[ad_1]

I used to be perusing the BLS information following the inflation launch final week and one quantity stands proud like Victor Wembanyana standing subsequent to a gaggle of kindergartners.

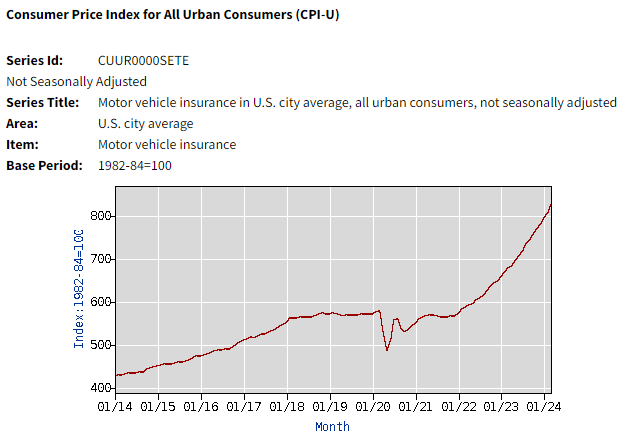

Auto insurance coverage was up 22% over the earlier 12 months versus an total inflation price of three.5%. Have a look at the change in auto insurance coverage charges these previous few years:

It’s like a meme inventory.

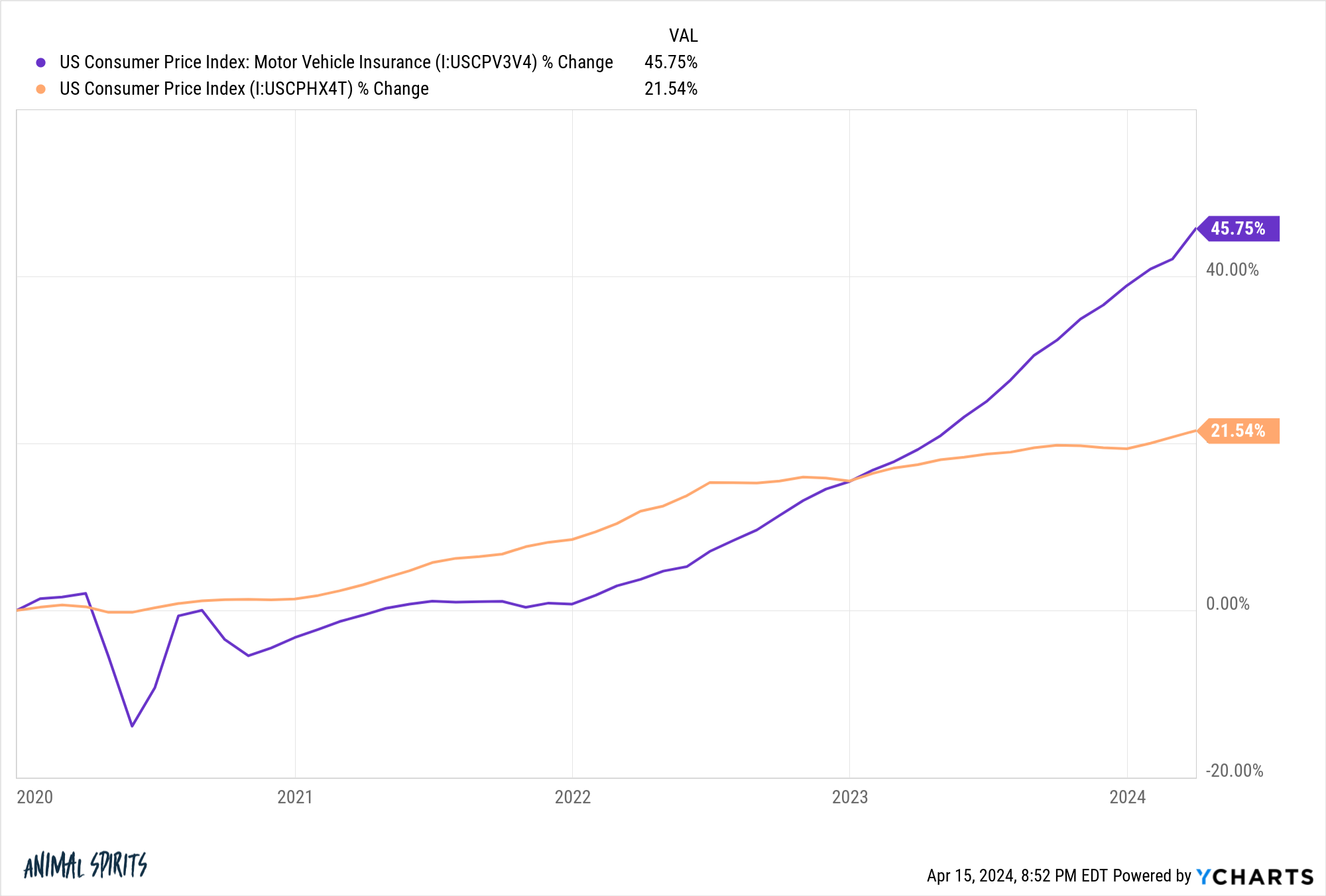

Because the begin of 2020, auto insurance coverage has spiked 46% towards an total surge in CPI of practically 22%:

A lot of the improve has come lately.

