[ad_1]

By Marina Dimova, Managing Director of Design and Innovation, Ladies’s World Banking and Julia Arnold, Senior Analysis Director, Ladies’s Monetary Inclusion, Middle for Monetary Inclusion

Knowledgeable and empowered women and men make fewer dangerous monetary selections than these with much less data. And for a low-income lady, having the precise data – like realizing when to borrow towards her financial savings or separating enterprise bills from family ones – could make a long-term distinction.

Digital monetary instruments are rising in significance as know-how turns into extra ubiquitous, accessible, and linked. But, the arrival of digital monetary companies (DFS) has surfaced distinctive challenges for low-income girls prospects. Throughout low- and middle-income international locations, girls are eight % much less probably than males to personal a cell phone, and 20 % much less probably to make use of the web on a cellular machine. This leaves girls fewer avenues to be taught digital monetary abilities.

Digital monetary companies will not be a silver bullet for monetary inclusion, however they’re the course through which the trade goes. Monetary functionality should evolve to incorporate digital monetary functionality (DFC), so low-income girls will not be left additional behind. Digital monetary functionality is a crucial part of the digital transformation journey, because it ensures that ladies prospects can use digital monetary companies with ease and confidence.

The shift from analog to digital tends to be seen as a simple transformation, swapping out one for the opposite. This assumption ignores the a number of boundaries which will impede the uptake of digital monetary companies and dangers additional excluding girls, oral communities, and others from the formal monetary system. It additionally results in a grave underestimation of the position of digital functionality and digital monetary functionality, amongst different components, in shaping monetary functionality. We imagine that digital monetary functionality can bridge that hole and supply sensible instruments to assist low-income girls successfully use digital monetary companies.

