[ad_1]

Up to date on January 28, 2024, with up to date screenshots from H&R Block software program for 2023 tax submitting. If you happen to use different tax software program, see:

If you happen to did a Backdoor Roth, which entails making a non-deductible contribution to a Conventional IRA after which changing from the Conventional IRA to a Roth IRA, it’s worthwhile to report each the contribution and the conversion within the tax software program. For extra data on Backdoor Roth, please learn Backdoor Roth: A Full How-To and Make Backdoor Roth Simple On Your Tax Return.

What To Report

You report on the tax return your contribution to a standard IRA *for* that yr, and also you report your conversion to Roth *throughout* that yr.

For instance, when you find yourself doing all of your tax return for yr X, you report the contribution you made *for* yr X, whether or not you really did it in yr X or within the following yr between January 1 and April 15. You additionally report your changing to Roth *throughout* yr X, whether or not the cash was contributed for yr X, the yr earlier than, or any earlier years.

Subsequently a contribution made throughout the next yr for yr X goes on the tax return for yr X. A conversion finished throughout yr Y after you made a contribution for yr X goes on the tax return for yr Y.

You do your self a giant favor and keep away from a whole lot of confusion by doing all of your contribution for the present yr and ending your conversion throughout the identical yr. I referred to as this a “deliberate” Backdoor Roth — you’re doing it intentionally.

Don’t wait till the next yr to contribute for the earlier yr. Contribute for yr X in yr X and convert it throughout yr X. Contribute for yr Y in yr Y and convert it throughout yr Y. This fashion all the things is clear and neat.

In case you are already off by one yr, catch up. Contribute for each the earlier yr and the present yr, then convert the sum throughout the identical yr. See Make Backdoor Roth Simple On Your Tax Return.

Use H&R Block Obtain Software program

The screenshots beneath are taken from H&R Block Deluxe downloaded software program. The downloaded software program is manner higher than on-line software program. If you happen to haven’t paid on your H&R Block On-line submitting but, take into account shopping for H&R Block obtain software program from Amazon, Walmart, Newegg, and plenty of different locations. If you happen to’re already too far in getting into your information into H&R Block On-line, make this your final yr of utilizing H&R Block On-line. Swap over to H&R Block obtain software program subsequent yr.

Right here’s the state of affairs we’ll use for instance:

You contributed $6,500 to a standard IRA in 2023 for 2023. Your earnings is just too excessive to assert a deduction for the contribution. By the point you transformed it to Roth IRA, additionally in 2023, the worth grew to $6,700. You don’t have any different conventional, SEP, or SIMPLE IRA after you transformed your conventional IRA to Roth. You didn’t roll over any pre-tax cash from a retirement plan to a standard IRA after you accomplished the conversion.

In case your state of affairs is totally different, you’ll must make some changes to the screens proven right here.

Earlier than we begin, suppose that is what H&R Block software program exhibits:

We are going to examine the outcomes after we enter the Backdoor Roth.

Convert Conventional IRA to Roth

Revenue comes earlier than deductions on the tax type. Tax software program can be organized this manner. Though you contributed earlier than you transformed, the software program makes you enter the earnings first.

Enter 1099-R

Whenever you convert the Conventional IRA to Roth, you obtain a 1099-R for that yr. Full this part provided that you transformed *throughout* the yr for which you might be doing the tax return. If you happen to solely contributed for the yr in query however didn’t convert till the next yr, skip all the best way to the subsequent part Non-Deductible Contribution to Conventional IRA.

On this instance, we assume by the point you transformed, the cash within the Conventional IRA had grown from $6,500 to $6,700.

