[ad_1]

A reader asks:

Ben in your latest weblog publish you stated $1M investable wealth makes you wealthy. I wish to present a counterargument to that. Whenever you retire, $1M mainly provides you $40,000 per yr to dwell off of, assuming the 4% rule of thumb is an inexpensive start line to consider retirement revenue. So is $40k spend a yr actually wealthy? I might argue that it’s center class at finest; most likely decrease center class actually. I might argue that in case your wealth is shopping for you a retirement, then it takes at the least $3M – $4M to be “wealthy” (higher center class). What are your ideas?

The publish in reference right here is final week’s $5 Million is Nothing, the place I shared some information that many millionaires don’t really feel rich. Many millionaires think about themselves higher center class and even common outdated center class.

I acquired numerous suggestions from people who find themselves members of the dos comma membership with seven figures of wealth.

I’ve some ideas on what being a millionaire means in retirement, however first, I wish to put this stage of wealth into perspective.

Credit score Suisse World Wealth Report tallies up the variety of wealthy individuals worldwide. There aren’t that a lot of them within the grand scheme of issues.

Out of a inhabitants of 8.1 billion individuals, simply 62.4 million are millionaires. That’s 0.8% of the inhabitants. There are 8.4 million individuals globally with a internet value of $5 million or extra. Having this stage of wealth would put you within the prime 0.1%.

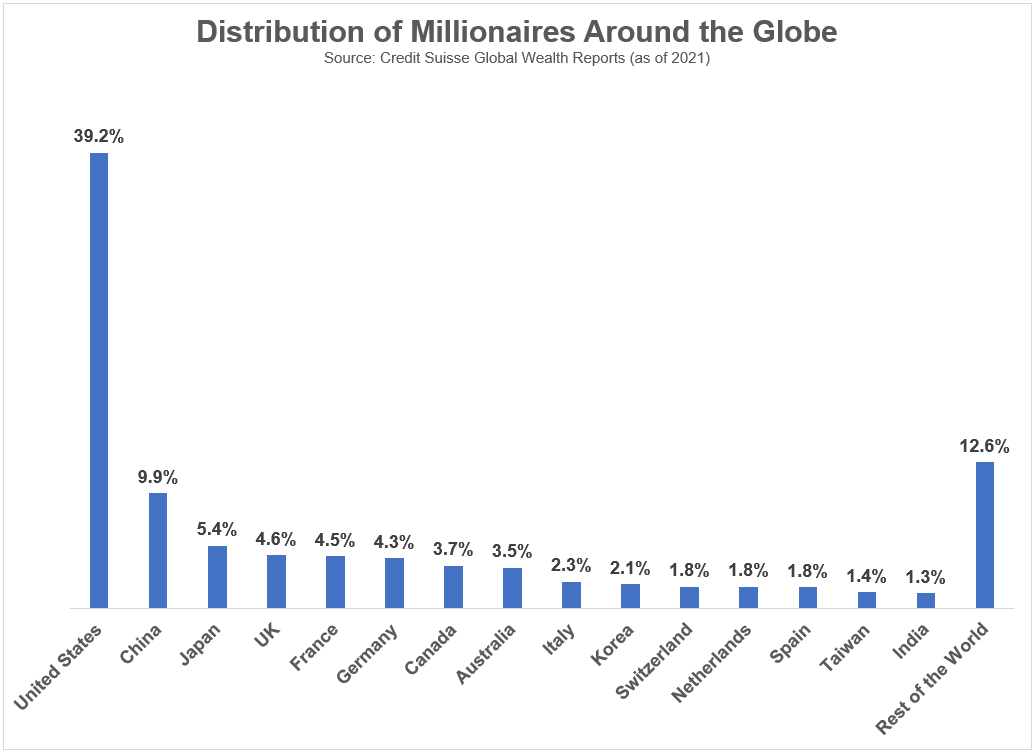

Folks within the U.S. might not notice how good now we have it. Right here’s the distribution of millionaires across the globe:

Almost 40% of all millionaires across the globe reside in america. There are extra millionaires right here than in China, Japan, Nice Britain, France, Germany, Canada, Australia, and Italy mixed.

