[ad_1]

The vast majority of high-net-worth (HNW) buyers wish to make a distinction—even when they gained’t get a tax break for it. Research present that the majority of those buyers—usually outlined as these with a web value of no less than $5 million—view charitable giving as intertwined with their total wealth technique and never as an exercise motivated by tax advantages. Should you have a tendency to emphasise the tax implications of assorted gifting methods upfront, you might wish to change the way you method charitable planning conversations with HNW purchasers.

By wanting into the numerous ways in which new HNW purchasers can provide to a trigger they care about, you’ve gotten a possibility to get to know what issues to them at the beginning of the connection whereas serving to them take a holistic view of how their philanthropy is tied to their wealth planning.

Some buyers will come to those talks with particular causes in thoughts, usually due to a private connection (equivalent to their alma mater, a household sickness, or a group group). Others will need assist determining what ought to matter to them at the moment of their life.

To satisfy them the place they’re, let’s talk about how HNW buyers usually method charitable giving and how one can assist them be strategic of their philanthropy efforts.

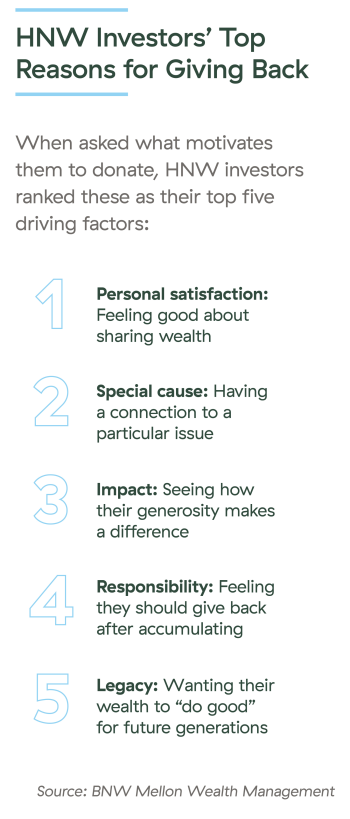

What Motivates Philanthropic HNW Buyers?

Basically, charitable giving is a high precedence for this group of buyers, whereas tax planning is towards the underside of the record. In a 2022 BNY Mellon Wealth Administration survey of 200 HNW buyers, 91 % of respondents stated they embody a charitable giving technique of their total wealth technique.

In one other examine of prosperous buyers carried out by Financial institution of America and Indiana College, 72.1 % stated their charitable giving would keep the identical even when the revenue tax deduction have been eradicated, and 73.3 % stated their giving wouldn’t change if the property tax have been eradicated. The survey additionally reported that 88 % of prosperous households gave to charity in 2020, with a median of $43,195 given towards a great trigger that yr.

Nonetheless, some HNW buyers are cautious of being too philanthropic—within the BofA survey, 30.9 % of prosperous people stated they prioritize the wants of their household first. Another excuse is that some buyers don’t know the place to present or how finest to go about it.

All of those traits present alternatives to current concepts and assets, alongside together with your experience, when first assembly with HNW purchasers.

Being Strategic with How HNW Buyers Give Again

There’s a lot to contemplate main as much as a dialog about charitable planning. The next steps can assist you assist purchasers by guiding them towards causes that match their pursuits, values, and total monetary image.

Get to know the shopper. Citing the subject of charitable giving early on within the relationship can reveal loads about your purchasers’ passions and priorities. What sort of mark do they wish to go away behind? How a lot of their wealth do they wish to dedicate to giving again versus leaving a legacy to their heirs? By asking the appropriate questions, you’ll be able to assist them decide or slender down the problems that matter most to them, equivalent to:

-

What sort of causes are most significant to you?

-

What organizations do you assist yr after yr, and why?

-

Have you ever needed to get behind a specific trigger however are not sure which group may make the best impression?

Sources like Constancy Charitable instruments can assist purchasers suppose by their choices. The positioning provides worksheets for figuring out why and the place to present again, questions they might ask nonprofits, and calculators to estimate tax financial savings.

Be their philanthropy useful resource. In keeping with the BofA examine, practically half of buyers (46.6 %) take into account themselves novices on the subject of charitable giving information, and solely 5 % view themselves as consultants. You may fill this hole by being accustomed to each assets and charitable planning automobiles, together with personal foundations, donor-advised funds (DAFs), charitable funds, and direct items.

To go additional and make philanthropy a cornerstone of your apply, begin with acquiring the Chartered Advisor in Philanthropy (CAP®) designation by the American School. Throughout three on-line programs, contributors study integrating property planning with charitable planning, evaluating charitable tax methods and instruments, and understanding how nonprofits are structured and ruled.

Assist them strategize. As a rule, donors use money to present again, and most don’t use a giving car. That is the place you’ll be able to deliver up extra strategic, tax-efficient giving, like donating appreciated or complicated property (e.g., funding property or intently held enterprise pursuits, actual property, or collectibles). In such instances, purchasers can usually decrease their capital positive aspects publicity and deduct the complete market worth of the property they’re donating (in the event that they itemize).

For a shopper who prioritizes philanthropy and needs to depart a legacy to members of the family, a DAF could be a becoming solution to meet each wants. By doubtlessly eliminating capital positive aspects taxes and permitting for an revenue tax deduction, it’s a tax-efficient solution to assist a favourite charity whereas encouraging heirs to hold on the custom of philanthropy by naming them as successor advisors.

Establishing a charitable the rest belief could facilitate the sale of an appreciated asset, with the tax legal responsibility unfold out over time. Your purchasers may retain an ongoing revenue stream, for a time frame or for all times, and take a charitable contribution deduction. Any remaining property on this irrevocable, tax-exempt belief could be distributed to charity.

Even when taxes usually are not high of thoughts, you’ll should be prepared to clarify the tax impacts of present giving. Your function is to assist purchasers residence in on their ardour whilst you discover probably the most environment friendly methods to couple their ardour with their planning. By so doing, your purchasers can have a major impression on a trigger they care about whereas guaranteeing that their generosity doesn’t undermine their monetary future.

Beginning the Proper Dialog

Advisors and HNW buyers could initially come on the subject of charitable giving from totally different angles. By attending to know your HNW purchasers’ predominant motivations and values, you’ll be able to assist them meet their objectives—whether or not they wish to make an impression, go away one thing behind for future generations, or tackle extra rapid monetary wants.

FREE DOWNLOAD

Philanthropic Giving for Excessive-Web-Value Shoppers

Understanding your purchasers’ charitable giving preferences can assist you higher anticipate their wants and assist them obtain their objectives.

Please seek the advice of your member agency’s insurance policies and acquire prior approval for any designations you want to use.

[ad_2]