[ad_1]

[Updated on January 28, 2024 with screenshots from TurboTax for 2023 tax filing.]

In case your employer presents an Worker Inventory Buy Program (ESPP), it is best to max it out. You come out forward even if you happen to promote the shares as quickly as you possibly can. See Worker Inventory Buy Plan (ESPP) Is a Improbable Deal.

After you promote the shares from the ESPP, a part of the earnings will probably be included in your W-2. Nonetheless, the 1099-B type you obtain from the dealer nonetheless displays your discounted buy value. This put up exhibits you methods to make the mandatory adjustment in your tax return utilizing TurboTax.

Don’t pay tax twice!

For those who use different tax software program, please learn:

For those who’re on the lookout for a information on doing taxes on RSU gross sales, please learn Restricted Inventory Models (RSU) and TurboTax: Web Issuance.

When to Report

Earlier than you start, make sure you perceive when you might want to report. You report once you promote the shares to procure below your ESPP. For those who solely purchased shares however you didn’t promote through the tax yr, there’s nothing to report but.

Wait till you promote, however write down the complete per-share value (earlier than the low cost) once you purchased. For those who bought a number of instances, write down for every buy:

- The acquisition date

- The closing value on the grant date

- The closing value on the acquisition date

- The variety of shares to procure

This data is essential once you promote.

Let’s use this instance:

You’ll write down:

| Grant Date | 4/1/20xx |

| Market Value on the Grant Date | $10 per share |

| Buy Date | 9/30/20xx |

| Market Value on the Buy Date | $12 per share |

| Shares Bought | 1,000 |

| Discounted Value | $8.50 per share |

Preserve this data till you promote.

1099-B From Dealer

Whenever you promote, you’ll obtain a 1099-B type from the dealer within the following yr. You’ll report your achieve or loss utilizing this 1099-B type and the knowledge you accrued for every buy.

Let’s proceed our instance:

Since you didn’t maintain it for 2 years after the grant date and one yr after the acquisition date, your sale was a “disqualifying disposition.” The low cost is added as earnings to your W-2. This raises your price foundation. For those who simply settle for the 1099-B as-is, you’ll be double-taxed!

Now let’s account for it in TurboTax.

Use TurboTax Obtain

The screenshots beneath are from TurboTax Deluxe downloaded software program. The downloaded software program is method higher than on-line software program. For those who haven’t paid in your TurboTax On-line submitting but, you should purchase TurboTax downloaded software program from Amazon, Costco, Walmart, and plenty of different locations and change from TurboTax On-line to TurboTax obtain (see directions for methods to make the change from TurboTax).

Enter 1099-B

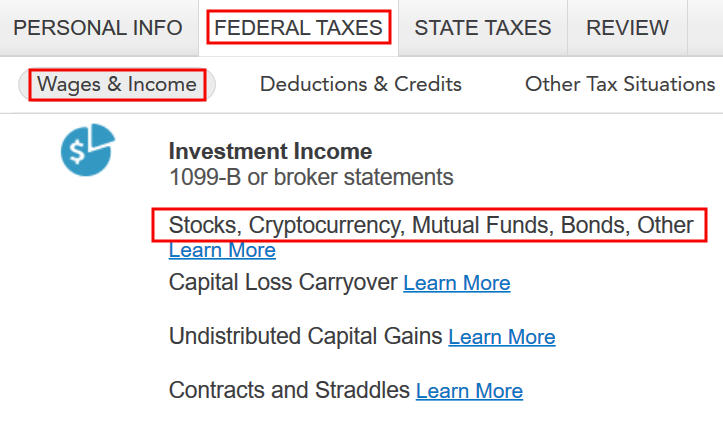

Go to “Federal Taxes” -> “Wages & Revenue” -> “Funding Revenue” and discover “Shares, Cryptocurrency, Mutual Funds, Bonds, Different.”

