[ad_1]

The buyer is the economic system.

I purchased a espresso this morning for $3.20. Later I’ll be taking my six-year-old to the town. We’re going to spend $30 on practice tickets, $50 on the Museum of Pure Historical past, and one other $30 on meals.

We’re a nation of spenders. 68% of our GDP comes from us opening our wallets.

For those who suppose we’re going to have a recession in 2024, it’s a must to suppose People are going to curtail their spending.

We heard from CEOs of the largest banks this week as we enter earnings season. What they’re seeing and saying will not be indicative of a shopper that’s something aside from wholesome.

Jamie Dimon of JPMorgan Chase stated “A really robust labor market means, all else equal, robust shopper credit score. In order that’s how we see the world.”

Brian Moynihan, the CEO of Financial institution of America had comparable issues to say. Earlier than we get to that, shameless investor plug. I pay attention to those earnings calls on Quartr. For those who’re an analyst who follows firms, I can’t advocate this extremely sufficient. Dwell transcripts and slides multi functional place. And that’s simply scratching the floor of what they’ll do.

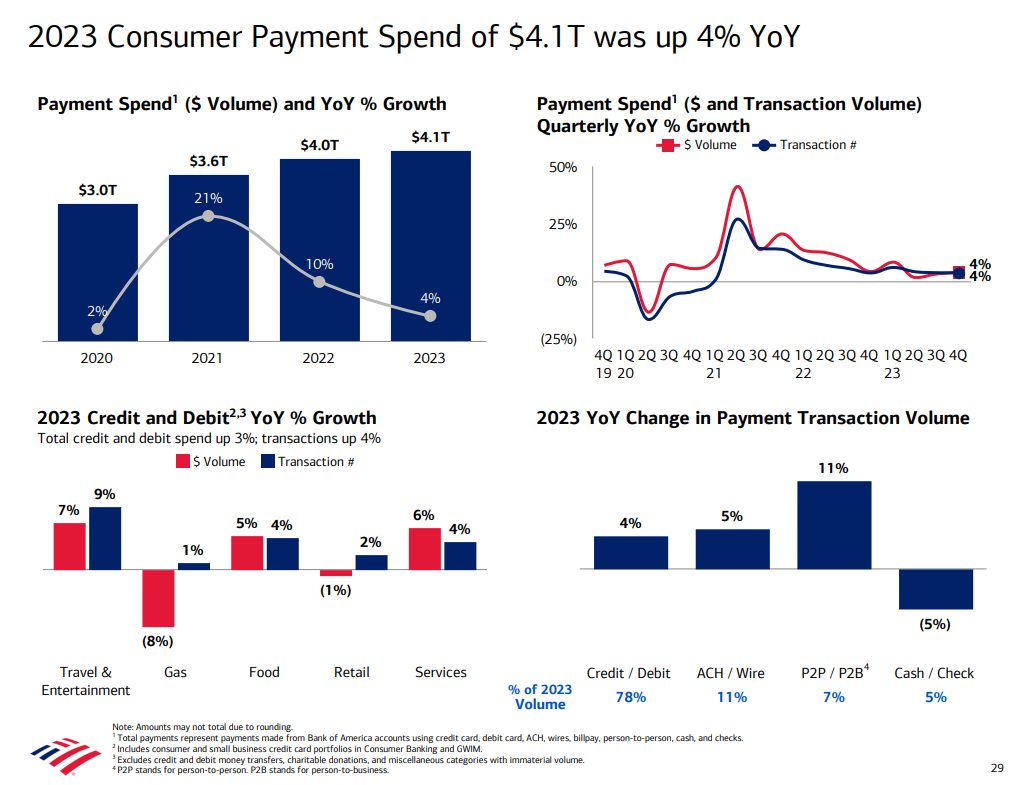

Here’s a screenshot from the Financial institution of America Name

Moynihan stated:

“For those who suppose again, as we ended 2022 and entered 2023, the nice debate was how a lot the pandemic surge in deposits would dissipate. However look — wanting at present, we ended 2023 with $1.924 trillion of deposits, solely $7 billion lower than we had at year-end ’22 and 4% larger than the trough in Might of this yr. The overall deposit — the full common deposits within the fourth quarter remained 35% larger than they did within the fourth quarter of 2019.”

Whole spending from BofA clients was $4.1 trillion in 2023, 4% larger than it was in 2022, and 35% larger than it was in 2019, the complete yr earlier than the pandemic.

We’re spending our butts off, however we’re not overextending ourselves. Right here’s Moynihan once more:

“They’re utilizing their credit score responsibly, a lot is made of upper bank card balances, however on the dimensions of the economic system and the dimensions — individuals are forgetting that economic system is loads greater than it was in ’19 due to the inflation and the whole lot. And as a share, we don’t see any stress there. We see a normalization of that credit score. In order that they’re working, they’re getting paid. They’ve balances in accounts. They’ve entry to credit score. They’ve locked in good charges on their mortgages and so they’re employed. It’s — we really feel it’s good. So we expect the gentle touchdown is a core thesis and our inner information helps what our analysis group sees.”

Persons are going to proceed to spend as they’ve been so long as they’ve the revenue to assist it. And the economic system goes to be fantastic so long as individuals proceed to spend.

This must be supportive of a good inventory market. It doesn’t imply we gained’t have corrections. We are going to. It doesn’t imply we are able to’t get a bear market. We will. However so long as the economic system is buzzing, danger belongings ought to do fantastic.

[ad_2]