New Maxims to Information Efficient Digital Monetary Functionality Applications

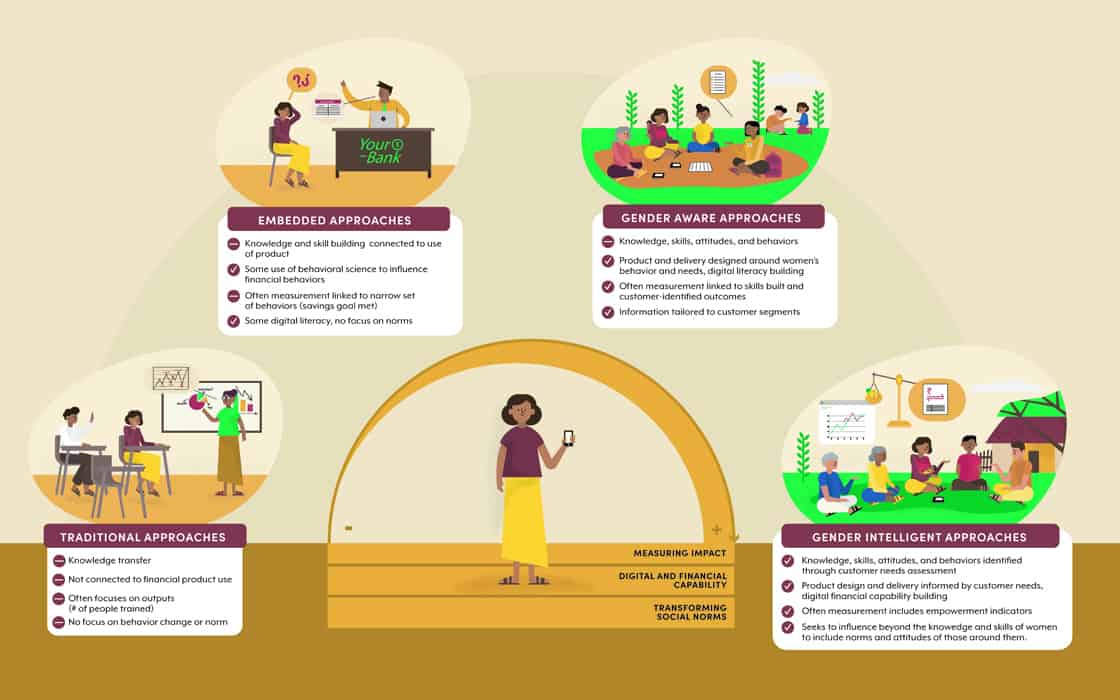

In the identical manner because the dialog on monetary literacy shifted to the extra action-oriented idea of economic functionality, we imagine that the digital monetary functionality dialog must transition to sensible instruments to assist prospects achieve the data, attitudes, and abilities to successfully use digital monetary companies. Upcoming analysis by CFI has recognized that conventional monetary literacy approaches had been ineffective, whereas social norms significantly impacted girls, who had been ranging from decrease academic ranges. Subsequently, the analysis discovered, peer and position mannequin studying was crucial in constructing digital functionality as a result of girls didn’t see themselves as digital monetary companies purchasers, and wanted to construct a level of confidence and belief with the channel earlier than totally partaking. In the meantime, constructing flexibility within the type of check and be taught approaches helped suppliers adapt to a lady’s contexts, like time constraints and steady studying alternatives via low-tech touchpoints (video, SMS, chatbot for instance). Lastly, sex-disaggregated information is crucial to measuring totally different impacts between women and men.