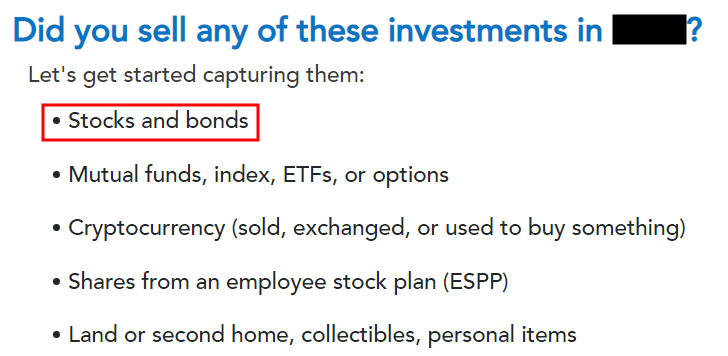

Reply “Sure” since you bought shares.

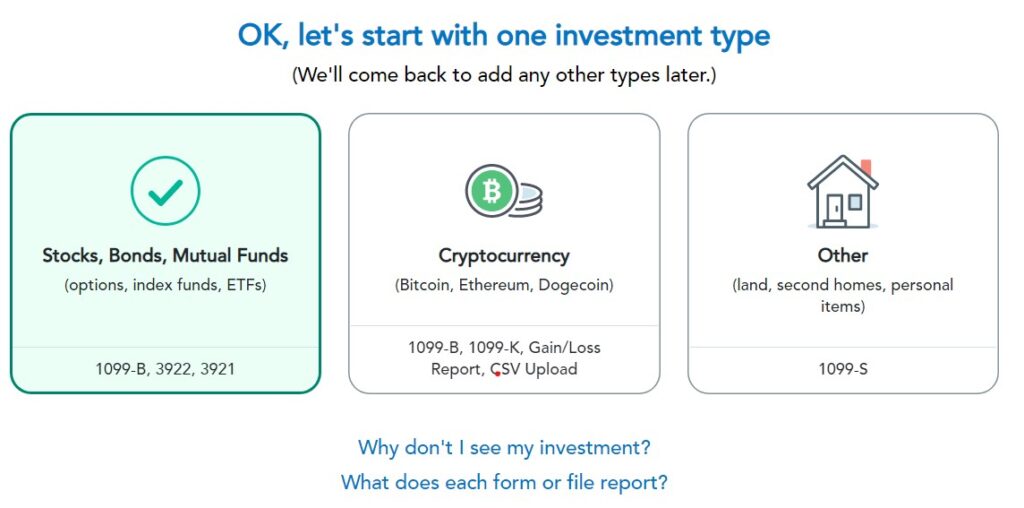

Select “Shares, Bonds, Mutual Funds” as the kind of investments you bought.

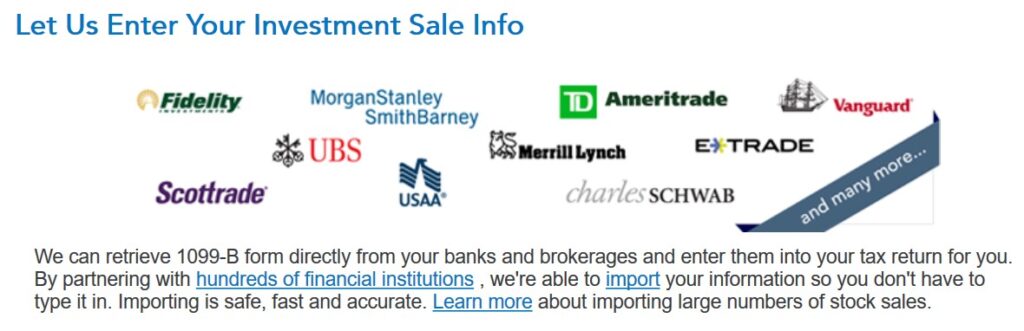

Import your 1099-B if you happen to’d like. I’ll skip import and proceed manually.

