[ad_1]

How a lot is the Gold Storage Restrict with out revenue proof? Are there any restrictions or limitations for preserving the gold with none revenue proof?

Gold is among the most valuable property for all of us. Nonetheless, many people are unaware of the restrictions imposed by the revenue tax division for preserving gold with none revenue proof.

How A lot Is The Gold Storage Restrict With out Earnings Proof?

Simply think about a case the place the revenue tax division raided your home they usually unearthed the gold you’re preserving. Then in such a state of affairs, how a lot gold as per the legislation is permissible to maintain with none revenue proof? Allow us to attempt to reply these questions intimately.

Everytime you purchase gold, it’s at all times higher to maintain the receipts safely with you. This may resolve the various points. Based on the CBDT press launch (1st Dec 2016), there isn’t any restrict on holding gold jewelry offered that the supply of funding or inheritance may be defined. Nonetheless, it’s important that the revenue of the taxpayer needs to be in step with the amount of gold held. Offering mandatory proof for such possession will assist in avoiding scrutiny from the revenue tax division. For those who fail to supply the right reply, then the assessing officer could confiscate such unaccounted gold.

Both you will need to have proof of buy or proof associated to gold you’ve gotten inherited or acquired as a present. If in case you have gold attributable to inheritance or reward, it’s important to present a receipt within the title of the preliminary proprietor of the merchandise. In any other case, it’s also possible to submit a household settlement deed, will, or a present deed stating the switch of such an asset to you. Nonetheless, in some circumstances, if there isn’t any such doc obtainable, the assessing officer could analyse your loved ones’s social standing, customs, and traditions to return to a conclusion on whether or not your assertion is legitimate or not.

Therefore, having correct payments and likewise the supply of shopping for such gold will resolve the pointless headache of asking questions like “How a lot GOLD can we maintain with out proof?”

Nonetheless, in some circumstances, it’s possible you’ll not hold the receipts of your gold buy otherwise you don’t have proof to indicate that the gold you’re holding now is because of inheritance or reward. In that case, what’s the permissible gold you’ll be able to maintain with none revenue proof?

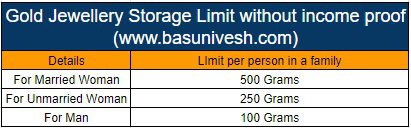

Based on the CBDT, the restrict is totally different for married ladies, single ladies, and males. In case you are holding the above-prescribed restrict of gold, then you aren’t obliged to provide proof of receipt, inheritance, or reward.

Do do not forget that the above limits are per particular person for a household. Therefore, take for instance, in case you are a household of 5 individuals the place two are married ladies, two are married males, and one is an single girl. In that case, the whole permissible gold storage restrict with out revenue proof is = 1,000 Grams for married ladies + 200 grams for married males + 250 Grams for single girl = 1,450 grams.

As I discussed above, if you happen to maintain the gold past this restrict, then the assessing officer has the correct to grab such unaccounted gold. Additionally, in case you are holding the gold that doesn’t belong to your loved ones, then that may also be sized.

Do do not forget that generally the assessing officer could not seize the gold which is past the above permissible restrict contemplating the household customs and traditions (for this there are not any such normal guidelines acknowledged).

Some essential court docket judgments –

# Married girls receiving jewelry within the type of ‘stree dhan’ throughout their lengthy married life on varied events just like the beginning of a kid, birthdays, marriage anniversaries, and so forth., and collected over a interval of years are to be excluded.

# Diamond Jewelry (not diamond studded gold jewelry), Gold Bar, or Gold Cash won’t type a part of the above restrict. Primarily as a result of the prescribed restrict is just for gold jewelry and ornaments.

Notice – Consult with our all Gold associated articles at “Gold Articles“

[ad_2]