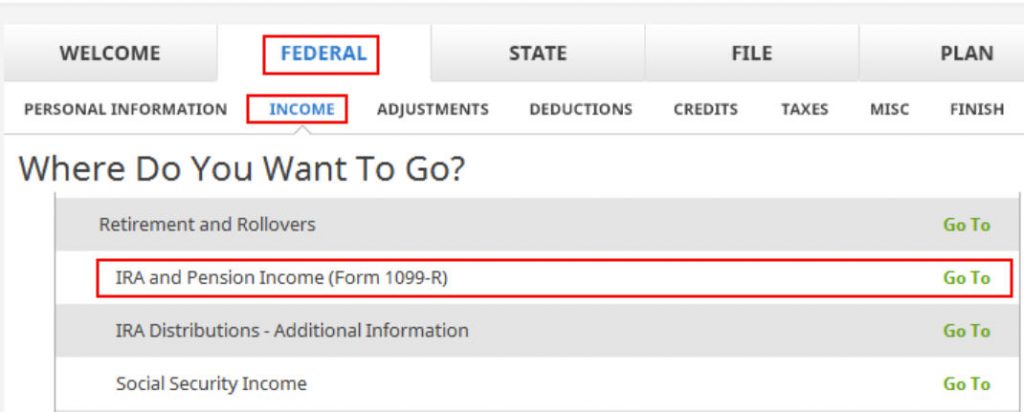

Click on on Federal -> Revenue. Scroll down and discover IRA and Pension Revenue (Type 1099-R). Click on on “Go To.”

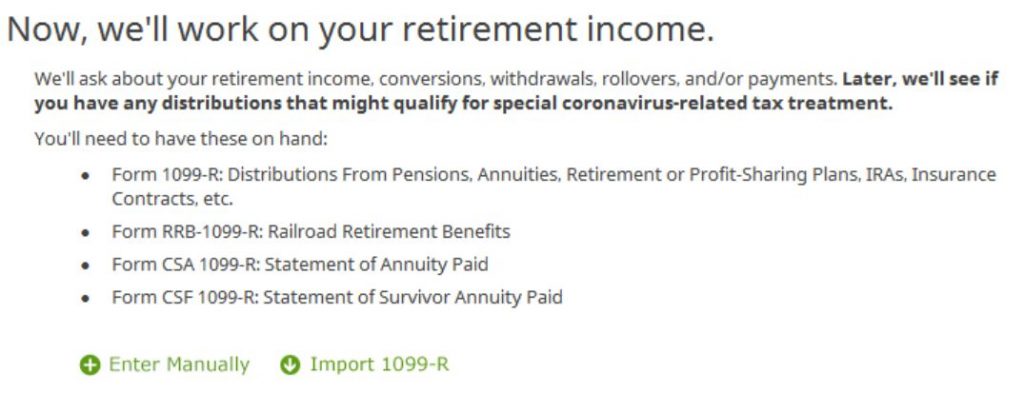

Click on on Import 1099-R in the event you’d like. I present guide entries with “Enter Manually” right here.

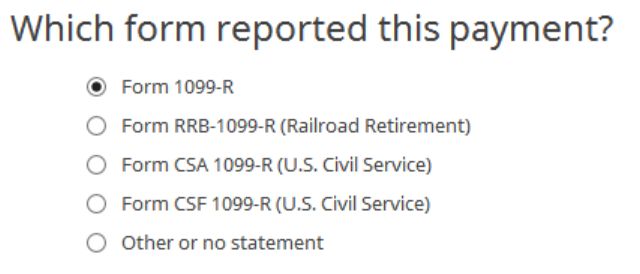

Only a common 1099-R.