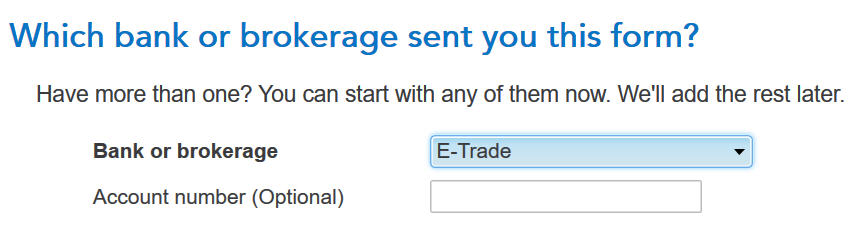

Choose or enter the monetary establishment. Suppose it’s E*Commerce.

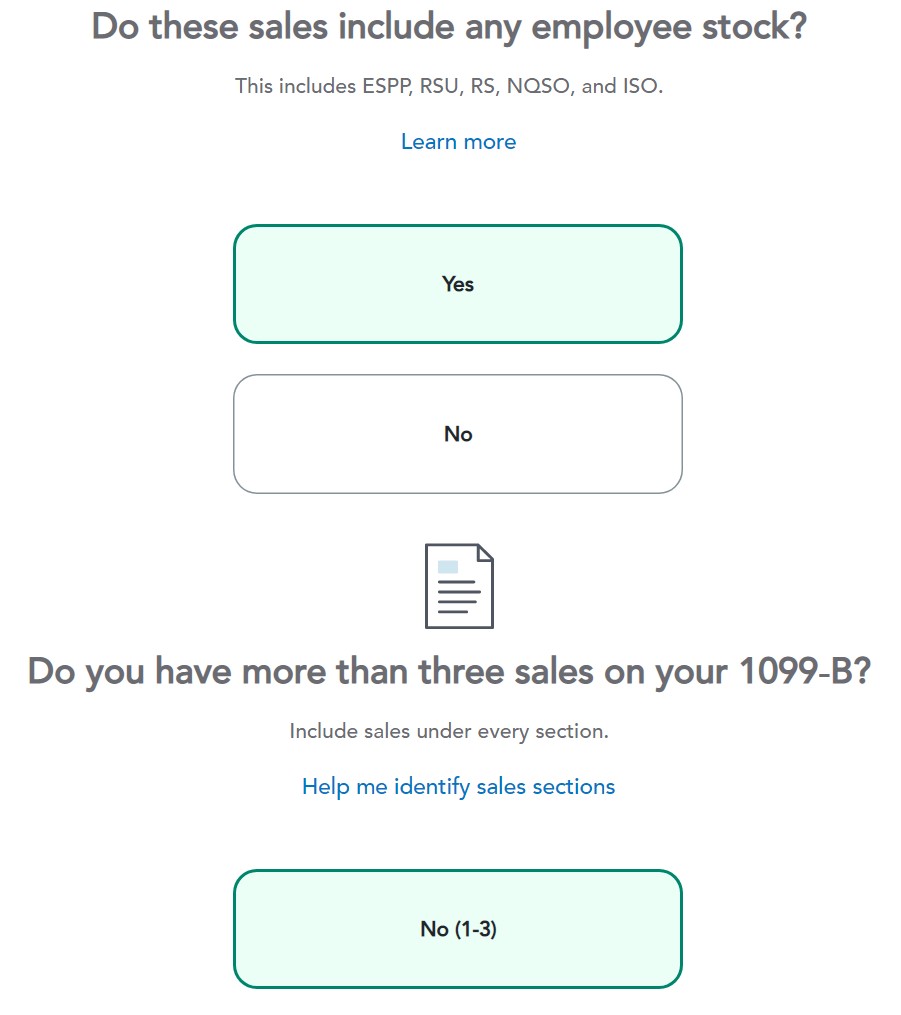

The gross sales included worker inventory. Suppose we solely had one sale.

