[ad_1]

I need to inform you about why Ritholtz Wealth Administration is coming to the West Coast of Florida within the first week of March. However earlier than I get there, let’s speak in regards to the state of the wealth administration business.

The ZIRP period of low-cost cash is over, however that doesn’t imply its impacts aren’t nonetheless being felt. Infinite leverage turned our world the wrong way up and gave it shake.

In Welcome to the Jungle: The Subsequent Part of the Evolution of the Wealth Administration Business, Mark Hurley et al writes:

Non-public fairness companies additionally raised trillions of {dollars} – together with greater than $2.2 trillion since 2016 – for which they wanted locations to speculate. They took discover of the business, and it was an inviting goal. Notably enticing was the soundness of wealth supervisor consumer relationships as a result of they generate predictable, recurring charges which permit consumers to make use of giant quantities of leverage when buying these companies.

Moreover, participant proprietor demographics created many transaction alternatives of dimension. Quite a few $2 billion to $10 billion AUM individuals had been based within the early Nineteen Nineties with homeowners who had been now of their mid-60s and wanted a approach to monetize their possession stakes.

Beneath such circumstances, it was unremarkable that greater than 100 acquirers instantly emerged, shopping for something and all the things that was on the market. Practically 1,600 transactions had been accomplished.

Measurement was what mattered most. High quality shortly grew to become an afterthought. PE companies backing these consumers had oceans of cash they wanted to speculate in the event that they had been going to gather the related administration charges that now dominated their very own profitability

Larger rates of interest will in the end influence the technique that non-public fairness consumers make use of, however some huge cash was already raised when charges had been a lot decrease, and that cash has to discover a residence. Certainly, it has.

RIA M&A exercise hit $331 billion in 2023 on 227 whole transactions. This improved upon 2022’s record-breaking 12 months of 230 transactions and $283 billion.

These transactions have hollowed out a big space of the market. The realm that was as soon as thought-about giant. The realm that my agency at present occupies.

Once more, right here’s Hurley et al. “Nevertheless, what’s completely different from solely a decade in the past is that there at the moment are far fewer companies that beforehand would have been thought-about “giant” (i.e., with $2 billion to $10 billion of AUM) however that at present could be thought-about “medium-sized.” The preponderance of such “medium- sized” companies have been acquired and the distinction between the large and the small (for a lot of the business) is now a lot larger.”

We began our firm in September 2013 with lower than $100 million underneath administration. By our tenth birthday (September 2023) we had grown to $3.9 billion. And we did it our means. If we had been a inventory, we’d be within the high quality development bucket.

We by no means took any exterior capital. Non-public fairness and different potential consumers have come sniffing round through the years. We by no means entertained the thought. We’re 100% employee-owned. We additionally by no means participated within the consumer referral program supplied by the biggest custodians, which is a large supply of development in our enterprise. Our shoppers are right here as a result of they need to be.

All of our development was natural for the primary couple of years. We put our ideas out into the world, constructed a fan base, and turned a few of these followers into shoppers. That is for one more day, however not a single particular person has ever come to us and stated, “I like your content material, please take my life financial savings.”

We’ve been capable of develop as a result of the engine that we constructed internally has each bit as a lot horsepower because the content material that our viewers devours. The blogs and podcasts get them within the door, however that’s when the actual work begins. Our advisors and ops staff are, in my biased opinion, the perfect within the enterprise.

Alongside our journey, we’ve efficiently been capable of combine natural development by way of new shoppers, and inorganic development by way of new advisors. And let me inform you, the latter is certainly a jungle.

As I wrote earlier, M&A by way of non-public equity-backed giants has dominated the advisor panorama for the final decade. And that world acquired very aggressive in a short time. Demand for belongings outpaced the availability, and so the costs of those offers went up, and up, and up.

For those who’re an advisor with a decent-sized ebook, likelihood is somebody’s come knocking at your door with a beautiful provide. And whereas the monetary phrases could be nice for the advisor, they’re not at all times proper for the top consumer. Once more, a unique matter for a unique day.

We get numerous advisors reaching out to see if Ritholtz Wealth Administration may very well be residence for them and their shoppers. Nevertheless it’s solely a fraction of what we might see had been these bottomless pocketed buyers not a part of the equation. They’re stiff competitors, little question.

