[ad_1]

That is the third in a three-part sequence analyzing a recent method to digital remittances in Indonesia.

By Angela Ang, Elwyn Panggabean, and Ker Thao

During the last six months, we launched a pilot program with DANA, one among Indonesia’s largest e-wallet suppliers, to supply a digital remittance answer for home staff to ship a refund house in a protected and safe method. The pilot answer was initially designed to focus on DANA’s current customers who could possibly be potential employers of home staff and leveraged them as the primary touchpoint in introducing DANA as a viable remittance channel. By method, employers would assist educate their staff about the advantages and values of utilizing DANA, offering a less expensive, quicker, and safer digital avenue for staff to ship cash house.

Taking an iterative method within the pilot implementation

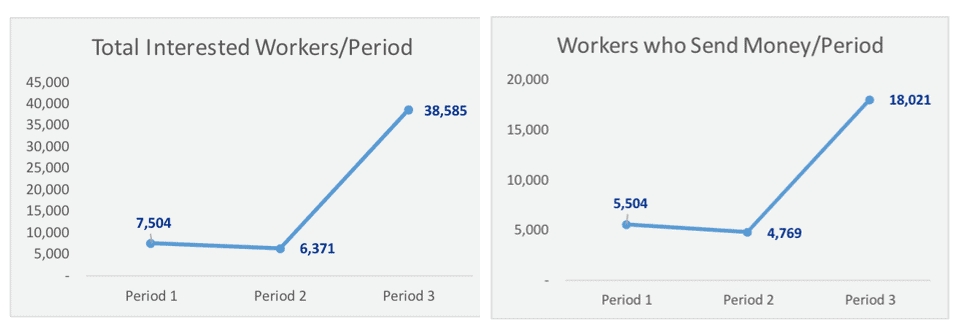

Initially, the pilot undertaking was deliberate to be launched throughout a three-month, three-part part: the primary and second with a deal with concentrating on employers as a touchpoint to succeed in home staff, serving to them sign-up their home staff for DANA accounts, and educating them about DANA and easy methods to use DANA to switch cash house; whereas the third part spanned during the last two months, instantly focused the home staff with a deal with constructing buyer’s confidence and expertise in utilizing DANA. Whereas the primary and second phases confirmed optimistic ends in serving to home staff with entry and use of DANA as a remittance service, the third part confirmed a big improve in engagement and use.

Key learnings from the pilot

Program Consciousness

Most of the individuals of the home employee remittance program realized about this system by means of quite a lot of completely different channels and media reminiscent of by means of word-of-mouth referrals, the preferred and trusted methodology between staff, from different customers who have been collaborating in this system (pal, neighbor, relative, or employer) and thru DANA’s Instagram web page and tales. The analysis highlighted further avenues to succeed in a bigger home employee viewers, with clients suggesting extra commercials and messages in locations that they frequented: companion retailers (reminiscent of comfort shops); social media (YouTube and TikTok, which they use for leisure); and leveraging influencers to assist get the message throughout.

Program Signal-up and Onboarding

It was evident in the course of the first two phases of this system that employers weren’t the best method to assist home staff sign-up for an account. This was additional validated within the pilot analysis. We found that staff who wished to take part in this system have been prepared, in a position, and able to signing themselves up for their very own account, with the caveat that the majority of those that have been in a position to take action are typically extra tech-savvy and digitally literate. They have been resourceful and in a position to entry movies and tutorials that which have been offered inside the program to assist them full the mandatory steps. The remainder of the home staff realized with the help of members of the family or their employer.

Whereas employers didn’t turn into an awesome sign-up touchpoint, they have been efficient in offering training and serving to their staff to make use of DANA. Nevertheless, the employers have been confronted with challenges of their very own. A few of the main challenges have been on account of staff not having smartphones or not being as tech/digitally-savvy, which discouraged employers from collaborating and assist their staff take part as nicely. One other problem was that employers didn’t have the time and/or information to show their staff. Many employers had no objections in assuming the educating function, however most popular somebody who was a lot nearer to the employees (like household, buddies, or friends) to show them with some saying that the tutorial piece ought to come instantly from DANA.