So what’s occurring right here? Why is auto insurance coverage going up a lot sooner than the typical basket of costs?

I did some analysis and talked to a handful of individuals within the insurance coverage area. It’s not only one factor. Listed here are the primary causes so far as I can inform:

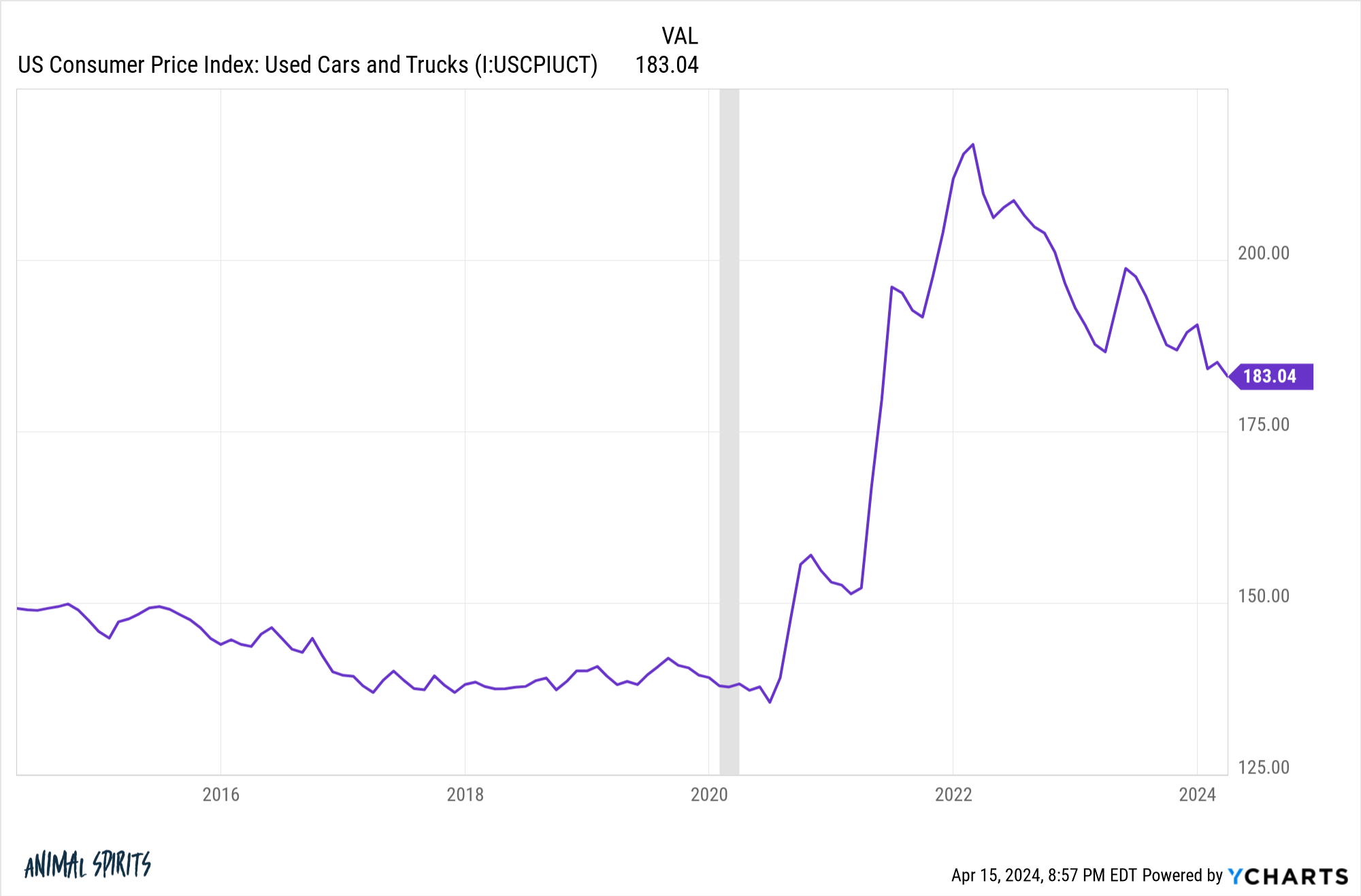

Automobile costs are larger. The substitute price of different autos went up so much throughout the pandemic. Simply have a look at hovering used automobile costs:

There have been pandemic-related and provide chain causes for this, however costlier autos imply larger substitute prices, which implies larger insurance coverage premiums.

