[ad_1]

Six Insights from the 2021 World Financial institution International Findex Information

By Sonja Kelly, Director of Analysis & Advocacy

For these of us within the monetary inclusion world, the discharge of the International Findex is a pivotal second. The info are usually compiled each three years – this time, resulting from Covid, it was 4 — offering us with the proof that can drive enterprise selections, authorities insurance policies and strategic decisions till the following launch.

Listed here are six insights we’re incorporating into our personal work:

1. Fewer ladies are excluded from formal monetary providers, however there’s a lot work forward.

Whereas round 250 million extra ladies in creating nations lastly have some type of monetary entry, 3 times that many, roughly three quarters of a billion ladies, are nonetheless excluded for completely no good reason, and so we nonetheless have a whole lot of work to do. That’s 742 million ladies – if that had been a rustic, it will be the third largest on this planet. We nonetheless have work to do as these remaining ladies would be the most troublesome to achieve—these are the poorest, in rural areas, least educated, with out connectivity, with restricted to no entry to a cell phone.

2. The brand new gender hole at 6 share factors is nuanced.

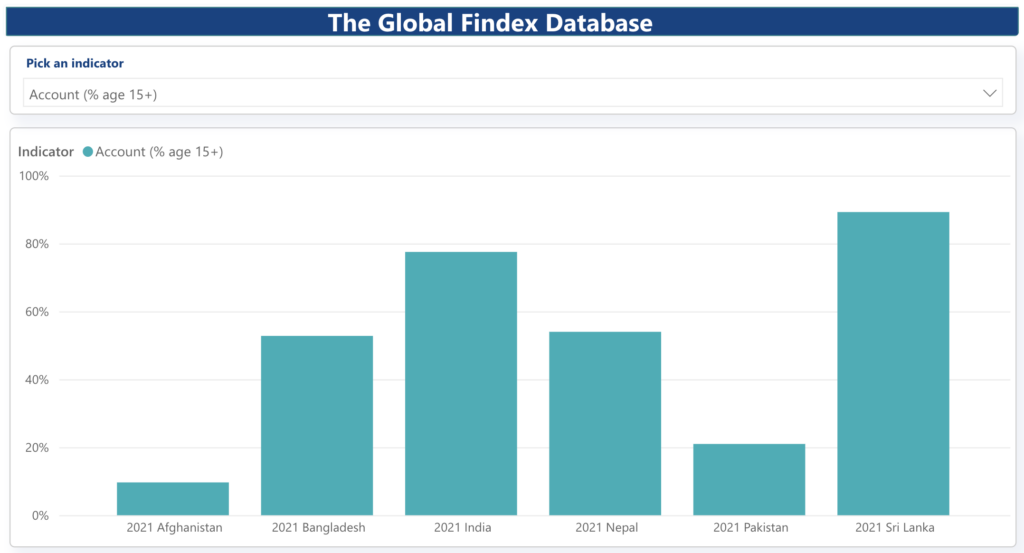

The gender hole in account possession in rising markets, down from 9%, doesn’t sufficiently replicate the situation in lots of nations the place ladies are nonetheless not given the identical alternative as males to take part in, and profit from, financial progress. Whereas India’s gender hole has fallen 17 share factors within the final decade (partly resulting from closure of dormant accounts, a lot of which had been held by males), Benin’s has risen the identical quantity. Bangladesh and Nigeria each present a 20 share level hole, Pakistan nonetheless has a 15 share level hole, and Tanzania reveals a 13 share level hole. The hole isn’t going to shut itself—progress of three share factors over a decade has taken monumental assets in addition to a disruptive world pandemic driving digitization and account opening by means of G2P funds. This brings us to…

3. Digital funds throughout Covid-19 drove ladies’s monetary inclusion.

Men and women had been equally prone to open accounts to ship and obtain digital funds throughout Covid-19. Proof helps that government-to-person funds had been an equal alternative drive for inclusion, with women and men equally prone to open an account to receive a authorities fee. Throughout Covid-19, women and men had been equally prone to pay utilities or make a service provider fee for the primary time. There’s strong proof that funds drive utilization of different providers for women and men—the World Financial institution workforce stories that receiving a fee can usher in energetic use of an account, construct a digital footprint on which to entry credit score, and purchase insurance coverage alongside of those merchandise. This proof additionally factors to an opportunity, as 40 million ladies nonetheless obtain government-to-person digital funds in money.

4. Proliferation of enabling applied sciences has slowed.

Covid-driven digital utilization, particularly funds, could have accelerated inclusion within the brief time period, however unequal entry to know-how opens up long term dangers of exclusion. It additionally stays unclear what the long run will maintain now that the drivers of know-how and digital finance adoption—particularly pandemic-related restrictions and authorities help funds associated to Covid-19—have waned. We all know from GSMA information that amongst smartphone possession – the gender hole has widened – it’s now 18%, up from 15% in 2021, translating to 315 million fewer ladies than males proudly owning a smartphone. Equally, whereas the cell web gender hole had been decreasing, progress has stalled. Ladies are actually 16% (up 1%) much less possible than males to make use of mobile web, which interprets into 264 million fewer ladies than males utilizing cell web. When the info assortment workforce fielding the Findex survey requested ladies with out cell accounts why they remained outdoors the monetary system, they cited cell phone possession and lack of ID as drivers of their lack of participation, amongst different causes.

5. There’s new proof to information a “women-centered design” method.

5. There’s new proof to information a “women-centered design” method.

Ladies’s World Banking is persistently incorporating insights on ladies’s distinctive wants, preferences, and behaviors into the merchandise it really works with monetary providers suppliers to design. The International Findex provides us new proof for this method. For instance:

- Globally, ladies are 31% extra prone to have an inactive account than males.

- 35% of ladies in rising markets retailer cash in accounts in comparison with 43% of males, an 8 share level hole in use of accounts for saving.

- In rising markets, unbanked ladies are 25% much less possible than males to say they might use an account self-sufficiently.

Specializing in constructing ladies’s digital monetary functionality, rising nudges to drive account activation, and constructing ladies’s financial savings habits will all work to extend their inclusion.

6. Entry is progress, however utilization isn’t assured.

The monetary providers business has moved shortly on entry, spurred on by commitments like Common Monetary Entry on the World Financial institution. However utilization has not adopted apace. 1 / 4 billion ladies who’ve an account admit that they haven’t used it for the previous yr. Provided that monetary providers are used will ladies have the ability to use these instruments for his or her financial engagement and empowerment. Ladies’s World Banking measures the fabric, cognitive, perceptual, and relational outcomes related to energetic use of providers, exhibiting that not all monetary providers are designed for all times change. There’s super room for progress on this space, as ladies are much less prone to be financially resilient than males are.

Take motion with us to economically empower ladies as we proceed design, scale, and put money into coverage, product, and other people. Progress is occurring, and collectively we will transfer the needle on ladies’s monetary inclusion to make sure ladies’s entry to and use of economic providers may help them pursue their targets.

[ad_2]