I’m not attempting to make you’re feeling dangerous should you’re a millionaire who nonetheless feels such as you’re center class at finest. However let’s be trustworthy– should you’re a millionaire, you’re rich. Perhaps that doesn’t change how you’re feeling about your wealth nevertheless it’s a reality.

Sadly, relating to cash selections, emotions override info.

I do have some excellent news relating to retirement spending although. Your cash will most likely take you additional than you assume.

Sure, retiring means giving up your revenue stream. That’s a scary proposition and one of many causes many millionaire retirees don’t really feel rich sufficient.

rule of thumb from most retirement specialists is you’ll have to interchange 70-80% of pre-retirement revenue. For people who find themselves financially literate, this quantity appears too excessive.

For those who gathered thousands and thousands of {dollars} by diligent saving over time, you don’t want as a lot revenue throughout retirement. A excessive financial savings price in your working years means much less cash to interchange in retirement.

For those who save 20-30% of your revenue, you’re already residing on 70-80%.

Most retirees have their mortgages paid off. That lowers your residing bills significantly.

These residing bills are inclined to fall in retirement as properly. Research present spending peaks from age 41 to 56. Common spending from age 57 to 75 is definitely decrease than what individuals spend from age 25 to 40. Spending falls by round a 3rd for these 76 and older.

Retirees typically pay much less in taxes as a result of they now not recieve a paycheck. Plus you’ve Social Safety to rely on.

Put all of it collectively and you most likely want lower than cash than you suppose in retirement. Many retirees have a tough time spending cash in retirement as a result of they’re nervous about working out of cash or don’t really feel wealthy sufficient to take pleasure in themselves.

It’s additionally essential to recollect the 4% rule for retirement withdrawals is a danger administration technique meant to guard in opposition to the worst-case situation (working out of cash). Michael Kitces carried out a examine on a 60/40 portfolio going again to 1870 with a 4% withdrawal price. The findings would possibly shock you:

The choice to comply with a 4% preliminary withdrawal price makes it exceptionally uncommon that the retiree finishes with lower than what they began with on the finish of the 30-year time horizon; solely a small variety of wealth paths end under the beginning principal threshold. The truth is, general, the retiree finishes with more-than-double their beginning wealth in a whopping 2/3rds of the eventualities, and is extra more likely to end with quintuple their beginning wealth than to complete with lower than their beginning principal!

There aren’t any ensures this may proceed however most retirees find yourself with even extra cash than once they began by following this rule of thumb. You probably have thousands and thousands of {dollars} and 30 years or so in retirement, there’s a very good likelihood your cash will preserve compounding.

I can’t let you know methods to really feel about your cash. Cash is extra about feelings than spreadsheets.

Defining “wealthy” is a difficult state of affairs.

Is it a excessive revenue? The sum of money you spend? Your internet value? How cash makes you’re feeling? All of these items?

For those who spend an inordinate period of time worrying about cash, you aren’t rich.

My take is you probably have sufficient cash to cease working and sustain your identical lifestyle, you’re rich.

Till the previous 100 years or so most individuals by no means retired. They labored till they died. You probably have the flexibility to purchase your freedom by spending time how you prefer to with out having to work, that’s a wealthy life.

That is true whether or not you’ve one million {dollars} within the financial institution or not.

Nick Maggiulli helped me take this query on the most recent version of Ask the Compound:

We additionally mentioned questions on retirement withdrawal methods, serving to your loved ones spend money on inheritance, investing in actual property when you’ll be able to’t afford a home and retirement withdrawal methods.

Additional Studying:

You Most likely Want Much less Cash in Retirement Than You Assume

And take a look at Nick’s new piece on secure withdrawal charges for a 60/40 portfolio:

What’s the Secure Withdrawal Charge in Retirement?

[ad_2]