[ad_1]

I first heard the time period ‘bagger’ in One Up on Wall Avenue by Peter Lynch.

He writes about Microsoft being a 100-bagger (the e-book got here out in 1989). He mentions Dell as an 889-bagger. Subaru was a 156-bagger.

There have been a variety of different baggers as nicely.

Lynch is credited with the time period ten-bagger for a inventory that’s up 10x.

There are some well-known ten-baggers in the course of the present bull run.

Nvidia is up 10x for the reason that spring of 2020 (loopy however true). Apple has been a ten-bagger for the reason that fall of 2013. In case you invested in Monster Beverage within the spring of 2011, you’d be up 10x on that funding.

I’m very a lot a buy-and-hold investor for the long-term however extra so with index funds than particular person shares.

So I used to be curious how usually ten-baggers happen within the U.S. inventory market itself, not simply a number of the largest particular person winners.

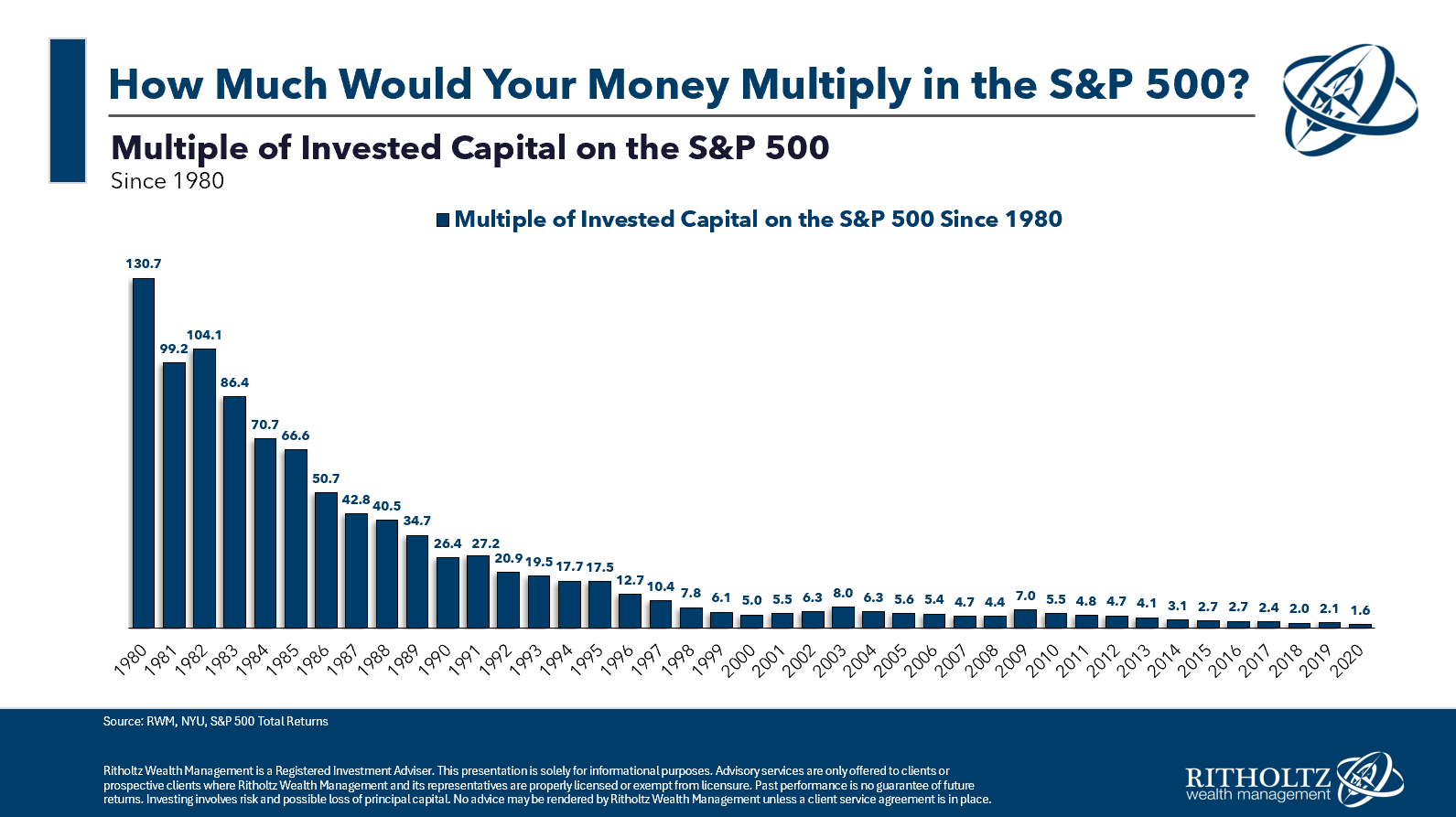

I regarded again at an preliminary funding at the beginning of every 12 months going again to 1980 by the tip of 2023 to see how far again you would need to go to earn a ten-bagger on the S&P 500:

The factor that stands out probably the most from this chart is the truth that buyers within the early-Eighties could be sitting on a 100-bagger from a complete return foundation.1

Not only a ten-bagger however a 100-bagger!

The S&P 500 was up near 13,000% from 1980-2023, which was ok for annual returns of 11.7% per 12 months throughout that point.

Fairly exceptional.

The newest ten-bagger was from an preliminary funding in 1997. That was a 9% annual return over 27 years, which can also be fairly exceptional when you think about that timeframe consists of two gigantic 50% crashes, two further bear markets and three recessions in addition.

Beginning in 2009 is getting near ten-bagger standing. If we wished to cherry-pick, from the underside of the Nice Monetary Disaster in March 2009, the S&P 500 is now a ten-bagger on a complete return foundation.

I used to be making purchases in my 401k all through 2008 and 2009 however don’t suppose I used to be fortunate sufficient to catch absolutely the backside. Nonetheless, these index fund buys again then are actually approaching ten-bagger ranges.

I don’t know what returns might be like from right here however this can be a back-of-the-envelope calculation for a way lengthy it takes to 10x your cash from totally different annual return ranges:

- 6% – 40 years

- 7% – 34 years

- 8% – 30 years

- 9% – 27 years

- 10% – 24 years

- 11% – 22 years

- 12% – 20 years

Compounding doesn’t occur in a single day. You need to be affected person. In case you are, a ten-bagger might be in your future, even in the event you don’t choose the subsequent Apple or Nvidia.

You simply should suppose and act for the long-term.

Ten-baggers are for affected person folks.

Additional Studying:

The Good & Dangerous of Investing within the Inventory Market

1The standard caveats apply — no charges or taxes right here. Simply illustrating some extent.

This content material, which accommodates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here might be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to supply funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.

[ad_2]