Individuals are additionally driving bigger, costlier autos lately, which provides to the prices.

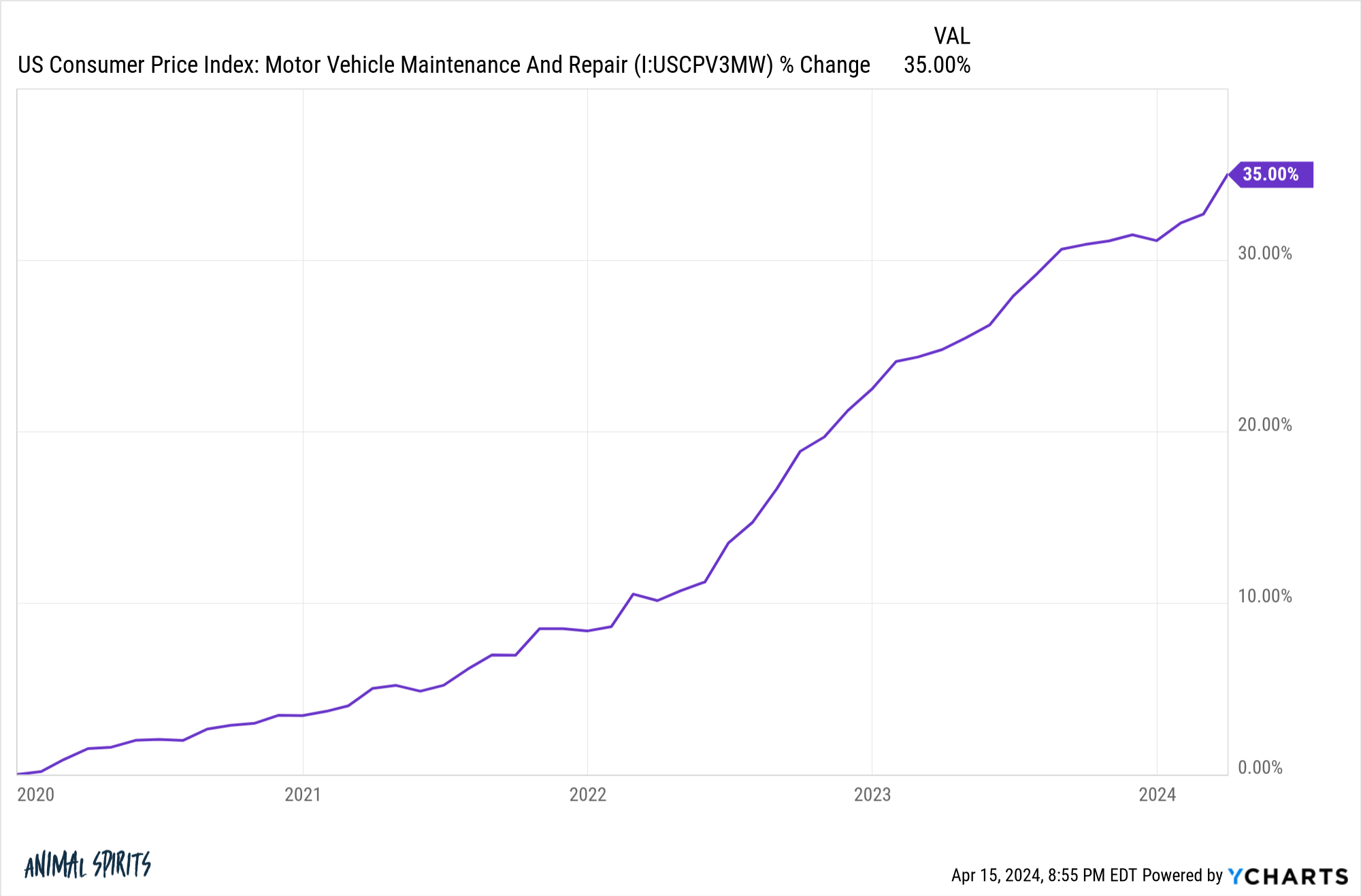

Upkeep & elements. A couple of years in the past, I acquired in a minor fender-bender with my Explorer. All it wanted was a brand new rear bumper and a few new panels. It was nonetheless drivable.

The overall restore prices had been greater than $15,000 (all I paid was my deductible).

