[ad_1]

Traders felt higher about their advisors in 2023 than the prior yr, in line with an annual examine performed by J.D. Energy.

Nevertheless, millennials with cash are unsure about whether or not to remain put with their present advisor; 36% of respondents on this group indicated they “most likely or undoubtedly” will change companies within the coming yr.

Investor happiness typically parallels inventory market efficiency, because it appears to do with the present survey, however J.D. Energy International Head of Wealth Craig Martin cautions companies to “construct a deeper degree of engagement” with purchasers to be prepared for the eventual downturn.

“That is very true among the many youthful section of traders who present decrease ranges of shopper loyalty than traders in different generational teams,” he mentioned. “Advisors might want to alter their strategy to meaningfully join with youthful traders or threat a serious outflow of property in coming years.”

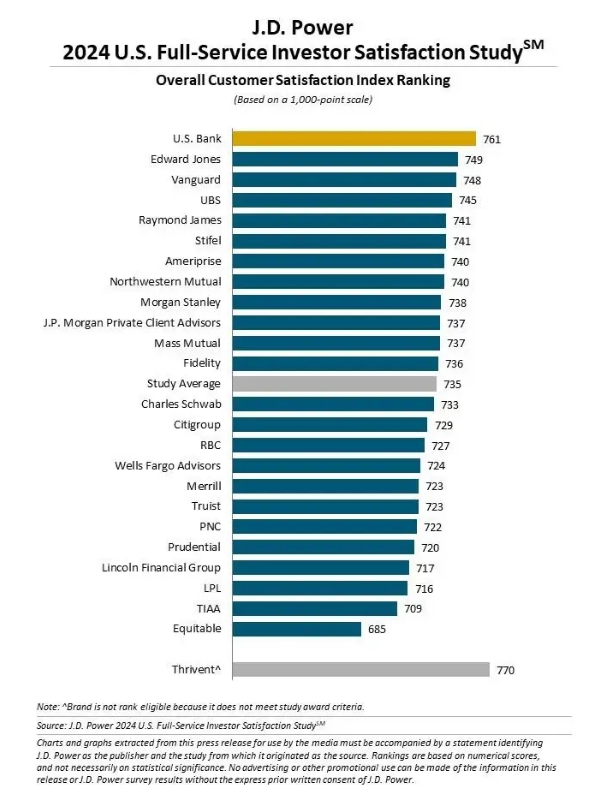

General investor satisfaction with their advisors jumped eight factors from the prior yr’s survey to 735 (on a 1,000-point scale). U.S. Financial institution ranked the best in “total investor satisfaction,” with a rating of 761. Edward Jones ranked second at 749, barely beating out Vanguard at 748. UBS and Raymond James rounded out the highest 5 at 745 and 741, respectively.

That is the survey’s twenty second yr; J.D. Energy obtained 9,951 responses between Jan. 2023 and Jan. 2024 from traders working instantly with an advisor or advisory crew.

Almost 9 out of ten traders reported they’d logged into their account by way of a agency’s web site prior to now yr, whereas six out of ten did so via a cellular app.

Attrition is usually low amongst Gen X and older purchasers, however for millennials with greater than $1 million in investible property, 36% mentioned they’d possible change companies throughout the yr. J.D. Energy speculated that this could possibly be partially because of the truth that seven out of ten prosperous Millennials reported they’ve a secondary funding agency, far larger than older demographics.

In final yr’s examine, J.D. Energy discovered 27% of millennial and Gen Z respondents reported they’d undoubtedly or most likely change companies within the subsequent 12 months, with practically half saying they labored with a secondary funding agency.

Traders’ satisfaction within the 2022 survey dropped 17 factors from 2021 (within the earlier yr, the rating climbed from 732 to 744). Like this current survey, the motion mirrored the market, which suffered its worst efficiency in 15 years in that timeframe.

[ad_2]