Transacting with DANA and different Use-cases

General, the answer program proved to achieve success. It helped educate home staff easy methods to use DANA to make remittance transfers again house and with the development of customers who began to grasp the advantages and values of utilizing DANA, they grew to become extra concerned with exploring different use-cases. We noticed as a direct consequence, clients who participated in this system began utilizing DANA for invoice funds (electrical energy tokens and water payments), top-ups, and on-line purchasing. Moreover, they even began to make use of DANA Objectives—a short-term financial savings aim characteristic in DANA.

Drivers and Detracting Elements for Utilization

As part of the analysis, we recognized particular components that helped drive using DANA for remittance providers and past, in addition to detracting elements that forestalls clients from utilizing DANA.

| Drivers | Detractors |

| Focused messaging and communications helped clients see and really feel that this system was geared toward them

Reminder messages and in-app notifications helped to nudge clients on the proper time to remind them to make use of DANA to ship cash house Ease of use and transacting made clients need to discover different use circumstances Program incentives (raffles and rewards) additionally helped to drive use |

Clients who didn’t have help or a instructor to assist information them prevented them from studying and utilizing Clients who didn’t have a smartphone or shared their smartphone with others resulted in them not with the ability to take part Clients who didn’t perceive the Phrases and Circumstances of this system (the mandatory steps wanted to be accomplished so as to qualify for this system and to qualify for adjustments to win incentives)

|

Incentives for Utilization Past Raffles and Rewards

The pilot analysis confirmed that the best answer elements have been a mixture of key advertising/messaging, reminders, and incentives to assist drive utilization. The focused advertising and messaging have been efficient to relay the values and advantages of utilizing DANA for home staff and struck a chord with a program that was designed particularly for them. The communications about DANA’s values and advantages have been clearly understood by clients. Reminders performed a essential function within the answer as nicely. It helped to nudge clients who could have forgotten about utilizing DANA and helped remind clients that DANA could possibly be used for a lot of different transactions past remittance transfers.

By means of the pilot analysis, we additionally found that whereas many purchasers have been initially interested in this system because of the probability to win money prizes and rewards. Nevertheless, upon additional utilization, many began to see the precise advantages and values of utilizing DANA. It was seen as a quick, simple, and free technique to transact. As well as, it was additionally considered to be a safe and protected technique to ship cash house; whereas on the similar time simple to be taught. These have been the true incentives for utilizing DANA as a remittance channel. It’s encouraging to see as this system helped construct consumer confidence and digital monetary capabilities by means of a learn-by-doing method which gave them the digital instruments to transact and handle their very own cash.

Subsequent Steps: Scaling for Affect for all Home Staff

The undertaking gives evidences on the effectives of utilizing remittances to assist convey migrant staff, on this case, home staff, into formal monetary providers, in addition to showcasing the vital function of digital wallets, like DANA, to drive digital remittance providers in Indonesia. The enterprise alternative on (home) remittances is large and is usually a robust use-case to focus on the low-income phase, notably migrant staff.

With the success of this pilot program with DANA, Girls’s World Banking is trying to scale this answer to the remainder of the home employee neighborhood in Indonesia. We plan on creating an answer that particularly targets them to supply a protected, safe, and simple technique to ship cash house. As well as, we need to measure the affect of the answer on the lives of ladies clients and plan to conduct an outcomes analysis. The upcoming analysis will measure the impacts of the answer within the quick and long-term durations in the direction of girls’s (financial) empowerment.

Our ongoing efforts are to maintain buyer engaged and proceed to be taught to make use of digital monetary providers for his or her each day monetary wants by constructing their digital monetary capabilities and confidence so that they can also turn into complicated and multi-case customers. It’s our hope, at Girls’s World Banking, that options reminiscent of it will assist help low-income girls develop to turn into extra assured and unbiased customers who can improve their monetary well being, monetary resilience, and monetary independence to make their very own monetary selections within the long-term.

[ad_2]