Provide chains didn’t assist. However the entire new sensors, know-how and cameras meant the elements had been rather more costly and the work extra advanced.

Extra complexity within the work and inflation in elements costs additionally translate into elevated labor prices for repairs.

This helps clarify why inflation is a lot larger in these areas:

With EVs and self-driving autos coming that is going to get much more costly.

Drivers are getting worse. Folks started driving sooner and extra recklessly throughout the pandemic with fewer automobiles on the highway. That habits didn’t cease as soon as visitors got here again.

Plus, the mixture of larger vehicles and SUVs, together with elevated smartphone utilization whereas driving, has led to the best degree of pedestrian fatalities in 40 years.

Folks gazing their telephones whereas driving is like including drunk drivers everywhere in the roads in any respect hours of the day.

With extra accidents comes greater insurance coverage claims.

Local weather change. Practically 360,000 autos had been ruined or broken throughout Hurricane Ian.

Hurricanes, wildfires, and different pure disasters are making car insurance coverage extra expensive. Some folks in climate-impacted areas are seeing extra restricted insurance coverage choices. Some insurers are pulling out of those areas altogether.

It’s not simply auto insurance coverage both. The Wall Avenue Journal lately ran a narrative about will increase in property insurance coverage:

The common annual house insurance coverage price rose about 20% between 2021 and 2023 to $2,377, based on insurance-shopping web site Insurify, which initiatives one other 6% improve in 2024.

Worst of all, house insurance coverage premiums are hovering. Charges rose by greater than 10% on common in 19 states in 2023 after a collection of massive payouts associated to floods, storms, wildfires and different pure disasters throughout the U.S., based on an Insurance coverage Info Institute evaluation of knowledge from S&P International Market Intelligence. Extra Individuals additionally moved to disaster-prone areas in recent times, growing the publicity to those occasions.

So even when you have already locked within the value of your home and vehicle, these ancillary bills can nonetheless increase the price of possession.

Some would level to company greed as a cause for the elevated prices however the numbers don’t bear out that thesis.

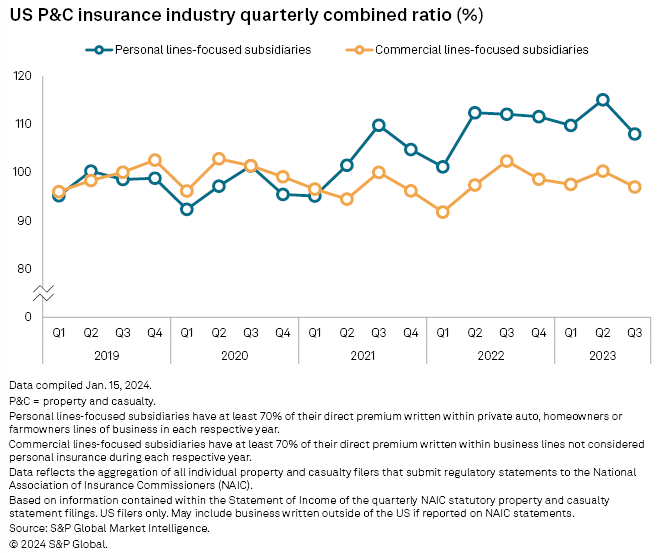

The mixed ratio is a solution to measure profitability within the insurance coverage area. It’s primarily the losses plus bills incurred by an insurance coverage firm divided by the premiums earned. The upper the ratio the more serious off the profitability for insurers.

If the quantity is bigger than 100 which means the insurers are dropping cash by paying out greater than they’re taking in. If it’s beneath 100 which means they’re worthwhile.

Information from Normal & Poors exhibits private suppliers of house and auto insurance coverage have been dropping cash for a couple of years now:

The payouts exceed the premiums earned from clients.

So what occurs from right here?

Used automobile costs are coming down after the dramatic re-pricing throughout the pandemic. Hopefully, that can filter by to decrease costs and decrease premiums now that provide chains have healed.

It’s tougher to see the opposite drawback areas enhance within the years forward.

We Individuals love driving huge vehicles and SUVs. With new applied sciences, our autos have gotten more and more advanced. Except we ban smartphones whereas driving, I don’t see a path to a highway full of higher drivers till we now have absolutely self-driving automobiles.

And pure disasters solely appear to be growing of their frequency and severity.1

It’s tough to ascertain a situation by which insurance coverage charges drastically decline to ranges customers had been accustomed to.

My solely monetary recommendation is to buy round when your insurance coverage comes due and also you see larger premiums.

And get used to paying larger insurance coverage costs, particularly in sure states.

Additional Studying:

How A lot is That $70,000 Truck Costing You

1A much less extreme hurricane and wildfire season would clearly assist, too.

[ad_2]