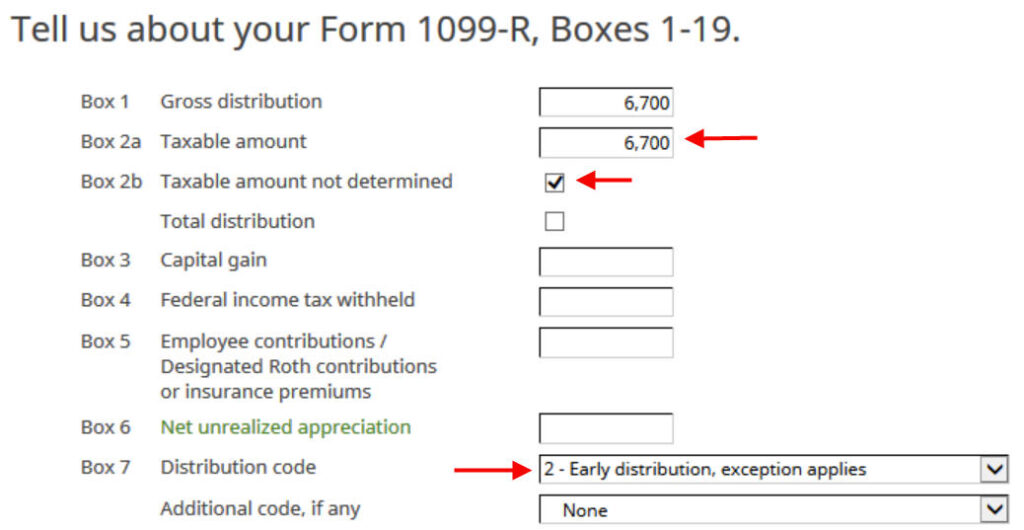

If you happen to imported your 1099-R, double-check to ensure the import precisely matches the copy you acquired. If you happen to enter your 1099-R manually, make sure to enter all the things on the shape precisely. Field 1 exhibits the quantity transformed to the Roth IRA. It’s regular to have the identical quantity because the taxable quantity in Field 2a when Field 2b is checked saying “taxable quantity not decided.” Take note of the distribution code in Field 7. My 1099-R has code 2.

My 1099-R had the IRA/SEP/SIMPLE field checked.

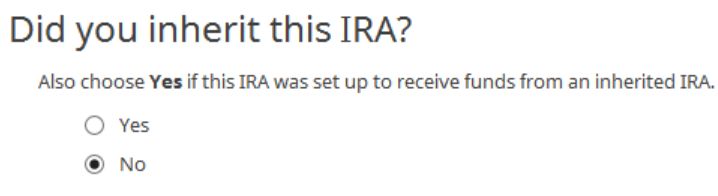

Didn’t inherit.

Transformed to Roth

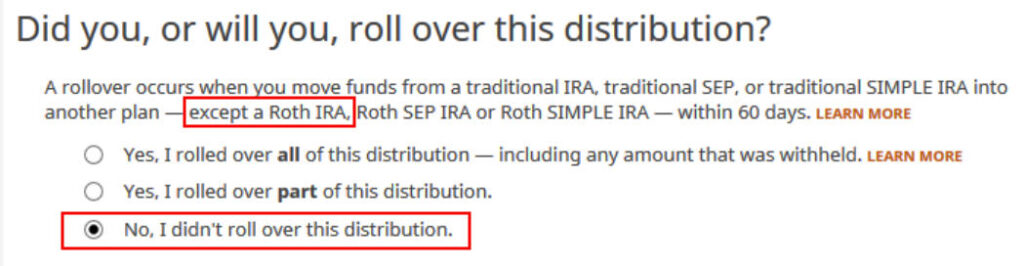

This can be a essential query. Learn rigorously. Reply No, since you transformed, not rolled over.

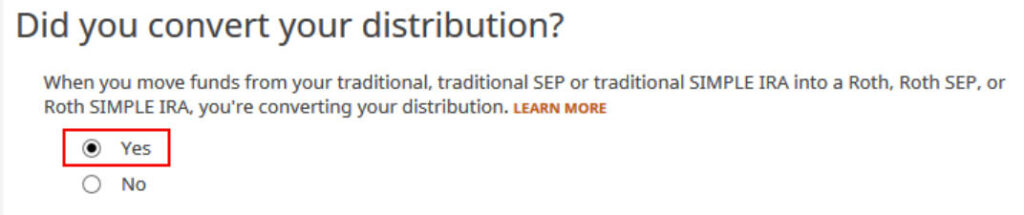

Now reply Sure, you transformed.

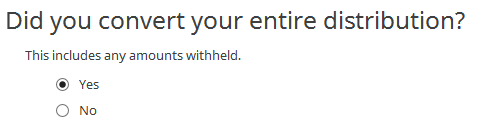

We transformed all of it in our instance.

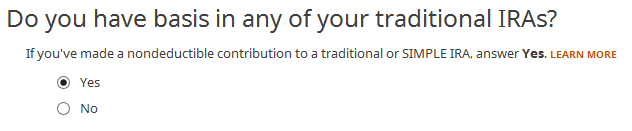

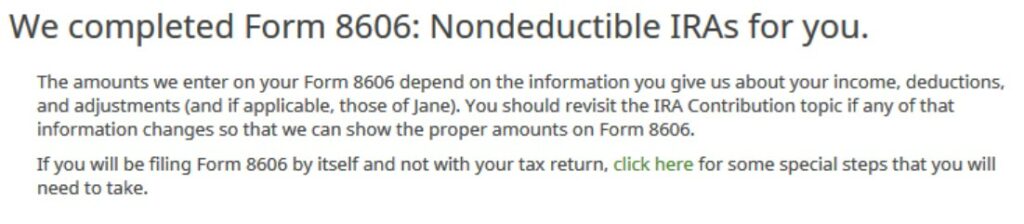

Reply Sure since you made a nondeductible contribution to a standard IRA.