A Framework for Creating Efficient Digital Monetary Functionality Applications

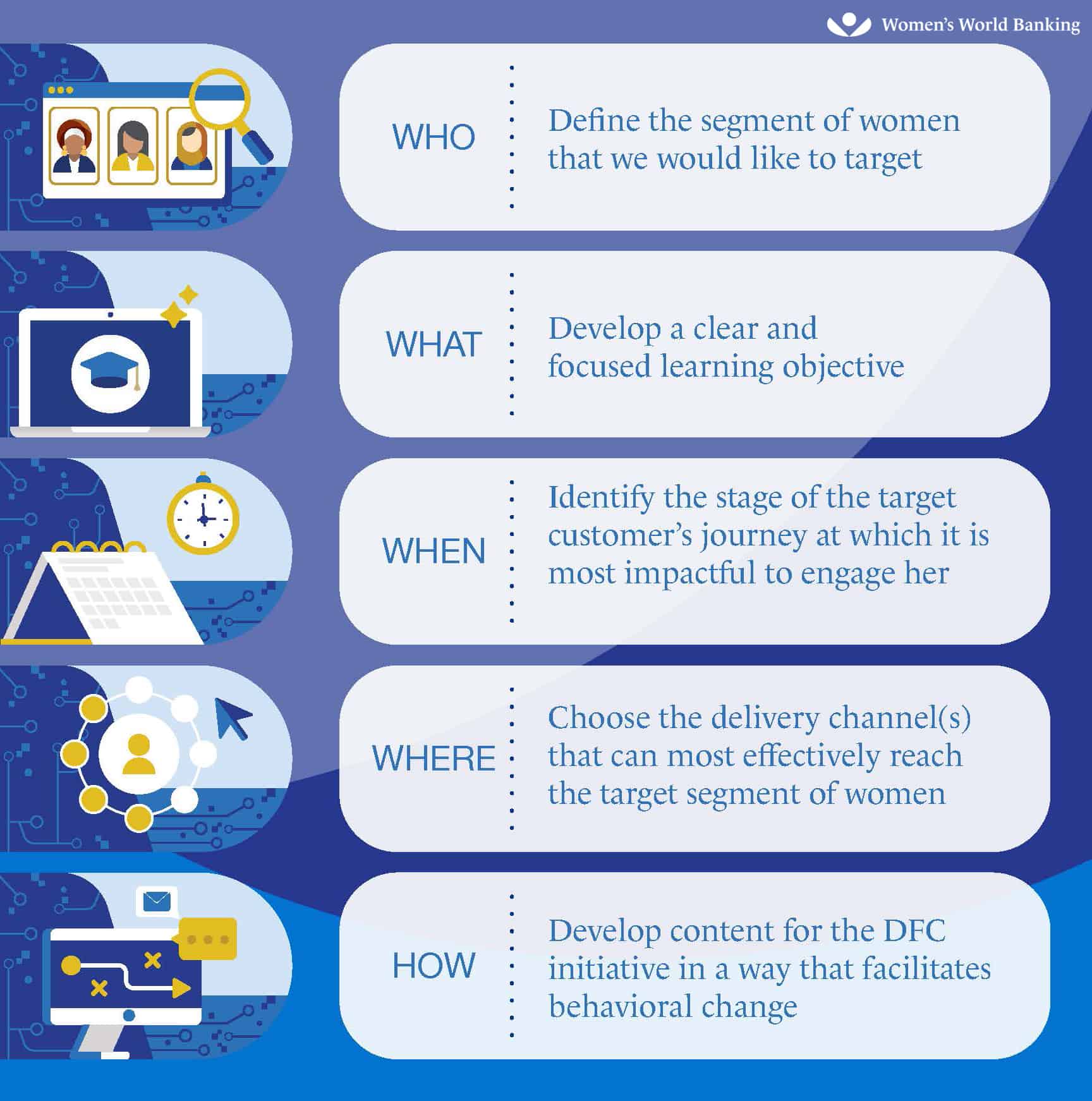

Ladies’s World Banking has developed a framework of 5 distinct ideas for creating efficient digital monetary functionality initiatives. The ladies-centered framework helps key monetary inclusion stakeholders and practitioners establish who’re the ladies prospects we’re designing for, what behaviors we’re driving towards, when and the place the digital monetary capabilty initiative can attain girls, and the way our initiatives must be delivered to optimize their effectiveness. These ideas are carefully interrelated; whereas every must be thought of and addressed individually, they inform each other and must be thought of holistically.

Ladies’s World Banking’s framework additionally makes use of a set of supporting design components to information DFC content material growth and implementation. These seven core design components, akin to edutainment and learning-by-doing, are sensible suggestions for packaging DFC content material so that ladies buyer segments can higher perceive and internalize it, convert it to new abilities, and use digital monetary services and products with extra independence and confidence.

Motion Steps in direction of Embracing Digital Monetary Functionality Efforts

For girls to have the ability to successfully improve their digital monetary capabilities, all stakeholders within the monetary inclusion ecosystem should play a task. We have now compiled a listing of suggestions for what key stakeholders may do to assist the transition to empowering girls to make use of monetary and digital monetary companies via digital monetary functionality.

- Time to go away conventional approaches behind. The proof on what doesn’t work to construct lasting monetary functionality is evident. It’s time to take heed to the info.

- Enhance the proof on what works. This may require funding in measuring each metrics that suppliers monitor (i.e., monitoring), in addition to embedded influence evaluations that may rigorously consider influence.

- Doc and monitor the advantages to suppliers. To achieve widespread adoption of digital monetary functionality approaches that produce lasting influence for girls, we should construct the case for suppliers, in addition to donors and traders who assist the inclusive finance ecosystem.

- Work with policymakers to shift monetary training investments into what works and what’s wanted to deliver girls into the digital age. As we construct the proof on the advantages and lasting influence of gender clever approaches, governments and those who assist them must shift insurance policies and actions towards simpler approaches to constructing digital monetary functionality.

Have we picqued your curiosity? Remember to be a part of Ladies’s World Banking on April 28th at 8am EDT for a webinar on this matter that includes co-authors Julia Arnold, Marina Dimova, and a number of different main consultants within the area to be taught extra and discover out how one can be a part of the journey of studying and advocacy in direction of digital monetary functionality. Go to Ladies’s World Banking and CFI to remain up-to-date.

[ad_2]