[ad_1]

(Bloomberg Opinion) — Investor worries about market focus aren’t going away, and it’s straightforward to know why: the so-called Magnificent Seven mega-cap progress shares now represent about 29% of the S&P 500 Index by market weighting, eliciting ominous comparisons to the height of the dot-com bubble. Index traders merely have too many eggs in too few baskets, the pondering goes. They usually’re pricy baskets, in addition!

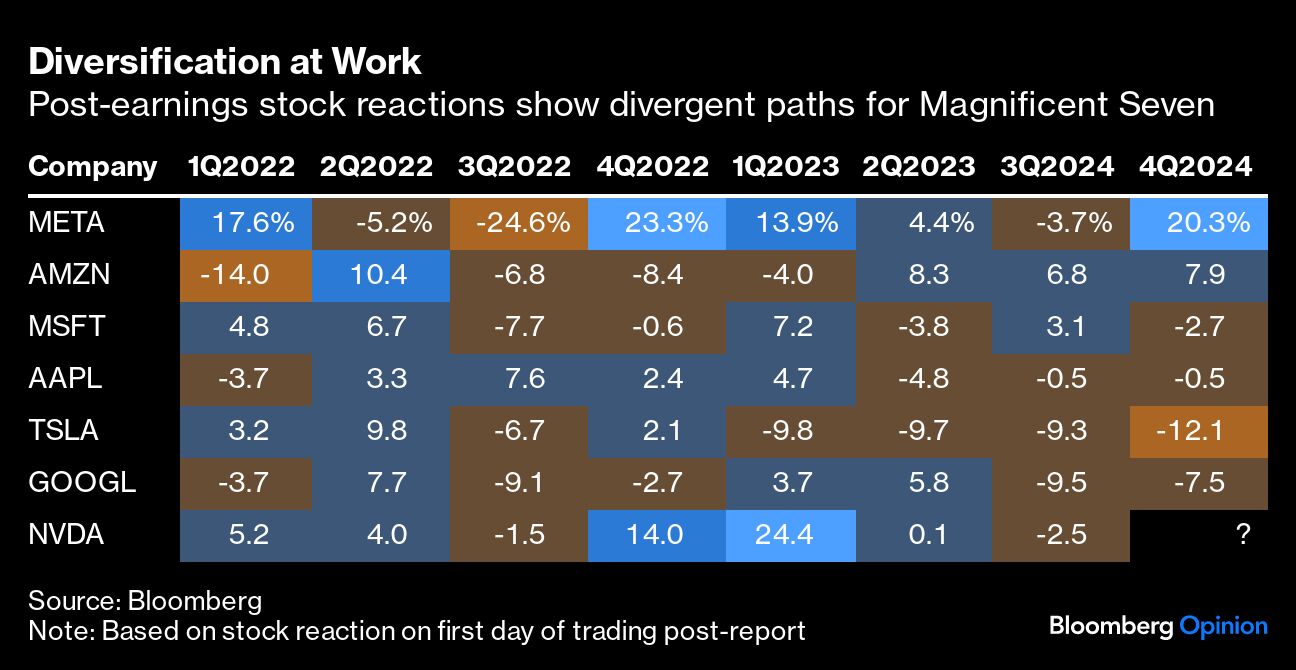

The most recent spherical of earnings might allay a few of these issues. Not solely have the Magnificent Seven carried out moderately effectively on the entire, however they’ve completed so whereas performing in another way from each other. That’s the facility of diversification at work! Right here’s how their shares reacted to earnings bulletins in current weeks:

- Meta Platforms Inc.: +20.3%

- Amazon.com Inc.: +7.9%

- Apple Inc.: -0.5%.

- Microsoft Corp.: -2.7%.

- Alphabet Inc.: -7.5%.

- Tesla Inc.: -12.1%

- Nvidia Corp.: ?

Any such earnings season is extra typical than not. Because the chart under exhibits, the Magnificent Seven are likely to take turns at exceeding investor expectations, an illustration of how completely different their companies are with income streams spanning promoting, cloud computing, e-commerce, {hardware}, automobiles and semiconductors, amongst different issues. Clearly, they’d all be systemically susceptible to, say, a crippling recession or a surge in authorities borrowing prices (extra on yields later), however these aren’t most individuals’s base-case eventualities.

As excessive as the present focus could also be, the US inventory market has all the time been considerably top-heavy. Firstly of the twentieth century, the market was mainly dominated by railroad shares; within the early Eighties, power corporations held outsize sway; and on the flip of the millennium, the market was largely dominated by Web and computing-adjacent corporations. Market dominance is a continuing function of the American system, as is turnover within the corporations and sectors on the high. Some day, a brand new crop of leaders will change lots of the Magnificent Seven, however I’m skeptical about anybody’s capacity to name the flip. In the meantime, I take a level of consolation from a number of locations.