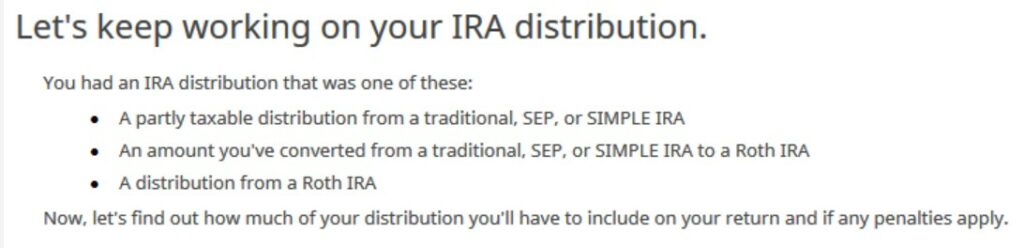

The refund in progress drops loads at this level. We went from a $2,434 refund to $946. Don’t panic. It’s regular and solely short-term. It’ll come again up after we full the part for IRA contributions.

You might be finished with one 1099-R. Repeat the above when you’ve got one other 1099-R. If you happen to’re married and each of you probably did a Backdoor Roth, take note of whose 1099-R it’s while you enter the second. You’ll have issues in the event you assign each 1099-R’s to the identical individual once they belong to every partner. Click on on Completed when you find yourself finished with all of the 1099-Rs.

Extra Questions

A number of extra questions.

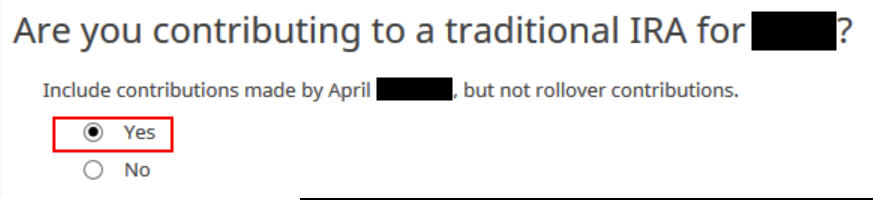

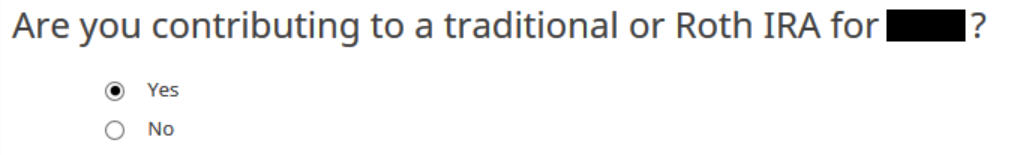

Reply Sure since you contributed to a Conventional IRA for the yr.

We are going to wait.

Non-Deductible Contribution to Conventional IRA

Now we enter the non-deductible contribution to the Conventional IRA *for* the yr in query. Full this half whether or not you contributed in the identical yr otherwise you did it or are planning on doing it within the following yr between January 1 and April 15.

In case your contribution throughout the yr in query was for the earlier yr, be sure you entered it in your earlier tax return. If not, repair your earlier return first.