TurboTax strongly suggests getting into gross sales one after the other. We’ll go along with that suggestion.

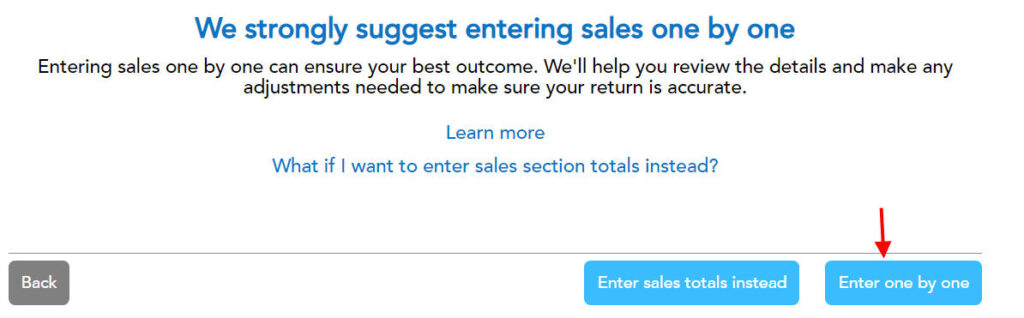

Fill within the packing containers out of your 1099-B type. Look fastidiously at which class the sale belongs to in your 1099-B type (short-term or long-term, foundation reported to the IRS or not). It was “short-term, foundation reported to the IRS” on my type. It could possibly be a special one in your type.

The associated fee foundation in your 1099-B was reported to the IRS nevertheless it was too low. Don’t change it in Field 1e straight however examine the field “The associated fee foundation is inaccurate or lacking on my 1099-B.”

Right Value Foundation

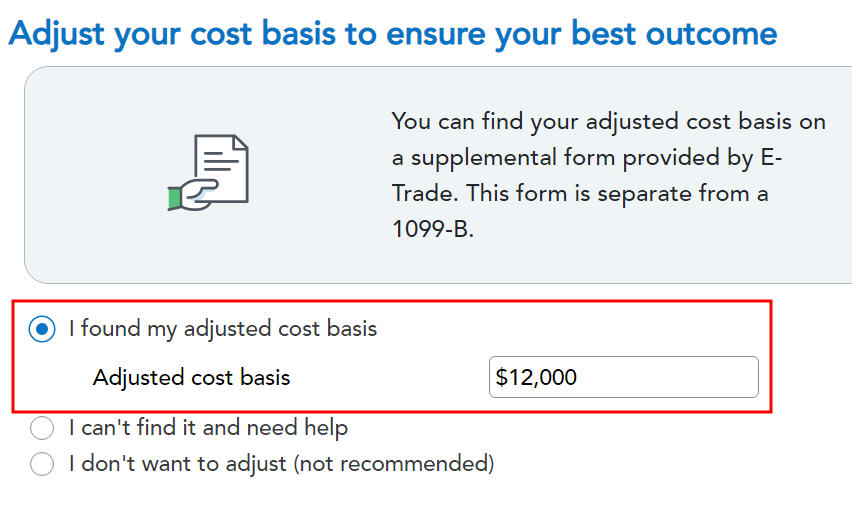

Enter your buy price plus the quantity added to your W-2. Whenever you did a “disqualifying disposition” your price foundation was the complete worth of the shares on the date of the acquisition. The market value was $12 per share once you bought these 1,000 shares at $8.50 per share. Your employer added the $3,500 low cost as earnings to your W-2. Subsequently your true foundation is $8,500 + $3,500 = $12,000.