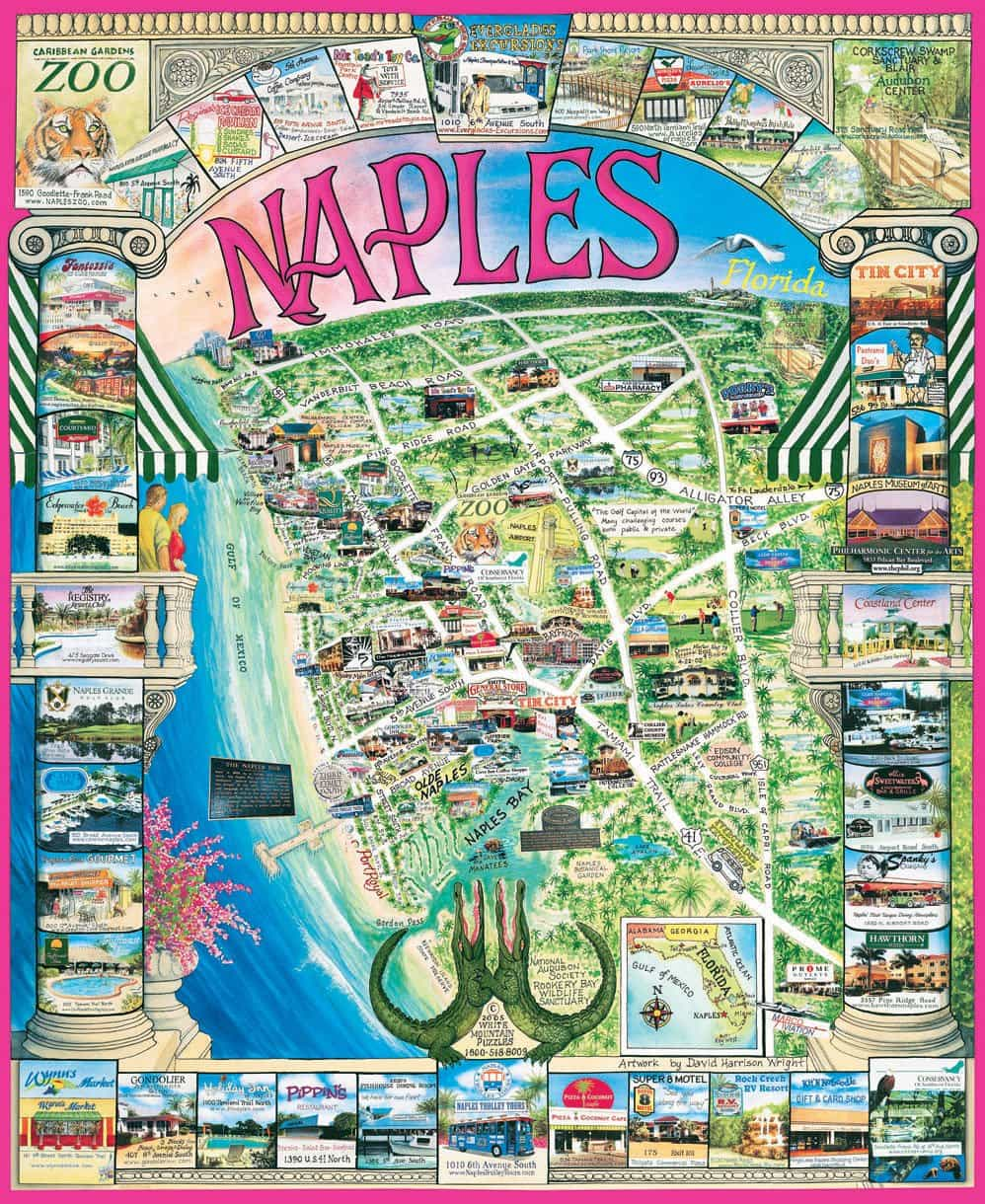

I referred to as us high quality development for a motive. We imagine the advisors that be a part of us are of the very best high quality by way of their character. We’re not writing them a verify to affix us. The business goes left, we’re going proper. For these advisors to forgo a extra enticing monetary provide says loads about them. A type of individuals is in stunning Naples, Florida, and we’re coming to see him and his shoppers within the first week of March.

For those who’re within the space and are interested in what our planning and funding course of appears to be like like, we’d love so that you can get in contact. Please electronic mail us at data@ritholtzwealth.com with “Naples” within the topic line.

[ad_2]