IRA Contribution

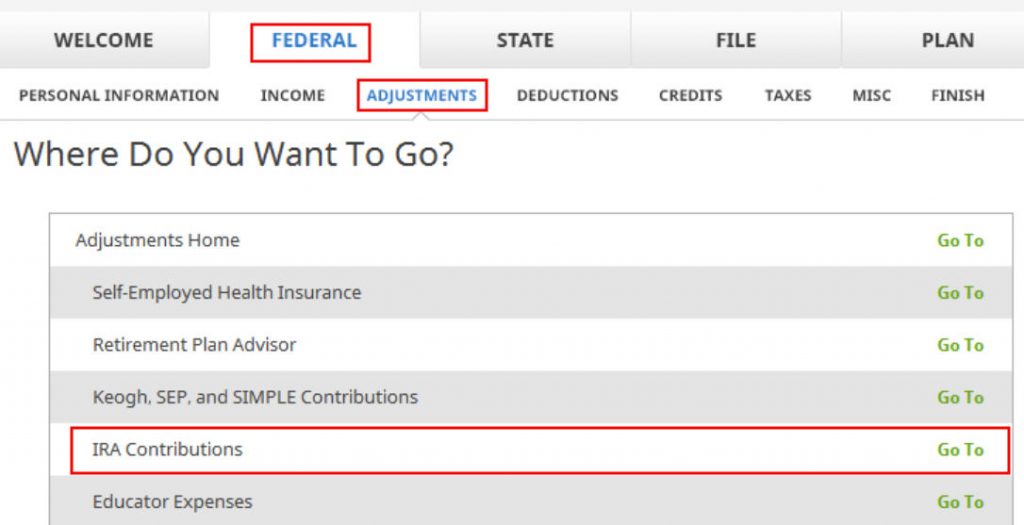

Click on on Federal -> Changes. Discover IRA Contributions. Click on on “Go To.”

Improper tense however reply “Sure” since you contributed to an IRA for the yr in query.

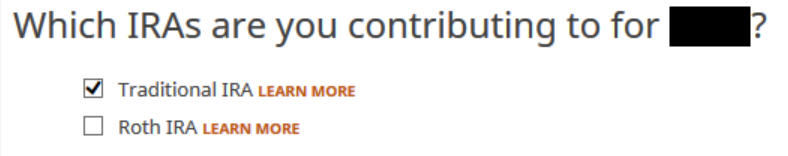

Test the field for Conventional IRA in the event you contributed on to a Conventional IRA. If you happen to initially contributed to a Roth IRA and then you definately recharacterized the contributions as conventional contributions, verify the Roth IRA containers right here after which reply sure when it asks you whether or not you recharacterized.

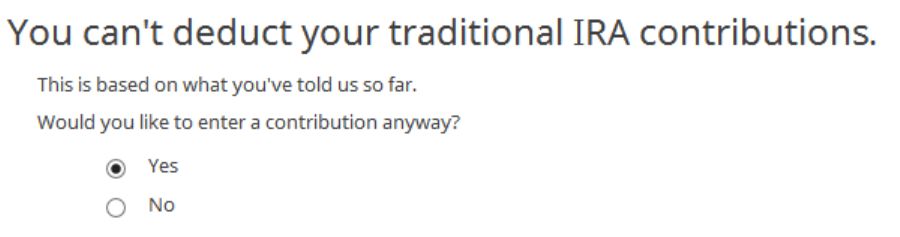

You already know you don’t get a deduction attributable to earnings. Enter anyway.

Enter your contribution quantity. We contributed $6,500 in our instance.

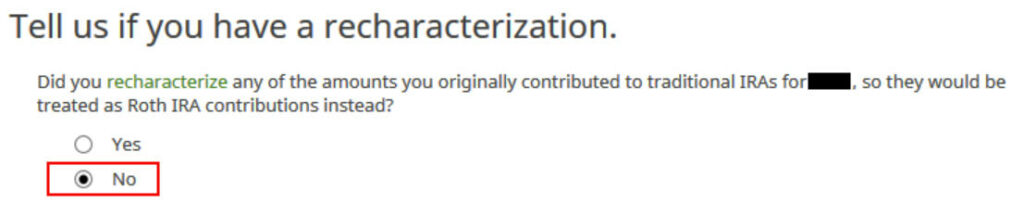

Conversion Isn’t Recharacterization

That is essential. Reply No since you didn’t recharacterize. You transformed to Roth.

We don’t have any extra contribution.