For those who didn’t promote all of the shares bought in that batch, multiply the variety of shares you bought by the low cost value on the date of buy and add the low cost included in your W-2. For instance, if you happen to bought solely 500 shares and your employer added $1,750 to your W-2, your corrected price foundation is:

$8.50 * 500 + $1,750 = $6,000

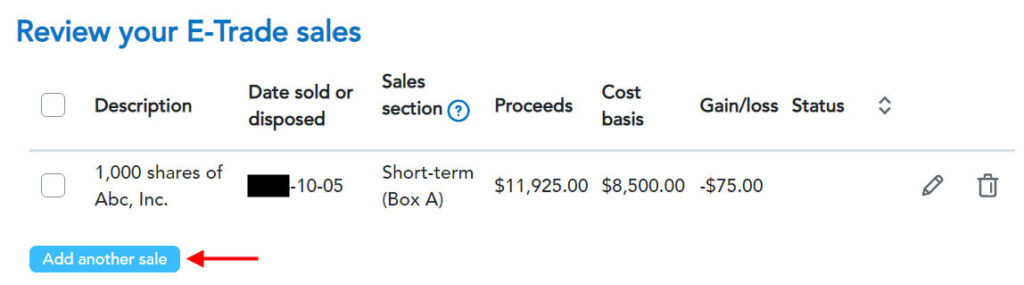

You get a abstract of the gross sales you entered. Repeat you probably have extra gross sales to enter. We solely had one sale in our instance.

You get a abstract of your internet achieve and loss. We’ve got a internet loss as a result of we acquired much less cash after promoting the shares and paying the fee and costs than our discounted buy plus the earnings added to our W-2.

Confirm on Schedule D

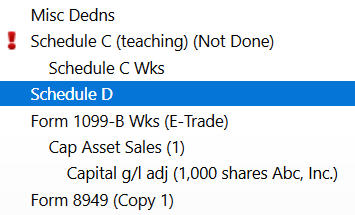

We will confirm that the adjustment makes all of it the way in which to the tax type. Click on on “Kinds” on the high proper.

Discover “Schedule D” within the left navigation pane.

Scroll up or down to seek out line 1b, 2, 3, 8b, 9, or 10 relying on the sale class in your 1099-B type.

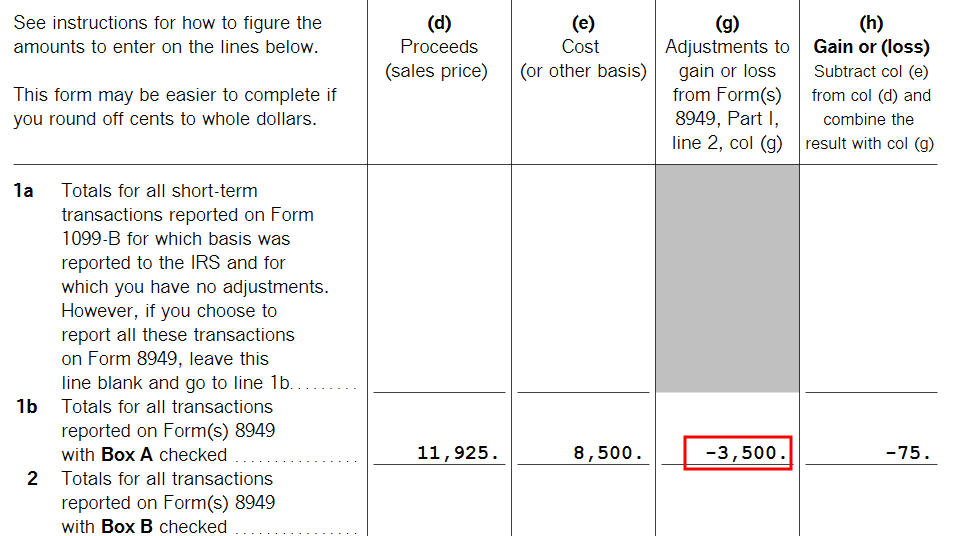

You see the unfavourable adjustment in column (g). For those who didn’t make the adjustment and also you simply accepted the 1099-B as-is, you’ll pay capital positive factors tax once more on the $3,500 low cost you might be already paying taxes via your W-2. Keep in mind to make the adjustment!

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you might be paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]