[ad_1]

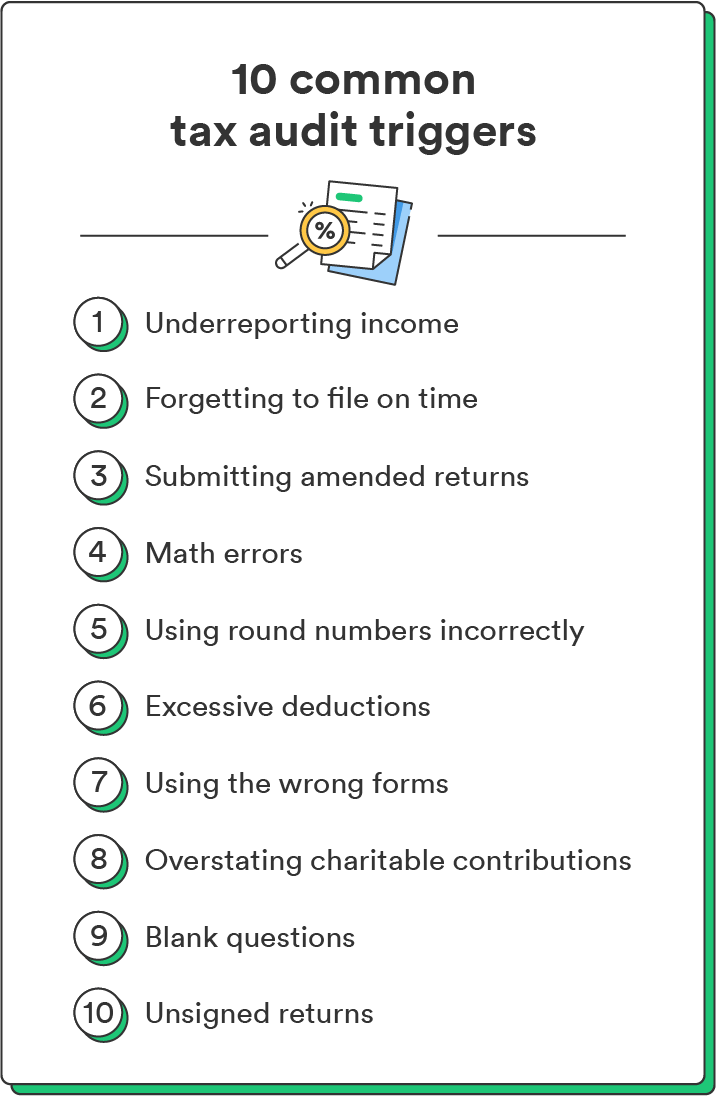

For those who’ve ever questioned what can result in a tax audit, beneath are 10 of the commonest causes.

1. Beneath-reporting revenue

You have to report all of the revenue you earned all year long in your tax return. Underreporting your revenue is a standard set off for tax audits. Examples embody constantly reporting a web loss or a big lower in revenue with none clear rationalization.

2. Forgetting to file on time

Routinely submitting taxes late can elevate the IRS’s eyebrows. Persistently submitting your tax return on time helps construct a optimistic monitor document, which may cut back the possibilities of an audit.

For those who’ve ever questioned what can result in a tax audit, beneath are 10 of the commonest causes.

3. Submitting amended returns

The one strategy to right errors in your tax return is by submitting an amended return. This received’t robotically set off a tax audit until you’re requesting important modifications with none documentation to again them up.

4. A number of math errors

Math errors are a few of the commonest tax return errors taxpayers make. In 2021, the IRS corrected roughly 9 million math errors on filed tax returns.³ Miscalculations might occur on something out of your deduction quantities to the quantity you listing to your whole revenue.

Whereas it’s a standard mistake, a number of math errors might improve the danger of an audit. At all times test your calculations earlier than submitting your return to keep away from easy errors. One other simple strategy to keep away from errors is by submitting your taxes on-line as a substitute of by hand.

5. Utilizing spherical numbers incorrectly

The IRS needs essentially the most correct info potential in your tax return. Excessively rounding up your monetary numbers (like rounding up by tens and even lots of of {dollars} to get a cleaner quantity) can elevate suspicion.

The IRS means that you can spherical off cents to entire {dollars}, however you must drop cent quantities below 50 cents and improve cent quantities over 49 cents to the subsequent greenback (i.e., $1.29 turns into $1.00, and $1.59 turns into $2.00).4 For those who select to spherical your numbers, be certain you spherical all numbers in the identical approach for consistency.

6. Unrealistic or extreme deductions

Honesty is the perfect coverage with tax returns – particularly with tax deductions (the identical is true for tax credit). Whereas deductions are a professional strategy to cut back your taxable revenue, be certain they’re correct and you’ve got documentation like receipts to confirm them.

For instance, you need to be capable of show how a lot you spent on your private home workplace and listing this quantity on the return – don’t estimate.

7. Utilizing the unsuitable varieties

Finishing the unsuitable varieties in your tax submitting might set off a tax audit, as inaccurate varieties can result in discrepancies within the monetary info you present to the IRS.

For instance, you’ll sometimes fill out a W-2 type to report your revenue when you’re a salaried worker. However, small enterprise house owners or freelancers ought to fill out Kind Schedule C to report revenue.

Utilizing the proper type is essential to correct tax submitting – and minimizing the possibilities of an audit. You’ll be able to overview the out there varieties on the IRS web site and decide which of them apply to you.

8. Overestimating charitable contributions

Overestimating or inflating your charitable contributions (a sort of tax write-off) is a fast strategy to set off an audit – and when you get caught, the IRS can penalize you with the Accuracy-Associated Penalty.

This penalty is 20% of the a part of your taxes that you simply underpaid on account of exaggerating your charitable contributions.5

Have your receipts or statements available when claiming any charitable donations you made throughout the tax yr. You’ll be able to connect them to your return as further supporting paperwork for credibility.

9. Clean questions

Leaving fields in your tax return clean can result in pointless scrutiny, even in case you have nothing to report. When you’ve got $0 to report in a subject, write that in your type. Filling out each part might help you keep away from issues.

10. Unsigned returns

Forgetting to signal your tax return is extra frequent than you’d assume. Sadly, unsigned tax returns aren’t thought-about legitimate. At all times test that you simply’ve signed and dated the place required earlier than you submit your return.

This easy (however essential) step will cut back any possibilities of being flagged for an audit – and provide help to keep away from the effort of resubmitting your return. Bonus: It’ll additionally make sure you get your tax refund rapidly.

[ad_2]