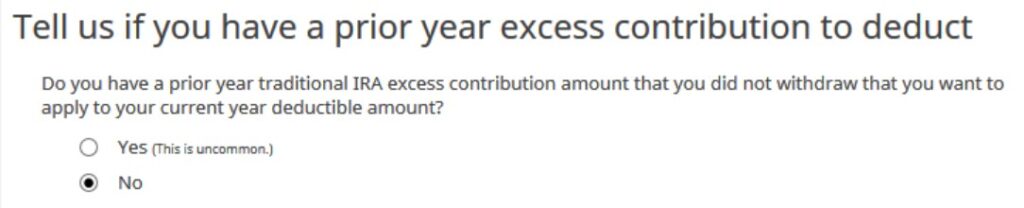

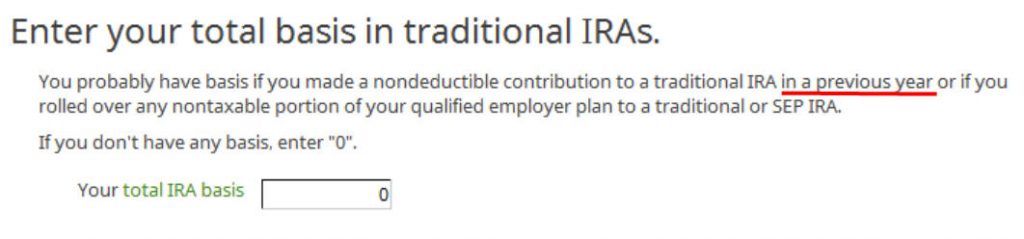

Foundation From Earlier 12 months

If you happen to did a clear “deliberate” backdoor Roth and also you began contemporary annually, enter zero. If you happen to contributed non-deductible for earlier years (no matter when), enter the quantity on line 14 of your Type 8606 from final yr.

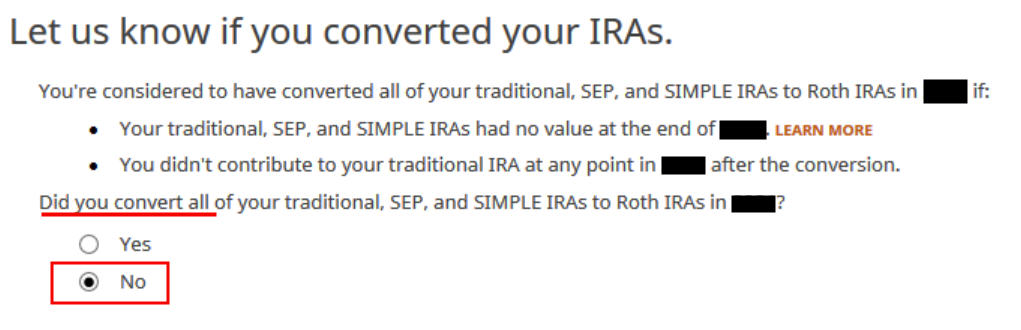

Professional-Rata Rule

That is one other essential query. In case you are doing it the simple manner as in our instance, technically you’ll be able to reply Sure and skip some questions. The safer wager is to reply No and undergo the follow-up questions. If you happen to’ve been going via these screens backwards and forwards, you could have put in some incorrect solutions in a earlier spherical. You should have an opportunity to overview and proper these solutions provided that you reply No.

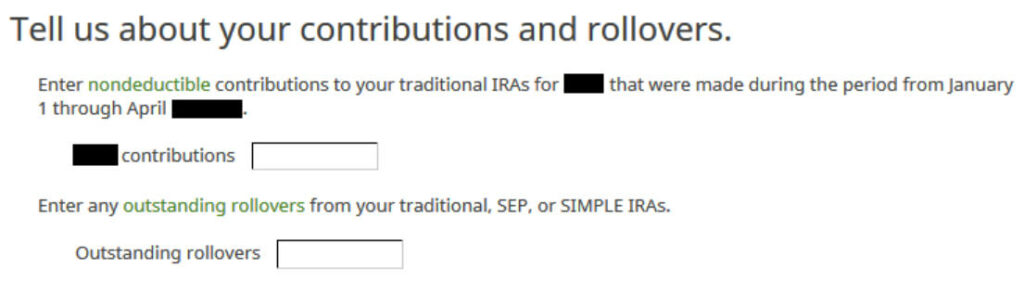

In a clear deliberate backdoor Roth, you contribute for yr X throughout yr X. Depart the containers clean. If you happen to didn’t know higher and also you contributed for the earlier yr after January 1, enter the quantity within the first field. If you happen to already did it the onerous manner for the earlier yr, please, please, please do your self a giant favor and do it the simple manner this yr. See Make Backdoor Roth Simple On Your Tax Return.

