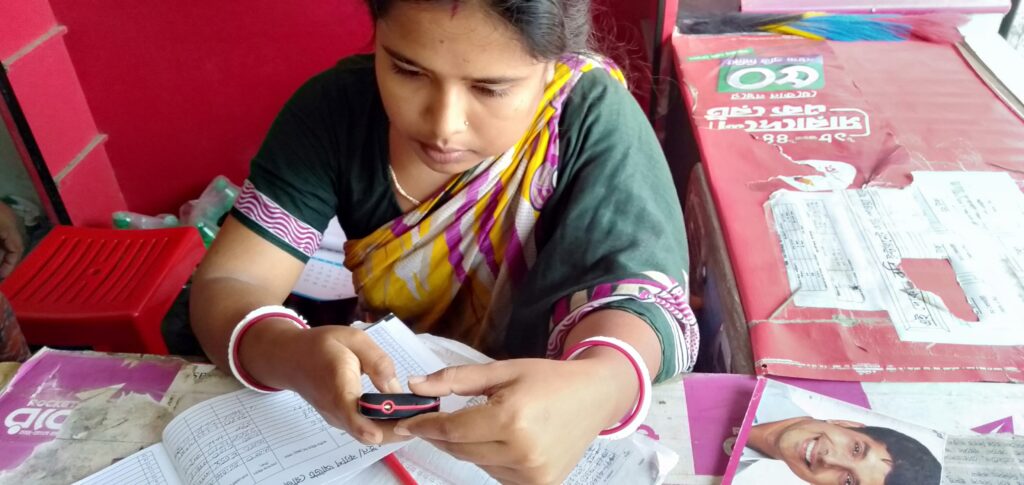

As one of many largest cellular cash suppliers in Bangladesh, Dutch Bangla Financial institution (DBBL) has monumental potential to drive monetary inclusion for girls by means of its cellular cash account providing, Rocket. Rocket supplies monetary companies by providing cash-in, money out, service provider cost, utility cost, wage disbursement, international remittance, authorities allowance disbursement, and ATM withdrawal by way of cellular gadgets.

Girls’s World Banking has partnered with MetLife and DBBL to raised perceive the monetary behaviors and experiences of DBBL Rocket’s ladies prospects. These findings will inform the design course of and be certain that any options created to fulfill the wants of ladies Rocket prospects and additional their monetary engagement.

Information helps us higher perceive low utilization of DBBL Rocket by ladies prospects

Preliminary information evaluation concluded that though DBBL Rocket has a big buyer base, its prospects are predominately inactive, with solely a 23 % exercise price as in comparison with the trade benchmark of 30 %. It additionally revealed that DBBL Rocket’s transaction varieties—cash-in/out, disbursement, P2P, airtime top-up, invoice cost, and service provider cost—have been all under the trade benchmark.

Girls’s World Banking performed qualitative behavioral buyer analysis to raised perceive DBBL Rocket’s prospects’ habits and interactions with their cellular cash account.

Utilizing Girls’s World Banking’s proprietary Girls-Centered Design analysis methodology 4 key behavioral limitations emerged from Rocket’s ladies prospects when deciding learn how to use their account:

- Rocket will not be an energetic selection

Throughout all buyer segments, prospects didn’t select to open their accounts. As an alternative, accounts have been opened for them: employers open the accounts for girls who use the account for wage disbursement; faculties open accounts for girls who obtain authorities stipends; and for different accounts that fall right into a “normal” class, household and pals usually open the account for girls to be able to facilitate a transaction. This passive relationship with the product makes prospects much less seemingly to make use of it. - Utilization is pushed predominately by cash-out

The shopper’s most important use of the account is pushed by cashing-out. Girls don’t see the account for some other functions than receiving and getting their cash. - Money continues to be king

The way in which which prospects are finishing up their monetary transactions continues to be pushed by money. - Lack of differentiation

If prospects use Rocket, they’re utilizing it interchangeably alongside its competitor. They don’t see the distinction between merchandise.

Girls-centered design will deepen engagement to be able to drive transactions

Girls have the potential to develop into complicated, multi-case customers of DBBL Rocket, given the fitting alternatives and assets.

So as to drive account utilization, the crew’s work will give attention to lowering the cash-out price, whereas concurrently rising and creating alternatives for girls to make use of their accounts. By making these alternatives salient to ladies prospects, Rocket can start to introduce and create new use circumstances, similar to financial savings.

Girls’s World Banking will use an iterative Girls-Centered Design course of with co-creation methods to take these insights and remodel them into commercially viable and customer-centric designs that work for the ladies prospects and for DBBL. This method varieties a central a part of Girls’s World Banking’s technique to handle the deepening gender hole in Bangladesh.

Girls’s World Banking’s work with DBBL is generously supported by the MetLife Basis.

[ad_2]