First, there’s actual progress behind the businesses’ booming market capitalizations. In accordance with Goldman Sachs Group Inc. estimates, the Magnificent Seven elevated gross sales by 14% within the fourth quarter to $523 billion amid increasing revenue margins, whereas the remainder of the index noticed simply 2% progress and contracting margins. The shares commerce at a lot richer valuations than their S&P 500 friends, however they’re not essentially getting very pricy relative to their very own buying and selling histories. Right here’s how Goldman researchers, led by Chief US Fairness Strategist David Kostin, put it in a observe Friday (emphasis mine):

Enhancing fundamentals, slightly than valuation enlargement, have pushed the majority of the group’s efficiency since 2019… Since December 2019, the Magnificent Seven shares collectively delivered a 28% annualized return. Roughly 27 [percentage points] of the annualized return is attributable to earnings progress (21 pp gross sales progress and 6 pp margin enlargement) with just one [percentage point] as a result of a number of enlargement. In distinction, earnings drove solely 13 [percentage points] of the S&P 500’s 17% annualized return since 2019.

In accordance with Kostin, the seven corporations are anticipated to broaden gross sales at a 12% compound annual progress fee over the subsequent three years, versus 3% for the remainder of the index, and revenue margins are anticipated to broaden by 256 foundation factors (versus 44 foundation factors for all different shares.) To additional put the outperformance into context: it’s coming at a time when solely about 57% of S&P 500 corporations which have reported thus far are rising their earnings in any respect, in line with Bloomberg knowledge.

Whereas price-earnings multiples for the Magnificent Seven do draw some parallels to the dot-com-era behemoths, Kostin notes that in the present day’s multiples are available in an surroundings of comparatively decrease bond yields: the 10-year Treasury observe yields about 4.16%, in contrast with a mean of 6.32% within the first half of 2000. Definitely, the sustainability of these valuations depends upon the sturdiness of the expansion story, however current expertise means that the seven disparate narratives are unlikely to break down suddenly.

In the meantime, there’s a energetic debate underway concerning the path of bond yields, however no mainstream forecasters see them returning to ranges seen within the early 2000s anytime quickly — and in the event that they did, few monetary property can be secure.

Second, market giants aren’t essentially terrible long-term investments on common — even should you purchase them on the peak. Take for instance the heavy hitters of the dot-com bubble. Clearly, corporations together with Microsoft (-61%), Cisco Programs Inc. (-88%), Common Electrical Co. (-57%) and Intel Corp. (-81%) carried out very poorly through the preliminary bust. However in the long term, the “Magnificent Seven of March 2000” have hung round. 5 are important underperformers, after all, however Microsoft has completed so effectively that it has carried the group. When you’d gone lengthy a basket of the highest seven shares on the peak on March 23, 2000, you’d nonetheless have quadrupled your cash. The S&P 500 quintupled within the interval, nevertheless it’s not the worst final result.

When you had a crystal ball, you’ll have offered the mega-cap giants in March 2000 and acquired again Microsoft and the brand new crop of leaders at their lows. However most of us don’t have that degree of foresight. In actuality, the controversy comes right down to a extra nuanced query about weightings: ought to long-run traders proceed to dollar-cost-average into concentrated market-cap-weighted indexes, or as an alternative discover equal-weighting?

It’s usually prompt that market-cap-weighted indexes are like momentum methods: in the end, they find yourself overweighting corporations which have not too long ago carried out effectively and underweighting those who have completed much less effectively. For these very causes, current historical past has favored market-cap weighting, however within the longer-run there have been intervals when equal weighting has completed higher.

- Within the Nineteen Nineties: market-cap weighting gained: +432% versus 224%.

- Within the 2000s: equal-weighting gained: +40% versus -9%.

- Within the 2010s: market-cap weighting gained by a hair: +256% versus +255%.

- Within the 2020s: market-cap weighting is pulling forward once more: +64% versus +48%

Briefly, completely different time horizons produce completely different conclusions, and each indexes have delivered moderately spectacular long-run returns. So, if market focus retains you up — greater than the worry of lacking out on probably juicy returns — then equal weighting could also be a superbly defensible treatment. However whereas historical past exhibits that empires rise and fall, there’s nothing apparent within the newest spherical of earnings that screams that this one is in its remaining days.

Extra From Bloomberg Opinion:

Need extra Bloomberg Opinion? OPIN

To contact the creator of this story:

Jonathan Levin at [email protected]

[ad_2]