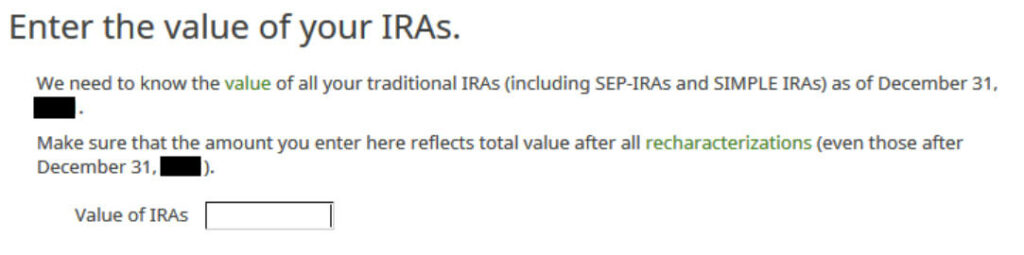

The field must be clean while you do a clear deliberate backdoor Roth. When you’ve got different Conventional, SEP, or SIMPLE IRAs, add up the balances out of your year-end statements and put the worth right here. The software program will apply the pro-rata rule.

That’s nice. We’re anticipating it.

A abstract of your contributions. 0 in Conventional IRA deduction means it’s nondeductible. Click on on Subsequent. Repeat on your partner if each of you probably did a Backdoor Roth.

We’re finished getting into the non-deductible contribution to the Conventional IRA. Now the refund in progress ought to return up. It was a refund of $2,434 after we first began. Now it’s a refund of $2,396. The distinction of $38 is because of the tax on the additional $200 earned earlier than the Roth conversion.

If you happen to solely contributed *for* final yr however you didn’t convert till the next yr, keep in mind to return again subsequent yr to complete the conversion half.

Taxable Revenue from Backdoor Roth

After going via all these, let’s affirm the way you’re taxed on the Backdoor Roth.

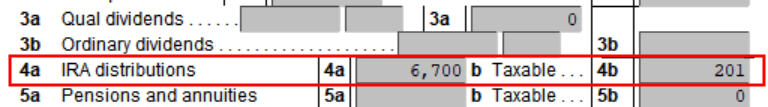

Click on on Types on the highest and open Type 1040 and Schedules 1-3. Click on on Conceal Mini WS. Scroll all the way down to strains 4a and 4b.

It exhibits $6,700 in IRA distributions, $201 of which is taxable. The taxable earnings got here out to $201, not $200, attributable to some rounding within the calculation. In case you are married submitting collectively and each of you probably did a backdoor Roth, the numbers right here will present double.

Tah-Dah! You set cash right into a Roth IRA via the backdoor while you aren’t eligible to contribute to it immediately. You’ll pay tax on a small quantity in earnings in the event you waited between contributions and conversion. That’s negligible relative to the good thing about having tax-free development in your contributions for a few years.

Troubleshooting

If you happen to adopted the steps and you aren’t getting the anticipated outcomes, right here are some things to verify.

Recent Begin

It’s finest to observe the steps contemporary in a single go. If you happen to already went backwards and forwards with totally different solutions earlier than you discovered this information, a few of your earlier solutions could also be caught someplace you now not see. You’ll be able to delete them and begin over.

Click on on Types and delete IRA Contributions Worksheet, 1099-R Worksheet, and Type 8606. Then begin over by following the steps right here.

Coated by Retirement Plan

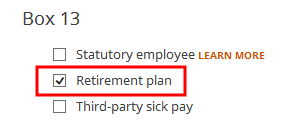

Be sure that the “Retirement plan” field in Field 13 of the W-2 you entered into the software program matches your precise W-2. In case you are married and each of you might have a W-2, ensure your entries for each W-2’s match the precise kinds you acquired.

When you’re not coated by a retirement plan at work, equivalent to a 401k or 403b plan, your Conventional IRA contribution could also be deductible, which additionally makes your Roth conversion taxable.

Self vs Partner

In case you are married, be sure you don’t have the 1099-R and the IRA contribution blended up between your self and your partner. If you happen to inadvertently assigned two 1099-Rs to at least one individual as an alternative of 1 for you and one on your partner, the second 1099-R won’t match up with a Conventional IRA contribution made by a partner. If you happen to entered a 1099-R for each your self and your partner however you solely entered one Conventional IRA contribution, you’ll be taxed on one 1099-R.

Say No To Administration Charges

In case you are paying an advisor a share of your belongings, you might be paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]